Trump's China Blacklist Sparks Reviews at Index Compilers

November 23 2020 - 4:52AM

Dow Jones News

By Frances Yoon

Index compilers FTSE Russell, JPMorgan Chase & Co. and MSCI

Inc. are rethinking their stance on securities from companies that

the U.S. government says help the Chinese military.

On Nov. 12, President Trump signed an executive order barring

Americans from investing in 31 Chinese companies that the U.S. says

supply and otherwise support China's military, intelligence and

security services.

The blacklist sparked a selloff in stocks and bonds issued by

some targeted companies or their units, though analysts said it

wasn't clear if the prohibition extended to publicly traded

subsidiaries as well as to companies named directly by U.S.

authorities. Adding to the uncertainty, the ban is due to start on

Jan. 11, just days before President-elect Joe Biden is due to take

office.

Late last week, MSCI said it was consulting investors on the

impact of the ban, including whether it needed to change existing

stock indexes or introduce new ones.

FTSE Russell, a unit of London Stock Exchange Group PLC, said

its policy was to exclude securities covered by U.S., UK or

European Union sanctions.

The index provider said it was " seeking rapid feedback from

clients and other stakeholders on the scope of the sanctions and

the timing of the deletion of the affected securities from FTSE

Russell indexes." FTSE Russell said it had asked the Treasury

Department's Office of Foreign Assets Control to define the scope

of these sanctions. It plans to reach a decision by Dec. 4.

The overall impact on benchmarks is likely to be modest. Of the

10 biggest stocks in the MSCI China Index, China Mobile is the only

one that would be affected by the ban. It has a market value of

$124 billion, with stock listed in Hong Kong and New York, and

makes up about 1.3% of the MSCI China index.

The order also has implications for corporate bond markets.

Kenneth Ho, head of Asia credit strategy for Goldman Sachs,

estimates that targeted companies and their subsidiaries have about

$53.9 billion in offshore debt, or about 6% of all Chinese bonds

issued in dollars, euros or yen.

FTSE Russell said it was also reviewing the order's impact on

its bond indexes. JPMorgan, another major bond-index provider, said

it wouldn't include new bonds issued by any of these companies in

its benchmarks.

The bank will keep existing bonds in its indexes, but said it

will "re-evaluate once there is more clarity on the impact to

benchmark replication," according to a JPMorgan note published last

week. The note said 16 targets or their subsidiaries had issued

bonds that were included in its indexes, and they make up 3.7% of

the JPMorgan Asia Credit Index, which has about $80 billion in

assets benchmarked against it.

Prices of bonds issued by some of these companies, including

China National Chemical Corp., have fallen since the order. The

company, often known as ChemChina, has borrowed heavily in

international markets in recent years after spending $43 billion to

acquire Switzerland's Syngenta AG.

Owen Gallimore, head of credit strategy at ANZ, said most

international buyers of such Chinese dollar bonds were passive

investors, with their holdings closely tracking a benchmark index.

That meant bonds that were cut off from indexes have a meaningfully

larger spread, or yield premium, versus comparable government debt,

he said.

Write to Frances Yoon at frances.yoon@wsj.com

(END) Dow Jones Newswires

November 23, 2020 04:37 ET (09:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

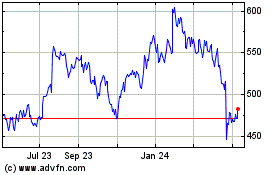

MSCI (NYSE:MSCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

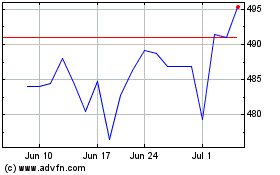

MSCI (NYSE:MSCI)

Historical Stock Chart

From Apr 2023 to Apr 2024