Current Report Filing (8-k)

July 07 2021 - 4:50PM

Edgar (US Regulatory)

false

0000106535

0000106535

2021-07-06

2021-07-06

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 6, 2021

WEYERHAEUSER COMPANY

(Exact name of registrant as specified in charter)

|

|

|

|

|

Washington

|

1-4825

|

91-0470860

|

|

|

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission

File Number)

|

(IRS Employer

Identification Number)

|

220 Occidental Avenue South

Seattle, Washington 98104-7800

(Address of principal executive offices)

(zip code)

Registrant’s telephone number, including area code:

(206) 539-3000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $1.25 per share

|

|

WY

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934:

|

|

|

|

☐

|

Emerging growth company

|

|

|

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

Table of Contents

TABLE OF CONTENTS

Table of Contents

Section 1 - Registrant’s Business and Operations

Item 1.01. Entry into a Material Definitive Agreement

On July 6, 2021, Weyerhaeuser Company (“Weyerhaeuser”) entered into a Second Amendment to Installment Note Agreement (“Second Amendment Agreement”) with MeadWestvaco Timber Note Holding Company II, LLC (“MWV”) to be effective as of June 30, 2021. The Second Amendment Agreement amends and confirms certain provisions of the $860 million installment note dated as of December 16, 2013 (as previously amended by that certain Assumption and Amendment Agreement dated as of April 28, 2016, and as further amended and restated, the “Amended Installment Note”). Pursuant to the terms of the Second Amendment Agreement, the parties agreed, among other things, to confirm the continued incorporation into the Amended Installment Note of the affirmative and negative covenants and certain other provisions in Weyerhaeuser’s 2017 Term Loan Agreement, as amended by that First Amendment to Term Loan Agreement (together, the “Term Loan Agreement”), notwithstanding that Weyerhaeuser has repaid amounts owed under the Term Loan Agreement and the agreement is therefore no longer in effect.

Under the Amended Installment Note, key covenants include requirements to maintain a minimum total adjusted shareholders’ equity (as defined in the Term Loan Agreement) of $3.0 billion, and a funded debt ratio of not more than 65%. The funded debt ratio is calculated as total funded indebtedness divided by the sum of total adjusted shareholders' equity plus total funded indebtedness (as each of those terms is defined in the Term Loan Agreement). As of December 31, 2020, Weyerhaeuser had total adjusted shareholders’ equity of $9.553 billion and a funded debt ratio of 36.43%.

The Amended Installment Note incorporates from the Term Loan Agreement other covenants customary for a borrower with Weyerhaeuser’s credit rating. These include covenants that place limitations on Weyerhaeuser’s ability to incur secured debt, enter into certain sale and leaseback transactions, merge or sell all or substantially all of its assets or fundamentally change its business.

The Second Amendment Agreement, which includes under Annex A the Amended Installment Note, and the Term Loan Agreement are filed herewith and are incorporated herein by reference. References to and descriptions of the Second Amendment Agreement, Amended Installment Note and Term Loan Agreement contained herein are summaries and are qualified in their entirety by reference to the Second Amendment Agreement, Amended Installment Note and Term Loan Agreement filed herewith. These documents are included to provide investors with information regarding the terms and conditions of these agreements and are not intended to provide any factual information about Weyerhaeuser. Each of these agreements contain representations and warranties that Weyerhaeuser Company has made to MWV as of specific dates. The assertions embodied in those representations and warranties were made solely for the purposes of entering into the agreements and may have been used to allocate risk between the parties rather than to establish matters as fact. For the foregoing reasons, investors should not rely on the representations and warranties as statements of factual information.

Section 9 - Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following items are filed with this report.

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

4.1

|

Second Amendment to Installment Loan Agreement (including as Annex A the Amended Installment Note) dated as of June 30, 2021 between Weyerhaeuser Company, as borrower, and MeadWestvaco Timber Note Holding Company II, LLC as Holder.

|

|

|

10.1

|

Term Loan Agreement dated July 24, 2017, by and among Weyerhaeuser Company, Northwest Farm Credit Services, PCA, as administrative agent, and the lender party thereto (incorporated by reference to Exhibit 10 to the Quarterly Report on Form 10-Q filed on July 28, 2017 – Commission File Number 1-4825). First Amendment to Term Loan Agreement dated as of July 22, 2020 by and among Weyerhaeuser Company, Northwest Farm Credit Services, PCA, as administrative agent, and the lender party thereto (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K filed on July 23, 2020 – Commission File Number 1-4825).

|

|

|

104

|

Cover page interactive data file (embedded within the inline XBRL document).

|

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

WEYERHAEUSER COMPANY

|

|

|

|

|

|

By:

|

|

/s/ Kristy T. Harlan

|

|

Name:

|

|

Kristy T. Harlan

|

|

Its:

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

|

|

|

|

Date: July 7, 2021

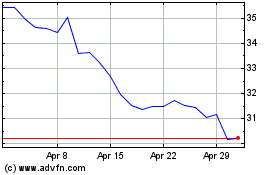

Weyerhaeuser (NYSE:WY)

Historical Stock Chart

From Mar 2024 to Apr 2024

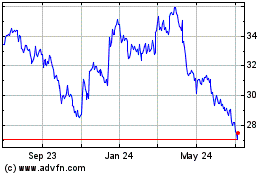

Weyerhaeuser (NYSE:WY)

Historical Stock Chart

From Apr 2023 to Apr 2024