Exco Technologies Limited - Fourth Quarter ended September 30, 2011 and Quarterly Dividend Declared

November 30 2011 - 4:30PM

PR Newswire (Canada)

-- Annual Sales increased 21% -- Annual Profits increased 46.9% --

Year-end Cash on hand $15.4 million -- No bank debt TORONTO, Nov.

30, 2011 /CNW/ - Exco Technologies Limited (TSX-XTC) today

announced results for its fourth quarter ended September 30,

2011. In addition, the Company announced that its quarterly

cash dividend of $0.03 per share will be paid on December 22, 2011

to shareholders of record on December 14, 2011. The

dividend is an "eligible dividend" in accordance with the Income

Tax Act of Canada. Three Months ended Twelve Months ended September

30 September 30 ($000s, except per share amounts) 2011 2010 2011

2010 Sales 52,347 45,929 199,608 165,512 Net income 2,270 2,449

14,807 10,077 Basic and diluted earnings $0.06 $0.06 $0.36 $0.25

per share Common shares outstanding 40,961,823 40,912,823

40,961,823 40,912,823 In the fourth quarter sales were $52.3

million - a $6.4 million or 14% increase over the prior year.

Both business segments reported higher quarterly sales. The

Casting and Extrusion segment recorded higher sales of $32.7

million compared to $30.1 million last year - an increase of

9%. The Automotive Solutions segment experienced a 24%

increase in sales from $15.9 million last year to $19.6 million.

Consolidated annual sales totalled $199.6 million compared to

$165.5 million last year - an increase of $34.1 million or 21% over

last year. Annual sales for the Casting and Extrusion segment

were $125.3 million - an increase of $20.3 million or 19% from the

prior year. Annual sales for the Automotive Solutions segment

were $74.3 million - an increase of $13.8 million or 23% from the

prior year. The Company's fourth quarter net income of $2.3 million

($0.06 per share) compared to $2.4 million ($0.06 per share) in

fiscal 2010 was severely impacted by exchange rate volatility in

the last months of the quarter. This caused expenses in the

Corporate segment to increase by $1 million from foreign exchange

losses mainly on the fair valuation of Mexican peso collars and in

the Casting and Extrusion segment to increase by $839 thousand from

the revaluation of the Company's Mexican peso investment in Excoeng

Mexico. These exchange losses - although notional, non-cash

in nature and under IFRS reporting which commences next quarter

will not recur with respect to the revaluation of the Company's

investment in Excoeng Mexico - reduced fourth quarter earnings per

share by 3 cents per share and annually by 2 cents per share.

Fourth quarter pretax earnings increased in the Automotive

Solutions segment by $2 million or 189% over the same quarter last

year ($3 million compared to $1.1 million last year) on strong

overall demand, efficient production and generally smooth new

product launches. Partially offsetting this improvement was a

decline in quarterly pretax earnings in the Casting and Extrusion

segment by $881 thousand. The extrusion tooling group's

earnings were impacted by the final costs of closing the AluDie

business (severances $340 thousand), production inefficiencies from

relocating the last of AluDie's machinery and equipment to Colombia

and write down of some equipment from the Colombian acquisition

($134 thousand). The large mould businesses struggled with

tight delivery dates on a growing book of business. This

caused excessive overtime and excessive outsourcing of certain long

lead time functions. As internal capacity is adjusted both

overtime and outsourcing should abate. This group also

experienced cost overruns on several first off moulds during the

quarter. The Company reported full year consolidated net income of

$14.8 million or $0.36 per share compared to $10.1 million or $0.25

per share last year. Annual Casting and Extrusion earnings

increased by 17% to $13.3 million from $11.4 million in the prior

year. The Automotive Solutions segment recorded earnings of

$12 million for the year compared to $4.4 million last year. Gross

margin in the quarter increased slightly to 23.8% compared to 23.3%

last year. Full year gross margin also increased slightly to 26.5%

compared to 26% last year. During the fourth quarter the Company

continued the sales and earnings momentum that has been

consistently building since 2010. With both automotive

tooling and component sales convincingly recovering in North

America and the closure of AluDie now complete, the Company's

earnings and cash position should continue to prosper. We

also look forward to our two start-ups, Excoeng Mexico and Exco

Colombia, beginning to contribute in the later part of the year and

our large mould businesses to improve operating efficiencies by

insourcing throughout the year as internal production capacity

rises. The Company continues to have a strong balance sheet with no

bank debt and $15.4 million cash on hand at year end despite having

funded increased account receivable and inventory of $23.5 million,

capital expenditures of $8.2 million and paying $4.3 million in

dividends during the year. "While exchange rate volatility caused

by unpredictable global events and some internal operating

inefficiencies have taken an unexpected bite out of our fourth

quarter, I am pleased with Exco's overall performance in 2011" said

Brian Robbins, President and CEO of Exco, "and I am

comfortable that the fundamentals of our various business units are

robust and point to continued growth." (For further information and

prior year comparison please refer to the Company's Fourth Quarter

Interim Financial Statements in the Investor Relations section

posted at www.excocorp.com. Alternatively, please refer to

www.sedar.com after November 30, 2011.) Exco Technologies

Limited is a global supplier of innovative technologies servicing

the die-cast, extrusion and automotive industries. Through

our 10 strategic locations, we employ 2,019 people and service a

diverse and broad customer base. Management will hold a conference

call to discuss the fourth quarter results on Thursday December 1,

2011 at 10:00 am (Toronto Time). The local dial in number for

the call is (647) 427-7450 or toll free 1-888-231-8191. To

access the live audio webcast, please log on to www.excocorp.com or

http://www.newswire.ca/en/webcast/viewEvent.cgi?eventID=3748140 a

few minutes before the event. Real Player is required for

access. For those unable to participate on December 1, 2011,

an archived version will be available on the Exco website.

This news release contains forward-looking information and

forward-looking statements within the meaning of applicable

securities laws. We use words such as "anticipate", "plan", "may",

"will", "should", "expect", "believe", "estimate" and similar

expressions to identify forward-looking information and statements

especially with respect to growth and financial performance of the

Company's business units, contribution of our two start-up business

units and improvement in operating efficiencies in the large mould

businesses. Such forward-looking information and statements

are based on assumptions and analyses made by us in light of our

experience and our perception of historical trends, current

conditions and expected future developments, as well as other

factors we believe to be relevant and appropriate in the

circumstances. These assumptions include the number of automobile

vehicles produced, investment by OEMs in drivetrain architecture,

weakening raw material prices, continuing economic recovery and

currency fluctuations. Readers are cautioned not to place

undue reliance on forward-looking information and statements, as

there can be no assurance that the assumptions, plans, intentions

or expectations upon which such statements are based will

occur. Forward-looking information and statements are subject

to known and unknown risks, uncertainties, assumptions and other

factors which may cause actual results, performance or achievements

to be materially different from any future results, performance or

achievements expressed, implied or anticipated by such information

and statements. These risks, uncertainties and

assumptions are described in the Company's Management's

Discussion and Analysis included in our 2011 Annual Report, in our

2011 Annual Information Form and, from time to time, in other

reports and filings made by the Company with securities regulatory

authorities. While the Company believes that the expectations

expressed by such forward-looking information and statements are

reasonable, there can be no assurance that such expectations and

assumptions will prove to be correct. In evaluating

forward-looking information and statements, readers should

carefully consider the various factors which could cause actual

results or events to differ materially from those indicated in the

forward-looking information and statements. Readers are cautioned

that the foregoing list of important factors is not

exhaustive. Furthermore, the Company will update its

disclosure upon publication of each fiscal quarter's financial

results and otherwise disclaims any obligations to update publicly

or otherwise revise any such factors or any of the forward-looking

information or statements contained herein to reflect subsequent

information, events or developments, changes in risk factors or

otherwise. Exco Technologies Limited CONTACT: Source: Exco

Technologies Limited (TSX-XTC)Contact: Paul Riganelli,

Vice-President, Finance and ChiefFinancial OfficerTelephone: (905)

477-3065 Ext. 7228Website: http://www.excocorp.com

Copyright

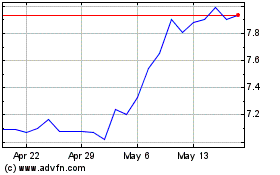

Exco Technologies (TSX:XTC)

Historical Stock Chart

From May 2024 to Jun 2024

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Jun 2023 to Jun 2024