Excelsior Announces Independent Resource Estimates and 45% Increase in Contingent Resources at Hangingstone

June 25 2009 - 4:40PM

Marketwired Canada

Excelsior Energy Limited (TSX VENTURE:ELE) ("Excelsior" or "the Company") is

pleased to announce the completion of an updated independent evaluation of

bitumen resources on Excelsior's Hangingstone property ("Hangingstone" or

"Hangingstone Asset"), near Fort McMurray, Alberta. The report was prepared to

provide an independent assessment of the results of a 29 core well drilling

program at Hangingstone completed in March, 2009. The Company has now drilled a

total of 55 wells on the Hangingstone property where Excelsior has a 75% working

interest in 39 contiguous sections of oil sands rights. Excelsior's drilling

objectives in the 2008/2009 winter drilling program were to increase drilling

density in the COGD pilot project area and to further delineate a thick channel

sand system discovered by core wells in early 2008. The Company met all of its

objectives with excellent well results.

As with last year the resource estimates were prepared by independent petroleum

engineers McDaniel & Associates Consultants Limited ("McDaniel"). The McDaniel

report ("the Report") was prepared using assumptions and methodology guidelines

outlined in the Canadian Oil and Gas Evaluation Handbook and in accordance with

National Instrument 51-101. The effective date of the evaluation is July 1,

2009. The Report incorporates the McDaniel price deck as at April 1, 2009 in the

forecast price scenario.

"Excelsior is very pleased with the incremental 50 million barrel increase of

net Contingent Resources assigned at Hangingstone. The Company's performance and

results to date equates to a very attractive full-cycle finding cost of $0.30

per best estimate contingent barrel" commented David Winter, CEO and President

of Excelsior, "An extensive channel system has been delineated in the western

part of the property with excellent, thick continuous net pay which gives

Management the confidence to estimate potential productivity in excess of 50,000

barrels of bitumen per day from Hangingstone."

Discovered and Undiscovered Petroleum Initially-in-Place

McDaniel has recognized best estimate Discovered Petroleum Initially-in-Place of

1.808 billion barrels on the Hangingstone Asset in proximity to well control

(Excelsior working interest share before royalty) with a low estimate of 1.262

billion barrels and a high estimate of 2.361 billion barrels. The area included

in Discovered Petroleum Initially-in-Place assignments, based on well control,

amounts to approximately 24% of the gross Hangingstone lands. Generally,

McDaniel's methodology for the assignment of Discovered Petroleum

Initially-In-Place requires a minimum delineation density of one well per square

mile. Discovered Petroleum Initially-in-Place increased by 14% on a year over

year basis.

McDaniel has determined additional prospectivity in an Undiscovered Petroleum

Initially-in-Place assignment. The Report assigns 2.849 billion barrels of best

estimate Discovered and Undiscovered Petroleum Initially-in-Place to the

Hangingstone Asset (Excelsior working interest share before royalty) with a low

estimate of 2.137 billion barrels and a high estimate of 3.561 billion barrels.

Discovered and Undiscovered Petroleum Initially-in-Place declined 6% on a year

over year basis as the drilling results modified the mapping of undiscovered

petroleum.

Contingent Resources

The Report assigned Contingent Resources to the Hangingstone Property based on

the well delineation density achieved as of July 1, 2009. Best estimate

Contingent Resources were estimated at 172 MMbbls (Excelsior working interest

share before royalty); low estimate Contingent Resources were estimated at 127

MMbbls and high estimate Contingent Resources were estimated at 230 MMbbls. The

assigned Contingent Resources are further categorized as economic. Contingent

Resources have increased 45% on a year over year basis.

The Report estimated that Excelsior's best estimate Contingent Resources would

generate $2.205 billion of future net revenue after deduction of $3.299 billion

in future full-cycle capital requirements over a 30 year field life and

abandonment costs of $54.4 million resulting in a net present value before

income tax discounted at 10% ("NPV10") of $208 million. On a NPV10 unit basis

the report valued Excelsior's Contingent Resources at $1.21 per barrel.

McDaniel calculates Contingent Resources based on that portion of Discovered

Petroleum-Initially-in-Place that meets the requisite minimum qualitative and

quantitative criteria to be exploited using conventional SAGD technology. The

Contingent Resource volumes have not been classified as Reserves at this time

pending further delineation drilling, development planning and regulatory

applications.

Share Value based on Contingent Resource and Common Shares Outstanding

On a per share basis the estimated NPV10 for best estimate Contingent Resources

equates to $1.45 per Excelsior common share outstanding, the estimated NPV10 for

the high estimate Contingent Resources equates to $3.86 per Excelsior common

share outstanding. There are approximately 143 million Excelsior common shares

outstanding.

Prospective Resources

McDaniel also assigned Prospective Resources to Hangingstone. Best estimate

Prospective Resources were estimated at 75 MMbbls (Excelsior working interest

share before royalty); low estimate Prospective Resources were estimated at 49

MMbbls and high estimate Prospective Resources were estimated at 92 MMbbls.

Prospective Resources declined 13% on a year over year basis as resources

previously assigned as Prospective Resources were upgraded to Contingent

Resources based on the drilling results.

McDaniel calculates Prospective Resources based on that portion of Undiscovered

Petroleum-Initially-in-Place that is expected to meet the requisite minimum

qualitative and quantitative criteria to be exploited using conventional SAGD

technology. The Prospective Resource volumes have not been classified as

Contingent Resources at this time pending additional delineation drilling.

Summary Tables

----------------------------------------------------------------------------

Summary of Discovered and Undiscovered

Petroleum Initially-in-Place

Hangingstone, Excelsior Working Interest Share Before Royalty

McDaniel & Associates - July 1, 2009

(Billions of barrels)

----------------------------------------------------------------------------

Low Best High

Estimate Estimate Estimate

----------------------------------------------------------------------------

Discovered Petroleum

Initially-in-Place 1.262 1.808 2.361

----------------------------------------------------------------------------

Discovered and Undiscovered

Petroleum Initially-in- Place 2.137 2.849 3.561

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Summary of Contingent and Prospective Resources

Hangingstone, Excelsior Working Interest Share Before Royalty

McDaniel & Associates - July 1, 2009

(Millions of barrels)

----------------------------------------------------------------------------

Low Best High

Estimate Estimate Estimate

----------------------------------------------------------------------------

Contingent Resources 127 172 230

----------------------------------------------------------------------------

Prospective Resources 49 75 92

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Petroleum Initially-in-Place and Resource Volumes (Best Estimate)

Hangingstone, Excelsior Working Interest Share Before Royalty

Year over Year comparison

(Millions of barrels)

----------------------------------------------------------------------------

July 1, 2008 July 1, 2009 % Change

----------------------------------------------------------------------------

Discovered Petroleum 1,587 1,808 14%

Initially in-Place

----------------------------------------------------------------------------

Contingent Resources 119 172 45%

----------------------------------------------------------------------------

Discovered and Undiscovered 3,041 2,849 -6%

Petroleum Initially-in-place

----------------------------------------------------------------------------

Prospective Resources 86 75 -13%

----------------------------------------------------------------------------

Definitions:

1) Discovered Petroleum Initially-in-Place

- Defined as that quantity of petroleum that is estimated, as of a given date,

to be contained in known accumulations prior to production. The recoverable

portion of Discovered Petroleum Initially-in-Place includes production,

reserves, and contingent resources; the remainder of the volume is

unrecoverable.

2) Undiscovered Petroleum Initially-in-Place

- Defined as that quantity of petroleum that is estimated, on a given date, to

be contained in accumulations yet to be discovered. The recoverable portion of

Undiscovered Petroleum-Initially-in-Place is referred to as Prospective

Resources; the remainder is classified as unrecoverable.

3) Contingent Resource

- Defined as those quantities of petroleum estimated, as of a given date, to be

potentially recoverable from known accumulations using established technology or

technology under development, but which are not currently considered to be

commercially recoverable due to one or more contingencies. Economic contingent

resources are those contingent resources that are currently economically

recoverable.

4) Prospective Resource

- Defined as those quantities of petroleum estimated, as of a given date, to be

potentially recoverable from undiscovered accumulations by application of future

development projects. Prospective resources have both an associated chance of

discovery and a chance of development.

5) Low Estimate

- Defined as a conservative estimate of the quantity that will actually be

recovered from the accumulation. If probabilistic methods are used, this term

reflects P90 confidence level.

6) Best Estimate

- Defined as the best estimate of the quantity that will actually be recovered

from the accumulation. If probabilistic methods are used this term is a measure

of central tendency of the uncertainty distribution (P50).

7) High Estimate

- Defined as an optimistic estimate of the quantity that will actually be

recovered from the accumulation. If probabilistic methods are used the term

reflects a P10 confidence level.

About Excelsior Energy

Excelsior is an early stage, oil sands company with 58 operated sections on two

contiguous blocks in the Hangingstone and West Surmont areas of the Athabasca

Oil Sands Region near Fort McMurray, Alberta. The Company has developed a

proprietary in situ combustion technology ("Combustion Overhead Gravity

Drainage" or "COGD") which has game-changing potential in the development and

recovery of heavy oil and bitumen. An application for an experimental pilot

project to field demonstrate the COGD technology will be submitted in at the end

of the second quarter of 2009 with a targeted start up in early 2011. In

addition the Company indirectly holds a 100% working interest in UK North Sea

Licences P1500 and P1691 covering four part-blocks through its 75% owned

subsidiary ENS Energy Ltd. Excelsior's strategy is to capture oil and gas

appraisal and development opportunities where we can leverage Management's

diverse international operating, heavy oil and field development expertise with

developing technologies to produce oil and gas.

Estimations of reserves and future net revenue discussed in this press release

constitute forward looking statements. See "Forward Looking Statements" below.

Forward Looking Statements

This press release contains forward-looking statements. Management's assessment

of future plans and operations, expected production levels, operating costs,

capital expenditures, the nature of capital expenditures, methods of financing

capital expenditures, future engineering reports and the timing of increases in

production may constitute forward-looking statements under applicable securities

laws and necessarily involve risks including, without limitation, risks

associated with oil and gas exploration, development, exploitation, production,

marketing and transportation, loss of markets, volatility of commodity prices,

currency fluctuations, imprecision of reserve estimates, environmental risks,

competition from other producers, inability to retain drilling rigs and other

services, incorrect assessment of the value of acquisitions, failure to realize

the anticipated benefits of acquisitions, delays resulting from or inability to

obtain required regulatory approvals and ability to access sufficient capital

from internal and external sources. As a consequence, the Company's actual

results may differ materially from those expressed in, or implied by, the

forward-looking statements. Readers are cautioned that the foregoing list of

factors is not exhaustive. Additional information on these and other factors

that could effect the Company's operations and financial results are included in

reports on file with Canadian securities regulatory authorities and may be

accessed through the SEDAR website (www.sedar.com). Furthermore, the forward

looking statements contained in this press release are made as at the date of

this press release and the Company does not undertake any obligation to update

publicly or to revise any of the included forward looking statements, whether as

a result of new information, future events or otherwise, except as may be

required by applicable securities laws.

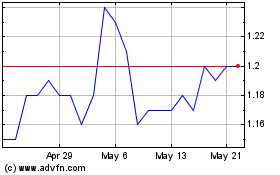

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From May 2024 to Jun 2024

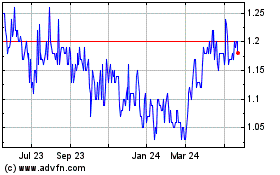

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2023 to Jun 2024