Exco Technologies Limited - Third Quarter ended June 30, 2012

July 25 2012 - 4:30PM

PR Newswire (Canada)

-- Year over year Quarterly Sales increased 20% -- Year over year

Quarterly Profits increased 50% -- Quarter-end Cash on hand

increased 49% to $22.9 million -- No bank debt TORONTO, July 25,

2012 /CNW/ - Exco Technologies Limited (TSX-XTC) today announced

results for its third quarter ended June 30, 2012. In

addition, the Company announced the quarterly dividend of $0.0375

per common share which will be paid on September 28, 2012 to

shareholders of record on September 14, 2012. The

dividend is an "eligible dividend" in accordance with the Income

Tax Act of Canada. Three Months ended Nine Months ended June 30

June 30 ($000s, except per share amounts) 2012 2011 2012 2011 Sales

59,213 49,183 180,849 148,605 Net income 5,516 3,688 17,302 10,603

Basic earnings per $0.14 $0.09 $0.42 $0.26 share Diluted earnings

$0.14 $0.09 $0.42 $0.26 per share Common shares 40,663,811

40,961,823 40,663,811 40,961,823 outstanding Consolidated sales for

the third quarter ended June 30, 2012 were $59.2 million - an

increase of $10.0 million or 20% compared to last year. The

Company experienced strong demand for its products and this quarter

marks the continuing trend of growing sales started over three

years ago. Year-to-date sales were $180.8 million - an increase of

$32.2 million or 22% compared to last year. During the third

quarter, the Casting and Extrusion segment reported sales of $36.0

million - an increase of $4.2 million or 13% compared to the same

quarter last year. Year-to-date, the segment reported sales

of $112.5 - an increase of $18.6 or 20% compared to last year.

Sales in the Automotive Solutions segment in the third quarter were

$23.2 million - an increase of $5.8 million or 33% from the same

quarter last year. Year-to-date, the segment reported sales of

$68.3 million - an increase of $13.7 million or 25% from last year.

Sales increased at all business units in both business

segments. Growth in extrusion tooling sales continues to

point towards a recovery in industrial activity in North

America. Castool and Exco's large mould businesses also

continue to benefit from the surge in demand for die cast tooling

and consumable components. At Polytech and Neocon, strong

light vehicle production levels in North America, favorable OEM

content positioning and better absorption of tightly controlled

manufacturing overhead costs fuelled growth at these divisions.

Sales at Polydesign have also increased in the quarter and

year-to-date as volumes have held up well, despite difficult

European market conditions. Consolidated net income for the third

quarter was $5.5 million or $0.14 per share compared to

consolidated net income of $3.7 million or $0.09 per share last

year. Year-to-date consolidated net income was $17.3 million or

$0.42 per share compared to consolidated net income of $10.6

million or $0.26 per share last year. Pretax income for the Casting

and Extrusion segment in the third quarter was $5.2 million

compared to segment pretax income of $3.5 million last year.

Year-to-date, the segment reported pretax income of $16.2 million

compared to $9.0 million last year. These improvements were led by

the large mould group which continued to benefit from very strong

demand for its powertrain tooling. Edco reported a

profit in the current quarter and losses at Excoeng Mexico, our

large mould maintenance facility in Queretaro Mexico, decreased

significantly in the current quarter mainly due to growing sales.

Year-to-date, losses at Edco and Excoeng Mexico were approximately

1 cent per share. Earnings at Castool were also significantly

stronger on higher sales in both current quarter and year-to-date.

Extrusion earnings in the current quarter and year-to-date

increased significantly over last year as efficiencies from

operating within the two-plant footprint were realized. The

start-up plant in Colombia, which started shipping in January 2012,

incurred losses of approximately 1 cent per share in the current

quarter and 2 cents year-to-date; however, as a group, the

extrusion businesses outperformed prior year results. The

Automotive Solutions segment reported segment pretax income in the

third quarter of $3.9 million compared to segment pretax income of

$2.7 million in the same quarter last year. Year-to-date, the

segment reported pretax income of $11.5 million compared to $8.7

million last year. Program refreshing and renewal activity has

enabled this segment to better recover raw material cost increases

experienced over the last several years. Strong light vehicle

production volume has also improved overhead absorption.

Polydesign continued improving its earnings as new product launches

have provided not only the necessary throughput but also higher

added value product mix than its traditional seat cover program

which comes to an end next quarter. The volume reduction on

existing European programs has not materialized to the extent that

was expected. However, erosion is still expected given current

trends in European automotive sales. Consolidated gross margin in

the third quarter increased to 28.8% from 27.1% in the same quarter

last year. Year-to-date gross margin also increase to 28.5% from

26.5% last year. The improvement in the current quarter and

year-date was mainly from; 1) declining losses at Edco and Excoeng

Mexico, 2) operating within a two-plant extrusion footprint and 3)

generally stable yet softening raw material cost environment.

Cash provided by operating activities increased to $4.6 million in

the third quarter from $2.5 million last year and $19.4 million

this year-to-date compared to $3.3 million last year. These

increases are primarily the result of improved earnings and stable

working capital requirements. This has caused the Company's

cash position at June 30, 2012 to increase to $22.9 million from

$15.4 million at the beginning of the year. The outlook for Exco

for the balance of the year continues to be promising. North

American automotive production is strong despite the overall

lackluster performance of the US economy. We believe the high

average age of North American vehicles, materially better mileage

of new automobiles and the return of low cost automobile financing

and leasing are the major factors driving this trend. This

bodes well for our automotive components and tooling businesses

which are expected to continue experiencing strong demand for their

products. Recent improvement in US industrial markets, seems

to be levelling off, however, improved demand for our extrusion

tooling products over the last year has been sustained. In Europe

the economy is in recession with automotive production contracting

precipitously. Exco's Polydesign operations are expected to

offset any declining volume on existing programs with the launch of

new programs throughout this year and next. In this way we

hope to position ourselves to take advantage of the recovery which

we expect to occur thereafter. Management also observes a

nascent trend in softening raw material costs. It would

appear that global trends toward more moderate growth particularly

among BRIC countries may cause Exco to obtain relief in the form of

better supply and more stable cost for polymers, steel and other

commodity inputs. The comparative amounts in the above analysis

have been adjusted to reflect the impact of the Company's

transition to IFRS effective October 1, 2010. Refer to Note 13 to

the interim consolidated financial statements for the second

quarter for a full reconciliation of the comparative period's

interim consolidated financial statements under GAAP to IFRS. (For

further information and prior year comparison please refer to the

Company's Third Quarter Interim Financial Statements in the

Investor Relations section posted at www.excocorp.com.

Alternatively, please refer to www.sedar.com) Exco Technologies

Limited is a global supplier of innovative technologies servicing

the die-cast, extrusion and automotive industries. Through

our 10 strategic locations, we employ 2,196 people and service a

diverse and broad customer base. To access the live audio webcast,

please log on to www.excocorp.com, or

http://www.newswire.ca/en/webcast/detail/1007495/1088509 a few

minutes before the event. Real Player is required for

access. For those unable to participate on July 26, 2012, an

archived version will be available on the Exco website. This news

release contains forward-looking information and forward-looking

statements within the meaning of applicable securities laws. We use

words such as "anticipate", "plan", "may", "will", "should",

"expect", "believe", "estimate" and similar expressions to identify

forward-looking information and statements especially with respect

to growth and financial performance of the Company's business

units, contribution of our businesses (particularly our start-up

business units in Mexico and Colombia), input costs and our

operating efficiencies. Such forward-looking information and

statements are based on assumptions and analyses made by us in

light of our experience and our perception of historical trends,

current conditions and expected future developments, as well as

other factors we believe to be relevant and appropriate in the

circumstances. These assumptions include, among other things, the

number of automobile vehicles produced in North America and Europe,

the rate of economic growth in North America and Europe and BRIC

countries, investment by OEMs in drivetrain architecture and

structural parts and currency fluctuations (particularly with

respect to the US dollar, Euro and Mexican Peso). Readers are

cautioned not to place undue reliance on forward-looking

information and statements, as there can be no assurance that the

assumptions, plans, intentions or expectations upon which such

statements are based will occur. Forward-looking information

and statements are subject to known and unknown risks,

uncertainties, assumptions and other factors which may cause actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed,

implied or anticipated by such information and statements.

These risks, uncertainties and assumptions are described in

the Company's Management's Discussion and Analysis included in our

2011 Annual Report, in our 2011 Annual Information Form and, from

time to time, in other reports and filings made by the Company with

securities regulatory authorities. While the Company believes that

the expectations expressed by such forward-looking information and

statements are reasonable, there can be no assurance that such

expectations and assumptions will prove to be correct. In

evaluating forward-looking information and statements, readers

should carefully consider the various factors which could cause

actual results or events to differ materially from those indicated

in the forward-looking information and statements. Readers are

cautioned that the foregoing list of important factors is not

exhaustive. Furthermore, the Company will update its

disclosure upon publication of each fiscal quarter's financial

results and otherwise disclaims any obligations to update publicly

or otherwise revise any such factors or any of the forward-looking

information or statements contained herein to reflect subsequent

information, events or developments, changes in risk factors or

otherwise. Exco Technologies Limited CONTACT: Source: Exco

Technologies Limited (TSX-XTC)Contact: Paul Riganelli,

Vice-President, Finance and Chief FinancialOfficerTelephone: (905)

477-3065 Ext. 7228Website: http://www.excocorp.com

Copyright

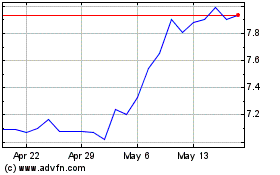

Exco Technologies (TSX:XTC)

Historical Stock Chart

From May 2024 to Jun 2024

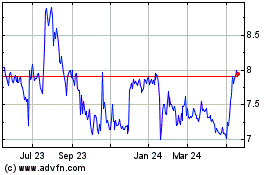

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Jun 2023 to Jun 2024