X-Tal Announces Financing Terms in Connection With Its Merger Agreement With American Eagle Resources, Inc.

November 18 2010 - 11:28AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN UNITED STATES

X-Tal Minerals Corp. (TSX VENTURE:XMT.H) (the "Company" or "X-Tal") is pleased

to announce that, further to its press release dated November 2, 2010, it has

agreed on the pricing terms of its previously announced $10 million financing.

The financing is being conducted in conjunction with the Company's announced

merger with American Eagle Resources, Inc. ("AME") (the "Transaction"), in which

the Company will acquire all of the outstanding shares of AME.

Terms for $10 Million Financing

In conjunction with the Transaction, the Company has engaged MGI Securities Inc.

("MGI") and PI Financial Corp. ("PI") as agents (the "Agents") to carry out a

concurrent private placement (the "Financing") of up to 10,000,000 subscription

receipts priced at $1.00 per subscription receipt for gross proceeds of up to

$10,000,000. MGI has also agreed to serve as a sponsor if needed for purposes of

TSXV approval. Upon completion of the Transaction, each subscription receipt

will, for no additional consideration, automatically be exercised into one unit

of the Company, each unit consisting of one common share of the Company and one

half of one share purchase warrant, with each whole warrant entitling the holder

to purchase one common share of the Company at a price of $2.00 for a period of

12 months following closing. The Financing is expected to close on or before

December 15, 2010. At closing the gross proceeds of the Financing will be held

in escrow pursuant to the terms of a subscription receipt agreement to be

entered into by the Company and Computershare Investor Services Inc., and will

be released to the Company upon the completion of the Transaction.

The Company has agreed to pay cash commissions of up to 6% of the gross proceeds

raised, and issue agent's warrants of up to 6% of the number of shares sold. In

addition, the Agents have the option (the "Agents' Option") to sell up to that

number of additional subscription receipts or units, as the case may be, which

is equal to 15% of the number of subscription receipts sold pursuant to the

offering at the same issue price. The Agents' Option may be exercised at any

time within 30 days after the closing date of the offering.

ON BEHALF OF THE BOARD OF DIRECTORS

Walter H. Berukoff, Chairman

Completion of the transaction is subject to a number of conditions, including

Exchange acceptance and disinterested Shareholder approval. The transaction

cannot close until the required Shareholder approval is obtained. There can be

no assurance that the transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the Management Information

Circular to be prepared in connection with the transaction, any information

released or received with respect to the RTO may not be accurate or complete and

should not be relied upon. Trading in the securities of the Company should be

considered highly speculative.

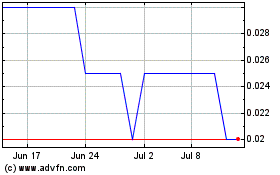

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From May 2024 to Jun 2024

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From Jun 2023 to Jun 2024