Current Report Filing (8-k)

January 04 2023 - 8:13AM

Edgar (US Regulatory)

false 0001777946 0001777946 2022-12-28 2022-12-28 0001777946 irnt:CommonStockParValue0.0001PerShare2Member 2022-12-28 2022-12-28 0001777946 irnt:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf11.50PerShare1Member 2022-12-28 2022-12-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 28, 2022

IronNet, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-39125 |

|

83-4599446 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

7900 Tysons One Place, Suite 400

McLean, VA 22102

(Address of principal executive offices, including zip code)

(443) 300-6761

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

IRNT |

|

The New York Stock Exchange |

| Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share |

|

IRNT.WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On December 30, 2022, IronNet, Inc. (the “Company”) issued a secured promissory note in the principal amount of $2.0 million (the “C5 Note”) to an entity affiliated with C5 Capital Limited (“C5”), a beneficial owner of more than 5% of the Company’s outstanding common stock.

The C5 Note has terms that are substantially similar to those secured promissory notes previously issued by the Company as disclosed in a Current Report on Form 8-K filed on December 20, 2022 (the “Prior Notes”). The C5 Note bears interest at a rate of 13.8% per annum, is payable at scheduled maturity on June 30, 2023, and is secured by substantially all of the assets of the Company, excluding the Company’s intellectual property.

The Company, C5 and the holders of the Prior Notes intend to, within five business days of the issuance of the C5 Note, amend and restate the Prior Notes and the C5 Note to be substantially in the form attached to this report as Exhibit 99.1 (the “Restated Notes”) and all security agreements to be substantially in the form attached to this report as Exhibit 99.2 (the “Restated Security Agreements”).

The Company will be permitted to prepay the Restated Notes at any time without premium or penalty. Each Restated Note will rank pari passu in right of payment with each of the other Restated Notes and any other note that may be issued by the Company on a substantially similar basis to C5 or its affiliates, and will rank senior in right of payment to all of the Company’s other existing and future unsecured indebtedness to the extent of the value of the assets securing the Restated Notes.

The Restated Notes include customary Events of Default that include:

| |

• |

|

the Company fails to timely pay any amounts due under the Restated Notes; |

| |

• |

|

the Company breaches any covenant under the Restated Notes or the Restated Security Agreements, or any representation or warranty of the Company is violated or becomes untrue or misleading in any material respect; |

| |

• |

|

the Company files any petition or action for relief under any bankruptcy, reorganization, insolvency or moratorium law or any other law for the relief of or relating to debtors, applies for or consents to the appointment of a receiver, trustee, custodian or liquidator for itself or any part of its property if such appointment is not terminated or dismissed within 60 days, is adjudicated as bankrupt or insolvent or makes any assignment for the benefit of creditors or takes any corporate action in furtherance of any of the foregoing; |

| |

• |

|

the Company becomes subject to any proceedings under any bankruptcy, reorganization, insolvency or moratorium law or any other law for the relief of, or relating to, debtors (unless such proceeding is dismissed or discharged within 60 days), or has an order of relief entered against it in any proceeding under the United States Bankruptcy Code; |

| |

• |

|

the Company generally fails to pay, or admits in writing its inability to pay, any material debt as it becomes due, subject to applicable grace periods, if any; |

| |

• |

|

any provision of the Restated Notes or the Restated Security Agreements shall for any reason cease to be valid and binding on or enforceable against the Company; or |

| |

• |

|

the Company or any of its subsidiaries fails to pay any principal or interest due in respect of the Prior Notes or the Company’s outstanding convertible promissory note issued to an institutional investor (as disclosed in the Company’s Current Report on Form 8-K filed on September 15, 2022) or the Company fails to observe or perform any other term, covenant, condition or agreement contained in any agreement or instrument evidencing or governing any such indebtedness, subject to certain exceptions, exclusions and limitations. |

Upon the occurrence of an Event of Default under the Restated Notes, all unpaid principal, accrued interest and other amounts owed shall, at the option of each holder upon written notice to the Company, and in certain cases automatically, be immediately due, payable and collectible.

The foregoing description of the Restated Notes and the Restated Security Agreements does not purport to be complete and is subject to, and is qualified in its entirety by reference to, the form of Restated Note and form of Restated Security Agreement filed hereto as Exhibits 99.1 and 99.2, respectively, and incorporated herein by reference.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information set forth in Item 1.01 of this Current Report is incorporated by reference into this Item 2.03.

| Item 7.01 |

Regulation FD Disclosure. |

On January 4, 2023, the Company issued a press release announcing, among other things, the issuance of the C5 Note. A copy of that press release is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

The information provided in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.3 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

On December 28, 2022, the Company and C5 entered into an agreement pursuant to which they have agreed to a mutual exclusivity period through January 31, 2023 to seek to negotiate definitive agreements with respect to a potential offer by C5 to acquire all of the outstanding common stock of the Company not presently owned by C5 and certain of its affiliates (the “Proposed Transaction”). Commencement of the exclusivity period was subject to C5 providing the $2.0 million of bridge financing described in Item 1.01 above. Continuation of the exclusivity period after January 9, 2023 is subject to C5 entering into additional Restated Notes providing $3.5 million of additional bridge financing by January 9, 2023. The January 31, 2023 expiration date is subject to an automatic extension of an additional seven days if C5 provides additional bridge financing sufficient to fund the Company’s operations for such seven-day period (up to a maximum additional amount of $3.5 million).

The Company plans to use the proceeds of the Restated Notes to fund its ongoing operations. However, management anticipates that, in the absence of additional sources of liquidity (which may include additional Restated Notes to be issued to C5 as described in the preceding paragraph), the Company’s existing cash and cash equivalents and anticipated cash flows from operations will not be sufficient to meet the Company’s operating and liquidity needs through the end of January 2023.

In the event the Company does not issue any additional Restated Notes to C5 and determines that additional sources of liquidity will not be available to it or will not allow it to meet its obligations as they become due, the Company may need to file a voluntary petition for relief under the United States Bankruptcy Code in order to implement a plan of reorganization, court-supervised sale and/or liquidation. Furthermore, in the event the Company is unable to pursue bankruptcy protection under Chapter 11 of the United States Bankruptcy Code, it may be necessary to pursue bankruptcy protection under Chapter 7 of the United States Bankruptcy Code, in which case a Chapter 7 trustee would be appointed or elected to liquidate the Company’s assets for distribution in accordance with the priorities established by the United States Bankruptcy Code. The Company expects that liquidation under Chapter 7 would result in significantly smaller distributions being made to stakeholders than those it might obtain under Chapter 11 primarily because of the likelihood that the Company’s assets would have to be sold or otherwise disposed of by a Chapter 7 trustee in a distressed fashion over a short period of time rather than sold by existing management as a going concern business. In the event that the Company pursues bankruptcy protection under Chapter 7, the Company’s material business activities will cease, and the Company will no longer have the capability to prepare financial statements and other disclosures required for periodic reports for filing with the Securities and Exchange Commission. The Company expects that no distributions would be available for stockholders in a Chapter 7 liquidation.

Forward-Looking Statements

Certain statements in this Current Report on Form 8-K may be considered forward-looking statements, including statements with respect to the negotiation of definitive agreements with C5 for the acquisition of the Company and the Company’s expectations with respect to the sufficiency of the Company’s cash resources and the ability to secure additional sources of liquidity, including the issuance of additional Restated Notes to C5, the Company’s ability to continue as a going concern and the potential need to pursue bankruptcy protection. Forward-looking statements generally relate to future events and can be identified by terminology such as “may,” “should,” “could,” “might,” “plan,” “possible,” “strive,” “budget,” “expect,” “intend,” “will,” “estimate,” “believe,” “predict,” “potential,” “pursue,” “aim,” “goal,” “mission,” “anticipate” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, risks and uncertainties set forth in the section entitled “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended July 31, 2022 and in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2022, and other documents filed by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation and does not intend to update or revise these forward-looking statements other than as required by applicable law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

IRONNET, INC. |

|

|

|

|

| |

|

|

|

By: |

|

/s/ Cameron D. Pforr |

| Date: January 4, 2023 |

|

|

|

|

|

Cameron D. Pforr

Chief Financial Officer |

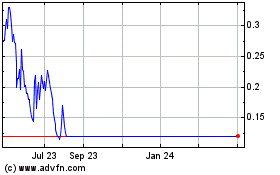

IronNet (NYSE:IRNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

IronNet (NYSE:IRNT)

Historical Stock Chart

From Apr 2023 to Apr 2024