UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14C

(RULE

14C-101)

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check

the appropriate box:

☐

Preliminary Information Statement

☒

Definitive Information Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

GBT

TECHNOLOGIES INC.

(Name

of Registrant As Specified In Its Charter)

Payment

of Filing Fee (Check the Appropriate Box):

☒

No fee required

☐

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate

number of securities to which the transaction applies: |

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which

the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total

fee paid: |

☐

Fee paid previously with preliminary materials

☐

check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

| |

(1) |

Amount

previously paid: |

| |

|

|

| |

(2) |

Form, Schedule

or Registration Statement No: |

| |

|

|

| |

(3) |

Filing

Party: |

| |

|

|

| |

(4) |

Date

Filed: |

GBT TECHNOLOGIES INC.

2450 Colorado Avenue,

Suite 100F

Santa Monica, CA 90404

INFORMATION STATEMENT

PURSUANT TO SECTION 14

OF THE SECURITIES EXCHANGE

ACT OF 1934

AND REGULATION 14C AND SCHEDULE

14C THEREUNDER

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE NOT REQUESTED TO

SEND US A PROXY

| |

|

Santa

Monica, California |

| |

|

August 23, 2023 |

This information

statement has been mailed on or about August 23, 2023 to the stockholders of record on August 21, 2023 (the “Record Date”)

of GBT Technologies Inc., a Nevada corporation (the “Company”) in connection with certain actions to be taken by the

written consent by stockholders holding a majority of the voting stock of the Company, dated as of July 27, 2023. The actions to

be taken pursuant to the written consent shall be taken on or about September 12, 2023, 20 days after the mailing of this information

statement.

THIS IS NOT A NOTICE OF A SPECIAL MEETING

OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER WHICH WILL BE DESCRIBED HEREIN.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Mansour Khatib |

| |

Chief Executive

Officer |

NOTICE OF ACTIONS TO BE TAKEN PURSUANT

TO THE WRITTEN CONSENT OF STOCKHOLDERS HOLDING A MAJORITY OF THE VOTING SHARES OF THE COMPANY IN LIEU OF A SPECIAL MEETING OF THE

STOCKHOLDERS, DATED JULY 26, 2023

To Our Stockholders:

NOTICE IS HEREBY

GIVEN that the following actions will be taken pursuant to a written consent of stockholders holding a majority of the issued and

outstanding voting shares of the Company dated July 27, 2023, in lieu of a special meeting of the stockholders. Such actions will

be taken on or about September 12, 2023:

| |

● |

To

amend the Company’s Articles of Incorporation, (the “Articles of Incorporation”) to increase the number

of authorized shares of common stock, par value $0.00001 per share (the “Common Stock”), of the Company from 10,000,000,000

shares to 30,000,000,000 shares. |

OUTSTANDING SHARES AND VOTING RIGHTS

As of the Record

Date, the Company’s authorized capitalization consisted of 10,000,000,000 shares of Common Stock, of which 6,103,695,062

shares were issued and outstanding. Holders of Common Stock of the Company have no preemptive rights to acquire or subscribe to

any of the additional shares of Common Stock. In addition, the Company has authorized 20,000,000 shares of preferred shares of

which 45,000 of Series B Preferred Shares, 700 Series C Preferred Shares, 20,000 Series H Preferred Shares and 1,000 Series I Preferred

Shares are presently outstanding.

Series B Preferred Shares

On November 1,

2011, the Company and certain creditors entered into a Settlement Agreement (the “Settlement Agreement”) whereby without

admitting any wrongdoing on either part, the parties settled all previous agreements and resolved any existing disputes. Under

the terms of the Settlement Agreement, the Company agreed to issue the creditors 45,000 shares of Series B Preferred Stock of the

Company on a pro-rata basis. Following the issuance and delivery of the shares of Series B Preferred Stock to said creditors, as

well as surrendering the undelivered shares, the Settlement Agreement resulted in the settlement of all debts, liabilities and

obligations between the parties.

The Series B Preferred

Stock has a stated value of $100 per share and is convertible into the Company’s common stock at a conversion price of $30.00 per

share representing 30 posts split common shares. Furthermore, the Series B Preferred Stock votes on an as converted basis and carries

standard anti-dilution rights. These rights were subsequently removed, except in cases of stock dividends or splits.

Series C Preferred Shares

On April 29, 2011,

GV Global Communications, Inc. (“GV”) provided funding to the Company in the aggregate principal amount of $111,000

(the “Loan”). On September 25, 2012, the Company and GV entered into a Conversion Agreement pursuant to which the Company

agreed to convert the Loan into 10,000 shares of Series C Preferred Stock of the Company, which was approved by the Board of Directors.

Each share of Series

C Preferred Stock is convertible, at the option of GV, into such number of shares of common stock of the Company as determined

by dividing the Stated Value (as defined below) by the Conversion Price (as defined below). The Conversion Price for each share

is equal to a 50% discount to the average of the lowest three lowest closing bid prices of the Company’s common stock during

the 10-day trading period prior to the conversion with a minimum conversion price of $0.02. The stated value is $11.00 per share

(the “Stated Value”). The Series C Preferred Stock has no liquidation preference, does not pay dividends and the holder

of Series C Preferred Stock shall be entitled to one vote for each share of common stock that the Series C Preferred Stock shall

be convertible into. GV has contractually agreed to restrict its ability to convert the Series C Preferred Stock and receive

shares of the Company’s common stock such that the number of shares of the Company’s common stock held by it and its

affiliates after such conversion does not exceed 4.9% of the then issued and outstanding shares of the Company’s common stock.

During the year

ended December 31, 2014, GV Global Communications, Inc. converted 7,770 of its Series C Preferred Stock into 120 post-splits.

During the third quarter of 2014, the Company received 42 post-split common shares to adjust the shares issued to reflect

the amount that both they and the Company believed that they were owed. At December 31, 2021 and 2020, GV owns 700 Series

C Preferred Shares.

Series H Preferred Shares

On June 17, 2019,

the Company, AltCorp Trading LLC, a Costa Rica company and a wholly-owned subsidiary of the Company (“AltCorp”), GBT

Technologies, S.A., a Costa Rica company (“GBT-CR”) and Pablo Gonzalez, a shareholder’s representative of GBT-CR

(“Gonzalez”), entered into and closed an Exchange Agreement (the “GBT Exchange Agreement”) pursuant to

which the parties exchanged certain securities. In accordance with the Exchange Agreement, AltCorp acquired 625,000 shares

of GBT-CR representing 25% of its issued and outstanding shares of common stock from Gonzalez in exchange for the issuance of 20,000 shares

of Series H Convertible Preferred Stock of the Company and a Convertible Note in the principal amount of $10,000,000 issued

by the Company (the “Gopher Convertible Note”) as well as additional consideration. The Gopher Convertible Note bears

interest of 6% per annum and is payable at maturity on December 31, 2021. At the election of Gonzalez, the Gopher Convertible

Note can be converted into a maximum of 20,000 shares of Series H Preferred Stock. Each share of Series H Preferred Stock is convertible,

at the option of the holder but subject to the Company increasing its authorized shares of common stock, into such number of shares

of common stock of the Company as determined by dividing the Stated Value ($500 per share) by the conversion price ($10.00

per share). The Series H Preferred Stock has no liquidation preference, does not pay dividends and the holder of Series H Preferred

Stock shall be entitled to one vote for each share of common stock that the Series H Preferred Stock may be convertible into. Each

share of Common Stock entitles its holder to one vote on each matter submitted to the stockholders.

Series I Preferred Shares

On

July 20, 2023, the Company through its wholly owned subsidiary, Greenwich International Holdings, a Costa Rica corporation (“Greenwich”),

entered into an Amended and Restated Joint Venture (the “2023 Tokenize Agreement”) with Magic Internacional Argentina

FC, S.L. (“Magic”) and GBT Tokenize Corp (“GBT Tokenize”).

On

March 6, 2020, the Company through Greenwich entered into a Joint Venture and Territorial License Agreement (the “2020 Tokenize

Agreement”) with Tokenize-It, S.A. (“Tokenize”). Under the 2020 Tokenize Agreement, the parties formed GBT Tokenize

and Tokenize contributed its technology portfolio as described in the 2020 Tokenize Agreement with each Tokenize and the Company

owning 50% of GBT Tokenize. The purpose of GBT Tokenize is to develop, maintain and support source codes for its proprietary technologies

including advanced mobile chip technologies, tracking, radio technologies, AI core engine, electronic design automation, mesh,

games, data storage, networking, IT services, business process outsourcing development services, customer service, technical support

and quality assurance for business, customizable and dedicated inbound and outbound calls solutions, as well as digital communications

processing for enterprises and start-ups (“Technology Portfolio”). In addition to the Technology Portfolio, Tokenize

contributed the services and resources for the development of the Technology Portfolio to GBT Tokenize. The Company contributed

2,000,000 shares of common stock.

On

May 28, 2021, the parties agreed to amend the 2020 Tokenize Agreement to expand the territory granted for the Technology Portfolio

under the license to GBT Tokenize to include the entire continental United States. The Company issued GBT Tokenize an additional

14,000,000 shares of common stock. On June 30, 2021, Tokenize and its shareholder assigned all their rights under the 2020 Tokenize

Agreement, including the Company’s pledged 50% ownership in GBT Tokenize to Magic.

On

April 11, 2022, the Company, through Greenwich, entered into a Master Joint Venture and Territorial License Agreement (the “2022

Tokenize Agreement”) with Magic and Tokenize which replaced the 2020 Tokenize Agreement. The Company issued GBT Tokenize

an additional 150,000,000 shares of common stock of the Company.

GBT Tokenize

has developed a vital device based on the Technology Portfolio that is ready for commercialization, as well as certain derivative

technologies, which positioned GBT Tokenize to further develop or license certain code sources. On April 3, 2023, GBT Tokenize

entered its first commercial transaction to date through the sale of the Avant-AI! technology that been developed by GBT Tokenize,

based on the Technology Portfolio pursuant to which GBT Tokenize received 26,000,000 shares of common stock of Buyer’s shares

– Avant Technologies, Inc.

The

2023 Tokenize Agreement restated and replaced the 2022 Tokenize Agreement. Pursuant to the 2023 Tokenize Agreement, as a result

of the contribution of the Technology Portfolio by Tokenize and the subsequent contribution of services for the development of

the Technology Portfolio by Tokenize and Magic, GBT Tokenize has been able to continue in operation, which has benefited the Company

despite its contribution of 166 million shares of common stock valued at approximately $50,000. In order to maintain its 50% ownership

interest in GBT Tokenize, the Company agreed to contribute its portfolio of intellectual property to GBT Tokenize and issue to

GBT Tokenize 1,000 shares of Series I Preferred Stock (the “Series I Stock”) with a stated value of $35,000 per share

which is convertible into common stock of the Company by dividing the stated value by the conversion price of $0.0035, which, if

converted in full would result in the issuance of 10 billion shares of common stock of the Company. Further, the Series I Stock

will vote on an as converted basis.

The

Company pledged its 50% ownership in GBT Tokenize and its 100% ownership of Greenwich to Magic to secure its Technology Portfolio

investment.

Pursuant to Rule

14c-2 under the Securities Exchange Act of 1934, as amended, the actions will not be adopted until a date at least 20 days after

the date on which this Information Statement has been mailed to the stockholders. The Company anticipates that the actions contemplated

herein will be effected on or about the close of business on September 12, 2023.

The Company has

asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of

the Common Stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding

such material.

This Information

Statement will serve as written notice to stockholders pursuant to Section 78.320 of the Nevada Revised Statutes of the State of

Nevada.

ABOUT THE INFORMATION

STATEMENT

WHAT IS THE PURPOSE OF THE INFORMATION STATEMENT?

This Information

Statement is being furnished to you pursuant to Section 14 of the Securities Exchange Act of 1934 to notify the Company’s

shareholders as of the close of business on the Record Date of corporate action expected to be taken pursuant to the consents or

authorizations of shareholders representing a majority of the Company’s Common Stock.

Shareholders holding

a majority of the Company’s outstanding voting stock voted in favor of the corporate matters outlined in this Information

Statement, which actions are expected to take place on or before September 12, 2023. The matter relates to the approval to authorize

an increase in the number of authorized shares of the Company’s Common Stock from 10,000,000,000 shares to 20,000,000,000

shares and the associated filing of the amendment to the Company’s Articles of Incorporation to implement the increase.

WHO IS ENTITLED TO NOTICE?

Each outstanding

share of Common Stock and Preferred Stock as of record on the Record Date will be entitled to notice of each matter to be voted

upon pursuant to consents or authorizations. Shareholders as of the close of business on the Record Date that held in excess of

fifty percent (50%) of the Company’s outstanding voting shares voted in favor of the actions. Under Nevada corporate law,

all the activities requiring shareholder approval may be taken by obtaining the written consent and approval of more than 50% of

the holders of voting stock in lieu of a meeting of the shareholders. No action by the minority shareholders in connection with

the action is required.

WHAT CONSTITUTES THE VOTING SHARES OF THE COMPANY?

The voting power

entitled to vote on the actions consists of the vote of the holders of a majority of the voting power of the Common Stock, each

of whom is entitled to one vote per share. The Series B Preferred Shares, Series C Preferred Shares, Series H Preferred Shares

and Series I Preferred Shares will be entitled to vote on all matters submitted to shareholders of the Company on an as-converted

basis.As of the Record Date, 6,103,695,062 shares of Common Stock were issued and outstanding.

WHAT CORPORATE MATTERS WILL THE SHAREHOLDERS

VOTE FOR, AND HOW WILL THEY VOTE?

Shareholders holding

a majority of our voting stock have voted in favor of the following actions:

| |

● |

To amend the Company’s Articles of Incorporation to increase the number of authorized shares of common stock of the Company from 10,000,000,000 shares to 30,000,000,000 shares. |

WHAT VOTE IS REQUIRED TO APPROVE THE ACTIONS?

The affirmative

vote of a majority of the shares of our voting stock outstanding on the Record Date, is required for approval of the actions. A

majority of the outstanding voting shares of voting stock voted in favor of the actions.

STOCK OWNERSHIP OF MANAGEMENT AND

PRINCIPAL STOCKHOLDERS

The

following table sets forth information with respect to the beneficial ownership of the Common Stock as of July 27, 2023 by (i)

each person known by the Company to own beneficially more than 5% of the outstanding Common Stock; (ii) each director of the Company;

(iii) each officer of the Company and (iv) all executive officers and directors as a group. Except as otherwise indicated below,

each of the entities or persons named in the table has sole voting and investment powers with respect to all shares of Common Stock

beneficially owned by it or him as set forth opposite its or his name.

| Name of Beneficial Owner |

Common Stock Beneficially Owned (1) |

Percentage of Common Stock (1) |

| Dr. Danny Rittman (2) |

1,980 |

* |

| Mansour Khatib (2) |

0 |

-- |

| GBT Tokenize Corp (2) (3) |

10,166,000,000 |

63.13% |

| |

|

|

| All Officers and Directors as a Group |

1,980 |

* |

* Less than

1%.

| (1) |

Beneficial ownership is determined in accordance with the Rule 13d-3(d)(1) of the Exchange Act, as amended and generally includes voting or investment power with respect to securities. Pursuant to the rules and regulations of the Securities and Exchange Commission, shares of common stock that an individual or group has a right to acquire within 60 days pursuant to the exercise of options or warrants are deemed to be outstanding for the purposes of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purposes of computing the percentage ownership of any other person shown in the table. The above is based on 6,103,695,062 shares of common stock outstanding as of July 27, 2023. |

| (2) |

Current Officer and/or Director of the Company. |

| (3) |

Via Preferred Serie I counted for 10 billion shares and 166 million holding as common. |

No Director, executive

officer, affiliate or any owner of record or beneficial owner of more than 5% of any class of voting securities of the Company

is a party adversary to the Company or has a material interest adverse to the Company.

AMENDMENT OF THE CERTIFICATE OF INCORPORATION

TO

INCREASE OF AUTHORIZED

SHARES

On July 27, 2023,

the majority stockholders holding a majority of the issued and outstanding voting shares of the Company approved an amendment to

the Company’s Articles of Incorporation, to increase the number of authorized shares of Common Stock from 10,000,000,000

shares to 30,000,000,000 shares. The Company currently has authorized capital stock of 10,000,000,000 shares of Common Stock and

approximately 6,103,695,062 shares of Common Stock are outstanding as of July 27, 2023. The Company’s Board of Directors

(the “Board”) believes that the increase in authorized common shares would provide the Company greater flexibility

with respect to the Company’s capital structure for such purposes as additional equity financings, and stock-based acquisitions.

The terms of the

additional shares of Common Stock will be identical to those of the currently outstanding shares of Common Stock. However, because

holders of Common Stock have no preemptive rights to purchase or subscribe for any unissued stock of the Company, the issuance

of additional shares of Common Stock will reduce the current stockholders’ percentage ownership interest in the total outstanding

shares of Common Stock. This amendment and the creation of additional shares of authorized Common Stock will not alter the current

number of issued shares. The relative rights and limitations of the shares of Common Stock will remain unchanged under this amendment.

As of August 21,

2023, a total of 6,103,695,062 shares of the Company’s currently authorized 10,000,000,000 shares of Common Stock are issued

and outstanding. The increase in the number of authorized but unissued shares of Common Stock would enable the Company, without

further stockholder approval, to issue shares from time to time as may be required for proper business purposes, such as raising

additional capital for ongoing operations, business and asset acquisitions, stock splits and dividends, present and future employee

benefit programs and other corporate purposes.

The proposed increase

in the authorized number of shares of Common Stock could have a number of effects on the Company’s stockholders depending

upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. The increase could have an anti-takeover

effect, in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that

could make a change in control or takeover of the Company more difficult. For example, additional shares could be issued by the

Company so as to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company, even if the persons

seeking to obtain control of the Company offer an above-market premium that is favored by a majority of the independent shareholders.

Similarly, the issuance of additional shares to certain persons allied with the Company’s management could have the effect

of making it more difficult to remove the Company’s current management by diluting the stock ownership or voting rights of

persons seeking to cause such removal. The Company does not have any other provisions in its certificate or incorporation, by-laws,

employment agreements, credit agreements or any other documents that have material anti-takeover consequences. Additionally, the

Company has no plans or proposals to adopt other provisions or enter into other arrangements, except as disclosed below, that may

have material anti-takeover consequences. The Board is not aware of any attempt, or contemplated attempt, to acquire control of

the Company, and this proposal is not being presented with the intent that it be utilized as a type of anti- takeover device.

Stockholders should

recognize that, as a result of this proposal, they will own a fewer percentage of shares with respect to the total authorized shares

of the Company, than they presently own, and will be diluted as a result of any issuances contemplated by the Company in the future.

Except as set forth

below, there are currently no plans, arrangements, commitments or understandings for the issuance of the additional shares of Common

Stock which are proposed to be authorized.

Series B Preferred Shares

On November 1,

2011, the Company and certain creditors entered into a Settlement Agreement (the “Settlement Agreement”) whereby without

admitting any wrongdoing on either part, the parties settled all previous agreements and resolved any existing disputes. Under

the terms of the Settlement Agreement, the Company agreed to issue the creditors 45,000 shares of Series B Preferred Stock of the

Company on a pro-rata basis. Following the issuance and delivery of the shares of Series B Preferred Stock to said creditors, as

well as surrendering the undelivered shares, the Settlement Agreement resulted in the settlement of all debts, liabilities and

obligations between the parties.

The Series B Preferred

Stock has a stated value of $100 per share and is convertible into the Company’s common stock at a conversion price of $30.00 per

share representing 30 posts split common shares. Furthermore, the Series B Preferred Stock votes on an as converted basis and carries

standard anti-dilution rights. These rights were subsequently removed, except in cases of stock dividends or splits.

As of March 31,

2022 and December 31, 2021, there were 45,000 Series B Preferred Shares outstanding.

Series C Preferred Shares

On April 29, 2011,

GV Global Communications, Inc. (“GV”) provided funding to the Company in the aggregate principal amount of $111,000

(the “Loan”). On September 25, 2012, the Company and GV entered into a Conversion Agreement pursuant to which the Company

agreed to convert the Loan into 10,000 shares of Series C Preferred Stock of the Company, which was approved by the Board of Directors.

Each share of Series

C Preferred Stock is convertible, at the option of GV, into such number of shares of common stock of the Company as determined

by dividing the Stated Value (as defined below) by the Conversion Price (as defined below). The Conversion Price for each share

is equal to a 50% discount to the average of the lowest three lowest closing bid prices of the Company’s common stock during

the 10-day trading period prior to the conversion with a minimum conversion price of $0.02. The stated value is $11.00 per share

(the “Stated Value”). The Series C Preferred Stock has no liquidation preference, does not pay dividends and the holder

of Series C Preferred Stock shall be entitled to one vote for each share of common stock that the Series C Preferred Stock shall

be convertible into. GV has contractually agreed to restrict its ability to convert the Series C Preferred Stock and receive

shares of the Company’s common stock such that the number of shares of the Company’s common stock held by it and its

affiliates after such conversion does not exceed 4.9% of the then issued and outstanding shares of the Company’s common stock.

During the year

ended December 31, 2014, GV Global Communications, Inc. converted 7,770 of its Series C Preferred Stock into 120 post-splits.

During the third quarter of 2014, the Company received 42 post-split common shares to adjust the shares issued to reflect

the amount that both they and the Company believed that they were owed. At December 31, 2021 and 2020, GV owns 700 Series

C Preferred Shares.

As of March 31,

2022 and December 31, 2021, there were 700 Series C Preferred Shares outstanding.

Series H Preferred Shares

On June 17, 2019,

the Company, AltCorp Trading LLC, a Costa Rica company and a wholly-owned subsidiary of the Company (“AltCorp”), GBT

Technologies, S.A., a Costa Rica company (“GBT-CR”) and Pablo Gonzalez, a shareholder’s representative of GBT-CR

(“Gonzalez”), entered into and closed an Exchange Agreement (the “GBT Exchange Agreement”) pursuant to

which the parties exchanged certain securities. In accordance with the Exchange Agreement, AltCorp acquired 625,000 shares

of GBT-CR representing 25% of its issued and outstanding shares of common stock from Gonzalez in exchange for the issuance of 20,000 shares

of Series H Convertible Preferred Stock of the Company and a Convertible Note in the principal amount of $10,000,000 issued

by the Company (the “Gopher Convertible Note”) as well as additional consideration. The Gopher Convertible Note bears

interest of 6% per annum and is payable at maturity on December 31, 2021. At the election of Gonzalez, the Gopher Convertible

Note can be converted into a maximum of 20,000 shares of Series H Preferred Stock. Each share of Series H Preferred Stock is convertible,

at the option of the holder but subject to the Company increasing its authorized shares of common stock, into such number of shares

of common stock of the Company as determined by dividing the Stated Value ($500 per share) by the conversion price ($10.00

per share). The Series H Preferred Stock has no liquidation preference, does not pay dividends and the holder of Series H Preferred

Stock shall be entitled to one vote for each share of common stock that the Series H Preferred Stock may be convertible into.

Series I Preferred Shares

On

July 20, 2023, the Company through its wholly owned subsidiary, Greenwich International Holdings, a Costa Rica corporation (“Greenwich”),

entered into an Amended and Restated Joint Venture (the “2023 Tokenize Agreement”) with Magic Internacional Argentina

FC, S.L. (“Magic”) and GBT Tokenize Corp (“GBT Tokenize”).

On

March 6, 2020, the Company through Greenwich entered into a Joint Venture and Territorial License Agreement (the “2020 Tokenize

Agreement”) with Tokenize-It, S.A. (“Tokenize”). Under the 2020 Tokenize Agreement, the parties formed GBT Tokenize

and Tokenize contributed its technology portfolio as described in the 2020 Tokenize Agreement with each Tokenize and the Company

owning 50% of GBT Tokenize. The purpose of GBT Tokenize is to develop, maintain and support source codes for its proprietary technologies

including advanced mobile chip technologies, tracking, radio technologies, AI core engine, electronic design automation, mesh,

games, data storage, networking, IT services, business process outsourcing development services, customer service, technical support

and quality assurance for business, customizable and dedicated inbound and outbound calls solutions, as well as digital communications

processing for enterprises and start-ups (“Technology Portfolio”). In addition to the Technology Portfolio, Tokenize

contributed the services and resources for the development of the Technology Portfolio to GBT Tokenize. The Company contributed

2,000,000 shares of common stock.

On

May 28, 2021, the parties agreed to amend the 2020 Tokenize Agreement to expand the territory granted for the Technology Portfolio

under the license to GBT Tokenize to include the entire continental United States. The Company issued GBT Tokenize an additional

14,000,000 shares of common stock. On June 30, 2021, Tokenize and its shareholder assigned all their rights under the 2020 Tokenize

Agreement, including the Company’s pledged 50% ownership in GBT Tokenize to Magic.

On

April 11, 2022, the Company, through Greenwich, entered into a Master Joint Venture and Territorial License Agreement (the “2022

Tokenize Agreement”) with Magic and Tokenize which replaced the 2020 Tokenize Agreement. The Company issued GBT Tokenize

an additional 150,000,000 shares of common stock of the Company.

GBT Tokenize

has developed a vital device based on the Technology Portfolio that is ready for commercialization, as well as certain derivative

technologies, which positioned GBT Tokenize to further develop or license certain code sources. On April 3, 2023, GBT Tokenize

entered its first commercial transaction to date through the sale of the Avant-AI! technology that been developed by GBT Tokenize,

based on the Technology Portfolio pursuant to which GBT Tokenize received 26,000,000 shares of common stock of Buyer’s shares

– Avant Technologies, Inc.

The

2023 Tokenize Agreement restated and replaced the 2022 Tokenize Agreement. Pursuant to the 2023 Tokenize Agreement, as a

result of the contribution of the Technology Portfolio by Tokenize and the subsequent contribution of services for the

development of the Technology Portfolio by Tokenize and Magic, GBT Tokenize has been able to continue in operation, which has

benefited the Company despite its contribution of 166 million shares of common stock valued at approximately $50,000. In

order to maintain its 50% ownership interest in GBT Tokenize, the Company agreed to contribute its portfolio of intellectual

property to GBT Tokenize and issue to GBT Tokenize 1,000 shares of Series I Preferred Stock (the “Series I

Stock”) with a stated value of $35,000 per share which is convertible into common stock of the Company by dividing the

stated value by the conversion price of $0.0035, which, if converted in full would result in the issuance of 10 billion

shares of common stock of the Company. Further, the Series I Stock will vote on an as converted basis.

The

Company pledged its 50% ownership in GBT Tokenize and its 100% ownership of Greenwich to Magic to secure its Technology Portfolio

investment.

$10,000,000

for Igor 1 Corp (Prior year - GBT Technologies S. A.)

In

accordance with the acquisition of GBT-CR the Company issued a convertible note in the principal amount of $10,000,000. The convertible

note bears interest of 6% per annum and is payable at maturity on December 31, 2021. At the election of the holder, the convertible

note can be converted into a maximum of 20,000 shares of Series H Preferred Stock. Each share of Series H Preferred Stock

is convertible, at the option of the holder but subject to the Company increasing its authorized shares of common stock, into such

number of shares of common stock of the Company as determined by dividing the Stated Value ($500 per share) by the conversion

price ($500.00 per share). This convertible note may convert into shares of the Company’s common stock at a conversion

price equal to 85% of the lowest trading price with a 20-day look back immediately preceding the date of conversion and therefore

recorded as derivative liability.

On

May 19, 2021, the Company, Gonzalez, GBT-CR and IGOR 1 Corp entered into a Mutual Release and Settlement Agreement and Irrevocable

Assignment of outstanding balance plus accrued interest (the “Gonzalez Agreement”). Pursuant to the Gonzalez Agreement,

without any party admission of liability and to avoid litigation, the parties has agreed to (i) extend the GBT convertible note

maturity date to December 31, 2022, (ii) amend the GBT convertible note terms to include a beneficial ownership blocker of 4.99%

and a modified conversion feature to the GBT convertible note with 15% discount to the market price during the 20 trading day period

ending on the latest complete trading day prior to the conversion date and (iii) provided for an assignment of the GBT convertible

note by Gonzalez to a third party. As a result of the change in terms of this convertible note, the Company took a charge related

to the modification of debt of $13,777,480 during the year ended December 31, 2021. This convertible note is recorded as derivative

liability because of the discounted price on conversion.

During

the year ended December 31, 2021, IGOR 1 converted $1,284,600 of the convertible note into 4,185,650 shares of the Company’s

common stock. Also, on June 24, 2021, the Company transferred 5,500,000 SURG shares received as repayment of $660,000 of this convertible

note.

As

of March 31, 2022, the note had an outstanding balance of $8,055,400 and accrued interest of $1,664,447.

1800 Diagonal Lending LLC

Promissory Note $59,408

On March 1, 2023, the Company entered

into a Securities Purchase Agreement, with 1800 Diagonal Lending LLC, an accredited investor (“DL”) pursuant to which

the Company issued to DL a Promissory Note (the “DL Note”) in the aggregate principal amount of $59,408 with an original

issue discount of $6,258 resulting in net proceeds of the Company of $53,150. The DL Note has a maturity date of June 1, 2024 and

the Company has agreed to pay interest on the unpaid principal balance of the DL Note at the rate of 12.0% per annum from the date

on which the DL Note is issued. A one-time interest charge of 12% or $7,128 was applied on the issuance date of the DL Note to

the principal amount owed under the DL Note. Accrued, unpaid interest and outstanding principal, subject to adjustment, shall be

paid in ten payments each in the amount of $6,653.60 resulting in a total payback to DL of $66,536. The first payment is due April

15, 2023 with nine subsequent payments each month thereafter. The Company shall have a five-day grace period with respect to each

payment. The Company has right to accelerate payments or prepay in full at any time with no prepayment penalty. This DL Note shall

not be secured by any collateral or any assets of the Company.

The outstanding principal amount

of the DL Note may not be converted into the Company common shares except in the event of default. In the event of default on the

DL Note, DL may convert the DL Note into shares of the Company’s common stock at

a conversion price equal to 75% of the lowest trading price during the 10 day period immediately preceding the date of conversion.

In addition, upon the occurrence and during the continuation of an event of default (as defined in the DL Note), the DL Note shall

become immediately due and payable and the Company shall pay to DL, in full satisfaction of its obligations hereunder, additional

amounts as set forth in the DL Note. In no event shall DL be allowed to effect a conversion if such conversion, along with all

other shares of Company common stock beneficially owned by DL and its affiliates would exceed 4.99% of the outstanding shares of

the common stock of the Company.

Convertible Note $62,680

On March 1, 2023, the Company entered

into a Securities Purchase Agreement with DL pursuant to which the Company issued to DL a Convertible Promissory Note (the “DL

Convertible Note”) in the aggregate principal amount of $62,680 for a purchase price of $52,150. The DL Convertible Note

has a maturity date of June 1, 2024 and the Company has agreed to pay interest on the unpaid principal balance of the DL Convertible

Note at the rate of six percent (6.0%) per annum from the date on which the DL Convertible Note is issued until the same becomes

due and payable, whether at maturity or upon acceleration or by prepayment or otherwise. The Company shall have the right to prepay

the DL Convertible Note, provided it makes a payment including a prepayment to DL as set forth in the DL Convertible Note.

The outstanding principal amount

of the DL Convertible Note may not be converted prior to the period beginning on the date that is 180 days following the date

the DL Convertible Note is issued . Following the 180th day, DL may convert the DL Convertible Note into shares of the

Company’s common stock at a conversion price equal to 85% of the lowest trading

price during the 20 day period preceding the date of conversion. In addition, upon the occurrence and during the continuation

of an event of default (as defined in the DL Convertible Note), the DL Convertible Note shall become immediately due and payable

and the Company shall pay to DL, in full satisfaction of its obligations hereunder, additional amounts as set forth in the DL

Convertible Note. In no event shall DL be allowed to effect a conversion if such conversion, along with all other shares of Company

common stock beneficially owned by DL and its affiliates would exceed 4.99% of the outstanding shares of the common stock of the

Company.

Straight Note $47,208

On April 24, 2023, the Company entered

into a Securities Purchase Agreement, with 1800 Diagonal Lending LLC, an accredited investor (“DL”) pursuant to which

the Company issued to DL a Promissory Note (the “DL Note”) in the aggregate principal amount of $47,208 with an original

issue discount of $5,058 resulting in net proceeds of the Company of $42,150. The DL Note has a maturity date of April 24, 2024

and the Company has agreed to pay interest on the unpaid principal balance of the DL Note at the rate of 12.0% per annum from the

date on which the DL Note is issued (the “Issue Date”). A one-time interest charge of 12% or $5,664 was applied on

the Issue Date to the principal amount owed under the DL Note. Accrued, unpaid interest and outstanding principal, subject to adjustment,

shall be paid in ten payments each in the amount of $5,287.20 resulting in a total payback to DL of $52,872. The first payment

is due June 15, 2023 with nine subsequent payments each month thereafter. The Company shall have a five-day grace period with respect

to each payment. The Company has right to accelerate payments or prepay in full at any time with no prepayment penalty. This DL

Note shall not be secured by any collateral or any assets of the Company.

The outstanding principal amount

of the DL Note may not be converted into the Company common shares except in the event of default. In the event of default on the

DL Note, DL may convert the DL Note into shares of the Company’s common stock at

a conversion price equal to 75% of the lowest trading price with a 10-day look back immediately preceding the date of conversion.

In addition, upon the occurrence and during the continuation of an event of default (as defined in the DL Note), the DL Note shall

become immediately due and payable and the Company shall pay to DL, in full satisfaction of its obligations hereunder, additional

amounts as set forth in the DL Note. In no event shall DL be allowed to effect a conversion if such conversion, along with all

other shares of Company common stock beneficially owned by DL and its affiliates would exceed 4.99% of the outstanding shares of

the common stock of the Company.

The transaction closed on April

26, 2023.

Convertible Note $50,580

On April 24, 2023, the Company entered

into a Securities Purchase Agreement with DL pursuant to which the Company issued to DL a Convertible Promissory Note (the “DL

Convertible Note”) in the aggregate principal amount of $50,580 for a purchase price of $42,150. The DL Convertible Note

has a maturity date of July 24, 2024 and the Company has agreed to pay interest on the unpaid principal balance of the DL Convertible

Note at the rate of six percent (6.0%) per annum from the date on which the DL Convertible Note is issued (the “Convertible

Issue Date”) until the same becomes due and payable, whether at maturity or upon acceleration or by prepayment or otherwise.

The Company shall have the right to prepay the DL Convertible Note, provided it makes a payment including a prepayment to DL as

set forth in the DL Convertible Note.

The outstanding principal amount

of the DL Convertible Note may not be converted prior to the period beginning on the date that is 180 days following the Convertible

Issue Date. Following the 180th day, DL may convert the DL Convertible Note into shares of the

Company’s

common stock at a conversion price equal to 85% of the lowest trading price with a 20-day look

back immediately preceding the date of conversion. In addition, upon the occurrence and during the continuation of an Event of

Default (as defined in the DL Convertible Note), the DL Convertible Note shall become immediately due and payable and the Company

shall pay to DL, in full satisfaction of its obligations hereunder, additional amounts as set forth in the DL Convertible Note.

In no event shall DL be allowed to effect a conversion if such conversion, along with all other shares of Company common stock

beneficially owned by DL and its affiliates would exceed 4.99% of the outstanding shares of the common stock of the Company.

Stanley

Hills LLC

The

Company entered into a series of loan agreements with Stanley Hills LLC (“Stanley”) pursuant to which it received more

than $1,000,000 in loans (the “Debt”) since May 2019 up to December 2019. On February 26, 2020, in order to induce

Stanley to continue to provide funding, the Company and Stanley entered into a letter agreement providing that the current note

payable balance due to Stanley in the amount of $1,214,900 may be converted into shares of common stock of the Company at

a conversion price equal to 85% multiplied by the lowest one trading price for the common stock during the 20-trading day period

ending on the latest complete trading day prior to the conversion date. Since the conversion price will vary based on the Company’s

stock price, the beneficial conversion feature associated with this note is accounted for as a derivative liability. Stanley has

agreed to restrict its ability to convert the Debt and receive shares of common stock such that the number of shares of common stock

held by it and its affiliates after such conversion or exercise does not exceed 4.99% of the then issued and

outstanding shares of common stock. During the year ended December 31, 2021, Stanley converted $1,231,466 of its convertible

note plus interest into 4,420,758 shares of the Company’s common stock, and during the year ended December 31,

2021, Stanley loaned the Company an additional $325,000. Also, during the year ended December 31, 2021, the Company transferred

the SURG shares received as repayment of $800,000 of this convertible note and also converted $126,003 of accrued interest

into the principal balance. During the year ended December 31, 2021, Gonzalez assigned all his accrued balances of $424,731 to

Stanley in a private transaction. The balance of the Stanley debt at March 31, 2022 and December 31, 2021 was $116,605 and

$116,605, respectively. The unpaid interest of the Stanley debt at March 31, 2022 and December 31, 2021 was $11,247 and $8,372,

respectively. The Stanley debt was secured via a pledge agreement on the SURG shares.

$8,340,000 Senior Secured Redeemable

Convertible Debenture

On December

3, 2018, the Company entered into a Securities Purchase Agreement (the “SPA”) with Discover Growth Fund, LLC (the

“Investor”) pursuant to which the Company issued a Senior Secured Redeemable Convertible Debenture (the

“Debenture”) in the aggregate face value of $8,340,000. In connection with the issuance of the Debenture and

pursuant to the terms of the SPA, the Company issued a Common Stock Purchase Warrant to acquire up

to 225,000 shares of common stock for a term of three years (the “Warrant”) on a cash-only basis at an

exercise price of $100.00 per share with respect to 50,000 Warrant Shares, $75.00 with respect to 75,000 Warrant Shares and

$50.00 with respect to 100,000 Warrant Shares. The holder may not exercise any portion of the Warrants to the extent that the

holder would own more than 4.99% of the Company’s outstanding common stock immediately after exercise. The outstanding

principal amount may be converted at any time into shares of the Company’s common stock at a conversion

price equal to 95% of the Market Price less $5.00 (the conversion price is lowered by 10% upon the occurrence of

each Triggering Event – the current conversion price is 75% of the Market Price less $5.00). The Market Price is the

average of the 5 lowest individual daily volume weighted average prices during the period the Debenture is outstanding. On

May 28, 2019, the Investor delivered to the Company a “Notice of Default and Notice of Sale of Collateral” (the

“Notice”). On December 23, 2019, in arbitration between the Company and the Investor, an Interim Award was

entered in favor of the Investor. On January 31, 2020, the Company was informed that a final award was entered (the

“Final Award”). The Final Award affirms that certain sections of the Debenture constitute unenforceable

liquidated damages penalties and were stricken. Further, it was determined that the Investor was entitled to recovery of

their attorney’s fees. Consequently, the arbitrator awarded Investor an award of $4,034,444 plus interest

of 7.25% accrued from May 15, 2019 and costs in the amount of $55,613. On February 18, 2020, the Company filed a motion

with the United States District Court District of Nevada (the “Nevada Court”) to confirm the Final Award and a

motion to consolidate Investor’s application to confirm the Final Award filed in the U.S. District Court of the Virgin

Islands (Case No: 3 :20-cv-00012-CVG-RM) (the “Virgin Island Court”). On February 27, 2020, the Nevada Court

denied the Company’s motion to confirm the Final Award and motion to consolidate and further decided that the

confirmation of the Final Award should be litigated in the Virgin Island Court. As such, on February 27, 2020, the

Company filed a Notice of Entry of Order as well as a Motion to Confirm the Arbitration Award, address the outstanding issues

regarding whether Investor’s rights are subordinated to other creditors and, thereafter, oversee a commercially

reasonable foreclosure sale (Case No: 3 :20-cv-00012-CVG-RM). It was the Company’s position that the Final Award must

first be confirmed and all questions regarding the rights of Investor relative to those of other creditors must be determined

before any foreclosure sale can proceed. It is further the position of the Company that the previously disclosed foreclosure

sale scheduled by Investor is being conducted in a commercially unreasonable manner and that if Discover proceeded forward

with the foreclosure sale it did so at its own risk. Nevertheless, on February 28, 2020, Investor advised that it conducted a

sale of the Company’s assets. As the date of this report Investor failed to present a deed of sale for the alleged sale

that allegedly took place as noticed. The Company filed with Virgin Island Court the motions disputing the validity of the

alleged sale. On July 28, 2020, Investor filed in the State of Nevada a motion for attorneys $48,844 and costs $716. The

Company filed an answer on August 11, 2020. On October 16, 2020, Investor motion for attorneys $48,844 and costs

$716 was denied. The balance was included in accounts payable for the unearned settlement. As of March 31, 2022, this

case is still pending with the Federal court and the Court has not taken any substantive action in the matter as of the date

hereof.

ANNUAL AND QUARTERLY REPORTS

Our Annual Report

on Form 10-K for the fiscal year ended December 31, 2022 and our Quarterly Report on Form 10-Q for the quarter ended March 31,

2023, as filed with the SEC, excluding exhibits, is being mailed to shareholders with this Information Statement. We will furnish

any exhibit to our Annual Report on Form 10-K or Quarterly Report on Form 10-Q free of charge to any shareholder upon written request

to the Company at 2450 Colorado Avenue, Suite 100F, Santa Monica, CA 90404. The Annual Report and Quarterly Report are incorporated

in this Information Statement. You are encouraged to review the Annual Report and Quarterly Report together with subsequent information

filed by the Company with the SEC and other publicly available information.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Mansour Khatib |

| |

Chief Executive

Officer |

| Santa Monica, California |

|

| August 23, 2023 |

|

18

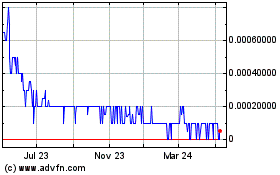

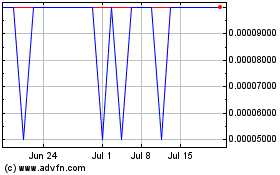

GBT Technologies (PK) (USOTC:GTCH)

Historical Stock Chart

From Oct 2024 to Nov 2024

GBT Technologies (PK) (USOTC:GTCH)

Historical Stock Chart

From Nov 2023 to Nov 2024