RPT Realty Declares Special Cash Dividend of $0.05444 Per Share

November 13 2023 - 4:45PM

RPT Realty (NYSE:RPT) (“RPT” or the “Company”)

announced today that its Board of Trustees declared a special

dividend of $0.05444 per common share in connection with the

previously announced definitive merger agreement entered into by

and between the Company and Kimco Realty Corporation and the

parties thereto. The special dividend is payable in cash on

December 21, 2023, to shareholders of record on December 7, 2023.

As a result of the payment of the special dividend on common

shares, the conversion ratio of the Series D convertible preferred

shares will be adjusted in accordance with the Company’s Articles

of Restatement of Declaration of Trust, as amended and

supplemented. The current conversion ratio of the Series D

convertible preferred shares can be found on the Company's website

at investors.rptrealty.com/shareholder-information/dividends.

About RPT Realty

RPT Realty owns and operates a national

portfolio of open-air shopping destinations principally located in

top U.S. markets. The Company's shopping centers offer diverse,

locally-curated consumer experiences that reflect the lifestyles of

their surrounding communities and meet the modern expectations of

the Company's retail partners. The Company is a fully integrated

and self-administered REIT publicly traded on the New York Stock

Exchange (the “NYSE”). The common shares of the Company, par value

$0.01 per share are listed and traded on the NYSE under the ticker

symbol “RPT”. As of September 30, 2023, the Company's property

portfolio (the "aggregate portfolio") consisted of 43 wholly-owned

shopping centers, 13 shopping centers owned through its

grocery-anchored joint venture, and 49 retail properties owned

through its net lease joint venture, which together represent 14.9

million square feet of gross leasable area. As of

September 30, 2023, the Company’s pro-rata share of the

aggregate portfolio was 93.5% leased. For additional information

about the Company please visit rptrealty.com.

Company Contact:

Vin Chao, Managing Director - Finance19 W 44th St. 10th Floor,

Ste 1002New York, New York 10036vchao@rptrealty.com(212)

221-1752

Important Additional Information and

Where to Find It

In connection with the proposed mergers, Kimco

has filed with the SEC a registration statement on Form S-4 to

register the shares of Kimco common stock, Kimco preferred stock

and depositary shares in respect thereof to be issued in connection

with the proposed mergers. The registration statement has been

declared effective. The registration statement includes a proxy

statement/prospectus that has been sent to shareholders of the

Company seeking their approval of certain merger-related proposals.

INVESTORS AND SECURITY HOLDERS OF RPT ARE URGED TO READ THE

REGISTRATION STATEMENT ON FORM S-4 AND THE RELATED PROXY

STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED OR THAT WILL

BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGERS, AS

AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN AND WILL

CONTAIN IMPORTANT INFORMATION ABOUT RPT, KIMCO AND THE PROPOSED

MERGERS.

Investors and security holders may obtain copies

of these documents free of charge through the website maintained by

the SEC at www.sec.gov or from RPT at its website,

www.rptrealty.com or from Kimco at its website,

www.kimcorealty.com. Documents filed with the SEC by RPT will be

available free of charge by accessing RPT’s website at

www.rptrealty.com under the heading Investors or, alternatively, by

directing a request to RPT at invest@rptrealty.com or 19 West 44th

Street, Suite 1002, New York, NY 10036, telephone: (212) 221-7139,

and documents filed with the SEC by Kimco will be available free of

charge by accessing Kimco’s website at kimcorealty.com under the

heading Investors or, alternatively, by directing a request to

Kimco at ir@kimcorealty.com or 500 North Broadway, Suite 201,

Jericho, NY 11753, telephone: (516) 869-9000.

Participants in the

Solicitation

RPT and Kimco and certain of their respective

trustees, directors and executive officers and other members of

management and employees may be deemed to be participants in the

solicitation of proxies from the shareholders of RPT in respect of

the proposed mergers under the rules of the SEC. Information about

RPT’s trustees and executive officers is available in RPT’s proxy

statement dated March 16, 2023 for its 2023 Annual Meeting of

Shareholders. Information about Kimco’s directors and executive

officers is available in Kimco’s proxy statement dated March 15,

2023 for its 2023 Annual Meeting of Stockholders. Other information

regarding the participants in the proxy solicitation and a

description of their direct and indirect interests, by security

holdings or otherwise, is contained in the proxy

statement/prospectus and other relevant materials filed and to be

filed with the SEC regarding the proposed mergers as and when they

become available. Investors should read the proxy

statement/prospectus carefully before making any voting or

investment decisions. You may obtain free copies of these documents

from RPT or Kimco using the sources indicated above.

No Offer or Solicitation

This communication shall not constitute an offer

to sell or the solicitation of an offer to buy any securities, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act.

Rithm Property (NYSE:RPT)

Historical Stock Chart

From Dec 2024 to Dec 2024

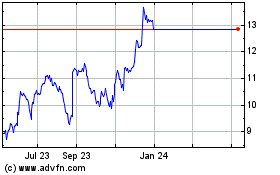

Rithm Property (NYSE:RPT)

Historical Stock Chart

From Dec 2023 to Dec 2024