X-Tal Announces Definitive Merger Agreement With American Eagle Resources, Inc.

November 02 2010 - 2:40PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN UNITED STATES

X-Tal Minerals Corp. (TSX VENTURE:XMT.H) (the "Company" or "X-Tal") and American

Eagle Resources Inc. ("AME") are pleased to announce that they have entered into

a definitive Merger Agreement (the "Agreement") dated November 1, 2010 to

complete a business combination (the "Transaction") in which the Company will

acquire all of the outstanding shares of AME. The combined entity will focus on

generating shareholder value through the exploration and development of its

mineral projects in Fiji.

Pursuant to the terms of the Agreement, all of the common shares of AME shall

become exchangeable for common shares of the Company on a basis of one (1)

common share of AME for one (1) common share of X-Tal. AME and X-Tal currently

have 21,108,543 and 6,300,001 common shares outstanding, respectively. The

Company will also complete a name change to Lion One Metals Limited and plans to

graduate from the NEX to the TSX Venture Exchange ("TSXV").

About American Eagle

AME is a private British Columbia corporation that holds, through its subsidiary

Lion One Limited Fiji, five Special Prospecting Licenses covering 38,034

hectares in the Fijian Islands, including the assets collectively known as the

Tuvatu project ("Tuvatu"). A technical report for Tuvatu dated October 1, 2010

has been completed according to NI 43-101 guidelines by P&E Mining Consultants

of Brampton, Ontario.

The Tuvatu High-Grade Gold Project

Tuvatu hosts the second largest gold deposit in Fiji after the large Emperor

Gold Mines ("Emperor") gold deposit at Vatukoula (6 million oz. Au produced to

date). These deposits are 50 km apart and are associated with the same NE

trending lineament of alkaline rocks on the island of Viti Levu. Epithermal gold

veins at Tuvatu occur along the margins of the eroded Navilawa volcanic center

in a multi-phase environment also featuring porphyry copper- style

mineralization.

Over US$32 Million of Previous Work

Previous work on Tuvatu includes over 80,000 meters of surface and underground

drilling and a total of over US$32 million worth of expenditures in drilling,

metallurgical testwork, a complete feasibility study, resource and reserve

estimation, and mine construction.

In 1997 Emperor developed 1,630 metres of underground workings after having

completed 48,008 meters of surface drilling, and followed up with underground

drilling, geophysical surveys, bulk sampling, and trial mining. In 2000 Emperor

commissioned Bateman-Kinhill to complete a feasibility study in conjunction with

a further 23,668 meters of drilling and environmental and community studies.

Metallurgical tests incorporated with the feasibility study included trial

milling of ores through the Emperor Mill at Vatukoula, reporting over 90% gold

recoveries.

Historic and Current Mineral Resource and Reserve Estimates

Historical mineral resource estimates for Tuvatu were reported in compliance

with the Australian Joint Ore Reserves Committee (JORC) guidelines and included

Indicated Mineral Resources of 1,065,000 tonnes at 8.45 grams Au per tonne, or

289,000 oz. Au, in addition to Inferred Mineral Resources of 757,000 tonnes at

10.31 grams Au per tonne, or 251,000 oz. Au. In connection with a

pre-feasibility study commissioned by Emperor in 2000, a Probable Reserve was

reported of 269,034 oz. Au grading 6.3 grams Au per tonne.

A NI 43-101 compliant Mineral Resource Estimate prepared in conformance with

generally accepted CIM "Estimation of Mineral Resource and Mineral Reserves Best

Practices" (2005) guidelines was completed in August 2010 by P&E and supersedes

all historic resources. Eugene Puritch P.Eng., and F.H. Brown, CPG, Pr.Sci.Nat.

of P&E are the QP's responsible for preparation of the Mineral Resource Estimate

shown below.

The total sampling database for the Tuvatu project consists of 607 records

encompassing data from surface and underground sampling and surface and

underground drilling. The mineral resource was estimated using Inverse Distance

Cubed weighting of capped composite samples, with a grade capping of 40g/t Au.

The strike length of the deposit is on the order of 900 m.

P&E Underground Mineral Resource estimate at a 2.0 g/t Au cut-off (1,2,3)

as of August 1, 2010

---------------------------------------------------------------------------

Indicated Inferred

---------------------------------------------------------------------------

Tonnes x Au Oz Tonnes x Au Oz

1000 Au g/t x 1000 1000 Au g/t x 1000

---------------------------------------------------------------------------

Sulphides 760 7.05 172 2.502 5.78 465

---------------------------------------------------------------------------

Oxides 0 0 0 116 4.15 15

---------------------------------------------------------------------------

TOTAL 760 7.05 172 2,618 5.71 480

---------------------------------------------------------------------------

1. Mineral Resources which are not Mineral Reserves do not have

demonstrated economic viability. The estimate of Mineral Resources may

be materially affected by environmental, permitting, legal, title,

taxation, socio-political, marketing, or other relevant issues.

2. The quantity and grade of reported inferred resources in this estimation

are conceptual in nature. There is no guarantee that all or any part of

the Mineral Resource will be converted into Mineral Reserve.

3. Based on a gold price of US$983.00/oz. and 90% process recovery.

Underground operating costs supporting the 2.0 g/t cut-off are as

follows; mining $30/t, processing $15/t, G&A $13/t

Planned Financing of $10 Million

In conjunction with the Transaction, the Company has engaged MGI Securities

Inc., to act as agent and advisor and carry out a concurrent private placement

(the "Financing") of up to $10,000,000. The Company has agreed to pay cash

commissions of up to 6% of the gross proceeds raised, and issue agent's warrants

of up to 6% of the number of shares sold. In addition, the Agent has the option

(the "Agents' Option") to sell up to that number of additional Units which is

equal to 15% of the number of Units sold pursuant to the Offering at a price

equal to the Issue Price. The Agents' Option may be exercised at any time within

30 days after the closing date of the Offering.

New Board Composition

Upon completion of the Transaction, it is expected that the board of directors

of the resulting Company will consist of four members, including Walter H.

Berukoff, George S. Young, Richard Meli, and David Duval. Mr. Berukoff has been

instrumental in building successful mining companies such as Miramar Mining,

Northern Orion Resources and La Mancha Resources, while Mr. Young has had

significant roles in building companies such as Mag Silver, International

Royalty Corp., and Bond International Gold. Mr. Berukoff will act as Chairman

and Director of Lion One Metals Limited.

The Transaction is unanimously supported by the Board of Directors of both AME

and X-Tal and will be fully described in the Management Information Circulars to

be filed with regulatory authorities and mailed to AME and X-Tal shareholders in

accordance with applicable securities laws. The Transaction will be subject to

shareholder approval, and will be voted upon at the Annual Meeting of the

Company, to be held at the offices of the Company on December 21, 2010. The

record date for the meeting will be November 15, 2010.

The Agreement will result in a reverse takeover of the Company subject to

shareholder and regulatory approval, including approval of the TSXV. The

Transaction is also subject to the approval of the AME shareholders. The shares

of the Company to be issued to current shareholders of AME may be subject to

escrow and/or resale restrictions in accordance with applicable securities

legislation and the policies of the TSXV.

Darcy Krohman, P.Geo, a Qualified Person for the Company under the meaning of

Canadian National Instrument 43-101, has reviewed the technical information in

this news release.

ON BEHALF OF THE BOARD OF DIRECTORS

Walter H. Berukoff, Chairman

This news release may contain forward-looking statements addressing future

events and conditions and therefore, involve inherent risks and uncertainties.

Actual results may differ materially from those currently anticipated in such

statements.

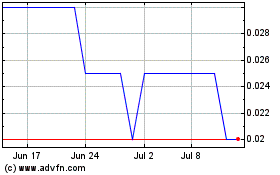

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From May 2024 to Jun 2024

Abacus Mining and Explor... (TSXV:AME)

Historical Stock Chart

From Jun 2023 to Jun 2024