UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

FOR THE MONTH OF JULY 2020

COMMISSION FILE NUMBER: 001-33863

XINYUAN REAL ESTATE CO., LTD.

27/F, China Central Place, Tower II

79 Jianguo Road, Chaoyang District

Beijing 100025

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Description of 2020 Restricted Stock

Unit Plan

The Company adopted the Xinyuan Real Estate

Co., Ltd. 2020 Restricted Stock Unit Plan (the “RSU Plan” or the “Plan”), effective June 30, 2020. The

RSU Plan is described below. This description of the RSU Plan is qualified in its entirety by reference to the complete terms,

conditions and provisions of the RSU Plan attached hereto as Exhibit 99.1.

Background

The purpose of the RSU Plan is to provide

to the Company and its shareholders the benefits of the additional incentive inherent in the ownership of the Company's common

shares by selected employees of the Company and its subsidiaries who are important to the success and growth of the Company and

its subsidiaries' business and to help the Company and its subsidiaries secure the services of those persons. The Plan provides

for discretionary grants of stock units (“RSUs”) to or for the benefit of participating employees.

Administration

The RSU Plan provides that it will be administered

by one or more committees of the Company’s Board of Directors (the “Board”). The Board has designated the Company’s

Compensation Committee (the “Committee”) to administer the Plan.

Eligible Employees

All employees and officers of the Company

or any subsidiary who are capable of contributing significantly to the successful performance of the Company, in the determination

of the Board, are eligible to be participants in the Plan. Each eligible employee selected to participate may be granted an award

of RSUs at such times and subject to such conditions as determined by the Board.

Incentive Pool

Under the Plan, the Company will establish

a long-term incentive pool for participants for each fiscal year (the “Grant Year”) of the Company based on the net

income attributable to shareholders (or other performance goals) of the Company for the most recently completed prior fiscal year

(the “Base Year”). The long-term incentive pool will be funded and RSUs will be granted only if 70% or more of the

target net income attributable to shareholders for the Base Year has been achieved. If the net income achieved for a Base Year

is less than 70% of the target, no amount will be credited to the long-term incentive pool for the Grant Year and no RSUs will

be awarded for the Grant Year.

If the Committee determines that a change

in the business, operations, corporate structure or capital structure of the Company or the manner in which the Company or a subsidiary

conducts its business, or other events or circumstances, such as a change in accounting principles, an acquisition or divestiture,

render the performance goals for a fiscal year to no longer be suitable, the Committee may modify the performance objectives in

whole or in part, as the Committee deems appropriate. The Board will have the authority to establish and administer performance-based

grant and/or vesting conditions and performance objectives with respect to awards as it considers appropriate, which performance

objectives must be satisfied, as the Board specifies, before the participant receives or retains an award or before the award becomes

nonforfeitable. If a participant is promoted, demoted or transferred to a different business unit or function during a performance

period, the Board may determine that the performance objectives or performance period are no longer appropriate and may adjust,

change or eliminate the performance objectives or the applicable performance period as it deems appropriate to make such objectives

and period comparable to the initial objectives and period.

Trust/Funding of Long-term Incentive

Pool

Pursuant to the Plan, the Company has established

a trust and will deposit or cause to be deposited in the trust amounts of cash not exceeding the amount of the long-term incentive

pool for a Grant Year. The trustee will use the funds to acquire in the open market or in private transactions that number of American

Depository Shares (“ADSs”) representing Common Shares as directed by the Company over a period of time as the Company

and the Trustee determine.

Granting and Allocation of Restricted

Stock Units to Participants

Following the end of a Base Year, the Committee

will allocate to each participant a percentage of the long-term incentive pool, if any, for that Grant Year based on such factors

as the Committee may determine from time to time in its discretion. A participant will be allocated RSUs based on the aggregate

of Common Shares represented by ADSs purchased by the trustee for a Grant Year multiplied by the percentage of the long-term incentive

pool allocated to that participant for the Grant Year.

Each RSU represents a right to receive

one Common Share to be delivered or made available at the time or times specified in the award agreement, subject to a risk of

cancellation and to the other terms and conditions set forth in the Plan, the award agreement and any additional terms and conditions

set by the Committee. At the Company's election, RSUs may be settled by delivery of Common Shares or ADSs representing the number

of Common Shares subject to the RSU.

Vesting and Settlement of Restricted

Stock Units

Except as otherwise provided in the RSU

Plan and in the award agreement, RSUs will vest in equal installments on the first, second, third and fourth anniversaries of the

Grant Date. Unless otherwise determined by the Committee or unless otherwise provided in the award agreement, in the event of the

participant’s termination of employment, the participant’s RSUs which are not vested as of the termination date will

not vest and will be immediately cancelled for no value. For purposes of the RSU Plan, “termination of employment”

means the event by which a participant ceases to be employed by the Company or any subsidiary of the Company, and immediately thereafter,

is not employed by or providing substantial services to any of the Company or a subsidiary of the Company. Notwithstanding the

foregoing, in the event of (i) death, (ii) disability as the result of a work injury, or (iii) retirement on or after age 60, a

participant's RSUs will continue to vest in installments on each subsequent vesting date after the event. In the event of death,

a participant's awards shall be paid to his personal representative or estate as provided by applicable law. In addition, RSUs

will be forfeited and cancelled if a Participant becomes an independent director, supervisor or other person who is not eligible

to hold RSUs of the Company. The Committee, in its sole discretion, may (but will not be required to) reallocate all or a portion

of RSUs forfeited by a participant to a different participant or participants continuing in employment on a vesting schedule as

the Committee may determine.

Upon vesting of an RSU, the trustee will

allot the number of ADSs or Common Shares (as directed by the Company) subject to the RSU into the participant's account under

the trust account. Following vesting and upon and subject to the satisfaction or expiration of any forfeiture provisions applicable

to Common Shares or ADSs subject to vested awards, including those set forth herein under "Transfer Restrictions", the

trustee will deposit such ADSs or Common Shares into an account maintained for the participant by a broker-dealer or stock plan

administrator, or deliver Common Shares or ADSs to the participant.

Transfer Restrictions

RSU awards may not be sold, assigned, transferred,

pledged or otherwise encumbered by the person to whom they are granted, either voluntarily or by operation of law, except by will

or the laws of descent and distribution, and, during the life of the participant, the rights of a participant shall be exercisable

only by the participant. Any Common Shares or ADSs delivered or made available in respect of an award may be subject to such special

forfeiture conditions, rights of repurchase, rights of first refusal and other transfer restrictions as the Board may determine.

The Company will be under no obligation to sell or deliver Common Shares or ADSs covered by an Award under the Plan unless the

participant executes an agreement giving effect to the restrictions in the form prescribed by the Company.

Common Shares or ADSs settling vested RSUs

Stock Units may not be sold, transferred or otherwise disposed of by the participant (other than being returned to the Company)

until one year after the participant's resignation or termination of employment other than as a result of death, disability as

the result of a work injury, or retirement on or after age 60. After such one year period if an off-office audit performed by the

internal audit department of the Company does not identify any risk (i.e., damage) to the Company or its subsidiaries from the

participant's conduct while employed with the Company or its subsidiaries, the trustee will deposit such ADSs or Common Shares

into an account maintained for the participant by a broker-dealer or stock plan administrator, or deliver Common Shares or ADSs

to the participant (as directed by the Company). Thereafter, the participant may sell, transfer or otherwise dispose of the Common

Shares or ADSs. If the off-office audit identifies a risk to the Company or its subsidiaries, the Common Shares or ADSs will be

forfeited and surrendered to the Company.

Shares Subject to Grants

The maximum number of the Company's Common

Shares that may be delivered to participants in connection with RSUs granted under the Plan is limited to 10,000,000 Common Shares

(equivalent to 5,000,000 ADSs). The Common Shares to be delivered under the Plan will be made available from ADSs purchased by

the trustee in the open market or in private transactions as discussed above. As noted above, RSUs may be settled in either Common

Shares or in the form of ADSs in the Committee’s discretion.

If the outstanding Common Shares of the

Company are increased, decreased, changed into or exchanged for a different number or kind of shares or securities of the Company

through a reorganization, recapitalization, reclassification, stock dividend, stock split, reverse stock split or other similar

transaction, the Board will make appropriate and proportionate adjustments as it deems necessary or appropriate in one or more

of (i) the number and class of shares subject to the Plan, and (ii) the number of shares or class of shares covered by each outstanding

award.

Dividend Equivalents

Except as otherwise provided in the RSU

award agreement, unvested RSUs will not be entitled to any dividend equivalent if the Company declares and pays a cash dividend

on Common Shares or declares and pays a dividend on Common Shares in the form of property other than Common Shares.

Voting Rights

So long as the ADSs or Common Shares subject

to the Plan remain in the trust, the trustee thereof will exercise all voting rights associated with such securities in its sole

discretion. No participant will have any voting rights with respect to such ADSs or Common Shares unless and until they have been

deposited into an account maintained for the participant by a broker-dealer or stock plan administrator or delivered to the participant.

Change in Control

In the event that the Company is a party

to a Change in Control (as defined in the RSU Plan), the Board may provide for any of the following: (i) the cancellation of each

outstanding award after payment to the participant of an amount, if any, in cash or cash equivalents equal to the fair market value

of the shares subject to the award at the time of the merger, consolidation or other reorganization; (ii) the assumption or continuation

by any surviving corporation or acquiring corporation (or the surviving or acquiring corporation’s parent company) of any

or all awards outstanding under the Plan or substitution of similar awards for awards outstanding under the Plan (including but

not limited to awards to acquire the same consideration paid to the stockholders of the Company pursuant to the Change in Control),

and any assignment by the Company to the successor of the Company (or the successor’s parent company, if any) of any reacquisition

or repurchase rights held by the Company in respect of shares issued pursuant to awards, in connection with such Change in Control;

and (iii) the acceleration of vesting of all or a portion of the awards (in full or in part) to a date prior to the effective time

of such Change in Control (contingent upon the effectiveness of the Change of Control event) as the Board may determine.

Term

The Plan became effective on June 30, 2020

and unless earlier terminated by action by the Board, the Plan will remain in effect until such time as no Common Shares remain

available for delivery under the Plan and the Company has not further rights of obligations with respect to outstanding awards

under the Plan.

General Provisions

Except as the Committee may otherwise determine

or provide in an RSU award agreement, RSUs may not be sold, assigned, transferred, pledged or otherwise encumbered by the person

to whom they are granted, either voluntarily or by operation of law, except by will or the laws of descent and distribution, and,

during the life of the participant, the rights of a participant are exercisable only by the participant. Any Common Shares or ADSs

delivered or made available in respect of an award may be subject to such special forfeiture conditions, rights of repurchase,

rights of first refusal and other transfer restrictions as the Board may determine.

The Board of Directors may amend, suspend

or terminate the Plan or the Committee’s authority to grant awards under the Plan without the consent of participants; provided,

however, that, without the consent of an affected participant, no such Board action may materially and adversely affect the rights

of the participant under any outstanding award. The Committee may amend any outstanding award without the consent of the affected

participant; provided, however, that, without such consent, no such action may materially and adversely affect the rights of the

participant under any outstanding award.

Exhibits

|

99.1

|

Xinyuan Real Estate Co., Ltd. 2020 Restricted Stock Unit Plan

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

|

|

Xinyuan Real Estate Co., Ltd.

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Yu (Brian) Chen

|

|

|

Name:

|

Yu (Brian) Chen

|

|

|

Title:

|

CFO

|

|

|

|

|

Date: July 6, 2020

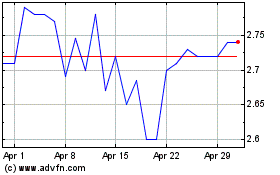

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

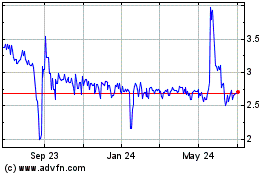

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Apr 2023 to Apr 2024