Excelsior Announces First Quarter 2009 Results

May 28 2009 - 6:32PM

Marketwired Canada

Excelsior Energy Limited (TSX VENTURE:ELE) ("Excelsior" or the "Company")

announces it has filed financial statements and management's discussion and

analysis for the three month periods ended March 31, 2009 and 2008. These

financial statements and associated management's discussion and analysis can be

found online at www.sedar.com.

"Two seasons of core well delineation have confirmed and expanded the high

quality bitumen resource at Hangingstone and Excelsior is on target to submit

its COGD project application by the end of the second quarter of 2009" said Dr.

David Winter, Excelsior's President and Chief Executive Officer. "We have a

growing bitumen resource that has been independently validated for SAGD

development, the mainstay of in situ bitumen recovery. Furthermore we believe

that this resource value is even more compelling when coupled with the potential

economic and exploitation leverage provided by our COGD technology."

First Quarter 2009 Highlights

- The Company completed the 2008/2009 winter drilling program in March 2009

drilling a total of 29 core wells at Hangingstone representing the majority of

$7.7 million of capital expenditures in the first quarter of 2009. The program

was completed on schedule and on budget with results exceeding expectations. The

drilling program targeted the area to be used for the experimental pilot program

application using an in situ combustion technology ("Combustion Overhead Gravity

Drainage" or "COGD") and further delineation of two additional areas of thick

bitumen reservoir discovered last year. This greatly expanded the area of thick

bitumen sands and confirms the excellent resource potential at Hangingstone.

- The Company had working capital of $3.5 million at March 31, 2009. This is

sufficient to fund the COGD pilot application and cover general and

administrative expenses through to the end of 2010. Further operations and

implementing the pilot project will require new funding.

- The environmental impact assessment and planning and engineering studies for

the COGD project application are nearing completion. A flow test was conducted

over a saline water aquifer as part of the winter drilling program which proved

it an excellent source to meet future process water needs. The cap rock

integrity evaluation is complete and confirmed cap rock integrity.

- The Company had commitments to incur and renounce $9,237,766 of eligible

expenditures, to subscribers of its flow through private placements, by December

31, 2009. The Company accounted for the $2.3 million tax effect of the

renunciation of the flow through shares in the first quarter of 2009 increasing

future income tax liability to approximately $5.5 million. As at March 31, 2009,

the Company had incurred $9,085,207 of eligible expenditures.

- Excelsior Energy North Sea Limited ("EENS"), a 75% indirectly owned subsidiary

of Excelsior, was awarded licence P1691 for two new blocks in the UK North Sea

at 16/1b and 16/2c in the United Kingdom Continental Shelf 25th Licensing Round

in March 2009. These blocks are contiguous to EENS's existing North Sea blocks

and cement the acreage position around the primary prospect. The licence

requires seismic reprocessing and interpretation on the blocks over the next two

years. EENS was also granted an extension to Licence P1500 until November 30,

2009, by the Department of Energy and Climate Change.

Outlook

- A new resource report incorporating the results from the full 20082009 winter

program by McDaniel and Associates is expected to be completed in late June

2009.

- All data necessary to support the experimental project application has been

obtained and Excelsior expects to submit a COGD experimental project application

to the Alberta Government targeted by June 30, 2009. Regulatory approval is

expected to take approximately one year with pilot start-up anticipated for the

first quarter of 2011.

- Excelsior awaits a response to an application submitted to the Alberta

Government's Innovative Energy Technology Program in support of the COGD

experimental program. The submission was made in September 2008 and provides for

royalty credits to be awarded for capital spent on this new technology.

Confirmation is expected in the near future.

- Seismic reprocessing on licence P1500 in the UK North Sea is completed and

interpreted. A drilling location has been identified to test one of the

prospects which is a step-out from an existing oil discovery drilled in 1996.

The Company is required to commit to drill on the block by November 30, 2009, or

relinquish the licence at no further cost. The Company is currently conducting a

farm-out process to seek an industry partner for the well.

- Excelsior recognizes that the current economic conditions limit access to

capital and will monitor the return of more favorable market environments in

order to finance the COGD pilot at Hangingstone and appraisal of the North Sea

properties. The Company is also investigating alternative financing arrangements

such as project or joint venture financing.

Selected Information

----------------------------------------------------------------------------

($'s except weighted average shares) Mar 31, 2009 Mar 31, 2008

----------------------------------------------------------------------------

Gas revenue 6,153 37,038

Royalties (249) (6,051)

Operating expenses (4,195) (8,046)

----------------------------------------------------------------------------

Net gas revenue 1,709 22,941

----------------------------------------------------------------------------

Interest income 27,979 140,529

General and administrative expense 261,614 279,028

Net loss and comprehensive loss (410,800) (577,495)

Loss per share (basic and diluted) - (0.01)

----------------------------------------------------------------------------

Capital expenditures

Petroleum and natural gas properties 7,739,361 10,839,905

----------------------------------------------------------------------------

Cash flows

Cash flows used in operations (409,372) (407,158)

Cash flows used in investing (8,321,785) (6,697,462)

Cash flows from financing - 1,111,725

----------------------------------------------------------------------------

Change in cash and cash equivalents (8,731,157) (5,992,895)

Cash and cash equivalents, beginning of period 13,748,057 15,858,648

----------------------------------------------------------------------------

Cash and cash equivalents, end of period 5,016,900 9,855,753

----------------------------------------------------------------------------

Basic and diluted weighted average number of

shares outstanding 143,060,590 108,517,539

----------------------------------------------------------------------------

About Excelsior

Excelsior is an early stage, oil sands company with 58 operated sections on two

contiguous blocks in the Hangingstone and West Surmont areas of the Athabasca

Oil Sands Region near Fort McMurray, Alberta. The Company has developed a

proprietary in situ combustion technology ("Combustion Overhead Gravity

Drainage" or "COGD") which has game-changing potential in the development and

recovery of heavy oil and bitumen. An application for an experimental pilot

project to field demonstrate the COGD technology will be submitted in at the end

of the second quarter of 2009 with a targeted start up in early 2011. In

addition the Company indirectly holds a 100% working interest in UK North Sea

Licences P1500 and P1691 covering four part-blocks through its 75% owned

subsidiary ENS Energy Ltd. Excelsior's strategy is to capture oil and gas

appraisal and development opportunities where we can leverage Management's

diverse international operating, heavy oil and field development expertise with

developing technologies to produce oil and gas.

Forward Looking Statements

This press release contains forward-looking statements. Management's assessment

of future plans and operations, expected production levels, operating costs,

capital expenditures, the nature of capital expenditures, methods of financing

capital expenditures, future engineering reports and the timing of increases in

production may constitute forward-looking statements under applicable securities

laws and necessarily involve risks including, without limitation, risks

associated with oil and gas exploration, development, exploitation, production,

marketing and transportation, loss of markets, volatility of commodity prices,

currency fluctuations, imprecision of reserve estimates, environmental risks,

competition from other producers, inability to retain drilling rigs and other

services, incorrect assessment of the value of acquisitions, failure to realize

the anticipated benefits of acquisitions, delays resulting from or inability to

obtain required regulatory approvals and ability to access sufficient capital

from internal and external sources. As a consequence, the Company's actual

results may differ materially from those expressed in, or implied by, the

forward-looking statements. Readers are cautioned that the foregoing list of

factors is not exhaustive. Additional information on these and other factors

that could effect the Company's operations and financial results are included in

reports on file with Canadian securities regulatory authorities and may be

accessed through the SEDAR website (www.sedar.com). Furthermore, the forward

looking statements contained in this press release are made as at the date of

this press release and the Company does not undertake any obligation to update

publicly or to revise any of the included forward looking statements, whether as

a result of new information, future events or otherwise, except as may be

required by applicable securities laws.

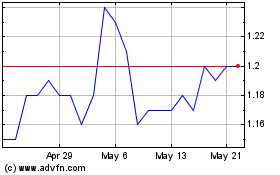

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From May 2024 to Jun 2024

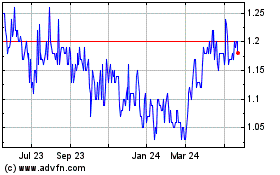

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2023 to Jun 2024