Real-Estate Shares Slip Despite Amazon's Grocery Plans

March 04 2019 - 5:02PM

Dow Jones News

By Micah Maidenberg

To roll out its new grocery chain, Amazon.com Inc. (AMZN) may

need to sign dozens of new real-estate leases, a potential bonanza

for landlords. But investors appear to be skeptical that retail

property companies that focus on shopping centers anchored by

grocery stores would benefit from the technology giant's plans.

The reason, analysts say, is the potential gains from property

deals with Amazon must be weighed against the impact the new chain

could have on grocery-store operators.

Shares in Kroger Co. (KR) and Walmart Inc. (WMT) fell after The

Wall Street Journal reported last Friday that Amazon has been

planning to develop its own grocery concept, signing at least two

leases and potentially opening dozens of stores in multiple cities.

The chain would be distinct from its high-end Whole Foods Market

unit and has the potential to cut into the big grocers' market

share.

"I think the knee-jerk reaction has definitely been negative,"

said Christopher Lucas, an analyst at Capital One Securities, who

follows real-estate investment trusts.

Grocery-focused real-estate investment trusts also saw their

stocks fall the day the news broke. Shares in Regency Centers Corp.

(REG), which owns all or part of 425 properties mostly anchored by

groceries, fell 1.6% Friday.

Kimco Realty Corp.'s (KIM) stock dropped 1.5%. The company

counted the parent of the Food Lion and Stop & Shop, and

Albertsons Cos. as its third- and fifth-largest tenants at the end

of last year, respectively.

Brixmor Property Group Inc. (BRX), which said in its latest

annual report that 68% of its properties are anchored by grocery

stores, saw its stock fall 0.9% Friday.

Shares of Kimco and Brixmor were both down 0.5% in Monday

afternoon trading, while Regency's stock gained 0.5%.

Grocery chains have been shaken in recent years after Amazon

bought Whole Foods and because consumers are expected to purchase

more food and consumer products via the internet.

As the market shifts, grocers like Kroger, Walmart and closely

held Albertsons, which runs chains like Vons, Jewel Osco and

Safeway, have been investing to bolster their ecommerce

capabilities.

"Amazon is one of the main storm clouds that hangs over the

industry," according to a Feb. 28 report from A&G Realty

Advisors and Readco Sylvia Advisors.

Retail property companies with grocery anchors have sold assets

in recent years, trying to focus their portfolios on strong

locations and markets, analysts say.

"To the degree that...there's a need or demand from retailers

for space, it's going to be for the better-located centers," said

Mr. Lucas, the Capital One Securities analyst.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

March 04, 2019 16:47 ET (21:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

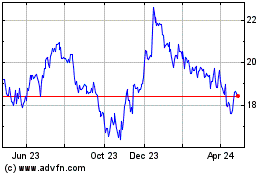

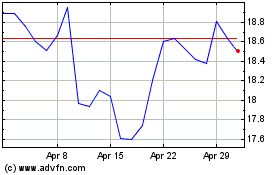

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Apr 2023 to Apr 2024