Current Report Filing (8-k)

December 30 2019 - 3:26PM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): Dec

30, 2019 (Dec 27, 2019)

Cuentas Inc.

(Exact name of registrant as specified in

its charter)

|

Florida

|

|

333-148987

|

|

20-3537265

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File Number)

|

|

Identification Number)

|

200 S. Biscayne Blvd., Suite 5500

Miami, FL

(Address of principal executive offices)

33131

(Zip Code)

(800) 611-3622

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 27, 2019,

the Compensation Committee (the “Compensation Committee”) of the Board of Directors of Cuentas Inc. (the

“Company”) finally approved the amendments to those certain employment agreements with each of Arik Maimon, the

Company’s Chief Executive Officer (“Maimon”), and Michael De Prado (“De Prado,” and together

with Maimon, the “Executives,” each an “Executive”), the Company’s President (the prior

employment agreements, the “Pre-existing Employment Agreements” and the new employment agreements, the “New

Employment Agreements”). The New Employment Agreements shall supersede the terms of the Pre-existing Employment

Agreements.

Pursuant to the terms

of the New Employment Agreements, among other things:

|

|

(1)

|

De Prado will receive the following compensation: (1) (a) a base salary of $265,000 per annum which will increase by a

minimum $15,000 or 5% on the 12 month anniversary of his employment agreement; (b) Restricted Stock Units; (c) a minimum grant

of 100,000 stock options per year, with the exercise price valued based on the Company’s stock price at the date of

exercise, pursuant to the terms and conditions of the Company’s Stock Option Incentive Plan; (d) an $8,000 automobile

expense allowance per year; (e) participation in the Company’s employee benefits plan; (f) participation in the Company’s

Performance Bonus Plan, if and when in effect.

|

|

|

(2)

|

Maimon will receive the following compensation: (a) a base salary of $295,000 per annum which will increase by a minimum

$15,000 or 5% on the 12 month anniversary of his employment agreement; (b) Restricted Stock Units; (c) a minimum grant of

100,000 stock options per year, with share price valued at the date of exercise, pursuant to the terms and conditions of the

Company’s Stock Option Incentive Plan; (d) An $10,000 automobile expense allowance per year; (e) participation in the

Company’s employee benefits plan; (f) participation in the Company’s Performance Bonus Plan, if and when in effect.

|

|

|

(3)

|

Each of De Prado and Maimon will be employed for an initial term of five years which will automatically renew for successive

one year period unless either party terminates the New Employment Agreements with 90 days’ prior notice.

|

|

|

(4)

|

Upon the successful up-listing of the Company’s shares of common stock, par value $0.001 per share, to the Nasdaq

Stock Market (“NASDAQ”), each executive would be entitled to receive a $250,000 bonus;

|

|

|

(5)

|

De Prado will be granted of 88,000 stock options and Maimon will be granted 100,000 stock options with the right to

exercise the options to purchase the equivalent of a minimum of 4% of the Company’s issued and outstanding shares of

Common Stock as of July 1, 2019;

|

|

|

(6)

|

Pursuant to the terms of the New Employment Agreements, the Executives are entitled to severance in the event of certain

terminations of his employment. The Executives are entitled to participate in the Company’s employee benefit, pension

and/or profit sharing plans, and the Company will pay certain health and dental premiums on their behalf.

|

|

|

(7)

|

Each of the Executives are entitled to Travel and expense reimbursement;

|

|

|

(8)

|

The Executives have agreed to a one year non-competition

agreement following the termination of their employment.

|

The foregoing description

of the New Employment Agreements does not purport to be complete and is qualified in its entirety by reference to the complete

New Employment Agreements. A copy of De Prado’s New Employment Agreement is attached hereto as Exhibit 10.1 and a copy of

Maimon’s New Employment Agreement is attached hereto as Exhibit 10.2 and each is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CUENTAS INC.

|

|

|

|

|

|

Date: Dec. 30, 2019

|

By:

|

/s/ Arik Maimon

|

|

|

|

Arik Maimon

|

|

|

|

Chief Executive Officer

|

2

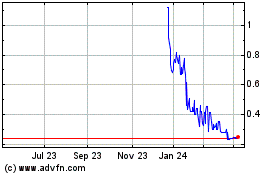

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

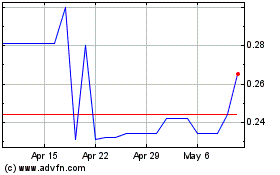

Cuentas (PK) (USOTC:CUEN)

Historical Stock Chart

From Apr 2023 to Apr 2024