UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE

ACT OF 1934.

For the fiscal year

ended

April 30, 2018

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934.

For the transition

period from ____________ to __________

Commission File

number

0-8862

FIRST HARTFORD CORPORATION

(Exact name of registrant as specified in its charter)

|

Maine

|

01-0185800

|

|

(State

or Other Jurisdiction of

|

(I.R.S.

Employer Identification Number)

|

|

Incorporation or Organization)

|

|

|

|

|

|

149 Colonial

Road, Manchester, Connecticut

06042

|

860-646-6555

|

|

(Address of

Principal Executive Offices)

(Zip Code)

|

(Registrant's telephone number)

|

Securities

registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common

Stock, par value of $1 per share

Indicate by check

mark if the registrant is a well-known seasoned issuer, as defined in Rule 405

of the Securities Act.

¨

Yes

x

No

Indicate by check

mark if the registrant is not required to file reports pursuant to Section 13

or Section 15(d) of the Act.

¨

Yes

x

No

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

x

Yes

¨

No

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of

Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or

for such shorter period that the registrant was required to submit and post

such files)

¨

Yes

x

No

|

Annual

Report on Form 10-K

|

Page 1

|

First Hartford Corporation

|

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of the Regulation S-K (§229.405 of this chapter) is

not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an “emerging growth company”. See definitions of “large

accelerated filer”, “accelerated filer”, “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

¨

|

Accelerated

filer

¨

|

|

Non-accelerated filer

¨

|

Smaller reporting company

x

|

|

(Do not check if a smaller

reporting company)

|

|

|

Emerging growth company

¨

|

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act.

¨

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Act).

¨

Yes

x

No

As of October 31, 2017, the aggregate market value of the registrant’s

common stock (based upon $2.99 closing price on that date on the OTC Securities

Market) held by non-affiliates (excludes shares reported as beneficially owned

by directors and officers – and does not constitute an admission as to

affiliate status) was $2,800,464.

Indicate the number of shares outstanding of each of the registrant’s

classes of common stock, as of the latest practicable date: 2,315,799 as of June

30, 2018.

Documents Incorporated by Reference: None.

Cautionary

Statement Concerning Forward Looking Statements

This Annual Report on Form 10-K contains forward looking statements

that are made pursuant to the Safe Harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve risks,

uncertainties and assumptions as described from time to time in registration

statements, annual reports, and other periodic reports and filings of First

Hartford Corporation and Subsidiaries (the Company) filed with the Securities

and Exchange Commission. All statements, other than statements of historical

facts, which address the Company’s expectations of sources of capital or which

express the Company’s expectation for the future with respect to financial

performance or operating strategies can be identified as forward-looking

statements. As a result, there can be no assurance that the Company’s future

results will not be materially different from those described herein as

“believe”, “anticipate”, “estimate” or “expect”, which reflect the current view

of the Company with respect to future events. We caution readers that these

forward-looking statements speak only as of the date hereof. The Company

hereby expressly disclaims any obligation or undertaking to release publicly

any updates or revisions to any such statement to reflect any change in the

Company’s expectations or any change in events, conditions or circumstances on

which such statement is based.

|

Annual

Report on Form 10-K

|

Page

2

|

First Hartford Corporation

|

PART I

ITEM 1.

BUSINESS

First Hartford Corporation, which was incorporated in Maine in 1909,

and its subsidiaries (collectively, the “Company”), is engaged in two business

segments: 1) the purchase, development, ownership, management and sale of real

estate and 2) providing preferred

developer services for two corporate franchise operators (i.e., “Fee for Service”).

Business

Narrative:

First

business segment:

The principal activity of the Company’s first segment of business is

the purchase, development, ownership, management and sale of real estate. The

real estate, owned and/or managed by the Company through various subsidiaries

and joint ventures, is located in Connecticut, Delaware, Louisiana,

Massachusetts, New York, New Jersey, Rhode Island, and Texas. Non-residential

tenants are obtained through brokers and employed representatives of the

Company, by means of Industry Trade Shows, direct contacts with retail stores

and other potential commercial tenants, and an occasional inquiry by potential

tenants at the Company’s on-site offices. Residential tenants are obtained

through advertisements and inquiry at on-site offices.

The Company has a comprehensive investment strategy when it comes to

new projects or acquisitions. Before investing, the Company conducts

comprehensive due diligence that includes researching demographics, traffic,

nearby vacancies, competition, and nearby market conditions. After a potential

investment has been fully vetted, a decision is made.

The Company’s real estate business is diversified by geographical

locations, type of commercial property, and form of ownership or management.

The commercial real estate business is not divided further into significant

separate classes of products or services.

When profitable

opportunities arise, the Company will buy and sell certain properties.

The only facilities the Company owns and operates are a movie theater

and a liquor store at one of its properties and a restaurant at another one of

its properties. In all other cases, the tenants of the Company’s properties

are third-parties.

Please also see

Note 11 of the Financial Statements included within.

Second business segment:

The

principal activity of the Company’s second segment of business is providing

preferred developer services to CVS Health (CVS) and Cumberland Farms Inc. in

certain geographic areas.

CVS

: The Company has an agreement with CVS to be a

preferred developer in Texas within the Rio Grande Valley and Houston, in New

York within Long Island and portions of Rockland County, in New Jersey, in most

of Connecticut, and in Louisiana. This is a fee for service agreement by which

the Company will locate a site, negotiate a letter of intent, prepare store

development budgets, demographics, arrange traffic counts and submit for CVS Real

Estate Committee approval. Once so approved, the Company will negotiate a

purchase or lease of such property and obtain permits. The Company will

invoice 75% of the total fee when the property is purchased or leased, and a

building permit is issued. Fees vary based on location and style of the

store. A CVS pre-qualified third party contractor is selected who will work

through the Company. The Company will manage the construction and administrate

the contracts and payments. When a Certificate of Occupancy is obtained, the

Company will invoice 15% of the total fee. After the store is opened and all

the open construction items are completed, the Company will invoice the final 10%

of the total fee. Income is recognized as required services, as outlined in the

development agreement, are completed. The entire process will normally take

1-3 years. The volume of revenue from this fee for service agreement is in

excess of 10% of the Company’s annual revenue (excluding sales of real estate).

The loss of the CVS contract would have a material adverse effect on the

revenues and operations of the Company.

|

Annual

Report on Form 10-K

|

Page

3

|

First Hartford Corporation

|

ITEM 1.

BUSINESS

(concluded):

Cumberland

Farms

: The Company is also a

preferred developer for Cumberland Farms Inc. within Connecticut, New York, and

Western Massachusetts. Its scope of work is less than the CVS arrangement

above as the Company is not involved in the construction management of the

store. This is a fee for service agreement by which the Company will locate a

site, negotiate a letter of intent, prepare store development budgets,

demographics, arrange traffic counts and submit for Cumberland Farms Real

Estate Committee approval. Once so approved, the Company will negotiate a

purchase or lease of such property and obtain state and local approval and

associated permits for construction. The Company will invoice 100% of the

total fee when the property is purchased or leased and a building permit is

issued. Income is recognized as required services, as outlined in the

development agreement, are completed. The entire process will normally take

1-2 years. The loss of the Cumberland Farms contract would

have a material adverse effect on the revenues and

operations of the Company.

Please also see

Note 11 of the Financial Statements included within.

Miscellaneous Business Reporting:

The Company does not produce or offer any products, and as such, it has

no foreign operations, no inventory (except small amounts at the liquor store

and restaurant), and does not export products or services. Its present business

segments are not seasonal in nature. The Company does not have any patents,

licenses, franchises, concessions, or royalty agreements. The Company is not

conducting any research and development. The Company's subsidiaries involved

with residential rental properties have some contracts or subcontracts,

including loans, with the United States government via Housing & Urban

Development (HUD).

The Company’s operations and property are subject to various federal,

state and local laws and regulations concerning the protection of the

environment, including air and water quality, hazardous or toxic substances and

human health safety. There is no significant environmental litigation

involving any of the Company’s properties.

The Company has a backlog, or pipeline, of potential development

projects with CVS and Cumberland Farms. The Company does not believe backlog

is a useful measure of past performance or continuing performance because the

life of each project ranges from one to three years and the number of future

projects is not predictable.

The Company’s economic performance and the value of its real estate are

subject to the risks incidental to the development, construction and ownership

of real estate properties, as well as the economic well-being of its tenants.

Employment

:

On April 30, 2018, the

Company employed 111 people full-time and 89 people part-time.

Competition

:

The Company competes with many other established

companies and entities, many of which are larger and possess substantially

greater financial resources and substantially larger staffs.

ITEM 1A.

RISK FACTORS

Smaller reporting companies are not required to provide the information

required by this item.

ITEM 1B.

UNRESOLVED STAFF COMMENTS

None.

|

Annual

Report on Form 10-K

|

Page

4

|

First Hartford Corporation

|

ITEM 2.

PROPERTIES

The following table shows the location, general character, ownership

status, and cost of the materially important physical properties of the

Company.

Consolidated Subsidiaries – Commercial

Properties:

|

Company

Managed

|

Location

of

Properties

|

Use

|

Available Space

or Facilities and

Major Tenants

|

Ownership

Status

|

Cost

|

|

|

|

|

|

|

|

|

X

|

Edinburg, TX

|

Shopping Center

|

469,583 sq. ft.

JC Penney 22%

Academy Sports 16%

Burlington Coat Factory 17%, Effective rent per sq.

ft. occupied, exclusive of JC Penney (JC Penney owns its building) is $10.31,

occupied 100%

|

100% owned by a subsidiary of the Company, except JC

Penney building. A lender to get extra interest if available (50% of cash

flow) plus 50% of cash proceeds from sale or refinancing. See Note 3 of the Financial Statements included within.

|

$52,710,395

|

|

|

|

|

|

|

|

|

X

|

West Springfield, MA

|

Shopping Center

|

144,350 sq. ft.

Price Rite 28%

Big Lots 21%

Harbor Freight 12%, Effective rent per sq. ft.

occupied is $9.76, 92.15% occupied

|

100% owned by a subsidiary of the Company.

|

8,146,629

|

|

|

|

|

|

|

|

|

X

|

North Adams, MA

|

Shopping Center

|

131,691 sq. ft.

Steeple City Cinema 20% (Company owned);

Steeple City Liquor 11% (Company owned);

Peebles 14%

Planet Fitness 8%

Effective rent per sq. ft. occupied – net of 41,067

sq. ft. Company owned $8.22, 80.86% occupied

|

100% owned by a subsidiary of the Company. Commencing on October 1, 2015 and continuing through

September 30, 2019 the Company will remit 50% of the cash flow of the

property to Lender.

|

7,552,471

|

|

|

|

|

|

|

|

|

X

|

Plainfield, CT

|

Strip Shopping Center

|

60,154 sq. ft.

Big Y 76%,

effective rent per sq. ft. occupied is $12.11, 100%

occupied

|

100% owned by a subsidiary of the Company.

|

4,975,881

|

|

Annual

Report on Form 10-K

|

Page

5

|

First Hartford Corporation

|

ITEM 2.

PROPERTIES (continued):

Consolidated Subsidiaries

- Commercial Properties (continued):

|

X

|

New Orleans, LA

|

Strip Shopping Center

|

37,671 sq. ft.

Marshalls 53%, Petco 33%

effective rent per sq. ft. occupied is $22.32, 100%

occupied

|

100% owned by a subsidiary of the Company.

|

9,201,659

|

|

|

Cranston, RI

|

Shopping Center

|

259,218 sq. ft.

Kmart (currently vacant – leased to 12/31/2027) 40%

Stop & Shop 25%

Effective rent per sq. ft. occupied is $13.59

98.43% occupied

|

50% owned by a subsidiary of the Company.

|

27,476,742

|

|

|

|

|

|

|

|

|

|

Cranston, RI

|

College

|

60,000 sq. ft. Career Education College

Effective rent per sq. ft. is $26.68

Currently vacant-leased to 12/31/18

|

50% owned by a subsidiary of the Company.

|

10,124,263

|

|

|

|

|

|

|

|

|

|

Cranston, RI

|

Restaurant

|

Texas Roadhouse

Land Lease

100% occupied

|

50% owned by a subsidiary of the Company.

|

239,414

|

|

|

|

|

|

|

|

|

|

Cranston, RI

|

Police Station

|

60,000 sq. ft. Leased to City of Cranston

Effective rent per sq. ft. occupied is $17.75

100% occupied

|

50% owned by a subsidiary of the Company.

|

10,132,902

|

|

|

|

|

|

|

|

|

X

|

Lubbock, TX

|

Shopping Center

|

160,531 sq. ft.

Steinmart 26%

Mardel 25%

TJ Maxx 19%

Effective rent per

sq. ft. occupied is $10.03 97.06% occupied

|

2.0% owned by a subsidiary of the Company.

|

6,258,420

|

|

Annual

Report on Form 10-K

|

Page

6

|

First Hartford Corporation

|

ITEM 2.

PROPERTIES (continued):

The

properties listed above contain approximately 1,337,873 rentable sq. ft., of

which approximately 45,325 sq. ft., or approximately 3.4%, was vacant at April

30, 2018. Over the next 10 years, 84 of the current 87 leases will expire as

follows:

|

Year

Ended

|

Number

of

Leases

|

Sq.

Ft.

|

Base

Rent

|

Percentage

of

Base Rent

|

|

|

|

|

|

|

|

4/30/19

|

21

|

226,063

|

$3,540,464

|

23.45%

|

|

4/30/20

|

9

|

135,092

|

$1,427,163

|

9.45%

|

|

4/30/21

|

6

|

56,070

|

$576,824

|

3.82%

|

|

4/30/22

|

15

|

142,107

|

$2,169,067

|

14.36%

|

|

4/30/23

|

12

|

137,219

|

$1,360,990

|

9.01%

|

|

4/30/24

|

3

|

45,826

|

$131,684

|

0.87%

|

|

4/30/25

|

2

|

38,754

|

$373,721

|

2.48%

|

|

4/30/26

|

6

|

87,231

|

$753,187

|

4.99%

|

|

4/30/27

|

6

|

50,621

|

$968,508

|

6.41%

|

|

4/30/28

|

4

|

178,201

|

$2,216,738

|

14.68%

|

Total

rental income of these properties for the year ended April 30, 2018 was $18,662,481,

of which $4,055,592 is allocated for reimbursement of real estate taxes, common

area expenses, and insurance expenses.

The

Company does not have any individual tenants that account for 5% or more of the

Company’s revenues.

Consolidated Subsidiaries

– Residential Properties:

|

Company

Managed

|

Location

of

Properties

|

Use

|

Available

Space

or Facilities

and

Major

Tenants

|

Ownership

Status

|

Cost

|

|

|

|

|

|

|

|

|

X

|

Rockland, MA

|

Apartments

|

204 units, low to moderate income, 91% occupied,

effective sq. ft. rent - $22.77

|

.01% owned by a 75% owned subsidiary of the Company.

|

26,928,518

|

|

|

|

|

|

|

|

|

X

|

Somerville, MA

|

Apartments

|

501 units, low to moderate income, 98% occupied,

effective sq. ft. rent - $24.45

|

.0049% owned by a 75% owned subsidiary of the

Company.

|

49,176,847

|

|

Annual

Report on Form 10-K

|

Page

7

|

First Hartford Corporation

|

ITEM 2.

PROPERTIES (continued):

Non-Consolidated

Subsidiaries:

|

Company

Managed

|

Location

of

Properties

|

Use

|

Available

Space

or

Facilities and

Major

Tenants

|

Ownership

Status

|

Cost

|

|

X

|

Claymont, DE

|

Apartments

|

208 units, senior housing, 100% sec 8 subsidized, 99%

occupied, effective sq. ft. rent - $21.20

|

Nonconsolidated,

.01% owned by a 75% owned subsidiary of the Company.

|

7,718,470

|

|

X

|

Bronx, NY

|

Apartments

|

99 units, senior housing, 100% sec 8 subsidized, 93%

occupied, effective sq. ft. rent - $33.71

|

Nonconsolidated,

.005% owned by a 75% owned subsidiary of the

Company.

|

17,341,187

|

|

|

Dover Township, NJ

|

Shopping Center

|

108,084 sq. ft.

Stop & Shop 52%

Dollar Tree 9%

Plus Outparcels

|

50% owned by a subsidiary of the Company.

|

14,267,148

|

|

|

Schertz, TX

|

Land for Development

|

N/A

|

50% owned by a subsidiary of the Company.

|

1,937,771

|

In addition to the materially important physical properties of the

Company listed above, the Company owns several other properties that are being

developed or may be developed in the future as opportunities arise. Many of

these other properties involve ground lease or build-to-suit deals. In some

cases, the land being developed is solely for a single entity, in other cases

the land is primarily for a single entity with some excess land retained for

future development, and in other cases the land is banked for future potential

development. Generally, the Company sells the properties within twelve months

after development is completed.

|

|

|

Anticipated

|

|

|

Location of Properties

|

Use

|

Completion

Date

|

Cost

Incurred to Date

|

|

|

|

|

|

|

Houma, LA

|

Single tenant

build-to-suit

|

FY

2019

|

4,811,003

|

|

|

|

|

|

|

Little Ferry , NJ

|

Single tenant build-to-suit

|

FY

2019

|

5,720,943

|

|

|

|

|

|

|

Houston, TX

|

18.58 acres of land – can support 100,000 sq. ft.

development

|

FY

2020

|

7,652,146

|

|

|

|

|

|

|

Montgomery, TX

|

22.70 acres of land – can support 130,000 sq. ft.

development

|

FY

2019 / 2020

|

5,679,750

|

|

|

|

|

|

|

Austin, TX

|

14.28 acres of land – can support 50,000 sq. ft.

development

|

FY

2019 / 2020

|

3,749,219

|

|

|

|

|

|

|

Spring, TX

|

3.70 acres of land – can support 15,000 sq. ft.

development

|

FY

2019

|

816,942

|

|

Annual

Report on Form 10-K

|

Page

8

|

First Hartford Corporation

|

ITEM 2.

PROPERTIES (concluded):

|

Pearland, TX

|

1.93 acres of land – can support 12,000 sq. ft.

development

|

FY 2019

|

1,039,773

|

|

|

|

|

|

|

Buda, TX

|

12.10 acres of land – can support 40,000 sq. ft.

development

|

FY

2019 / 2020

|

4,265,439

|

|

|

|

|

|

|

Conroe, TX

|

3.40 acres of land – can support 20,000 sq. ft.

development

|

FY

2019

|

2,210,304

|

|

|

|

|

|

|

Del Valle, TX

|

15.60 acres of land – can support 52,000 sq. ft.

development

|

FY

2019 / 2020

|

1,452,091

|

|

|

|

|

|

|

All Other Properties Held

|

|

|

|

|

|

|

|

|

|

Total cost of developed properties and property

under construction (excludes non-consolidated subsidiaries)

|

|

The Company also

owns properties that it is currently holding for sale. The properties include

a single-tenant property in Cedar Park, TX, a single-tenant property in

Houston, TX, and a single-tenant property in Montgomery, TX. The cost of these

properties as of April 30, 2018 was $7,465,163.

ITEM 3.

LEGAL

PROCEEDINGS

The

Company is involved in legal proceedings which arise during the normal course

of its business, including disputes over tax assessments, commercial contracts,

lease agreements, construction contracts, employee disputes and personal

injuries. The Company does not believe the outcome of any of these proceedings

will have a material impact on its consolidated financial statements.

Following

a site inspection of asbestos abatement activities being conducted at the

Spring Gate Apartments in Rockland, Massachusetts (Facility) on April 14, 2017,

the Massachusetts Department of Environmental Protection (MassDEP) by letter

dated April 21, 2017 requested that Rockland Place Apartments, LP (Company)

temporarily cease and desist from any additional asbestos removal, abatement

and/or handling activities at the Facility. Upon receipt of the MassDEP

letter, the Company engaged MassDEP in discussions regarding the abatement

project. Following submission to and approval by MassDEP of a work plan

addressing the issues raised in MassDEP’s April 21 letter, MassDEP permitted

the asbestos abatement work to go forward. There have been no further

enforcement actions taken by MassDEP.

By

letters dated May 15, May 16 and May 30, 2017, three attorneys representing

tenants in three units at the Facility notified the Company and/or its

management company, FHRC Management Corporation, of claims related to

environmental conditions at the Facility. The first of these letters alleges

that the tenant and her family have been exposed to and have been living in an

apartment containing asbestos for many years. The second letter claims that

the tenant and her three minor children have suffered injuries believed to be

caused by the presence of mold and asbestos in the apartment. The final letter

asserts claims with respect to the tenant and her three minor children

involving the presence and remediation of asbestos including violation of a

tenant’s quiet enjoyment, breach of the warranty of habitability, causation of

emotional distress and the use of unfair and deceptive practices under M.G.L.

c. 93A. The first two letters made no specific monetary demand; the third

letter demanded $312,600. All three claims were tendered to the Company’s

insurer, which agreed to respond under a reservation of rights. On July 14,

2017, counsel retained by the insurer provided a timely response to the third

letter, adamantly denying the Company’s liability pursuant to M.G.L. c. 93A or for any of the other claims. By letter dated July

27, 2017, the insurer acknowledged receipt of the three claims, at the same

time stating however that as no lawsuit had arisen, it did not have a duty to

defend, but nonetheless would continue to investigate. With respect to the

third letter above, the suit was transferred to the Superior Court and, on May

11, 2018, the Company’s insurer stated that it will defend Rockland against the

claimant’s counterclaims subject to a reservation of rights.

|

Annual

Report on Form 10-K

|

Page

9

|

First Hartford Corporation

|

ITEM 3.

LEGAL

PROCEEDINGS (concluded):

Other proceedings

The Company is not

aware of any material legal proceedings which would need to be cited herein.

There are no

proceedings involving officers and directors; see Item 10(f) on Page 23.

ITEM 4.

MINE

SAFETY DISCLOSURES

Not Applicable.

PART II

ITEM 5.

MARKET FOR REGISTRANT’S COMMON

EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The

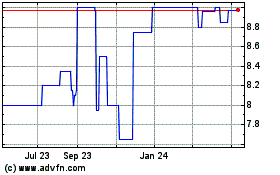

Company trades on the OTC Securities Market under the symbol FHRT. Investors

can find current financial disclosures and quotes for the Company on Yahoo

Finance and other financial sites.

STOCK PRICE AND DIVIDEND INFORMATION

|

|

Stock Price

|

|

|

2018

|

High

|

Low

|

Dividends Paid

Per

Common Share

|

|

First Quarter

|

$3.00

|

$2.55

|

None

|

|

Second Quarter

|

$3.50

|

$2.50

|

None

|

|

Third Quarter

|

$2.99

|

$2.36

|

None

|

|

Fourth Quarter

|

$2.50

|

$2.25

|

None

|

|

|

|

|

|

|

2017

|

|

|

First Quarter

|

$2.68

|

$2.35

|

None

|

|

Second Quarter

|

$2.50

|

$2.01

|

None

|

|

Third Quarter

|

$3.25

|

$2.25

|

None

|

|

Fourth Quarter

|

$2.90

|

$2.25

|

None

|

No

dividends have been paid in the past two fiscal years and the Company has no

plans or intentions to institute payment of dividends in the foreseeable

future.

Publicly

traded sales of common stock on the open-market occur sporadically. A recent reported

public sale was for $2.00 per share on June 15, 2018 for a total of 8,500

shares.

The

Company did not sell any unregistered shares of securities during the year

ended April 30, 2018.

Shareholders

of Record and Potential Termination of SEC Reporting

:

The

Company first publicly expressed interest in “going dark” in its 2017 Annual

Report, where it noted the number of shareholders of record had been

consistently attenuating each quarter.

The Company explained its

rationale, and certain benefits and disadvantages of Going Dark for the Company

and for its shareholders in its proxy statement as filed December 12, 2017 with

the SEC for the annual meeting of shareholders. The Company’s annual meeting

of shareholders was held on January 17, 2018 in Hartford, CT. At that meeting,

the shareholders voted to approve the Company suspending or terminating its

filing obligations with the U.S. Securities and Exchange Commission, also

called “Going Dark”, once the Company is eligible. The vote was 2,006,379 in

favor, 16,481 against, and 1,830 abstaining. Thus 99% of the voting

shareholders approved such potential action.

|

Annual

Report on Form 10-K

|

Page

10

|

First Hartford Corporation

|

ITEM 5.

MARKET FOR REGISTRANT’S COMMON

EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

(continued):

After the conclusion of the quarter ended January 31,

2018, the number of shareholders fell below 300 (276 as of April 30, 2018),

which, subject to other conditions of the SEC’s Regulations, the Company asserts

it is eligible to “Go Dark.”

The common stock of the Company currently trades on

the OTC Securities Market under the symbol “FHRT”. The common stock of the

Company has an illiquid trading market and fails to attract any market

following. The Company understands that its public shareholders have freely

tradable common stock and that maintaining a trading market, even if it is

illiquid, is beneficial for the continued ability of the public shareholders to

trade the stock. Therefore, the Company intends to maintain at least one of

its listings in the Mergent Industrial Manual, the Mergent OTC Industrial

Manual, and/or the Mergent OTC Unlisted Manual, which by being tri-published in

a “recognized securities manual” provides the 39 individual states’ securities

regulations “manual exemption” provision under which broker-dealers are free to

solicit and trade stock of the published companies thus permitting secondary

trading in the Company’s stock for investors in up to 39 states. Further, the

Company will attempt to maintain a continued listing through the OTC Securities Market through its Pink Sheets

listings; however, there can be no assurance that any broker-dealer will make

or continue to make a market in the Company’s common stock; it is required for

trading on the OTC Pink Sheets that at least one broker-dealer make a market in

the Company’s common stock. However, once it Goes Dark, it is anticipated that

the Company’s shares would have far less visibility and the current limited

liquidity may be further constrained in the market, and the current

broker-dealers making markets in the Company’s common stock may cease doing so,

further constraining the market for the Company’s common stock.

Once the Company Goes Dark, it will have reduced

regulatory oversight and, therefore, may be able to implement shareholder

initiatives such as share repurchase programs with less regulatory

restrictions. By Going Dark, the Company will produce and share far less

information available to the investing public. Thus investors will often not

have relatively current information on which to base their investment

decisions. However, the Company’s common stock will still be eligible to trade

among public investors and thus continues to be a publicly traded entity and continue

to be subject to the antifraud and insider trading provisions of the Securities

Exchange Act of 1934.

The

Company intends to file its Form 15 to suspend and terminate its reporting

obligations in the first half of fiscal year 2019.

10b5-1

Private Repurchase Stock Plan:

On January 5, 2017, the Company’s Board of Directors

amended and approved the Amended and Restated 10b5-1 Private Repurchase Stock

Plan (the “

Repurchase Plan

”), which was initially adopted on March 29,

2016. The Repurchase Plan provided for the repurchase of up to 150,000 shares

of the Company’s common stock in minimum blocks of 15,000 shares and maximum

blocks of 25,000 shares. Eligible shareholders were those holding blocks of

common stock of the Company in excess of fifteen thousand (15,000) shares and

less than three hundred fifty thousand (350,000) shares. Repurchases could be made at management’s discretion

from time-to-time only through privately negotiated transactions pursuant to

the terms of the 10b5-1 plan to meet the requirements of Rule 10b5-1 under

the Securities Exchange Act of 1934. The privately negotiated purchase price could

not exceed 1.5 times

the highest independent bid

or the last independent transaction price and in no event be higher than five

($5.00) dollars per share. The purchases and negotiations could resume 15 days

after filing of the quarterly report; the program could be suspended for 15

days before the due date of each next quarterly or annual report filing and could

resume 15 days after the filing. The repurchase program expired on March 28,

2017. Any shares acquired under this program were retired.

|

Annual

Report on Form 10-K

|

Page

11

|

First Hartford Corporation

|

ITEM 5.

MARKET FOR REGISTRANT’S COMMON

EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

(concluded):

Please

see the below table for information with respect to repurchases by the Company:

Issuer Repurchases of its Equity Securities

|

Month of Transactions

|

Total number of

shares

purchased

|

Average price

paid per

share

|

Total number of

shares

purchased as

part of publicly

announced plans or

programs

|

Number of potential

shares

that went

unpurchased under

the plans or

programs

|

|

|

|

|

|

150,000

|

|

May 1, 2016 – April 30, 2017

a

|

2,025

|

$2.45

|

0

|

0

|

|

May 11, 2016

b

|

25,000

|

$3.00

|

25,000

|

(25,000)

|

|

February 1, 2017

b

|

25,000

|

$2.50

|

25,000

|

(25,000)

|

|

March 1, 2017

b

|

5,100

|

$2.50

|

5,100

|

(5,100)

|

|

March 7, 2017

b

|

6,666

|

$2.50

|

6,666

|

(6,666)

|

|

May 25, 2017

b,c

|

25,000

|

$3.00

|

25,000

|

(25,000)

|

|

TOTAL

|

88,791

|

$2.78

|

86,766

|

63,234

|

a: The transactions comprised of the

acquisition of the 2,025 shares were not conducted pursuant to a publicly

announced program, and therefore are discontinued.

b: The transactions comprised of the

acquisition of these shares were made pursuant to the publicly announced 10b5-1

Private Repurchase Stock Plan.

c: The offer to sell these shares was

initiated by the shareholder on February 21, 2017.

ITEM 6.

SELECTED FINANCIAL DATA

Smaller

reporting companies are not required to provide the information required by

this item.

|

Annual

Report on Form 10-K

|

Page

12

|

First Hartford Corporation

|

ITEM 7.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The discussion and analysis below provides information that the Company

believes is relevant to an assessment and understanding of its consolidated

financial position, results of operations and cash flows. This discussion and

analysis should be read in conjunction with the consolidated financial

statements and related notes included elsewhere herein.

This and certain other sections of the Company’s Annual Report on Form

10-K contain statements reflecting the Company’s views about its future

performance and constitute “forward-looking statements” under the Private

Securities Litigation Reform Act of 1995. Readers should consider that various

factors, including changes in general economic conditions, interest rates and

the availability of funds, and competition and relationships with key customers

and their financial condition, may affect the Company’s performance. The

Company undertakes no obligation to update publicly any forward-looking

statements as a result of new information, future events, or otherwise.

RESULTS OF OPERATIONS

Rental Income

Rental income for the years ended April 30, by type of tenant, follows:

|

|

2018

|

2017

|

|

Residential

|

$12,227,584

|

$12,171,608

|

|

Commercial

|

19,191,847

|

19,813,217

|

|

|

$31,419,431

|

$31,984,825

|

|

|

|

|

The slight increase in residential rental income was primarily caused

by rent increases at the Somerville, MA property (i.e., Clarendon), partially

offset by lower revenue at the Rockland, MA property due to vacancies from

converted apartments needed for the renovation project.

The decrease in commercial rental income was primarily caused by lower

rent at the Cranston, RI property due to a loss of a tenant, lower common area

maintenance (CAM) billings to tenants resulting from lower associated expenses,

and prior year rents on some of the Company’s development properties that have

since been sold (e.g., Olathe, KS; Conroe, TX; Stanhope, NJ), partially offset

by additional rents from a new tenant at the Company’s Lubbock, TX property.

Service Income

Service income for

the years ended April 30 is made up of the following:

|

|

2018

|

2017

|

|

Preferred Developer Fees

|

$3,935,000

|

$4,839,500

|

|

Management and Other Fees

|

1,257,144

|

614,419

|

|

|

$5,192,144

|

$5,453,919

|

Preferred developer fees are from CVS and Cumberland Farms. The decrease in preferred developer fees reflected lower fees received from CVS and, to a lesser extent,

Cumberland Farms. The decrease in CVS fees, which continues a trend over the

past several years, was the result of a recent acquisition that has impacted in

the slowing of their pipeline for new stores. The decrease in Cumberland Farms

was the result of timing of closings based on the construction schedule.

The increase in management and other fees are primarily from the first

installment ($350,000) of a developer fee earned as part of the Bronx, NY

subsidized housing project and higher fees received from the Company’s unconsolidated

Claymont, DE property.

|

Annual

Report on Form 10-K

|

Page

13

|

First Hartford Corporation

|

ITEM 7.

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (continued):

Sales (and Cost of Sales) of Real Estate

When profitable opportunities arise, the Company will buy and sell

certain properties. The Company had several purchases and sales of real estate

in fiscal years 2018 and 2017. While the Company expects to continue to

discover more opportunities going forward, there are no guarantees that they

will be discovered or, if discovered, be of the magnitude and profitability of

recent real estate sales.

FY 2018

St. Louis, MO – Sale of Property:

On May 30, 2017, the Company sold its single-tenant

property in St. Louis, MO for $6,800,000 (cost of $6,582,820). A loan with a

balance of $5,120,000 and a credit line of $1,000,000 were paid off with the

proceeds.

New Orleans, LA – Sale of Property:

On June 7, 2017, the Company sold a parcel of its

property in New Orleans, LA for $11,350,000 (cost of $9,042,647). A loan with

a balance of $7,436,745 was paid off with the proceeds. The Company continues

to hold the parcel of the property that includes the shopping center.

Austin, TX – Sale of Property:

On June 15, 2017, the Company sold its single-tenant

property in Austin, TX for $3,210,000 (cost of $3,009,317). A loan with a

balance of $1,102,899 was paid off with the proceeds.

East Providence, RI – Sale of

Property

: On September 7, 2017, the

Company sold its property held for sale in East Providence, RI for $830,000

(cost of $664,312).

Wethersfield, CT – Sale of

Condominium:

On November 14, 2017,

the Company sold a condominium in Wethersfield, CT for $225,000 (cost of

$271,802). The net proceeds were used to pay off a mortgage loan on this

property. The Company owned another two condominiums on this site after this

sale. The loss on the sale of this property resulted in the Company recording an

impairment loss on the remaining properties.

Spring, TX – Partial Sale of Property

: On January 30, 2018, the Company purchased three

adjacent parcels of land in Spring, TX for $1,161,240 including closing costs.

Simultaneously, one of these parcels was sold to another party for $1,404,504

(cost of $1,008,623, including additional development costs of $549,011). The

purchase was financed by working capital and the proceeds from the sale. The

Company netted $27,807 of cash for these two transactions, which was received

on February 2, 2018. The remaining two parcels will be marketed to retail

establishments.

Wethersfield, CT – Sale of Condominium:

On February 28, 2018, the Company sold a condominium

in Wethersfield, CT for $255,000 (cost of $269,807). The Company owns one more

condominium on this site after this sale.

Humble, TX – Sale of Land:

On March 29, 2018, the Company sold its land in

Humble, TX for $650,000 (cost of $576,665).

Brentwood, NY – Sale of Property:

On April 17, 2018,

the Company sold a property in Brentwood, NY for $15,700,000 (cost of $11,070,213).

A mortgage loan with a balance of $10,590,508 was paid off with the proceeds.

In fiscal year 2018, there were also

adjustments of costs incurred related to property sales that occurred in prior

fiscal years. The net amount of these adjustments resulted in a $41,792

reduction of costs.

|

Annual

Report on Form 10-K

|

Page

14

|

First Hartford Corporation

|

ITEM 7.

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (continued):

Sales (and Cost of Sales) of Real Estate (concluded):

FY 2017

On

June 29, 2016, the Company sold a property in Stanhope, NJ for $10,000,051

(cost of $8,294,103). A construction loan with a balance of $6,329,667 was

paid off with the proceeds.

On June 30, 2016, the Company sold a portion of its property in

Edinburg, TX (i.e., Texas Roadhouse) for $2,210,000 (cost of $1,355,597). A

mortgage loan with a balance of $1,279,136 was paid off with the proceeds.

On August 16, 2016, the Company sold a condominium in Wethersfield, CT

for $285,000 (cost of $277,191). The net proceeds were used to reduce a

mortgage loan on this property. The Company owned three other condominiums at

this site after this sale.

On September 20, 2016, the Company sold a parcel of land in Austin, TX

for $6,100,000 (cost of $4,185,023) that was previously ground leased. The

Company continued to own land attached to the sold parcel and oversaw

construction of a single-tenant retail building of approximately 6,900 square

feet on this property. The remainder of this property was sold on June 15,

2017.

On

December 14, 2016, the Company sold a

property in Conroe, TX for $8,778,442 (cost of $6,730,715). A mortgage loan

with a balance of $5,363,913 was paid off with the proceeds.

On

December 28, 2016, the Company sold a

property in Olathe, KS for $7,000,000 (cost of $6,867,228). A mortgage loan

with a balance of $5,335,000 was paid off with the proceeds.

There were also costs incurred in fiscal year 2017 related to property

sales that occurred in the fiscal year ended April 30, 2016 totaling $13,943

that were not anticipated as of the prior fiscal year end.

Other Revenues (and Expenses)

The increase in other revenues and expenses was primarily due to the

Company’s new restaurant it built and owns at its Edinburg, TX property. This

store was opened on July 14, 2017.

Operating Costs and Expenses

Rental Expenses

Rental expense for the years ended April 30, by type of tenant, follows:

|

Residential

|

2018

|

2017

|

|

|

|

Depreciation and

Amortization

|

$2,308,089

|

$2,274,234

|

|

|

|

Other Rental Expenses

|

8,535,235

|

8,128,427

|

|

|

|

|

$10,843,324

|

$10,402,661

|

|

|

|

Commercial

|

|

|

|

|

|

Depreciation and

Amortization

|

$3,411,084

|

$3,393,939

|

|

|

|

Other Rental Expenses

|

6,699,870

|

6,293,904

|

|

|

|

|

$10,110,954

|

$9,687,843

|

|

|

|

|

|

|

|

|

|

Total

|

$20,954,278

|

$20,090,504

|

|

|

|

Annual

Report on Form 10-K

|

Page

15

|

First Hartford Corporation

|

ITEM 7.

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (continued):

Rental Expenses (concluded):

The increase in residential rental expenses were mainly from higher

legal fees incurred at the Rockland, MA property resulting from a temporary

cease and desist order from the Massachusetts Department of Environmental

Protection (MassDEP). See Part I, Item 3, Legal Proceedings, on page 9 for

more information.

The increase in commercial rental expenses were primarily related to

the Company’s New Orleans, LA shopping center, which was completed and

refinanced in the first quarter of fiscal 2018, and higher expenses at the

Edinburg, TX shopping center, including higher property taxes and a fee paid to

a tenant to allow the Company to lease to another tenant. Partially offsetting

these increases were expenses incurred in the prior year related to a lawsuit against

a former tenant, including a legal settlement of $200,000. Also, in the prior

year there was accelerated amortization expense of deferred commissions arising

from the sale of a portion of its property in Edinburg, TX (i.e., Texas

Roadhouse) and accelerated depreciation of tenant improvements at the Lubbock,

TX properties upon the departure of two tenants.

Service Expenses

Service expenses for

the years ended April 30 is made up of the following:

|

|

2018

|

2017

|

|

Preferred Developer

Expenses

|

$4,011,464

|

$5,011,262

|

|

Construction and Other

Costs

|

1,329,606

|

87,637

|

|

|

$5,341,070

|

$5,098,899

|

|

|

|

|

The decrease in preferred developer expenses and fees primarily

reflects lower commissions paid commensurate with the lower revenue, primarily

at CVS.

The increase in construction expenses relates to unbudgeted costs

(i.e., overruns) incurred at the renovation project at the Company’s Rockland,

MA property resulting from a temporary cease and desist order from the

Massachusetts Department of Environmental Protection (MassDEP). See Part I,

Item 3, Legal Proceedings, on page 9 for more information.

Selling, General and

Administrative Expenses (“SG&A”)

The increase in SG&A expenses relates primarily to non-capitalizable

legal and professional expenses related to its completed affordable housing

deal in the Bronx, NY and costs incurred related to the Rockland, MA matter

discussed above, including providing hotels and meals to displaced tenants and

legal and professional fees (see Part I, Item 3, Legal Proceedings, on page 9

for more information). These items were partially offset by higher write-offs

of costs related to abandoned projects in the prior year.

Non-Operating Income (Expense):

Equity in

Earnings (Losses) of Unconsolidated Subsidiaries

The equity in earnings (losses) of unconsolidated subsidiaries is

broken down as follows:

|

|

2018

|

2017

|

|

Income

from Operations

|

$321,267

|

$325,452

|

|

Distributions

|

360,000

|

360,000

|

|

Equity in Earnings of

Unconsolidated Subsidiary

|

$681,267

|

$685,452

|

|

Annual

Report on Form 10-K

|

Page

16

|

First Hartford Corporation

|

ITEM 7.

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (continued):

Non-Operating Income (Expense) (continued):

Equity in

Earnings (Losses) of Unconsolidated Subsidiaries (concluded):

The Company has an investment in an affiliated limited liability entity

Dover Parkade, LLC, (Dover). The Company has a 50% interest in Dover, which

owns a shopping center in Dover Township, NJ. The operating and financial

policies of Dover are not controlled by the Company. For years prior to May 1,

2009, the Company was committed to provide funding to this equity method

investee. The Company’s investment was recorded at cost and subsequently

adjusted for its share of their net income and losses and distributions.

Through April 30, 2009, losses and distributions from Dover exceeded the Company’s

investment and the Company’s investment balance was reduced below $0 and

recorded as a liability. Beginning May 1, 2009, distributions from Dover have

been credited to income and any additional losses have not been allowed to

further reduce the investment balance. The Company does not control the rate

of distributions of Dover. Such distributions are in excess of Dover’s net

assets since its accumulated net losses (including significant amounts for

depreciation and amortization) have exceeded capital contributions.

Other Income

Other income is broken down as follows:

|

|

2018

|

2017

|

|

Investment Income (Losses)

|

$(51,081)

|

$137,186

|

|

Proceeds from Lawsuit

|

200,000

|

-0-

|

|

Total

|

$148,919

|

$137,186

|

The decrease in investment income reflected realized losses on sales of

securities in the current year first and fourth quarters.

During the year ended April 30, 2018, the Company received $200,000

from a settlement of a lawsuit filed against another party for breach (relating

to an alleged wrongful termination) of a contract to purchase a commercial

shopping center owned by the Company and located in New Orleans, LA. As a

result, the sale did not go through and the Company retains ownership of the

shopping center.

Gain (Loss) on Derivatives

The Company, through its 50% owned consolidated subsidiaries, has

entered into two separate floating-to-fixed interest rate swap agreements with

banks that expire in May 2025 and July 2031. The Company has determined that

these derivative instruments do not meet the requirements of hedge accounting

and have therefore recorded the change in fair value of these derivative

instruments through income. Note that the change in fair value recorded

through income is a non-cash item.

The aggregate fair value of the Company’s interest rate swap agreements

as of April 30, 2018 and 2017 were liabilities of $659,780 and $2,023,793,

respectively.

On January 1, 2018, the Company entered into three interest rate swap

agreements to fix the interest rate on its outstanding debt on its Brentwood,

NY property at 4.42%. Upon the sale of the Brentwood property on April 17,

2018, the Company realized a $167,000 gain on settlement of these swap

agreements.

Loss on Defeasance

In fiscal year 2017, the Company paid a defeasance premium of $437,776

when refinancing its mortgage loan on its shopping center in Lubbock, TX.

|

Annual

Report on Form 10-K

|

Page

17

|

First Hartford Corporation

|

ITEM 7.

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (continued):

Non-Operating Income (Expense) (concluded):

Loss on Impairment

In fiscal year 2018, the Company recorded an impairment loss of $40,000

on its two remaining condominiums it owns in Wethersfield, CT. The amount of

the impairment loss represented the excess of the cost over the estimated sales

proceeds from the condominiums.

Interest Expense

Interest expense for the years ended April 30, by type of tenant,

follows:

|

|

2018

|

2017

|

|

Residential

|

$2,953,063

|

$2,892,724

|

|

Commercial

|

7,863,036

|

7,501,274

|

|

|

$10,816,099

|

$10,393,998

|

The increase in residential interest expense was the result of the

prior year first quarter refinancing at Rockland (note the loans paid off as

part of this refinancing did not accrue interest) and the end of monthly

interest subsidy payments upon a loan payoff in March 2018.

The increase in commercial interest expense was the result of prepayment

and other debt-related fees incurred upon the sale of the Brentwood, NY

property and interest on loans related to the Company’s new restaurant it built

and owns at its Edinburg, TX property.

Income Tax Expense (Benefit)

The Company files a Federal consolidated tax return to report all

income and deductions for its subsidiaries. The Company and its subsidiaries

file income tax returns in several states. The tax returns are filed by the

entity that owns the real estate or provides services in such state. Some

states do not allow a consolidated or combined tax filing. This sometimes

creates income taxes to be greater than expected as income for some

subsidiaries cannot be offset by other subsidiaries with operating losses.

On December 22, 2017, the Tax Cuts and Jobs Act of 2017 (the Tax Act)

was signed into law. The Tax Act makes significant changes to the Internal

Revenue Code, including but not limited to, decreasing the statutory corporate

tax rate from 35% to 21% effective January 1, 2018 and repealing AMT tax

treatment. The Company calculated its best estimate of the impact of the Tax

Act in its income tax provision and re-measured its deferred tax assets and

liabilities at the enacted corporate tax rate of 21% as of the enacted date, in

accordance with its understanding of the Tax Act and available guidance. During

the third quarter of fiscal 2018, the Company recorded charges of approximately

$200,000 within its income tax provision in connection with the Tax Act, which

related to the revaluation of the Company’s deferred tax assets and

liabilities.

On October 26, 2017, the Company was informed that its fiscal year 2016

Federal tax return was selected for examination. This examination is currently

in process.

See Note 7 to the Company’s financial statements for

information about the effective income tax rate.

|

Annual

Report on Form 10-K

|

Page

18

|

First Hartford Corporation

|

ITEM 7.

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (continued):

Income Tax Expense (Benefit) (concluded):

As

of April 30, 2018, the Company had a net deferred tax liability in the amount

of $210,215. The Federal net operating loss carryforwards that were previously available

to offset future Federal taxable income have been fully utilized. The

Company has recorded a net deferred liability of $250,845 for untaxed rental

income and $315,692 for basis differences in the Company’s partnerships. Offsetting

these, the Company has recorded a net deferred asset in the amount of $158,589,

which represents a basis difference in real estate assets owned by the Company.

It also has an Alternative Minimum Tax (AMT) credit of $197,733. Lastly, no

valuation allowance has been recorded based on anticipated future profitability

being able to fully utilize the AMT credit carryforwards and future

depreciation benefits.

CAPITAL RESOURCES AND LIQUIDITY

At April 30, 2018, the Company had $7,206,445 of unrestricted cash and

cash equivalents. This includes $4,679,218 belonging to partner entities in

which the Company’s financial interests range from .01% (VIEs) to 50%. Funds

received from CVS, which are to be paid out in connection with CVS developments,

of $375,501, tenant security deposits held by VIEs of $386,505, and cash held

in a lender-controlled lockbox account for our Edinburg, TX property of

$230,917 are included in restricted cash and cash equivalents.

At April 30, 2018, the Company had $619,432 of investments in

marketable securities, all of which belongs to partner entities.

The sources of future borrowings that may be needed for new

construction loans, property purchases, or balloon payments on existing loans are

unclear at this time.

On July 30, 2015, the Company obtained a credit line with a regional

bank. This $2,760,000 line of credit is

used from time to time primarily to fund initial investments related to

development opportunities. The interest rate on these loans is 3.00% plus One Month ICE LIBOR rate up to maturity

date (i.e., twelve months from issuance of proceeds) and 12.0% thereafter. As of April 30, 2018, the Company had borrowings of $2,760,000

against this credit line.

On December 7, 2015, the Company entered into a $2,000,000 revolving

demand loan agreement (“line of credit”) with a regional bank. The interest

rate on this loan is Wall Street Journal Prime, with a floor of 3.25%. The

loan is unsecured and there are no guarantors. Interest is to be paid monthly;

principal is to be repaid within twelve months or on demand, at the bank’s

discretion. There are no prepayment penalties. This line of credit is used

from time to time primarily to fund initial investments related to development

opportunities. As of April 30, 2018, the Company had borrowings of $2,000,000

against this credit line. Subsequent to April 30, 2018, on June 11, 2018, this

line of credit was increased to $3,000,000 and the final payment date was set

at September 30, 2020.

On April 19, 2017, the Company entered into a $2,000,000 unsecured line

of credit with a regional bank. This line of credit was increased to

$4,000,000 on April 17, 2018. Terms of the line of credit are as follows:

|

Term:

|

3

years – matures 5/1/2020

|

|

Rate:

|

LIBOR

+ 3.25%

|

|

Fee:

|

0.50%

(One Time)

|

|

Unused

Fee:

|

0.25%

annually on the unused line

|

|

Guarantee:

|

Full

guarantee by the Chairman of the Company (Individual)

|

|

Deposits:

|

Must

maintain a minimum of $500,000 at bank

|

|

Other:

|

Each

funding request to be at the sole discretion of the bank and only to acquire

credit tenanted properties.

|

|

Clean

Up:

|

Borrower

to be out of debt once each year for at least 30 days.

|

As of April 30, 2018, the Company had borrowings of $-0- against this

credit line.

|

Annual

Report on Form 10-K

|

Page

19

|

First Hartford Corporation

|

ITEM 7.

MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (continued):

Recently Issued Accounting

Guidance:

For

a description of recently issued accounting pronouncements, see Note 1 to the

consolidated financial statements included in Item 8 as presented in Item 15. Summary

of Significant Accounting Policies.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES:

For a discussion of accounting policies see Note 1 to the consolidated

financial statements included in Item 8 as presented in Item 15, Summary of

Significant Accounting Policies.

ITEM 7A.

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Smaller reporting companies are not required to provide the information

required by this item.

ITEM 8.

FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA

Financial statements begin at page 35. See the index to Financial

Statements in Item 15.

ITEM 9.

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

No change in the Company’s principal

independent accountants occurred during the Company’s two most recent fiscal

years or any subsequent interim period, nor did any disagreements occur with

the Company’s accountants on any matter of accounting principles or practices

or financial statement disclosure that would require a current report on Form

8-K.

ITEM 9A.

CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

We maintain “disclosure controls and procedures”, as such term is

defined in Rule 13a – 15(e) under the Securities Exchange Act of 1934 (the

“Exchange Act”), that are designed to ensure that information required to be

disclosed in our Exchange Act reports is recorded, processed, summarized and

reported within the time periods specified in the Securities and Exchange

Commission rules and forms, and that such information is accumulated and

communicated to our management, including our President and Treasurer, as

appropriate, to allow timely decisions regarding required disclosure. We

conducted an evaluation (the “Evaluation”), under the supervision and with the

participation of the President and Treasurer, of the effectiveness of the

design and operation of disclosure controls and procedures (“Disclosure

Controls”) as of the end of the period covered by this report pursuant to Rule

13a – 15b of the Exchange Act.

Based on this Evaluation, our President and Treasurer concluded that

because of weaknesses in our control environment, our Disclosure Controls were

not effective as of the end of the period covered by this report.

Management’s Annual Report on Internal Control over

Financial Reporting

The management of First Hartford Corporation is responsible for

establishing and maintaining adequate internal control over financial

reporting, as such term is defined in Exchange Act Rule 13a – 15(f). The

Company’s internal control over financial reporting is a process designed to

provide reasonable assurance to the Company’s management and Board of Directors

regarding the reliability of financial reporting and the preparation of the

financial statements for external purposes in accordance with accounting

principles generally accepted in the United States of America.

|

Annual

Report on Form 10-K

|

Page

20

|

First Hartford Corporation

|

ITEM 9A.

CONTROLS AND PROCEDURES (concluded):

Management’s Annual Report on Internal Control over

Financial Reporting (continued):

The Company’s internal control over financial reporting includes those

policies and procedures that (i) pertain to the maintenance of records that, in

reasonable detail, accurately and fairly reflect the transactions and

dispositions of the assets of the Company; (ii) provide reasonable assurance

that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles

generally accepted in the United States of America, and that receipts and

expenditures of the Company are being made only in accordance with

authorizations of management and directors of the Company; and (iii) provide

reasonable assurance regarding prevention or timely detection of unauthorized

acquisition, use, or disposition of the Company’s assets that could have a

material effect on the financial statements.

Because of its inherent limitations, internal controls over financial

reporting may not prevent or detect misstatements. All internal control

systems, no matter how well designed, have inherent limitations, including the

possibility of human error and the circumvention of overriding controls. Accordingly,

even effective internal control over financial reporting can provide only

reasonable assurance with respect to financial statement preparation. Also,

projections of any evaluation of effectiveness to future periods are subject to

the risk that controls may become inadequate because of changes in conditions,

or that the degree of compliance with the policies or procedures may

deteriorate.

Our management assessed the effectiveness of the Company’s internal

control over financial reporting as of April 30, 2018. In making this

assessment, it used the criteria set forth by the Committee of Sponsoring

Organizations of the Treadway Commission (COSO) in Internal Control-Integrated

Framework. Based on our assessment, we believe that, as of April 30, 2018, the

Company’s internal control over financial reporting was not effective due to

the existence of the material weaknesses identified by management and disclosed

below:

Lack of Appropriate Independent Oversight.

There are no independent members of the Board of

Directors who could provide an appropriate level of oversight, including

challenging management’s accounting for and reporting of transactions.

Although the Company has identified a lack of appropriate independent

oversight as a material weakness, an independent board of directors is not

required by The OTC Markets (the electronic quotation system that trades the

Company’s securities) and the Company does not intend to remediate this

material weakness at this time.

The Company has engaged a consultant to assist the Company with certain

complex, non-routine and unusual accounting issues and transactions when they

are encountered.

Changes in Internal Control over Financial Reporting

During the years ended April 30, 2018 and 2017, there have been no

changes in internal control over financial reporting that materially affected,

or are reasonably likely to materially affect, the Company’s internal control

over financial reporting.

ITEM 9B.

OTHER

INFORMATION

None.

|

Annual

Report on Form 10-K

|

Page

21

|

First Hartford Corporation

|

PART III

ITEM 10.

DIRECTORS, EXECUTIVE OFFICERS AND

CORPORATE GOVERNANCE

(a)

Identification of Directors

:

The directors of First Hartford Corporation, their

ages and the periods during which each has served as such are as follows:

|

Name

|

Age

|

Period

of Service

|

|

Neil H. Ellis

|

90

|

1966 – Present

|

|

John Toic

|

46

|

2015 – Present

|

|

Jeffrey Carlson

|

63

|

2015 – Present

|

|

William Connolly

|

69

|

2015 –

Present

|

|

Jonathan Bellock

|

32

|

2017 –

Present

|

There are no arrangements or understandings between

any of the foregoing and any other person pursuant to which such person was or

is to be selected director or officer.

The

directors of the Company are each elected to one-year terms.

(b)

Identification of Executive

Officers

:

The names

and ages of all executive officers of First Hartford Corporation, their

positions and the periods during which each has served as such are as follows:

|

Name

|

Age

|

Position

|

Period of Service

|

|

|

|

|

|

|

John Toic

|

46

|

President

|

2015 – Present

|

|

Neil H. Ellis

|

90

|

Chairman of the Board

|

1966 – Present

|

|

Jeffrey Carlson

|

63

|

Secretary

|

2015 – Present

|

|

Eric J. Harrington

|

48

|

Treasurer

|

2015 – Present

|

|

Jonathan Bellock

|

32

|

Vice President

|

2017 – Present

|

There are

no arrangements or understandings between any of the foregoing and any other person

pursuant to which such person was or is to be selected director or officer.

(c)

Identification of Certain

Significant Employees

:

|

Name

|

Age

|

Position

|

Period of

Service

|

|

N/A

|

|

|

|

(d)

Family Relationships

:

Mr. Bellock is the grandson of Mr. Ellis, the Chairman

of the Company. There are no other family relationships among any directors or

executive officers.

|

Annual

Report on Form 10-K

|

Page

22

|

First Hartford Corporation

|

ITEM 10.

DIRECTORS, EXECUTIVE OFFICERS AND

CORPORATE GOVERNANCE (continued)

(e)

Business Experience

:

1. Following is a brief description of the

background of each director and executive officer: