Amended Annual Report (10-k/a)

April 22 2022 - 4:33PM

Edgar (US Regulatory)

0000930775

true

2021

FY

0000930775

2020-04-01

2021-03-31

0000930775

2020-09-30

0000930775

2021-05-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No. 2)

(Mark One)

x ANNUAL

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2021

OR

o TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No.: 0-28604

ENCISION INC.

(Exact name of registrant as specified

in its charter)

| Colorado |

84-1162056 |

|

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer Identification No.) |

6797 Winchester Circle

Boulder, Colorado 80301

(Address of principal executive offices)

(303) 444-2600

(Registrant’s telephone number)

Registrant’s telephone number, including area

code: (303) 444-2600

Securities registered pursuant to Section 12(b)

of the Securities Exchange Act of 1934:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

ECIA |

OTC Bulletin Board |

Securities registered under Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer,

as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x

No o

Yes

Indicate by check mark if disclosure of delinquent filers pursuant to Item

405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s

knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

| Non-accelerated Filer ☒ |

|

Smaller reporting company ☒ |

| |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act). Yes o No x

As of September 30, 2020, the aggregate market value of the shares of common

stock held by non-affiliates of the issuer on such date was $2,933,441. This figure is based on the average bid and asked price of $0.55

per share of the issuer’s common stock on September 28, 2020 as quoted on the OTC Bulletin Board.

The number of shares outstanding of each of the issuer’s classes

of common equity, as of the last practicable date.

| Common Stock, no par value |

11,582,641 |

| (Class) |

(outstanding

at May 28, 2021) |

Explanatory Note:

We are filing this Amendment No. 2 on Form

10-K/A (“Amendment No. 1”) to our Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”)

on June 23, 2021 (“Original Form 10-K) to revise Item 9A and Item 15. This Amendment No. 2 does not reflect events occurring after

the filing of the Original Form 10-K on June 23, 2021 and no attempt has been made is this Amendment No. 2 to modify or update other

disclosures as presented in the Original Form 10-K. Accordingly, this Amendment No. 2 should be read in conjunction with the Original

Form 10-K and our filings with the SEC subsequent to the filing of the Original Form 10-K.

Item 9A. Controls and Procedures.

Management’s Evaluation of Disclosures Controls

and Procedures

We carried out an evaluation under the supervision

and with the participation of our management, including our Chief Executive Officer and Principal Financial and Accounting Officer, of

the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act

of 1934 (the "Exchange Act")) as of the end of the period covered by this report. Based upon that evaluation, the Chief Executive

Officer and the Principal Accounting Officer concluded that our disclosure controls and procedures were not effective as of March 31,

2021.

Management’s Annual Report on Internal Control

Over Financial Reporting

Our management is responsible for establishing and

maintaining adequate internal control over financial reporting, as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act. Our internal

control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting

and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Our internal

control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable

detail, accurately and fairly reflect the transactions and dispositions of our assets; (ii) provide reasonable assurance that transactions

are recorded to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts

and expenditures of the Company are made only in accordance with authorizations of our management and directors; and (iii) provide reasonable

assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material

effect on our financial statements.

Management assessed the effectiveness of our internal

control over financial reporting as of March 31, 2021. In making this assessment, management used the criteria set forth in Internal Control-Integrated

Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in 2013.

Based upon our evaluation of internal controls, our

CEO and PFAO determined that (i) we have a material weakness over our entity level control environment as of March 31, 2021 and (ii) our

internal control over financial reporting was not effective as of March 31, 2021. Our preventive and review controls failed to detect

errors related to the valuation of inventory and cutoff of service revenue.

Remediation Activities

Management has been actively engaged in remediating

the above described material weaknesses. The following remedial actions have been taken:

| · | We have made changes in our policy regarding how contract revenue and related

costs are booked. Under the revised policy, such revenue and costs are now booked in the same month as the related work is performed. |

| · | We have changed our policy regarding reserves for slow moving inventory.

Under our revised, policy we now book additional inventory reserves for all inventory older than 18 months, even if management believes

such inventory is still salable. |

The Company will design and implement additional procedures

in fiscal 2022 and 2023 in order to assure that audit/accounting personnel are more involved with the Company’s inventory activities

and service revenue to monitor and earlier identify accounting issues that may be raised by the Company’s ongoing activities.

The process of implementing an effective financial

reporting system is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory

environments and to expend significant resources to maintain a financial reporting system that is adequate to satisfy our reporting obligations.

As we continue to evaluate and take actions to improve our internal control over financial reporting, we may take additional actions to

address control deficiencies or modify certain of the remediation measures described above.

While progress has been made to enhance our internal

control over financial reporting, we are still in the process of implementing these processes, procedures and controls. Additional time

is required to complete implementation and to assess and ensure the sustainability of these procedures. We believe the above actions will

be effective in remediating the material weaknesses described above and we will continue to devote significant time and attention to these

remedial efforts. However, the material weaknesses cannot be considered remediated until the applicable remedial controls operate for

a sufficient period of time and management has concluded that these controls are operating effectively.

This Annual Report does not include an attestation

report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s

report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the Securities

and Exchange Commission that permit the Company to provide only management’s report in this Annual Report.

Changes In Internal Control Over Financial Reporting

Other than the applicable remediation efforts described

above, there were no significant changes in our internal control over financial reporting during the twelve months ended March 31, 2021

that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Item 15. Exhibits, Financial Statement

Schedules.

(b) Exhibits - The following exhibits are attached

to this report on Form 10-K or are incorporated herein by reference:

| 3.1 | Articles of Incorporation of the Company, as amended. (Incorporated by reference from Registration Statement #333-4118-D dated June

25, 1996). |

| 4.1 | Form of certificate for shares of Common Stock. (Incorporated by reference from Registration Statement #333-4118-D dated June 25,

1996). |

| † | Denotes management contract or compensatory plan or arrangement. |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d)

of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| |

ENCISION INC. |

| |

|

| |

|

| April 22, 2022 |

By: |

/s/ Mala Ray |

| Date |

|

Mala Ray Controller

Principal Accounting Officer &

Principal Financial Officer

|

4

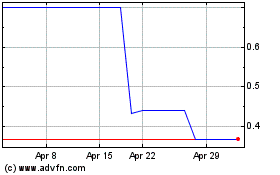

Encision (PK) (USOTC:ECIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Encision (PK) (USOTC:ECIA)

Historical Stock Chart

From Apr 2023 to Apr 2024