Current Report Filing (8-k)

July 15 2021 - 5:18PM

Edgar (US Regulatory)

0001040829

false

0001040829

2021-07-15

2021-07-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 15, 2021 (July 15, 2021)

RYMAN HOSPITALITY PROPERTIES, INC.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

1-13079

|

|

73-0664379

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

One Gaylord Drive

Nashville, Tennessee

|

37214

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number,

including area code: (615) 316-6000

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on

Which Registered

|

|

Common Stock, par value $.01

|

|

RHP

|

|

New York Stock Exchange

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ¨

|

ITEM 2.02.

|

RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

|

On July 15, 2021, Ryman Hospitality Properties,

Inc. (the “Company”) furnished a presentation (the “Presentation”) to investors that discloses certain preliminary

estimates of certain operating results as of and for the three and six months ended June 30, 2021. A copy of the Presentation is furnished

herewith as Exhibit 99.1 and is incorporated herein by reference.

The Presentation is based on preliminary estimates

of certain operating results and liquidity information as of and for the three and six months ended June 30, 2021, based upon the information

available to the Company as of July 15, 2021. These estimates are not a comprehensive statement of the Company's results for such periods,

and the Company's actual results may differ materially from these preliminary estimated results. These estimates are preliminary and are

inherently uncertain and subject to change as the Company completes the preparation of its condensed consolidated financial statements

and related notes and completion of its financial close procedures for the three and six months ended June 30, 2021. Therefore, you should

not place undue reliance upon this information. The Company’s independent registered accounting firm has not audited, reviewed,

compiled or performed any procedures with respect to the preliminary estimated financial information included in the Presentation and,

accordingly, does not express an opinion or any other form of assurance with respect thereto. The Company currently intends to release

its finalized second quarter earnings results before the market opens on Tuesday, August 3, 2021, and management will hold a conference

call to discuss the results at 10:00 a.m. ET on the same day. In addition, you should carefully review the Company’s condensed,

consolidated financial statements for the three and six months ended June 30, 2021, when they become available.

Cautionary Note Regarding

Forward-Looking Statements

This Current

Report on Form 8-K contains “forward-looking statements” of the Company that are subject to risks and uncertainties that could

cause actual results to differ materially from the statements made. You can identify these statements by the fact that they do not relate

strictly to historical or current facts. Examples of these statements include, but are not limited to, statements regarding the future

performance of the Company’s business, the impact of COVID-19 on travel, transient and group demand, the effects of COVID-19 on

the Company’s results of operations, the amount of cancellation and attrition fees, rebooking efforts, the Company’s liquidity,

monthly cash expenses and cash flow, recovery of group business to pre-pandemic levels, anticipated business levels and anticipated financial

results for the Gaylord Hotels during future periods and other business or operational issues. These forward-looking statements are subject

to risks and uncertainties that could cause actual results to differ materially from the statements made. These risks and uncertainties

include, but are not limited to, the effects of the COVID-19 pandemic on the Company and the hospitality and entertainment industries

generally, the impact of the COVID-19 pandemic on demand for travel, transient and group business (including government-imposed restrictions),

levels of consumer confidence in the safety of travel and group gathering as a result of COVID-19 and vaccine availability, the duration

and severity of the COVID-19 pandemic in the United States and the pace of recovery following the COVID-19 pandemic, the duration and

severity of outbreaks of any new variants of the COVID-19 virus, the duration and severity of the COVID-19 pandemic in the markets where

the Company’s assets are located, governmental restrictions on the Company’s businesses, economic conditions affecting the

hospitality business generally, the geographic concentration of the Company’s hotel properties, business levels at the Company’s

hotels, and the Company’s ability to borrow funds pursuant to its credit agreement. Other factors that could cause results to differ

are described in the filings made from time to time by the Company with the U.S. Securities and Exchange Commission and include the risk

factors and other risks and uncertainties described in the Company’s Annual Report on Form 10-K for the fiscal year ended December

31, 2020 and its Quarterly Reports on Form 10-Q and subsequent filings. Except as required by law, the Company does not undertake any

obligation to release publicly any revisions to forward-looking statements made by it to reflect events or circumstances occurring after

the date hereof or the occurrence of unanticipated events.

|

ITEM 9.01.

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline

XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

RYMAN HOSPITALITY PROPERTIES, INC.

|

|

|

|

|

|

Date: July 15, 2021

|

By:

|

/s/ Scott J. Lynn

|

|

|

Name:

|

Scott J. Lynn

|

|

|

Title:

|

Executive Vice President, General Counsel and Secretary

|

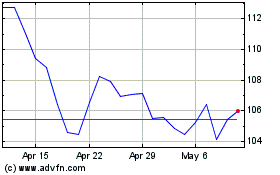

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From May 2024 to Jun 2024

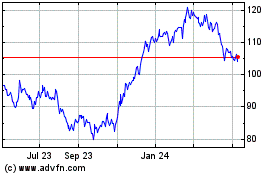

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2023 to Jun 2024