UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

|

☐

|

Preliminary

Proxy Statement

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive

Proxy Statement

|

|

☒

|

Definitive

Additional Materials

|

|

☐

|

Soliciting

Material Pursuant to §240.14a-12

|

ADVAXIS,

INC.

(Name

of Registrant as Specified in Its Charter)

Not

Applicable

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

|

☒

|

No

fee required.

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

Leading

Independent Proxy Advisory Firm ISS Recommends Advaxis Stockholders Vote “FOR” the Merger with Biosight

MONMOUTH

JUNCTION, N.J., Nov. 3, 2021 (GLOBE NEWSWIRE) — Advaxis, Inc. (Nasdaq: ADXS), a clinical-stage biotechnology company focused on

the development and commercialization of immunotherapy products today announced that leading proxy advisory firm Institutional Shareholder

Services Inc. (“ISS”) issued a report on November 1, 2021, recommending that Advaxis stockholders vote “FOR”

the merger of the Company with Biosight and recommends voting “FOR” all proposals, at the Company’s Special

Meeting scheduled for November 16, 2021.

The

ISS recommendation stated, “The board ran what appears to have been a thorough strategic review process, corresponding with over

200 potential counterparties on a broad variety of transaction types, and no competing offers have been publicly disclosed since announcement.

The strategic rationale also appears logical, as it will diversify the pipeline of product candidates, and is expected to result in a

combined company with a more stable financial position. In light of these factors, support for the proposal is warranted.”

In

addition, in recommending stockholders vote “FOR” the reverse stock split proposal, ISS highlighted “the reverse

split may enable the company to maintain listing of its common stock on the Nasdaq Capital Market.”

The

Special Meeting is scheduled to take place on November 16, 2021 at 10:00 AM Eastern Time unless postponed or adjourned to a later date,

in order to obtain the stockholder approvals necessary to complete the merger and related matters. Advaxis stockholders will be able

to attend and participate in the Advaxis special meeting online by visiting www.virtualshareholdermeeting.com/ADXS2021SM where

they will be able to listen to the meeting live, submit questions and vote.

To

vote, or if you have already voted and would like to change your vote, or if you have any questions or need assistance voting your shares,

please call the firm assisting us with the solicitation of proxies:

Kingsdale

Advisors

1-888-508-1560

(toll free)

contactus@kingsdaleadvisors.com

About

Advaxis, Inc.

Advaxis,

Inc. is a clinical-stage biotechnology company focused on the development and commercialization of proprietary Lm-based antigen

delivery products. These immunotherapies are based on a platform technology that utilizes live attenuated Listeria monocytogenes (Lm)

bioengineered to secrete antigen/adjuvant fusion proteins. These Lm-based strains are believed to be a significant advancement

in immunotherapy as they integrate multiple functions into a single immunotherapy and are designed to access and direct antigen presenting

cells to stimulate anti-tumor T cell immunity, activate the immune system with the equivalent of multiple adjuvants, and simultaneously

reduce tumor protection in the tumor microenvironment to enable T cells to eliminate tumors.

To

learn more about Advaxis, visit www.advaxis.com and connect on Twitter, LinkedIn, Facebook and YouTube.

Important

Information about the Merger and Where to Find It

This

press release contains information that relates to a proposed transaction between the Company and Biosight Ltd. (“Biosight”)

pursuant to the Agreement and Plan of Merger and Reorganization, dated July 4, 2021 by and among the Company, Biosight and other parties

referenced therein (the “Merger Agreement”), the Company filed with the SEC a definitive proxy statement / prospectus contained

in a registration statement on Form S-4, as amended, and the Company has mailed the definitive proxy statement / prospectus and other

relevant documentation to Company stockholders. This document does not contain all the information that should be considered concerning

the proposed transaction. It is not intended to form the basis of any investment decision or any other decision in respect of the proposed

business combination. Advaxis stockholders and other interested persons are advised to read the definitive proxy statement / prospectus

in connection with the solicitation of proxies for the special meeting to be held to approve the transactions contemplated by the proposed

business combination because these materials contain important information about Biosight, Advaxis and the proposed transaction. The

definitive proxy statement / prospectus was mailed to Advaxis stockholders of record as of September 19, 2021. Stockholders are also

able to obtain a copy of the definitive proxy statement / prospectus free of charge at the Company’s website at www.advaxis.com

or by written request to the Company at 9 Deer Park Drive, Suite K-1, Monmouth Junction, NJ, Attention: Igor Gitelman, VP of Finance

and Chief Accounting Officer.

Completion

of the proposed transactions is subject to approval by the stockholders of Advaxis, Inc. and certain other conditions. The proposed business

combination is expected to close shortly after the special meeting assuming all conditions are met.

Participants

in the Solicitation

The

Company and Biosight and their respective directors and executive officers may be considered participants in the solicitation of proxies

with respect to the proposed transaction. Information regarding such directors and executive officers, including a description of their

interests, by security holdings or otherwise, in the proposed transaction will be set forth in the definitive proxy statement/prospectus

filed with the SEC regarding the proposed transaction. Stockholders, potential investors and other interested persons should read the

definitive proxy statement/prospectus carefully before making any voting or investment decisions. These documents, when available, can

be obtained free of charge as described in the preceding paragraph.

Forward-Looking

Statements

This

press release contains forward-looking statements that are made pursuant to the safe harbor provisions within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements

are any statements that express the current beliefs and expectations of management, including but not limited to statements related to

the risk that the proposed transaction may not be completed in a timely manner or at all, which may adversely affect the Company’s

business and the price of the common stock of the Company; the failure of either party to satisfy any of the conditions to the consummation

of the proposed transaction, including the adoption of the Merger Agreement by the Company’s stockholders and the receipt of certain

governmental and regulatory approvals; uncertainties as to the timing of the consummation of the proposed transaction; the occurrence

of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; the effect of the announcement

or pendency of the proposed transaction on the Company’s business relationships, operating results and business generally; risks

that the proposed transaction disrupts current plans and operations and the potential difficulties in employee retention as a result

of the proposed transaction; risks related to diverting management’s attention from the Company’s ongoing business operations;

the outcome of any legal proceedings that may be instituted against the Company related to the Merger Agreement or the proposed transaction;

unexpected costs, charges or expenses resulting from the proposed transaction; the Company’s history of net operating losses and

uncertainty regarding its ability to achieve profitability; expected clinical development of the Company’s drug product candidates,

statements about the Company’s balance sheet position, including the sufficiency of the Company’s cash and cash equivalents

to fund its obligations into the future, and statements related to the goals, plans and expectations for the Company’s ongoing

clinical studies. These and other risks are discussed in the Company’s filings with the SEC, including, without limitation, the

definitive proxy statement on Schedule 14A, filed on October 29, 2021, its Annual Report on Form 10-K, filed on January 22, 2021, and

its periodic reports on Form 10-Q and Form 8-K. Any statements contained herein that do not describe historical facts are forward-looking

statements that are subject to risks and uncertainties that could cause actual results, performance and achievements to differ materially

from those discussed in such forward-looking statements. The Company cautions readers not to place undue reliance on any forward-looking

statements, which speak only as of the date they were made. The Company undertakes no obligation to update or revise forward-looking

statements, except as otherwise required by law, whether as a result of new information, future events or otherwise.

Contact:

Tim McCarthy, LifeSci Advisors, LLC

212.915.2564

tim@lifesciadvisors.com

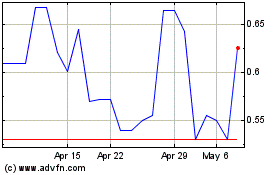

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Apr 2023 to Apr 2024