Current Report Filing (8-k)

October 11 2022 - 6:06AM

Edgar (US Regulatory)

0001471781

false

0001471781

2022-10-05

2022-10-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 5, 2022

GBT

TECHNOLOGIES INC.

(Exact

name of small business issuer as specified in its charter)

| Nevada |

000-54530 |

27-0603137 |

| (State or other jurisdiction

of incorporation or organization) |

Commission File Number |

(I.R.S. Employer Identification

No.) |

2500

Broadway, Suite F-125, Santa Monica, CA 90404

(Address

of principal executive offices) (Zip code)

Registrant’s

telephone number including area code: 888-685-7336

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instructions A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check

mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered

pursuant to Section 12(b) of the Act: Not applicable.

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Not

applicable. |

|

|

| Item 1.01 | Entry into a Material Definitive Agreement. |

GBT Technologies, Inc. (the “Company”)

entered into the Confidential Settlement Agreement and Mutual Release (“RJW Agreement”) by and between RWJ Advanced Marketing,

LLC, Robert Warren Jackson, Gregory Bauer (collectively the “RJW Parties”) and W.L. Petrey Wholesale Company, Inc., (“Petrey”)

on one hand; and GBT Technologies Inc., on behalf of itself and its agents (collectively the GBT Parties”), on the other hand. The

Company the RJW Agreement effective September 26, 2022 with final signatures delivered to the Company on or about October 5, 2022.

Pursuant to the RJW Agreement, the parties have agreed

to settle, release, and otherwise resolve all known or unknown claims between them and agreed to jointly stipulate, move, or otherwise

dismiss the lawsuits filed in the United States District Court of Nevada (Case No. 2:20-cv- 02078), in the Superior Court of the State

of California, County of Los Angeles, Central District (Case Nos. 19STCV03320 and 20STCV32709), and in the United States District Court

of the Central District of California (Case No. 2:20-cv-09399-RGK-AGR) with prejudice.

The parties agreed and stipulated to release all funds

currently being held in a blocked account in the amount of approximately of $19,809.55 with 50% distributed to the RWJ Parties and 50%

distributed the Company or its assignee. The Parties also entered into the InComm Assignment Agreement (“IAA”) which assigned,

transferred and conveyed all proceeds derived from the RWJ Parties’ agreements with Interactive Communications International, Inc.,

and its affiliate Hi Technology Corp., including but not limited to that Master Distribution and Service Agreement between Interactive

Communications International, Inc. and Petrey d/b/a UGO-HUB dated August 29, 2016, as amended (collectively referred to as the “InComm

Proceeds”), and which shall divide the InComm Proceeds 90% to the Company or its assignee and 10% to the RWJ Parties or their assignee.

Finally, the Company agreed to pay $40,000 to the RWJ Parties or their assignee.

As disclosed by the Company on Form 8-K on December 27, 2021 (https://www.sec.gov/Archives/edgar/data/1471781/000173112221002207/e3390_8-k.htm),

the Company under a different settlement agreement with a third party, committed to assign the IAA. As such, on October 5, 2022 and as

cumulation of all settlement agreements the Company issued a request to the third party regarding release of certain escrow funds and

the execution of an assignment of rights as contemplated in the aforereferenced agreement.

Item 9.01 Financial Statements and Exhibits.

Pursuant to the requirements

of the Securities Exchange Act 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

GBT TECHNOLOGIES INC. |

| |

|

|

| |

By: |

/s/ Mansour Khatib |

| |

Name: |

Mansour Khatib |

| |

Title: |

Chief Executive Officer |

Date: October 10, 2022

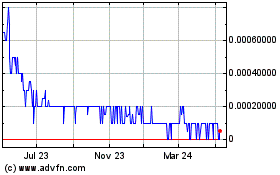

GBT Technologies (PK) (USOTC:GTCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

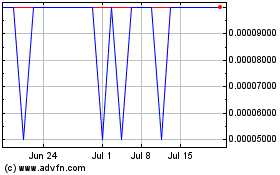

GBT Technologies (PK) (USOTC:GTCH)

Historical Stock Chart

From Apr 2023 to Apr 2024