Exco Technologies Limited - Third Quarter Ended June 30, 2011 Results

July 27 2011 - 4:25PM

PR Newswire (Canada)

TORONTO, July 27, 2011 /CNW/ -- -- Sales increased 14% -- Profits

increased 10% -- Cash on hand $11.3 million -- No bank debt

TORONTO, July 27, 2011 /CNW/ - Exco Technologies Limited (TSX-XTC)

today announced results for its third quarter ended June 30, 2011.

Three Months ended Nine Months ended June 30 June 30 ($000s, except

per share amounts) 2011 2010 2011 2010 Sales 48,784 42,681 147,261

119,583 Net income 3,865 3,502 12,537 7,628 Basic earnings $0.10

$0.09 $0.31 $0.19 per share Diluted earnings $0.10 $0.09 $0.31

$0.19 per share Common shares 40,961,823 40,911,323 40,961,823

40,911,323 outstanding Consolidated sales for the third quarter

ended June 30, 2011 were $48.8 million - an increase of $6.1

million or over 14% compared to last year. Year-to-date sales were

$147.3 million - an increase of $27.7 million or over 23% compared

to last year. Strong underlying demand for our products

continues to fuel sales growth and mitigate the adverse impact of a

climbing Canadian dollar. The Casting and Extrusion segment

reported sales of $31.4 million - an increase of $4.8 million or

over 18% compared to the same quarter last year.

Year-to-date, the segment reported sales of $92.6 million - an

increase of $17.7 million or almost 24%. Within this segment,

sales in the large mould group increased by 55% in the current

quarter and 61% year-to-date compared to last year reflecting

strong shipments of powertrain tooling moulds. Sales at Castool

increased both in the current quarter and year-to-date by 26% and

31% reflecting strong demand for that division's die cast and

extrusion consumable components and the inclusion this year of

Allper's sales. In the extrusion tooling businesses, sales

were down from last year by 7% in the current quarter and 1%

year-to-date. Die production volumes, while growing, are impacted

by soft economic conditions in North America and currency

fluctuations, the latter of which reduced sales. Sales in the

Automotive Solutions segment in the third quarter were $17.4

million - an increase of $1.3 million or almost 8% from the same

quarter last year. Year-to-date, the segment reported sales of

$54.6 - an increase of $10 million or over 22% compared to last

year. Sales volumes at Polytech and Polydesign have improved

significantly both in the current quarter (25% and 32%

respectively) and year-to-date (22% and 52% respectively). This

reflects the recovering of light vehicle production levels in both

North America and, to a lesser extent, in Europe and in the case of

Polydesign the launch of significant new interior trim and

instrument panel programs. Sales at Neocon decreased in the

current quarter by 19% compared to last year as the impact of the

Tsunami was felt and the sales backlog last year which temporarily

increased sales was cleared. Year-to-date sales at this division

also decreased by 7% compared to last year for the same reasons.

Consolidated net income for the third quarter was $3.9 million or

$0.10 per share compared to consolidated net income of $3.5 million

or $0.09 per share in the same quarter last year. Year-to-date,

consolidated net income was $12.5 million or $0.31 per share

compared to consolidated net income of $7.6 million or $0.19 per

share last year. Consolidated net income in the third quarter last

year benefited from an unusually low tax provision of 7.4%

reflecting non-recurring US federal tax recoveries for prior

years. The tax provision in the quarter this year at 28.7% is

more reflective of Exco's typical rate. The improvement in the

current year's earnings was led by the Automotive Solutions segment

with segment pretax income in the third quarter of $2.7 million

compared to segment pretax income of $1 million in the same quarter

last year. Year-to-date, the segment also reported higher

pretax income of $8.9 million compared to $3.3 million last year.

The Casting and Extrusion segment reported higher segment pretax

income in the third quarter of $3.7 million compared to segment

pretax income of $3.4 million in the same quarter last year.

Year-to-date, the segment also reported higher pretax income of

$11.7 million compared to $8.9 million last year. Consolidated

gross margin in the third quarter remained relatively constant at

26.7% compared to 27.6% in the same quarter last year.

Year-to-date gross margin also remained constant at 27.4% compared

to 27.1% last year. The Company continues to have a strong

cash position at quarter end of $11.3 million (which is expected to

increase by approximately $3 million before fiscal year-end from

the sale of the AluDie production facility) and no bank debt

despite having funded significantly higher working capital

necessary to support the strong sales growth over the last several

quarters. The overall outlook for Exco over the next several

quarters has not materially changed from last quarter. The

two major trends of strong light vehicle production volumes and

steady introduction of new or refreshed vehicles and powertrain

systems by virtually all OEMs remain intact. These trends

continue to benefit our components businesses, Castool and our

large mould businesses. Our large mould business in

particular is experiencing strong demand from its die cast

customers who are both rolling out next generation powertrain

architecture and experiencing high production requirements in the

aftermath of the Tsunami disruption. With mould demand in

many cases recovering faster than capacity the emphasis is

increasingly on managing WIP inventory and meeting tight delivery

dates. The business impacts of the Tsunami are largely over

and any further production and supply disruptions in the vehicle

production chain are not expected to materially affect Exco in the

coming quarters. Stubbornly high oil prices and the Canadian

dollar's new plateau beyond US dollar parity continue to keep

pressure on our raw material costs, in the former case, and

revenue, in the latter case. Exco earnings have adjusted to

this reality, although continuous efforts to mitigate the impact of

these factors will continue. Developing lower cost petroleum

based raw material, raising prices where necessary to recover

costs, moving production to low cost countries and generally

improving operating efficiencies in all of our production

facilities are but a few of the measures constantly under

consideration. (For further information please refer to the

Company's Third Quarter Interim Financial Statements in the

Investor Relations section posted at www.excocorp.com.

Alternatively, please refer to www.sedar.com) Exco Technologies

Limited is a global supplier of innovative technologies servicing

the die-cast, extrusion and automotive industries. Through

our 10 strategic locations, we employ 1,994 people and service a

diverse and broad customer base. Management will hold a conference

call to discuss the third quarter results on Thursday July 28, 2011

at 10:00 am (Toronto Time). The local dial in number for the

call is (647) 427-7450 for local (Toronto) calls or toll free

1-888-231-8191. To access the live audio webcast, please log on to

www.excocorp.com or directly to the webcast at

http://www.newswire.ca/en/webcast/viewEvent.cgi?eventID=3595020 a

few minutes before the event. Real Player is required for

access. For those unable to participate on July 28, 2011, an

archived version will be available on the Exco website. This news

release contains forward-looking information and forward-looking

statements within the meaning of applicable securities laws. We use

words such as "anticipate", "plan", "may", "will", "should",

"expect", "believe", "estimate" and similar expressions to identify

forward-looking information and statements especially with respect

to consolidated and operational sales levels and earnings and the

future cash flow of the Company. Such forward-looking

information and statements are based on assumptions and analyses

made by us in light of our experience and our perception of

historical trends, current conditions and expected future

developments, as well as other factors we believe to be relevant

and appropriate in the circumstances. Readers are cautioned not to

place undue reliance on forward-looking information and statements,

as there can be no assurance that the assumptions, plans,

intentions or expectations upon which such statements are based

will occur. Forward-looking information and statements are

subject to known and unknown risks, uncertainties, assumptions and

other factors which may cause actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed, implied or anticipated by

such information and statements. These risks, uncertainties

and assumptions are described in the Company's Management's

Discussion and Analysis included in our 2010 Annual Report, in our

2010 Annual Information Form and, from time to time, in other

reports and filings made by the Company with securities regulatory

authorities. While the Company believes that the expectations

expressed by such forward-looking information and statements are

reasonable, there can be no assurance that such expectations and

assumptions will prove to be correct. In evaluating

forward-looking information and statements, readers should

carefully consider the various factors which could cause actual

results or events to differ materially from those indicated in the

forward-looking information and statements. Readers are cautioned

that the foregoing list of important factors is not

exhaustive. Furthermore, the Company disclaims any

obligations to update publicly or otherwise revise any such factors

or any of the forward-looking information or statements contained

herein to reflect subsequent information, events or developments,

changes in risk factors or otherwise. To view this news release in

HTML formatting, please use the following URL:

http://www.newswire.ca/en/releases/archive/July2011/27/c7831.html

table valign="top" border="0" tr td bSource:/b /td td Exco

Technologies Limited (TSX-XTC) /td /tr tr td bContact:/b /td td

Paul Riganelli, Vice-President, Finance and Chief Financial Officer

/td /tr tr td bTelephone:/bb /bb /bb /bb /b /td

td (905) 477-3065 ext. 7228 /td /tr tr td bWebsite:/b /td td a

href="http://www.excocorp.com"http://www.excocorp.com/a /td /tr

/table

Copyright

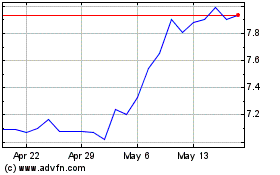

Exco Technologies (TSX:XTC)

Historical Stock Chart

From May 2024 to Jun 2024

Exco Technologies (TSX:XTC)

Historical Stock Chart

From Jun 2023 to Jun 2024