Ormat Technologies, Inc. (NYSE: ORA), a leading geothermal, energy

storage, solar PV and recovered energy power company, today

announced financial results for the first quarter ended March 31,

2023.

|

KEY FINANCIAL RESULTS |

|

|

|

| |

|

|

|

| (Dollars in millions,

except per share) |

Q1 2023 |

Q1 2022 |

Change (%) |

|

GAAP Measures |

|

|

|

|

Revenues |

|

|

|

|

Electricity |

170.3 |

162.5 |

4.8% |

|

Product |

10.0 |

14.6 |

(31.4) % |

|

Energy Storage & Management Services |

4.9 |

6.6 |

(25.6) % |

| Total Revenues |

185.2 |

183.7 |

0.8% |

| |

|

|

|

| Gross margin (%) |

|

|

|

|

Electricity |

44.4% |

41.8% |

|

|

Product |

6.9% |

6.9% |

|

|

Energy Storage & Management Services |

(3.6) % |

13.5% |

|

| |

|

|

|

| Gross margin (%) |

41.1% |

38.1% |

|

| Operating income |

53.2 |

45.1 |

17.9% |

| Net income attributable to the

Company’s stockholders |

29.0 |

18.4 |

57.5% |

| Diluted EPS ($) |

0.51 |

0.33 |

54.5% |

| |

|

|

|

|

Non-GAAP Measures 1 |

|

|

|

| Adjusted Net income

attributable to the Company’s stockholders |

29.0 |

19.9 |

45.8% |

| Adjusted Diluted EPS ($) |

0.51 |

0.35 |

45.7% |

| Adjusted EBITDA1 |

123.5 |

107.9 |

14.5% |

| |

“Ormat had a strong start to the year,

delivering a 57% improvement in net income over the same period

last year and record first quarter Adjusted EBITDA. Our Electricity

segment led the growth compared to the previous year first quarter,

driven by the contributions from capacity additions of our newly

built assets. The strategic portfolio expansions at our CD4,

Tungsten and Heber 2 plants, which were completed last year,

further supports the expected growth of our revenues and operating

income,” said Doron Blachar, Ormat’s Chief Executive Officer.

“As we enter the second quarter of the year, we

successfully commenced operation at our new 25MW North Valley

geothermal power plant and at the new 6MW Brady solar facility. In

our storage segment, we have successfully begun operations on

19MW/19MWh battery storage facilities and expect to start operation

of additional two projects with a total capacity of 45MW/45MWh in

the second quarter. These new projects are expected to support

improved storage margin performance for the segment across the

remainder of the year and onward. We also plan to commence

commercial operation at our newly built Heber 1 power plant by the

end of the second quarter, further strengthening our growth

trajectory. This expanded portfolio is expected to allow us to

generate even stronger Adjusted EBITDA, earnings, and improved net

income going forwards, supported by additional Production Tax

Credits (PTC) and Investment Tax Credits (ITC).”

Blachar added, “We remain confident in our

ability to meet our operating capacity goals and long-term

financial targets. We also expect to continue capturing the direct

benefits related to the Inflation Reduction Act (IRA) that are

expected to meaningfully enhance our net income results. We believe

the demand for renewable energy and storage remains strong and we

anticipate continued capacity and revenue growth across our

operating segments.”

FINANCIAL AND RECENT BUSINESS

HIGHLIGHTS

- Net income

attributable to the Company’s stockholders and diluted EPS for the

first quarter of 2023 increased 57.5% and 54.5%, respectively,

versus the prior year.

- Adjusted EBITDA

for the first quarter of 2023 was $123.5 million, an increase of

14.5% compared to $107.9 million in 2022, driven by improved

operating income results in the Electricity segment including

higher income related to tax equity transactions supported by the

recognition of PTCs associated mainly with CD4.

- Electricity

segment revenues increased 4.8% for the first quarter of 2023,

compared to 2022, supported by contributions from Ormat’s portfolio

expansion efforts in 2022, including the addition of the CD4,

Tungsten, and Heber 2 geothermal power plants.

- Product segment

revenues decreased by 31.4% for the first quarter of 2023, compared

to 2022, due primarily to the timing of revenue recognition

compared to the prior year period. Despite this year-over-year top

line decline, we expect to see an increase in revenue

year-over-year and anticipate improved margins going forward,

supported by an improved backlog. As such, the Company expects the

Product segment results for the full year to come in near the high

end of the guidance range.

- Product segment

backlog stands at $147 million as of May 9, 2023.

- Energy Storage

segment revenues decreased 25.6% for the first quarter of 2023,

compared to 2022, driven primarily by lower energy rates captured

by the PJM facilities.

- In addition,

since the beginning of the year, the Company:

- Commenced

commercial operation of the 25MW North Valley project in Nevada.

This project is selling energy to NV Energy under a 25-year long

term contract.

- Commenced

commercial operations at two battery storage facilities for 19MW of

combined capacity, with these projects becoming eligible for ITCs

for the first time which will allow Ormat to reduce its income

taxes and meaningfully improve the economics of these

projects.

- Commenced

commercial operation of the 6MW Brady Solar project in Nevada that

will be used for the ancillary needs of the geothermal power plant

and should allow us to sell more electricity from the nearby

geothermal power plant to Southern California Public Power

Authority (SCPPA) under the SCPPA portfolio power purchase

agreement (PPA).

2023 GUIDANCE

- Total revenues

of between $823 million and $858 million.

- Electricity

segment revenues between $670 million and $685 million.

- Product segment

revenues of between $120 million and $135 million.

- Energy Storage

revenues of between $33 million and $38 million.

- Adjusted EBITDA

to be between $480 million and $510 million.

- Adjusted EBITDA

attributable to minority interest of approximately $36

million.

The Company provides a reconciliation of

Adjusted EBITDA, a non-GAAP financial measure for the three months

ended March 31, 2023, and 2022. However, the Company does not

provide guidance on net income and is unable to provide a

reconciliation for its Adjusted EBITDA guidance range to net income

without unreasonable efforts due to high variability and complexity

with respect to estimating certain forward-looking amounts. These

include impairments and disposition and acquisition of business

interests, income tax expense, and other non-cash expenses and

adjusting items that are excluded from the calculation of Adjusted

EBITDA.

DIVIDEND

On May 9, 2023, the Company’s Board of Directors

declared, approved, and authorized payment of a quarterly dividend

of $0.12 per share pursuant to the Company’s dividend policy. The

dividend will be paid on June 6, 2023, to stockholders of record as

of the close of business on May 23, 2023. In addition, the Company

expects to pay a quarterly dividend of $0.12 per share in each of

the next two quarters.

CONFERENCE CALL DETAILS

Ormat will host a conference call to discuss its

financial results and other matters discussed in this press release

on Wednesday, May 10, 2023, at 9:00 a.m. ET.

Participants within the United States and

Canada, please dial 1-888-770-2286, approximately 15 minutes prior

to the scheduled start of the call. If you are calling outside of

the United States and Canada, please dial +1-646-960-0440. Access

code for the call is 9122486. Please request the “Ormat

Technologies, Inc. call” when prompted by the conference call

operator. The conference call will also be accompanied by a webcast

live on the Investor Relations section of the Company’s

website.

A replay will be available one hour after the

end of the conference call. To access the replay within the United

States and Canada, please dial 1-800-770-2030. From outside of the

United States and Canada, please dial +1-647-362-9199. Please use

the replay access code 9122486. The webcast will also be archived

on the Investor Relations section of the Company’s

website.

ABOUT ORMAT TECHNOLOGIES

With over five decades of experience, Ormat

Technologies, Inc. is a leading geothermal company and the only

vertically integrated company engaged in geothermal and recovered

energy generation (“REG”), with robust plans to accelerate

long-term growth in the energy storage market and to establish a

leading position in the U.S. energy storage market. The Company

owns, operates, designs, manufactures and sells geothermal and REG

power plants primarily based on the Ormat Energy Converter – a

power generation unit that converts low-, medium- and

high-temperature heat into electricity. The Company has engineered,

manufactured and constructed power plants, which it currently owns

or has installed for utilities and developers worldwide, totaling

approximately 3,200 MW of gross capacity. Ormat leveraged its core

capabilities in the geothermal and REG industries and its global

presence to expand the Company’s activity into energy storage

services, solar Photovoltaic (PV) and energy storage plus Solar PV.

Ormat’s current total generating portfolio is 1,208 MW with a 1,101

MW geothermal and solar generation portfolio that is spread

globally in the U.S., Kenya, Guatemala, Indonesia, Honduras, and

Guadeloupe, and a 107 MW energy storage portfolio that is located

in the U.S.

ORMAT’S SAFE HARBOR STATEMENT

Information provided in this press release may

contain statements relating to current expectations, estimates,

forecasts and projections about future events that are

“forward-looking statements” as defined in the Private Securities

Litigation Reform Act of 1995. All statements, other than

statements of historical facts, included in this press release that

address activities, events or developments that we expect or

anticipate will or may occur in the future, including such matters

as our projections of annual revenues, expenses and debt service

coverage with respect to our debt securities, future capital

expenditures, business strategy, competitive strengths, goals,

development or operation of generation assets, market and industry

developments and the growth of our business and operations, are

forward-looking statements. When used in this press release, the

words “may”, “will”, “could”, “should”, “expects”, “plans”,

“anticipates”, “believes”, “estimates”, “predicts”, “projects”,

“potential”, or “contemplate” or the negative of these terms or

other comparable terminology are intended to identify

forward-looking statements, although not all forward-looking

statements contain such words or expressions. These forward-looking

statements generally relate to Ormat’s plans, objectives and

expectations for future operations and are based upon its

management’s current estimates and projections of future results or

trends. Although we believe that our plans and objectives reflected

in or suggested by these forward-looking statements are reasonable,

we may not achieve these plans or objectives. Actual future results

may differ materially from those projected as a result of certain

risks and uncertainties and other risks described under “Risk

Factors” as described in Ormat’s Form 10-K filed with the

Securities and Exchange Commission (“SEC”) on February 24, 2023,

and from time to time, in Ormat’s quarterly reports on Form 10-Q

that are filed with the SEC.

These forward-looking statements are made only

as of the date hereof, and, except as legally required, we

undertake no obligation to update or revise the forward-looking

statements, whether as a result of new information, future events

or otherwise.

| |

| ORMAT

TECHNOLOGIES, INC AND SUBSIDIARIES |

| Condensed

Consolidated Statement of Operations |

| For the

Three-Month periods Ended March 31, 2023, and 2022 |

| |

|

| |

Three Months Ended March 31, |

|

|

2023 |

2022 |

| |

(Dollars in thousands, except per share data) |

| Revenues: |

|

|

|

Electricity |

170,310 |

162,525 |

|

Product |

10,042 |

14,628 |

|

Energy storage |

4,880 |

6,557 |

|

Total revenues |

185,232 |

183,710 |

| Cost of revenues: |

|

|

|

Electricity |

94,758 |

94,521 |

|

Product |

9,351 |

13,613 |

|

Energy storage |

5,054 |

5,671 |

|

Total cost of revenues |

109,163 |

113,805 |

|

Gross profit |

76,069 |

69,905 |

| Operating expenses: |

|

|

|

Research and development expenses |

1,288 |

1,064 |

|

Selling and marketing expenses |

3,948 |

4,365 |

|

General and administrative expenses |

17,667 |

17,572 |

|

Write-off of Energy Storage projects and assets |

— |

1,826 |

|

Operating income |

53,166 |

45,078 |

| Other income (expense): |

|

|

|

Interest income |

1,851 |

342 |

|

Interest expense, net |

(23,631) |

(21,081) |

|

Derivatives and foreign currency transaction gains (losses) |

(1,937) |

260 |

|

Income attributable to sale of tax benefits |

12,566 |

7,705 |

|

Other non-operating income (expense), net |

60 |

75 |

|

Income from operations before income tax and equity in earnings

(losses) of investees |

42,075 |

32,379 |

| Income tax (provision)

benefit |

(8,885) |

(10,163) |

| Equity in earnings (losses) of

investees, net |

271 |

577 |

|

Net income |

33,461 |

22,793 |

|

Net income attributable to noncontrolling interest |

(4,432) |

(4,363) |

|

Net income attributable to the Company’s stockholders |

29,029 |

18,430 |

| Earnings per share

attributable to the Company’s stockholders: |

|

|

|

Basic: |

0.51 |

0.33 |

|

Diluted: |

0.51 |

0.33 |

|

Weighted average number of shares used in computation of earnings

per share attributable to the Company’s stockholders: |

|

|

|

Basic |

56,710 |

56,063 |

|

Diluted |

57,104 |

56,366 |

|

|

|

|

| ORMAT

TECHNOLOGIES, INC AND SUBSIDIARIES |

| Condensed

Consolidated Balance Sheet |

| For the Periods

Ended March 31, 2023, and December 31, 2022 |

| |

|

|

March 31, 2023 |

|

December 31, 2022 |

|

ASSETS |

| Current assets: |

(Dollars in thousands) |

|

Cash and cash equivalents |

414,856 |

|

95,872 |

|

Restricted cash and cash equivalents |

107,466 |

|

130,804 |

|

Receivables: |

|

|

|

|

Trade |

144,199 |

|

128,818 |

|

Other |

36,409 |

|

32,415 |

|

Inventories |

45,447 |

|

22,832 |

|

Costs and estimated earnings in excess of billings on uncompleted

contracts |

17,136 |

|

16,405 |

|

Prepaid expenses and other |

45,474 |

|

29,571 |

|

Total current assets |

810,987 |

|

456,717 |

| Investment in unconsolidated

companies |

119,185 |

|

115,693 |

| Deposits and other |

36,920 |

|

39,762 |

| Deferred income taxes |

155,966 |

|

161,365 |

| Property, plant and equipment,

net |

2,541,677 |

|

2,493,457 |

| Construction-in-process |

905,505 |

|

893,198 |

| Operating leases right of

use |

22,770 |

|

23,411 |

| Finance leases right of

use |

4,277 |

|

3,806 |

| Intangible assets, net |

327,537 |

|

333,845 |

| Goodwill |

90,446 |

|

90,325 |

|

Total assets |

5,015,270 |

|

4,611,579 |

| |

|

|

|

|

LIABILITIES AND EQUITY |

| Current liabilities: |

|

|

|

|

Accounts payable and accrued expenses |

172,751 |

|

149,423 |

|

Billings in excess of costs and estimated earnings on uncompleted

contracts |

24,651 |

|

8,785 |

|

Current portion of long-term debt: |

|

|

|

|

Limited and non-recourse (primarily related to VIEs): |

63,465 |

|

64,044 |

|

Full recourse |

110,706 |

|

101,460 |

|

Financing Liability |

15,454 |

|

16,270 |

|

Operating lease liabilities |

2,381 |

|

2,347 |

|

Finance lease liabilities |

1,552 |

|

1,581 |

|

Total current liabilities |

390,960 |

|

343,910 |

| Long-term debt, net of current

portion: |

|

|

|

|

Limited and non-recourse: |

504,460 |

|

521,885 |

|

Full recourse: |

742,222 |

|

676,512 |

|

Convertible senior notes |

421,376 |

|

420,805 |

|

Financing liability |

220,603 |

|

225,759 |

|

Operating lease liabilities |

19,421 |

|

19,788 |

|

Finance lease liabilities |

2,732 |

|

2,262 |

| Liability associated with sale

of tax benefits |

159,305 |

|

166,259 |

| Deferred income taxes |

78,613 |

|

83,465 |

| Liability for unrecognized tax

benefits |

6,581 |

|

6,559 |

| Liabilities for severance

pay |

12,394 |

|

12,833 |

| Asset retirement

obligation |

99,192 |

|

97,660 |

| Other long-term

liabilities |

11,021 |

|

3,317 |

|

Total liabilities |

2,668,880 |

|

2,581,014 |

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| Redeemable noncontrolling

interest |

9,361 |

|

9,590 |

| |

|

|

|

| Equity: |

|

|

|

|

The Company’s stockholders’ equity: |

|

|

|

|

Common stock |

60 |

|

56 |

|

Additional paid-in capital |

1,560,445 |

|

1,259,072 |

|

Treasury stock, at cost |

(17,964) |

|

(17,964) |

|

Retained earnings |

646,204 |

|

623,907 |

|

Accumulated other comprehensive income (loss) |

(4,209) |

|

2,500 |

|

Total stockholders’ equity attributable to Company’s

stockholders |

2,184,536 |

|

1,867,571 |

|

Noncontrolling interest |

152,493 |

|

153,404 |

|

Total equity |

2,337,029 |

|

2,020,975 |

|

Total liabilities, redeemable noncontrolling interest and

equity |

5,015,270 |

|

4,611,579 |

|

|

|

|

|

ORMAT TECHNOLOGIES, INC AND

SUBSIDIARIESReconciliation of EBITDA and Adjusted

EBITDA For the Three-Month Periods ended March 31,

2023, and 2022

We calculate EBITDA as net income before

interest, taxes, depreciation, amortization and accretion. We

calculate Adjusted EBITDA as net income before interest, taxes,

depreciation, amortization and accretion, adjusted for (i)

mark-to-market gains or losses from accounting for derivatives,

(ii) stock-based compensation, (iii) merger and acquisition

transaction costs, (iv) gain or loss from extinguishment of

liabilities, (v) cost related to a settlement agreement, (vi)

non-cash impairment charges; (vii) write-off of unsuccessful

exploration activities; and (viii) other unusual or non-recurring

items. We adjust for these factors as they may be non-cash, unusual

in nature and/or are not factors used by management for evaluating

operating performance. We believe that presentation of these

measures will enhance an investor’s ability to evaluate our

financial and operating performance. EBITDA and Adjusted EBITDA are

not measurements of financial performance or liquidity under

accounting principles generally accepted in the United States, or

U.S. GAAP, and should not be considered as an alternative to cash

flow from operating activities or as a measure of liquidity or an

alternative to net earnings as indicators of our operating

performance or any other measures of performance derived in

accordance with U.S. GAAP. Our Board of Directors and senior

management use EBITDA and Adjusted EBITDA to evaluate our financial

performance. However, other companies in our industry may calculate

EBITDA and Adjusted EBITDA differently than we do.

Starting in the fourth quarter of 2022, we

include accretion expenses related to asset retirement obligation

in the adjustments to net income when calculating EBITDA and

adjusted EBITDA. The presentation of EBITDA and adjusted EBITDA

includes accretion expenses for the three months ended March 31,

2023, however, the prior year has not been recast to include

accretion expenses as the amounts were immaterial.

The following table reconciles net income to

EBITDA and Adjusted EBITDA for the three-month periods ended March

31, 2023, and 2022:

| |

Three Months Ended March 31, |

|

|

2023 |

|

2022 |

| |

(Dollars in thousands) |

| Net income |

33,461 |

|

22,793 |

| Adjusted for: |

|

|

|

| |

|

|

|

| Interest expense, net

(including amortization of deferred financing costs |

21,780 |

|

20,739 |

| Income tax provision

(benefit) |

8,885 |

|

10,163 |

| |

|

|

|

| Adjustment to investment in an

unconsolidated company: our proportionate share in interest

expense, tax and depreciation and amortization in Sarulla |

2,982 |

|

2,124 |

| Depreciation and

amortization |

52,396 |

|

46,769 |

| EBITDA |

119,504 |

|

102,588 |

| |

|

|

|

| Mark-to-market gains or losses

from accounting for derivative |

993 |

|

277 |

| Stock-based compensation |

2,990 |

|

2,814 |

| Write-off related to Storage

projects and activity |

— |

|

1,825 |

| Allowance for bad debt |

— |

|

115 |

| Merger and acquisition

transaction costs |

— |

|

249 |

| Adjusted

EBITDA |

123,487 |

|

107,868 |

| |

|

|

|

ORMAT TECHNOLOGIES, INC AND

SUBSIDIARIESReconciliation of Adjusted Net Income

attributable to the Company’s stockholders and Adjusted

EPS For the Three-month periods ended March 31,

2023, and 2022

Adjusted Net Income attributable to the

Company’s stockholders and Adjusted EPS are adjusted for one-time

expense items that are not representative of our ongoing business

and operations. The use of Adjusted Net income attributable to the

Company’s stockholders and Adjusted EPS is intended to enhance the

usefulness of our financial information by providing measures to

assess the overall performance of our ongoing business.

The following tables reconciles Net income

attributable to the Company’s stockholders and Adjusted EPS for the

three-month periods ended March 31, 2023, and 2022.

| |

Three Months Ended March 31, |

| |

2023 |

|

2022 |

|

(in millions, except for EPS) |

|

|

|

|

|

| GAAP Net income attributable

to the Company’s stockholders |

$ |

29.0 |

|

$ |

18.4 |

| |

|

|

|

|

|

| Write-off of related to Energy

Storage projects and activity |

$ |

— |

|

|

1.4 |

| |

|

|

|

|

|

| Adjusted Net income

attributable to the Company’s stockholders |

$ |

29.0 |

|

$ |

19.9 |

| |

|

|

|

|

|

| GAAP diluted EPS |

$ |

0.51 |

|

$ |

0.33 |

| Write-off of related to Energy

Storage projects and activity |

$ |

— |

|

|

0.02 |

| Diluted Adjusted EPS |

$ |

0.51 |

|

$ |

0.35 |

|

Ormat Technologies Contact:Smadar LaviVP Head of IR and ESG

Planning & Reporting 775-356-9029 (ext.

65726)slavi@ormat.com |

Investor Relations Agency Contact:Alec Steinberg or Joseph

CaminitiAlpha IR Group312-445-2870ORA@alpha-ir.com |

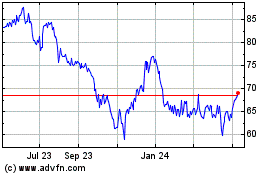

Ormat Technologies (NYSE:ORA)

Historical Stock Chart

From Jun 2024 to Jul 2024

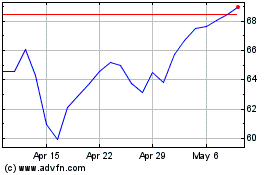

Ormat Technologies (NYSE:ORA)

Historical Stock Chart

From Jul 2023 to Jul 2024