Western Exploration Inc. (TSXV: WEX; OTCQX: WEXPF) (the

"Company" or "Western Exploration") is pleased to

announce the results of 2024 metallurgical testing on composite

samples from the Jarbidge rhyolite hanging wall zone of the Gravel

Creek deposit.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240920466506/en/

Figure 1: Location of 2023 PQ Oriented

core holes at Gravel Creek. (Graphic: Business Wire)

Highlights from the work include:

- Locked-cycle flotation tests indicate recoveries of 94.8% for

gold and 89.8% for silver in a combined gravity and flotation

concentrate.

- The combined gravity and flotation concentrate were 10.9% of

the feed weight and averaged 57.1 g/t Au, 1,725 g/t Ag.

- The flotation concentrate averaged 29.1% sulphide sulphur.

- Gravity concentration before rougher flotation concentration

(from the gravity tailings) recovered 22.4% of the Gold and 4.4% of

the silver in 0.16% of the total feed weight with a gold grade of

920 g/t and a silver grade of 5,750 g/t.

Western Exploration CEO, Darcy Marud said, "Preliminary

metallurgical test work on Gravel Creek hanging wall mineralization

has returned very positive results for the recovery of gold and

silver to concentrate. The recoveries are similar to past Gravel

Creek metallurgical test work and demonstrate a potential path to

economic recovery for precious metals."

2024 Flotation Metallurgy Sample Locations

Flotation test work was conducted on a gold and silver bearing

diamond drill composite from core holes WG456 and WG457, drilled in

2023 in the Jarbidge rhyolite. The two oriented core holes were

completed to evaluate resource expansion potential in mineralized

vein/breccia trends northeast of the Gravel Creek resource

(Figure 1).

- Hole WG456, located 250 meters northeast of the Gravel Creek

resource area, reported individual assays up to 34.9 g/t Au and

2800.0 g/t Ag as reported in a Company news release dated November

21, 2023.

- Hole WG457, located 140 meters northeast of the Gravel Creek

resource area, reported individual assays up to 257.0 g/t Au and

1655.0 g/t Ag as reported in a Company news release dated January

8, 2024.

- The composite was comprised of sulphide mineralization

collected from samples ranging in downhole depths of 316 meters to

731 meters in WG456 and WG457.

Flotation Program and Results

All test work was completed by McClelland Laboratories, Inc

(“MLI”) of Sparks, Nevada. Flotation testing was conducted

on a gold and silver bearing Gravel Creek drill core composite,

designated 4991-001, to evaluate response to flotation processing.

The composite comprised sulphidic mineralization ranging from 316

meters to 731 meters downhole depths from two drill holes (WG456

and WG457).

Composite assays showed that it contained 6.14 g/t Au, 206 g/t

Ag and 2.71% sulphide sulphur. Cyanide shake analysis showed that

the sample had cyanide soluble to fire assay ratios (CN/FA) of

53.4% for gold and 36.8% for silver. The composite contained

negligible amounts (<0.1%) carbon. A preg-rob assay showed that

it was not preg-robbing.

Initially, six rougher flotation tests were conducted at feed

sizes ranging from 80%-150 micron to 80%-45 micron. A typical bulk

sulphide flotation collector reagent suite was employed for all

tests. Following grind optimization testing, a bulk rougher

concentrate was produced and used for preliminary cleaner flotation

testing. The objectives for the testing were to maximize gold and

silver recovery and concentrate grades. Sulphide sulphur recoveries

were also tracked during testing. Variability in flotation tail

grade caused significant variability in flotation gold

recoveries.

Flotation testing showed that the Gravel Creek mineralization

responded very well to bulk sulphide flotation treatment. Gold and

silver recoveries of as high as >92% were achieved with rougher

flotation mass pulls of approximately 11%, Table 1 and

Figure 2.

Table 1. - Flotation Concentration Test

Results, Test F-5, Gravel Creek Composite 4991-001, 80%-75-micron

Feed Size

Wt.

Cum. Wt.

Assay

Au Distribution

Ag Distribution

S= Distribution

Product

%

%

Au g/t

Ag g/t

% S=

%

Cum. %

%

Cum. %

%

Cum. %

Ro. Conc. Stg. 1 (0-2 min)

4.1

4.1

95.5

3,360

28.07

57.0

57.0

64.0

64.0

42.9

42.9

Ro. Conc. Stg. 1 (2-5 min)

2.3

6.4

54.1

1,480

28.96

18.1

75.1

15.8

79.8

24.8

67.7

Ro. Conc. Stg. 2

2.3

8.7

47.4

1,010

22.17

15.8

90.9

10.8

90.6

19.0

86.7

Ro. Conc. Stg. 3

0.9

9.6

22.2

546

12.73

2.9

93.8

2.3

92.9

4.3

91.0

Ro. Conc. Stg. 4

0.6

10.2

12.4

306

7.42

1.1

94.9

0.9

93.8

1.7

92.7

Ro. Conc. Stg. 5

0.4

10.6

7.0

206

3.81*

0.4

95.3

0.4

94.2

0.6

93.3

Ro. Tail

89.4

100.0

0.36

14

0.20

4.7

100.0

5.8

100.0

6.7

100.0

Composite

100.0

6.87

215

2.68

100.0

100.0

100.0

* Insufficient sample was available for

sulphide assay. The average of the adjacent product grades was

used.

Preliminary cleaner flotation testing showed that it was

possible to significantly increase concentrate grades by cleaning.

Cleaner concentrate grades of as high as >70 g/t Au, >3,900

g/t Ag and 41% sulphide sulphur were achieved.

Regrinding the rougher concentrate for as much as 90 minutes

resulted in production of a cleaner concentrate that was 3.2% of

the ore weight, assayed 72.4 g/t Au, 3,920 g/t Ag and 41.07%

sulphide sulphur and represented recoveries of 35.9% gold, 59.6%

silver and 49.2% sulphide sulphur. The corresponding cleaner tail

was another 7.4% of the feed weight, assayed 40.6 g/t Au, 898 g/t

Ag and 16.04% sulphide sulphur and represented additional

recoveries of 46.5% gold, 31.5% silver and 44.4% sulphide sulphur,

Table 2.

Table 2. - Rougher/Cleaner Flotation

Concentration Test Results, Gravel Creek Composite 4991-001, 4991

F-6 Rougher Concentrate, 90 min Regrind of Ro. Conc.

Wt.

Cum. Wt.

Assay

Au Distribution

Ag Distribution

S= Distribution

Product

%

%

Au g/t

Ag g/t

% S=

%

Cum. %

%

Cum. %

%

Cum. %

Cl. Conc.

3.2

3.2

72.4

3,920

41.07

35.9

35.9

59.6

59.6

49.2

49.2

Cl. Tail

7.4

10.6

40.6

898

16.04

46.5

82.4

31.5

91.1

44.4

93.6

Ro. Tail

89.4

100.0

1.27

21

0.19

17.6

100.0

8.9

100.0

6.4

100.0

Composite

100.0

6.46

211

2.67

100.0

100.0

100.0

A gravity concentration test was conducted on tailings from one

of the flotation tests to evaluate causes for variability in

flotation tail grade. Results showed that most (77%) of the gold

contained in the flotation rougher tail sample was gravity

recoverable. The gravity concentrate produced was 0.07% of the

flotation tail weight, assayed 2,250 g/t Au and represented 77.0%

of the gold contained in the flotation tailing.

Follow up locked-cycle flotation test work was conducted at an

80%-150 micron grind size on gravity tails generated from the

sample composite. Test results showed that the combined gravity and

flotation concentrate was 10.9% of the feed weight, assayed 57.1

g/t Au and 1,725 g/t Ag. Recoveries reporting to this combined

concentrate were 94.8% gold and 89.8% silver of the values

contained in the whole feed. The combined concentrate described

above included a gravity cleaner concentrate and flotation rougher

concentrate (from locked-cycle testing on the gravity tailing). The

gravity concentrate was 0.16% of the feed weight, assayed 920 g/t

Au and 5,750 g/t Ag and represented gold and silver recoveries of

22.4% and 4.4% respectively. The gravity concentrate was not

assayed for sulphide sulphur. The flotation concentrate was 10.74%

of the whole feed weight, assayed 44.3 g/t Au, 1,665 g/t Ag and

21.9% sulphide sulphur and represented gold and silver recoveries

of 72.4% and 85.4% respectively of values contained in the whole

feed weight.

Table 3. – Gravity/Flotation Test, Gravel

Creek Composite 4991-001, 80%-212-micron (Gravity Test G-2)/80%-150

micron Regrind (Locked Cycle Flotation Test F-9, average of Cycles

5&6)

Wt.

Cum. Wt.

Assay

Au Distribution

Ag Distribution

S= Distribution

Product

%

%

Au g/t

Ag g/t

% S=

%

Cum. %

%

Cum. %

%

Cum. %

Grav. Cl. Conc.

0.16

0.16

920

5750

N/A*

22.4

22.4

4.4

4.4

N/A

N/A

Flotation Ro. Conc.

10.74

10.90

44.3

1665

21.9

72.4

94.8

85.4

89.8

95.3

95.3

Flotation Ro. Tail

89.10

100.00

0.38

24

0.13

5.2

100.0

10.2

100.0

4.7

100.0

Composite

100.00

6.56

209

2.46

100.0

100.0

100.0

*N/A denotes Not Available

About the Aura Project

The 6,000-hectare Aura Project has established mineral resource

estimates in three different deposits (Doby George, Gravel Creek

and Wood Gulch), as reported in the "2021 Updated Resource

Estimates and Technical Report for the Aura Gold-Silver Project,

Elko County, Nevada" dated October 20, 2021 (with an effective date

of October 14, 2021) that was prepared for the Company by Mine

Development Associates (the "Technical Report"; see Table

4 below). The mineral resource estimates in the Technical

Report were established in accordance with National Instrument

43-101 – Standards of Disclosure for Mineral Projects ("NI

43-101").

In addition, the Aura Project has well established

infrastructure including year-round accessibility by highway and

county-maintained road and nearby access to water and electricity.

Western Exploration has exploration, development, and mining rights

on 930 hectares of privately owned land through a mineral lease

agreement with a local landowner and may purchase those fee lands

at any time for the development of Doby George.

Table 4. Mineral resource estimates for

the Aura Project as reported in the 2021 Technical Report.

MINERAL RESOURCE(1)

Indicated

Inferred

Tonnes

Au (g/t)

Au (ozs)

Ag (g/t)

Ag (ozs)

AuEq (g/t)

AuEq (oz.)

Tonnes

Au (g/t)

Au (ozs)

Ag (g/t)

Ag (ozs)

AuEq (g/t)

AuEq (oz.)

Doby George(2)

12,922,000

0.98

407,000

-

-

0.98

407,000

4,999,000

0.73

118,000

-

-

0.73

118,000

Wood Gulch(3)

-

-

-

-

-

-

-

4,359,000

0.66

93,000

5.80

808,000

0.74

104,543

Gravel Creek(4)

1,315,000

4.73

200,000

75.0

3,169,000

5.81

245,271

2,744,000

4.16

367,000

60.20

5,307,000

5.02

442,814

TOTAL

14,237,000

1.33

607,000

75.0

3,169,000

1.43

652,271

12,102,000

1.48

578,000

15.74

6,115,000

1.71

665,357

Notes:

(1)

Au equivalent oz assumes US$1,800

per oz Au and 70:1 ratio of Ag:Au.

(2)

Pit constrained 0.2 g/t AuEq

cutoff for oxide, 0.4 g/t Au cutoff for mixed and 1.4 g/t Au cutoff

for unoxidized.

(3)

Pit constrained 0.2 g/t AuEq

cutoff.

(4)

3.0 g/t Au cutoff.

See "Cautionary Statements Regarding Estimates of Mineral

Resources" below.

About Western Exploration

Western Exploration is focused on advancing the 100% owned

gold-silver Aura project, located approximately 120 kilometers/75

miles north of the city of Elko, Nevada. The project includes three

unique gold and silver deposits: Doby George, Gravel Creek, and

Wood Gulch.

Western Exploration is comprised of an experienced team of

precious metals experts that aim to lead the company to becoming

North America's premier gold and silver development company.

Additional information regarding Western Exploration and the

Aura Project can be found on the Company's website and on SEDAR+

(www.sedarplus.ca) under the Company's issuer profile.

Qualified Person Approval

The scientific and technical information in this news release

has been reviewed and approved by Mark Hawksworth, General Manager

of the Aura Project, and Jack McPartland of MLI, each of whom is a

"qualified person" within the meaning of NI 43-101.

Quality Assurance / Quality Control

Exploration program design, Quality Assurance/Quality Control

("QA/QC") and the interpretation of results is performed by

qualified persons employing a QA/QC program consistent with NI

43-101 and industry best practices. For Western Exploration legacy

samples, standards and blanks and duplicates were generally

included approximately every 20th sample for QA/QC purposes by the

Company as well as the lab. Approximately 5% of sample pulps are

sent to secondary laboratories for check assay. QA/QC controls are

not fully documented for legacy assays from the 1980s and 1990s but

Mine Development Associates conducted rigorous evaluation of

adjacent assay intervals as part of the Technical Report resource

calculations. Please see below under the heading "Cautionary Note

Regarding Forward-Looking Information" for further details

regarding the risks facing Western Exploration.

Metallurgical Test Work

Interval Preparation and Assay: A total of 28 drill interval

samples, from the Gravel Creek deposit were received on January 18,

2024. Select samples from drill holes WG456 (ranging from 1,792.7'

to 2,397') and WG457 (ranging from 1,036.5' to 2,319.2') were used

for testing. The interval samples were previously crushed to a

nominal 2mm and weighed 0.3 to 7.3 kg each. Select samples (19)

were combined in entirety to produce Gravel Creek composite

4991-001.

The entire composite was stage crushed to just passing 1.7mm in

size. The -1.7mm composite was thoroughly blended and split to

obtain multiple 1.0 kg samples for testing and triplicate 0.25 kg

samples for head assay.

The composite was assayed directly in triplicate, using

conventional fire assay fusion procedures, to determine gold and

silver content. A single cyanide shake analysis was conducted, with

and without a “gold spike” leach solution (preg-rob test series).

Carbon and sulphur speciation analyses were conducted using

Leco/pyrolysis methods. A single multi-element ICP scan was

conducted.

Flotation Testing

A total of six rougher flotation tests were conducted on

composite 4991-001, at feed sizes ranging from 80%-150µm to

80%-45µm, to evaluate response to flotation and to optimize

flotation feed size. The tests were conducted using a bulk sulphide

flotation reagent scheme, designed to maximize recoveries of

sulphide minerals, gold and silver.

Initially, a scouter rougher flotation test was conducted on a 1

kg sample at an 80%-75µm feed size, to obtain preliminary

information concerning response of the ore to flotation treatment.

Based on those results, a series of three additional rougher

flotation tests (1 kg each) were conducted at feed sizes of

80%-150µm, 80%-106µm and 80%-45µm to optimize feed size. Based on

those test results, the 75µm feed size was selected for further

testing. A kinetic rougher flotation test was conducted at the 75µm

feed size, to establish the relationships between flotation time,

mass pull, rougher concentrate grade and recovery. A bulk flotation

test (16 kg) was conducted at the 75µm feed size to generate

rougher concentrate for cleaner flotation testing. Cleaner

flotation tests (3) were conducted on the resulting bulk rougher

concentrate to evaluate the potential for increasing concentrate

grade by regrinding and cleaner flotation.

The same reagent suite was used for all rougher flotation tests.

Flotation was conducted using a Denver laboratory scale flotation

unit at 1,200 rpm. Each ground pulp was slurried with grind water

to achieve 33% solids (wt/wt) and was conditioned for 5 minutes

with 0.25 kg/mt CuSO4∙5H2O.

Flotation was conducted in 5 stages with incremental additions

of 0.005 kg/mt ore of PAX (potassium amyl xanthate) and 0.010 kg/mt

AERO 208 (dithiophosphate) collectors at each stage. Respective

total addition of each reagent was 0.025 and 0.050 kg/mt ore.

AEROFROTH 65 was used as frother. The pulp was floated at natural

pH. For all rougher flotation tests, except for the kinetic test,

the 5 stages of concentrate were combined into a rougher

concentrate. Those rougher concentrates were dried, weighed and

assayed directly to determine gold, silver and sulphide sulphur

content.

The five staged rougher concentrate samples generated from the

kinetic flotation test (F-5) were each dried, weighed and assayed

separately for the same constituents.

In the case of the bulk (16 kg) rougher flotation test (F-6),

rougher flotation was conducted in two 8 kg lots, using a larger

flotation machine. The rougher concentrates produced from those two

tests were combined, dried, weighed and split to obtain three 0.5

kg samples for cleaner flotation testing and 0.2 kg for assay. The

combined rougher concentrate was assayed directly to determine

gold, silver and sulphide sulphur content. The rougher tails from

each 8 kg lot were dried, weighed and assayed separately, in

triplicate to determine gold silver and sulphide sulphur content

(one sulphide sulphur assay per 8 kg lot). Results presented for

rougher flotation test F-6 are based on the average of assay

results from the two 8 kg lots (designated F-6A and F-6B).

Cleaner flotation tests (3) were conducted on the rougher

concentrate generated from the bulk flotation test (F-6). The tests

were conducted on 0.5 kg splits of rougher concentrate after

regrinds of 1 minute (polish grind), 45 minutes and 90 minutes.

Cleaner flotation was conducted without additional collector or

promoter. Frother was added as required. The resulting cleaner

concentrates and cleaner tails were dried, weighed and assayed to

determine gold, silver and sulphide sulphur content.

For additional information on the Aura Project, please see the

Technical Report, which has been prepared in accordance with the

requirements of NI 43-101, a copy of which is available on SEDAR+

(www.sedarplus.ca) under Western Exploration's issuer profile and

on Western Exploration's corporate website

(www.westernexploration.com).

Cautionary Statements Regarding Estimates of Mineral

Resources

This news release uses the terms measured mineral resources,

indicated mineral resources, and inferred mineral resources as a

relative measure of the level of confidence in the resource

estimate. Readers are cautioned that mineral resources are not

mineral reserves and that the economic viability of mineral

resources that are not mineral reserves has not been demonstrated.

The mineral resource estimate disclosed in this news release may be

materially affected by geology, environmental, permitting, legal,

title, socio-political, marketing, or other relevant issues. It

cannot be assumed that all or any part of the inferred mineral

resources will ever be upgraded to the category of indicated

mineral resource or measured mineral resource. The mineral resource

estimate is classified in accordance with the Canadian Institute of

Mining, Metallurgy and Petroleum's "CIM Definition Standards on

Mineral Resources and Mineral Reserves" (CIM) incorporated by

reference into NI 43-101. Under NI 43-101, estimates of inferred

mineral resources may not form the basis of feasibility or

pre-feasibility studies or economic studies except for preliminary

economic assessments. Readers are cautioned not to assume that

further work on the stated resources will lead to mineral reserves

that can be mined economically.

Inferred mineral resources have a great amount of uncertainty as

to their existence and as to whether they can be mined legally or

economically. On October 31, 2018, the U.S. Securities and Exchange

Commission adopted new mining disclosure rules ("S-K 1300")

that are more closely aligned with current industry and global

regulatory practices and standards, including NI 43-101, although

there are some differences in the two standards. Accordingly,

information concerning mineral deposits contained in this release

may not be comparable with information made public by U.S.

companies that report in accordance with S-K 1300.

Cautionary Note Regarding Forward-Looking Information

This news release may contain "forward-looking information" and

"forward-looking statements" within the meaning of the applicable

Canadian and United States securities legislation (collectively,

"forward-looking statements"). These forward-looking statements, by

their nature, require the Company to make certain assumptions and

involve known and unknown risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

in such forward-looking statements. Any statement that involves

predictions, expectations, interpretations, beliefs, plans,

projections, objectives, assumptions, future events or performance

(often, but not always, using phrases such as "expects", or "does

not expect", "is expected", "interpreted", "management's view",

"anticipates" or "does not anticipate", "plans", "budget",

"scheduled", "forecasts", "estimates", "potential", "feasibility",

"believes" or "intends" or variations of such words and phrases or

stating that certain actions, events or results "may" or "could",

"would", "might" or "will" be taken to occur or be achieved) are

not statements of historical fact and may be forward-looking

information and are intended to identify forward-looking

information. This news release contains the forward-looking

information pertaining to, among other things: the focus and

results of the surface exploration program; the accuracy of results

from prior exploration activities conducted at the Aura Project;

the key assumptions, parameters and methods used to estimate the

mineral resource estimate disclosed in this news release; the

prospects, if any, of the Doby George, Wood Gulch and Gravel Creek

mineral deposits; future drilling at the Aura Project; the

significance of historic exploration activities, results and data;

and the ability to expand the existing mineral resources at the

Aura Project. Such factors include, among others, risks relating to

the ability of exploration activities (including drill results) to

accurately predict mineralization; errors in management's

geological modelling; management's perceptions of historical

trends, current conditions and expected future developments; the

ability to realize upon geological modelling; the ability of

Western Exploration to complete further exploration activities,

including drilling; property and royalty interests in respect of

the Aura Project; the ability of the Company to complete and

publish a pre-feasibility study on the Aura Project and the timing

thereof (if at all); the ability to expand mineral resources beyond

current mineral resource estimates; the ability to identify mineral

reserves on the Aura Project (if at all); the ability of the

Company to obtain required approvals; the results of exploration

activities; risks relating to mining activities; the global

economic climate; metal prices; dilution; environmental risks; and

community and non-governmental actions. Although the

forward-looking information contained in this news release is based

upon what management believes, or believed at the time, to be

reasonable assumptions, Western Exploration cannot assure

shareholders and prospective purchasers of securities of the

Company that actual results will be consistent with such

forward-looking information, as there may be other factors that

cause results not to be as anticipated, estimated or intended, and

neither Western Exploration nor any other person assumes

responsibility for the accuracy and completeness of any such

forward-looking information. Western Exploration does not

undertake, and assumes no obligation, to update or revise any such

forward-looking statements or forward-looking information contained

herein to reflect new events or circumstances, except as may be

required by law.

For additional information with respect to these and other

factors and assumptions underlying the forward-looking statements

and forward-looking information made in this news release

concerning Western Exploration, please refer to the public

disclosure record of Western Exploration, including the management

information circular dated November 12, 2021 and the Company's most

recent annual and interim financial statements and related

management's discussion and analysis, which are available on SEDAR+

(www.sedarplus.ca) under Western Exploration's issuer profile. The

forward-looking statements set forth herein concerning Western

Exploration reflect management's expectations as at the date of

this news release and are subject to change after such date.

Western Exploration disclaims any intention or obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, other than as required

by law.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240920466506/en/

Darcy Marud Chief Executive Officer Telephone: (775) 329-8119

Email: dmarud@westernexploration.com Nichole Cowles Investor

Relations Telephone: (775) 240-4172 Email:

nicholecowles@westernexploration.com

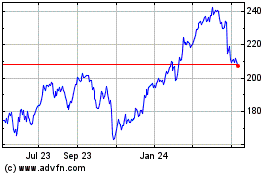

WEX (NYSE:WEX)

Historical Stock Chart

From Oct 2024 to Nov 2024

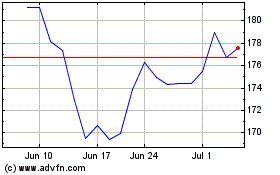

WEX (NYSE:WEX)

Historical Stock Chart

From Nov 2023 to Nov 2024