Glencore Sees 2021 Marketing Earnings Above Guidance Range

October 29 2021 - 2:53AM

Dow Jones News

By Jaime Llinares Taboada

Glencore PLC said Friday that it now expects earnings from its

marketing business to be ahead of the guidance range in 2021.

The FTSE 100 company forecast full-year marketing adjusted

earnings before interest and taxes to exceed the top end of the

$2.2 billion-$3.2 billion per annum long-term guidance range.

In addition, the commodity mining and trading company said that

its assets performed in line with expectations in the third

quarter, and that full-year production guidance remains

unchanged.

"Notably, as energy markets have improved, we are recovering

from the market-driven production cuts initiated within our

Australian coal portfolio in the second half of 2020," Chief

Executive Gary Nagle said.

Glencore also reported that on Oct. 15 it agreed the sale of its

Chemoil Terminals LLC subsidiary, which owns two oil storage

terminals in California, for $242 million. Closing is expected

before the end of the year.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

October 29, 2021 02:38 ET (06:38 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

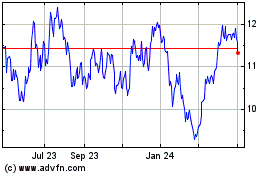

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Jul 2024 to Aug 2024

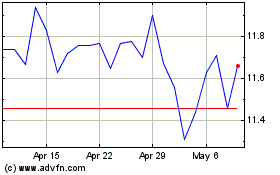

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Aug 2023 to Aug 2024