false

0001679049

true

0001679049

2024-02-29

2024-02-29

0001679049

us-gaap:CommonStockMember

2024-02-29

2024-02-29

0001679049

insw:RightscommonstockMember

2024-02-29

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United

States

Securities

and Exchange Commission

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the

Securities

Exchange Act of 1934

February 29, 2024

Date of Report (Date

of earliest event reported)

International Seaways, Inc.

(Exact Name of Registrant

as Specified in Charter)

1-37836-1

Commission File Number

| Marshall Islands |

|

98-0467117 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

600 Third Avenue,

39th Floor

New York, New York

10016

(Address of Principal

Executive Offices) (Zip Code)

Registrant's telephone

number, including area code (212) 578-1600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Symbol |

Name of each exchange on which registered |

| Common Stock (no par value) |

INSW |

New York Stock Exchange |

| Rights to Purchase Common Stock |

N/A true |

New York Stock Exchange |

Section

2 – Financial Information

| Item 2.02 | Results of Operations and Financial

Condition. |

The following information, including the Exhibit to this

Form 8-K, is being furnished pursuant to Item 2.02 — Results of Operations and Financial Condition of Form 8-K. This information

is not deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 and is not incorporated

by reference into any Securities Act of 1933 registration statements.

On February 29, 2024, International Seaways, Inc. issued

a press release, a copy of which is attached hereto as Exhibit 99.1, announcing fiscal year 2023 earnings.

Section

7 – Regulation FD

| Item 7.01 | Regulation FD Disclosure. |

The following information, including the Exhibit to this

Form 8-K, is being furnished pursuant to Item 7.01 — Regulation FD Disclosure

of Form 8-K. This information is not deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934 and is not incorporated by reference into any Securities Act of 1933 registration statements.

On February 28, 2024, INSW’s Board of Directors

declared a combined dividend of $1.32 per share of common stock, comprised of a regular quarterly dividend of $0.12 per share of common

stock and a supplemental dividend of $1.20 per share of common stock for the fourth quarter of 2023. Both such dividends are payable on

March 28, 2024 to shareholders of record at the close of business on March 14, 2024.

Section 9 – Financial Statements

and Exhibits

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

Pursuant to General Instruction B.2 of Form 8-K, the

following exhibit is furnished with this Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

INTERNATIONAL SEAWAYS, INC. |

| |

(Registrant) |

| |

|

| |

|

| Date: February 29, 2024 |

By |

/s/ James D. Small III |

| |

|

Name: |

James D. Small III |

| |

|

Title: |

Chief Administrative Officer, Senior Vice President, Secretary and General Counsel |

EXHIBIT

INDEX

Exhibit 99.1

INTERNATIONAL SEAWAYS REPORTS

FOURTH QUARTER AND FULL YEAR 2023 RESULTS

New York, NY – February 29, 2024–

International Seaways, Inc. (NYSE: INSW) (the “Company”, “Seaways”, or “INSW”), one of the largest

tanker companies worldwide providing energy transportation services for crude oil and petroleum products, today reported results for the

fourth quarter and full year of 2023.

HIGHLIGHTS & RECENT DEVELOPMENTS

Record Annual Earnings:

| · | Net income for the full year of 2023 was $556.4

million, or $11.25 per diluted share, representing an increase of $168.6 million compared to the full year of 2022, which was $387.9 million,

or $7.77 per share. Net income for the fourth quarter was $132.1 million, or $2.68 per diluted share, compared to net income of $218.4

million, or $4.40 per diluted share, in the fourth quarter of 2022. |

| · | Adjusted net income(A), defined as

net income excluding special items, for the fourth quarter of 2023 was $107.6 million, which excludes gains on vessel sales and write-off

of deferred financing costs. |

| · | Adjusted EBITDA(B) for the fourth

quarter was $158.8 million and for the full year of 2023 was $723.8 million. |

Balance Sheet Enhancements:

| · | Total liquidity was approximately $601 million

as of December 31, 2023, including cash and short-term investments(C) of $187 million and $414 million of undrawn revolving

credit capacity. |

| · | Prepaid nearly $300 million in debt during 2023

in addition to mandatory debt repayments of approximately $150 million and $27 million in debt prepayments related to vessel sales. |

| · | Net loan-to-value of 17% as of December 31, 2023,

is the lowest in Company history. |

| · | Doubled revolver capacity over the last 12 months

with two refinancings that also released vessels from the collateral package, reduced interest costs and extended the maturity profile.

During 2023, 30 vessels were unencumbered. |

Returns to Shareholders:

| · | Paid a combined $1.25 per share in regular and

supplemental dividends in December 2023. |

| · | Returned over $320 million to shareholders during

2023. The Company paid over $308 million in dividends, representing $6.29 per share and repurchased shares for $14 million at an average

price of $38. |

| · | Declared a combined dividend of $1.32 per share

composed of a supplemental dividend of $1.20 per share and $0.12 per share of a regular quarterly cash dividend to be paid in March 2024.

The combined dividend represents 60% of adjusted net income for the fourth quarter. |

Fleet Optimization Program:

| · | Agreed to purchase six MRs, built between 2014

and 2015, for $232 million; 15% funded through shares with the remainder from available liquidity. |

| · | Sold two, 2008-built MRs for net proceeds of

$28 million after debt repayment during the fourth quarter of 2023. |

| · | Increased contracted revenues to $354 million

by entering into two new time charter agreements during the fourth quarter of 2023. |

“2023 marked another record year for Seaways

and our portfolio of tanker assets,” said Lois K. Zabrocky, International Seaways President and CEO. “During the year, drawing

on our substantial cash flows, we continued to pull all the levers of our balanced capital allocation strategy. This included ordering

LR1s to renew our fleet for our niche joint venture in the Panamax International pool, enhancing the balance sheet with substantial debt

prepayments that lowered our cash break evens, doubling our revolving credit capacity and returning approximately 16% of our average market

capitalization during 2023 to shareholders through dividends and share repurchases. Looking ahead, we expect to continue executing this

balanced approach and further building on our track record of opportunistically renewing the fleet, improving the balance sheet, and returning

substantial cash to shareholders.”

Ms. Zabrocky added, “Seaways has significant

momentum that we expect to carry forward throughout the year, as positive market fundamentals remain intact. Strong tanker demand continues

to be driven by growing oil demand and higher utilization from the evolving global energy trade where energy security is prioritized.

Combined with the lowest orderbook in more than 30 years and an aging global fleet, we remain confident that current tanker market dynamics

will prove to be sustainable in the near term and drive strong earnings for the foreseeable future.”

Jeff Pribor, the Company’s CFO stated, “We

took important steps to enhance and diversify our capital structure in 2023 and believe Seaways’ balance sheet is the strongest

it has ever been. This strength is evidenced by over $600 million in total liquidity and the lowest net-loan-to-value ratio in Company

history at 17%. As part of our balanced capital allocation strategy, we proactively de-levered, exceeding our mandatory debt repayments

by nearly $300 million in 2023, which reduced our break evens to below $14,500 per day. As we continue to generate free cash, we expect

to build on our track record of compelling shareholder returns.”

FOURTH QUARTER 2023 RESULTS

Net income for the fourth quarter of 2023 was $132.1 million, or $2.68

per diluted share, compared to net income of $218.4 million, or $4.40 per diluted share, for the fourth quarter of 2022. The decrease

in net income for the fourth quarter of 2023 was driven by the lower spot earnings primarily due to lower OPEC+ production. The reported

net income for the fourth quarter of 2023 includes the impact of one-time items, consisting of the gain on disposal of vessels, and write-off

of deferred financing costs, which aggregated to $24.6 million. Excluding these items, net income for the fourth quarter of 2023 was $107.6

million, or $2.18 per diluted share.

Shipping revenues for the fourth quarter were

$250.7 million, compared to $338.2 million for the fourth quarter of 2022. Consolidated TCE revenues(D) for the fourth quarter

were $247.9 million, compared to $335.7 million for the fourth quarter of 2022.

Adjusted EBITDA for the fourth quarter was $158.8

million, compared to $254.3 million for the fourth quarter of 2022.

Crude Tankers

Shipping revenues for the Crude Tankers segment

were $125.2 million for the fourth quarter of 2023, compared to $152.9 million for the fourth quarter of 2022. TCE revenues were $123.3

million for the fourth quarter, compared to $150.7 million for the fourth quarter of 2022. This decrease was primarily attributable to

lower spot rates as the average spot earnings of the VLCC, Suezmax, Aframax sectors were approximately $43,000, $47,300, and $44,000 per

day, respectively, compared with approximately $64,600, $59,100, and $62,000 per day, respectively, during the fourth quarter of 2022.

Product Carriers

Shipping revenues for the Product Carriers segment

were $125.6 million for the fourth quarter, compared to $185.2 million for the fourth quarter of 2022. TCE revenues were $124.7 million

for the fourth quarter, compared to $184.9 million for the fourth quarter of 2022. This decrease is primarily attributed to lower spot

earnings in the LR1 and MR sectors that averaged approximately $46,200 and $31,500 per day, respectively, in the fourth quarter of 2023,

compared to approximately $64,000 and $39,700 per day, respectively, during the fourth quarter of 2022.

FULL YEAR 2023 RESULTS

Net income for the year ended December 31, 2023,

was $556.4 million, or $11.25 per diluted share, compared to net income of $387.9 million, or $7.77 per diluted share, for the year ended

December 31, 2022. The reported net income for 2023 includes the impact of one-time items, consisting of the gain on disposal of vessels,

debt modification expenses, and write-off of deferred financing costs and loss on extinguishment of debt, which aggregated $31.4 million.

Excluding these items, net income for 2023 was $525.1 million, or $10.62 per diluted share.

Shipping revenues for the year ended December

31, 2023, were $1,071.8 million, compared to $864.7 million for the year ended December 31, 2022. Consolidated TCE revenues for the year

ended December 31, 2023, were $1,055.5 million, compared to $853.7 million for the year ended December 31, 2022.

Adjusted EBITDA for the year ended December 31,

2023 was $723.8 million, compared to $549.1 million for the year ended December 31, 2022.

Crude Tankers

TCE revenues for the Crude Tankers segment were

$512.2 million for the year ended December 31, 2023, compared to $321.9 million for the year ended December 31, 2022. Shipping revenues

for the Crude Tankers segment were $524.0 million for the year ended December 31, 2023, compared to $331.7 million for the year ended

December 31, 2022.

Product Carriers

TCE revenues for the Product Carriers segment

were $543.3 million for the year ended December 31, 2023, compared to $531.9 million for the year ended December 31, 2022. Shipping revenues

for the Product Carriers segment were $547.8 million for the year ended December 31, 2023, compared to $533.0 million for the year ended

December 31, 2022.

BALANCE SHEET ENHANCEMENTS

During 2023, the Company extinguished approximately

$324 million of debt. During the first quarter, the Company amended the $750 Million Credit Facility, which included a prepayment of $97

million on the term loan, increased the capacity of the revolving credit facility tranche by $40 million and released 22 vessels from

the collateral package. During the second quarter, the Company prepaid approximately $75 million in debt with the exercise of purchase

options for two vessels under sale-leaseback agreements for $46 million and the prepayment of $29 million on the $750 Million Credit Facility,

which also released another vessel from the collateral package. During the third quarter, a net prepayment of $54 million resulted from

the execution of a new revolving credit facility that increased revolving credit capacity by $160 million with an attractive margin, maturity

extension and age-adjusted amortization profile. The transaction resulted in a prepayment of existing debt of $104 million and a drawdown

on the new facility of $50 million. During the fourth quarter, the Company prepaid approximately $71 million of debt, including a $50

million payment on the aforementioned revolving credit facility. The Company’s revolving credit is fully undrawn with capacity of

$414 million.

The Company also paid approximately $27 million

on the $750 Million Credit Facility in connection with the sales of three 2008-built MRs during 2023.

RETURNING CASH TO SHAREHOLDERS

In December 2023, the Company paid a combined

dividend of $1.25 per share of common stock, composed of a regular quarterly dividend of $0.12 per share of common stock and a supplemental

dividend of $1.13 per share. For the year ended December 31, 2023, the Company has paid combined dividends of approximately $6.29 per

share.

On February 28, 2024, the Company’s Board

of Directors declared a combined dividend of $1.32 per share of common stock, composed of a regular quarterly dividend of $0.12 per share

of common stock and a supplemental dividend of $1.20 per share of common stock. Both dividends will be paid on March 28, 2024, to shareholders

with a record date at the close of business on March 14, 2024.

For the year ended December 31, 2023, the Company

repurchased and retired a total of 366,483 shares of its common stock in open market purchases, at an average price of $38.03 at an aggregate

cost of approximately $14 million.

The Company currently has $50 million authorized

under its share repurchase program, which expires at the end of 2025.

FLEET OPTIMIZATION PROGRAM

On February 23, 2024, the Company entered into

agreements to acquire two 2014-built and four 2015-built MR vessels for total consideration of $232 million. The Company expects to finance

15% of the total consideration with shares of common stock with the balance funded by available liquidity. Each of the six vessel purchases

is subject to the satisfaction of closing conditions customary for vessel purchases. Delivery of the vessels is expected to be completed

by the end of the second quarter 2024.

In the fourth quarter, the Company entered into

two new time charter agreements for over two years on two 2009-built MRs. During 2023, the Company has entered into eight, time charter

agreements: one 2017-built Aframax, three 2008-built MRs, two 2009-built MRs, one 2011-built MR and one 2012-built Suezmax. The charters

have durations of two to three years and have increased contracted future revenues to approximately $354 million remaining under time

charter agreements from January 1, 2024 through charter expiry, excluding any applicable profit share.

During 2023, the Company sold three 2008-built

MRs, which generated approximately $39 million in net proceeds after debt repayment.

The Company entered into contracts and declared

options to build a total of four scrubber-fitted, dual-fuel (LNG) ready, LR1 vessels in Korea with K Shipbuilding Co, Ltd at a price in

aggregate of approximately $231 million. Two contracts were executed in August 2023 with two additional options that were exercised in

October 2023. The vessels are expected to be delivered beginning in the second half of 2025 through the first quarter of 2026. Upon delivery,

these vessels are expected to deliver into our niche, Panamax International Pool, which has consistently outperformed the market. During

the fourth quarter, the Company entered into an option agreement for two additional, dual-fuel ready LR1 vessels at the same shipyard

for delivery during the third quarter of 2026 at an additional cost of $116 million. Under the terms of the agreement, the Company’s

option will expire on March 31, 2024.

During 2023, the Company took delivery of three

dual-fuel VLCC newbuildings. The vessels were ordered for an aggregate contract price of $288 million, which are financed under sale leaseback

arrangements at a fixed rate of approximately 4.25%. The vessels have commenced long-term time charters into 2030 with an oil major at

a base rate of $31,000 per day plus a profit share component.

In December 2022, the Company exercised its purchase

options on two 2009-built Aframax vessels under sale leaseback arrangement, which were accounted for as operating leases prior to declaration

of the options. The aggregate purchase price, net of prepaid charter hire of both vessels was approximately $41 million, representing

a discount at the time of approximately 45% to the market value of these vessels. One vessel was delivered in March 2023 while the other

delivered in April 2023.

CONFERENCE CALL

The Company will host a conference call to discuss

its fourth quarter and full year 2023 results at 9:00 a.m. Eastern Time (“ET”) on Thursday, February 29, 2024. To access

the call, participants should dial (833) 470-1428 for domestic callers and (929) 526-1599 for international callers and entering 708633.

Please dial in ten minutes prior to the start of the call. A live webcast of the conference call will be available from the Investor

Relations section of the Company’s website at https://www.intlseas.com.

An audio replay of the conference call will be

available until March 7, 2024, by dialing (866) 813-9403 for domestic callers and +44 204 525 0658 for international callers, and entering

Access Code 428746.

ABOUT INTERNATIONAL SEAWAYS, INC.

International Seaways, Inc. (NYSE: INSW) is one

of the largest tanker companies worldwide providing energy transportation services for crude oil and petroleum products in International

Flag markets. International Seaways owns and operates a fleet of 77 vessels, including 13 VLCCs, 13 Suezmaxes, five Aframaxes/LR2s, 11

LR1s, of which four are newbuildings, and 35 MR tankers. International Seaways has an experienced team committed to the very best operating

practices and the highest levels of customer service and operational efficiency. International Seaways is headquartered in New York City,

NY. Additional information is available at https://www.intlseas.com.

Forward-Looking Statements

This release contains forward-looking statements.

In addition, the Company may make or approve certain statements in future filings with the U.S. Securities and Exchange Commission (SEC),

in press releases, or in oral or written presentations by representatives of the Company. All statements other than statements of historical

facts should be considered forward-looking statements. These matters or statements may relate plans to issue dividends, the Company’s

prospects, including statements regarding vessel acquisitions, expected synergies, trends in the tanker markets, and possibilities of

strategic alliances and investments. Forward-looking statements are based on the Company’s current plans, estimates and projections,

and are subject to change based on a number of factors. Investors should carefully consider the risk factors outlined in more detail in

the Annual Report on Form 10-K for 2023 for the Company, and in similar sections of other filings made by the Company with the SEC from

time to time. The Company assumes no obligation to update or revise any forward-looking statements. Forward-looking statements and written

and oral forward-looking statements attributable to the Company or its representatives after the date of this release are qualified in

their entirety by the cautionary statements contained in this paragraph and in other reports previously or hereafter filed by the Company

with the SEC.

Investor Relations & Media Contact:

Tom Trovato, International Seaways, Inc.

(212) 578-1602

ttrovato@intlseas.com

Category: Earnings

Consolidated Statements of Operations

($ in thousands, except per share amounts)

| | |

Three Months Ended | | |

Fiscal Year Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

| | |

| |

| Shipping Revenues: | |

| | | |

| | | |

| | | |

| | |

| Pool revenues | |

$ | 204,174 | | |

$ | 311,193 | | |

$ | 905,808 | | |

$ | 774,922 | |

| Time and bareboat charter revenues | |

| 29,695 | | |

| 10,239 | | |

| 96,544 | | |

| 33,034 | |

| Voyage charter revenues | |

| 16,865 | | |

| 16,725 | | |

| 69,423 | | |

| 56,709 | |

| Total Shipping Revenues | |

| 250,734 | | |

| 338,157 | | |

| 1,071,775 | | |

| 864,665 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| Voyage expenses | |

| 2,822 | | |

| 2,507 | | |

| 16,256 | | |

| 10,955 | |

| Vessel expenses | |

| 71,023 | | |

| 62,229 | | |

| 259,539 | | |

| 240,674 | |

| Charter hire expenses | |

| 8,805 | | |

| 9,333 | | |

| 39,404 | | |

| 32,132 | |

| Depreciation and amortization | |

| 33,682 | | |

| 28,404 | | |

| 129,038 | | |

| 110,388 | |

| General and administrative | |

| 12,391 | | |

| 13,499 | | |

| 47,473 | | |

| 46,351 | |

| Third-party debt modification fees | |

| - | | |

| - | | |

| 568 | | |

| 1,158 | |

| Gain on disposal of vessels and other assets, net of impairments | |

| (25,286 | ) | |

| (10,308 | ) | |

| (35,934 | ) | |

| (19,647 | ) |

| Total operating expenses | |

| 103,437 | | |

| 105,664 | | |

| 456,344 | | |

| 422,011 | |

| Income from vessel operations | |

| 147,297 | | |

| 232,493 | | |

| 615,431 | | |

| 442,654 | |

| Equity in income of affiliated companies | |

| - | | |

| 280 | | |

| - | | |

| 714 | |

| Operating income | |

| 147,297 | | |

| 232,773 | | |

| 615,431 | | |

| 443,368 | |

| Other income | |

| 2,344 | | |

| 2,772 | | |

| 10,652 | | |

| 2,332 | |

| Income before interest expense and income taxes | |

| 149,641 | | |

| 235,545 | | |

| 626,083 | | |

| 445,700 | |

| Interest expense | |

| (14,081 | ) | |

| (17,091 | ) | |

| (65,759 | ) | |

| (57,721 | ) |

| Income before income taxes | |

| 135,560 | | |

| 218,454 | | |

| 560,324 | | |

| 387,979 | |

| Income tax provision | |

| (3,446 | ) | |

| (25 | ) | |

| (3,878 | ) | |

| (88 | ) |

| Net income | |

$ | 132,114 | | |

$ | 218,429 | | |

$ | 556,446 | | |

$ | 387,891 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Number of Common Shares Outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 48,888,084 | | |

| 49,049,539 | | |

| 48,978,452 | | |

| 49,381,459 | |

| Diluted | |

| 49,343,856 | | |

| 49,619,307 | | |

| 49,428,967 | | |

| 49,844,904 | |

| | |

| | | |

| | | |

| | | |

| | |

| Per Share Amounts: | |

| | | |

| | | |

| | | |

| | |

| Basic net income per share | |

$ | 2.70 | | |

$ | 4.45 | | |

$ | 11.35 | | |

$ | 7.85 | |

| Diluted net income per share | |

$ | 2.68 | | |

$ | 4.40 | | |

$ | 11.25 | | |

$ | 7.77 | |

Consolidated Balance Sheets

($ in thousands)

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 126,760 | | |

$ | 243,744 | |

| Short-term investments | |

| 60,000 | | |

| 80,000 | |

| Voyage receivables | |

| 247,165 | | |

| 289,775 | |

| Other receivables | |

| 14,303 | | |

| 12,583 | |

| Inventories | |

| 1,329 | | |

| 531 | |

| Prepaid expenses and other current assets | |

| 10,342 | | |

| 8,995 | |

| Current portion of derivative asset | |

| 5,081 | | |

| 6,987 | |

| Total Current Assets | |

| 464,980 | | |

| 642,615 | |

| | |

| | | |

| | |

| Vessels and other property, less accumulated depreciation | |

| 1,914,426 | | |

| 1,680,010 | |

| Vessels construction in progress | |

| 11,670 | | |

| 123,940 | |

| Deferred drydock expenditures, net | |

| 70,880 | | |

| 65,611 | |

| Operating lease right-of-use assets | |

| 20,391 | | |

| 8,471 | |

| Finance lease right-of-use assets | |

| - | | |

| 44,391 | |

| Pool working capital deposits | |

| 31,748 | | |

| 35,593 | |

| Long-term derivative asset | |

| 1,153 | | |

| 4,662 | |

| Other assets | |

| 6,571 | | |

| 10,041 | |

| Total Assets | |

$ | 2,521,819 | | |

$ | 2,615,334 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable, accrued expenses and other current liabilities | |

$ | 57,904 | | |

$ | 51,069 | |

| Current portion of operating lease liabilities | |

| 10,223 | | |

| 1,596 | |

| Current portion of finance lease liabilities | |

| - | | |

| 41,870 | |

| Current installments of long-term debt | |

| 127,447 | | |

| 162,854 | |

| Total Current Liabilities | |

| 195,574 | | |

| 257,389 | |

| Long-term operating lease liabilities | |

| 11,631 | | |

| 7,740 | |

| Long-term debt | |

| 595,229 | | |

| 860,578 | |

| Other liabilities | |

| 2,628 | | |

| 1,875 | |

| Total Liabilities | |

| 805,062 | | |

| 1,127,582 | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Total Equity | |

| 1,716,757 | | |

| 1,487,752 | |

| Total Liabilities and Equity | |

$ | 2,521,819 | | |

$ | 2,615,334 | |

Consolidated Statements of Cash Flows

($ in thousands)

| | |

Fiscal Year Ended December 31, | |

| | |

2023 | | |

2022 | |

| Cash Flows from Operating Activities: | |

| | | |

| | |

| Net income | |

$ | 556,446 | | |

$ | 387,891 | |

| Items included in net income not affecting cash flows: | |

| | | |

| | |

| Depreciation and amortization | |

| 129,038 | | |

| 110,388 | |

| Loss on write-down of vessels and other assets | |

| — | | |

| 1,697 | |

| Amortization of debt discount and other deferred financing costs | |

| 5,623 | | |

| 5,224 | |

| Amortization of time charter hire contracts acquired | |

| — | | |

| 842 | |

| Deferred financing costs write-off | |

| 2,686 | | |

| 1,266 | |

| Stock compensation | |

| 8,518 | | |

| 6,746 | |

| Earnings of affiliated companies | |

| 20 | | |

| (10,297 | ) |

| Other – net | |

| (2,562 | ) | |

| (2,242 | ) |

| Items included in net income related to investing and financing activities: | |

| | | |

| | |

| Gain on disposal of vessels and other assets, net | |

| (35,934 | ) | |

| (21,344 | ) |

| Loss on extinguishment of debt | |

| 1,323 | | |

| — | |

| Loss on sale of investment in affiliated companies | |

| — | | |

| 9,513 | |

| Cash distributions from affiliated companies | |

| — | | |

| 3,111 | |

| Payments for drydocking | |

| (34,539 | ) | |

| (43,327 | ) |

| Insurance claims proceeds related to vessel operations | |

| 3,156 | | |

| 5,301 | |

| Changes in operating assets and liabilities | |

| 54,627 | | |

| (166,968 | ) |

| Net cash provided by operating activities | |

| 688,402 | | |

| 287,801 | |

| Cash Flows from Investing Activities: | |

| | | |

| | |

| Expenditures for vessels, vessel improvements and vessels under construction | |

| (205,159 | ) | |

| (115,976 | ) |

| Proceeds from disposal of vessels and other assets | |

| 66,002 | | |

| 99,157 | |

| Expenditures for other property | |

| (1,471 | ) | |

| (710 | ) |

| Pool working capital deposits | |

| (3,639 | ) | |

| 1,362 | |

| Proceeds from sale of investments in affiliated companies | |

| — | | |

| 138,966 | |

| Investments in short-term time deposits | |

| (235,000 | ) | |

| (105,000 | ) |

| Proceeds from maturities of short-term time deposits | |

| 255,000 | | |

| 25,000 | |

| Net cash (used in)/provided by investing activities | |

| (124,267 | ) | |

| 42,799 | |

| Cash Flows from Financing Activities: | |

| | | |

| | |

| Borrowings on long term debt, net of lenders' fees | |

| — | | |

| 641,050 | |

| Borrowings on revolving credit facilities | |

| 50,000 | | |

| — | |

| Repayments on revolving credit facilities | |

| (50,000 | ) | |

| — | |

| Repayments of debt | |

| (382,050 | ) | |

| (798,740 | ) |

| Premium and fees on extinguishment of debt | |

| (1,323 | ) | |

| — | |

| Proceeds from sale and leaseback financing, net of issuance and deferred financing costs | |

| 169,717 | | |

| 108,005 | |

| Payments on sale and leaseback financing and finance lease | |

| (135,965 | ) | |

| (39,240 | ) |

| Payments of deferred financing costs | |

| (3,577 | ) | |

| (909 | ) |

| Cash dividends paid | |

| (308,154 | ) | |

| (69,841 | ) |

| Repurchase of common stock | |

| (13,948 | ) | |

| (20,017 | ) |

| Cash paid to tax authority upon vesting or exercise of stock-based compensation | |

| (5,819 | ) | |

| (6,097 | ) |

| Net cash used in financing activities | |

| (681,119 | ) | |

| (185,789 | ) |

| Net (decrease)/increase in cash, cash equivalents and restricted cash | |

| (116,984 | ) | |

| 144,811 | |

| Cash, cash equivalents and restricted cash at beginning of year | |

| 243,744 | | |

| 98,933 | |

| Cash, cash equivalents and restricted cash at end of period | |

$ | 126,760 | | |

$ | 243,744 | |

Spot and Fixed TCE Rates Achieved and Revenue Days

The following tables provide a breakdown of TCE rates achieved for

spot and fixed charters and the related revenue days for the three months and year ended December 31, 2023 and the comparable period of

2022. Revenue days in the quarter ended December 31, 2023 totaled 6,471 compared with 6,620 in the prior year quarter. Revenue days in

the year ended December 31, 2023 totaled 26,292 compared with 26,495 in the prior year. A summary fleet list by vessel class can be found

later in this press release. The information in these tables excludes commercial pool fees/commissions averaging approximately $853 and

$723 per day for the three months ended December 31, 2023 and 2022, respectively, and approximately $861 and $706 per day for the years

ended December 31, 2023 and 2022, respectively.

| | |

Three Months Ended December 31, 2023 | | |

Three Months Ended December 31, 2022 | |

| | |

Spot | | |

Fixed | | |

Total | | |

Spot | | |

Fixed | | |

Total | |

| Crude Tankers | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| VLCC | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 42,991 | | |

$ | 38,826 | | |

| | | |

$ | 64,596 | | |

$ | 43,883 | | |

| | |

| Number of Revenue Days | |

| 837 | | |

| 276 | | |

| 1,113 | | |

| 799 | | |

| 92 | | |

| 891 | |

| Suezmax | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 47,318 | | |

$ | 30,989 | | |

| | | |

$ | 59,064 | | |

$ | 32,095 | | |

| | |

| Number of Revenue Days | |

| 1,006 | | |

| 184 | | |

| 1,190 | | |

| 1,029 | | |

| 92 | | |

| 1,121 | |

| Aframax | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 43,952 | | |

$ | 38,499 | | |

| | | |

$ | 62,030 | | |

$ | - | | |

| | |

| Number of Revenue Days | |

| 256 | | |

| 92 | | |

| 348 | | |

| 284 | | |

| - | | |

| 284 | |

| Total Crude Tankers Revenue Days | |

| 2,099 | | |

| 552 | | |

| 2,651 | | |

| 2,112 | | |

| 184 | | |

| 2,296 | |

| Product Carriers | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Aframax (LR2) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 43,666 | | |

$ | - | | |

| | | |

$ | - | | |

$ | 18,994 | | |

| | |

| Number of Revenue Days | |

| 92 | | |

| - | | |

| 92 | | |

| - | | |

| 92 | | |

| 92 | |

| Panamax (LR1) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 46,199 | | |

$ | - | | |

| | | |

$ | 63,950 | | |

$ | - | | |

| | |

| Number of Revenue Days | |

| 561 | | |

| - | | |

| 561 | | |

| 818 | | |

| - | | |

| 818 | |

| MR | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 31,493 | | |

$ | 21,599 | | |

| | | |

$ | 39,678 | | |

$ | 20,816 | | |

| | |

| Number of Revenue Days | |

| 2,738 | | |

| 429 | | |

| 3,167 | | |

| 3,350 | | |

| 64 | | |

| 3,414 | |

| Total Product Carriers Revenue Days | |

| 3,391 | | |

| 429 | | |

| 3,820 | | |

| 4,168 | | |

| 156 | | |

| 4,324 | |

| Total Revenue Days | |

| 5,490 | | |

| 981 | | |

| 6,471 | | |

| 6,280 | | |

| 340 | | |

| 6,620 | |

| | |

Fiscal Year Ended December 31, 2023 | | |

Fiscal Year Ended December 31, 2022 | |

| | |

Spot | | |

Fixed | | |

Total | | |

Spot | | |

Fixed | | |

Total | |

| Crude Tankers | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| VLCC | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 45,483 | | |

$ | 40,098 | | |

| | | |

$ | 29,361 | | |

$ | 44,043 | | |

| | |

| Number of Revenue Days | |

| 3,269 | | |

| 979 | | |

| 4,248 | | |

| 3,220 | | |

| 310 | | |

| 3,530 | |

| Suezmax | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 51,293 | | |

$ | 31,065 | | |

| | | |

$ | 32,579 | | |

$ | 28,287 | | |

| | |

| Number of Revenue Days | |

| 4,002 | | |

| 680 | | |

| 4,682 | | |

| 3,901 | | |

| 365 | | |

| 4,266 | |

| Aframax | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 46,841 | | |

$ | 38,566 | | |

| | | |

$ | 36,488 | | |

$ | - | | |

| | |

| Number of Revenue Days | |

| 1,182 | | |

| 164 | | |

| 1,346 | | |

| 1,283 | | |

| - | | |

| 1,283 | |

| Panamax | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | - | | |

$ | - | | |

| | | |

$ | 19,851 | | |

$ | - | | |

| | |

| Number of Revenue Days | |

| - | | |

| - | | |

| - | | |

| 70 | | |

| - | | |

| 70 | |

| Total Crude Tankers Revenue Days | |

| 8,453 | | |

| 1,823 | | |

| 10,276 | | |

| 8,474 | | |

| 675 | | |

| 9,149 | |

| Product Carriers | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| LR2 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 35,842 | | |

$ | 18,588 | | |

| | | |

$ | - | | |

$ | 17,613 | | |

| | |

| Number of Revenue Days | |

| 225 | | |

| 140 | | |

| 365 | | |

| - | | |

| 362 | | |

| 362 | |

| LR1 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 60,428 | | |

$ | - | | |

| | | |

$ | 38,706 | | |

$ | - | | |

| | |

| Number of Revenue Days | |

| 2,826 | | |

| - | | |

| 2,826 | | |

| 3,113 | | |

| - | | |

| 3,113 | |

| MR | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | 29,479 | | |

$ | 21,040 | | |

| | | |

$ | 30,345 | | |

$ | 20,927 | | |

| | |

| Number of Revenue Days | |

| 11,615 | | |

| 1,210 | | |

| 12,825 | | |

| 13,262 | | |

| 140 | | |

| 13,402 | |

| Handy | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average TCE Rate | |

$ | - | | |

$ | - | | |

| | | |

$ | 13,861 | | |

$ | - | | |

| | |

| Number of Revenue Days | |

| - | | |

| - | | |

| - | | |

| 469 | | |

| - | | |

| 469 | |

| Total Product Carriers Revenue Days | |

| 14,666 | | |

| 1,350 | | |

| 16,016 | | |

| 16,844 | | |

| 502 | | |

| 17,346 | |

| Total Revenue Days | |

| 23,119 | | |

| 3,173 | | |

| 26,292 | | |

| 25,318 | | |

| 1,177 | | |

| 26,495 | |

Revenue days in the above tables exclude days related to full service

lighterings and days for which recoveries were recorded under the Company’s loss of hire insurance policies. In addition, during

2023 and 2022, certain of the Company’s vessels were employed on transitional voyages in the spot market prior to delivering to

pools. These transitional voyages are excluded from the tables above.

During the 2023 and 2022 periods, each of the Company’s LR1s

participated in the Panamax International Pool and transported crude oil cargoes exclusively.

Fleet Information

As of December 31, 2023, INSW’s fleet totaled 77 vessels, of

which 63 were owned and 14 were chartered in.

| | |

| | |

| | |

Total at December 31, 2023 | |

| Vessel Fleet and Type | |

Vessels Owned | | |

Vessels

Chartered-in | | |

Total Vessels | | |

Total Dwt | |

| Operating Fleet | |

| | | |

| | | |

| | | |

| | |

| VLCC | |

| 4 | | |

| 9 | | |

| 13 | | |

| 3,910,572 | |

| Suezmax | |

| 13 | | |

| - | | |

| 13 | | |

| 2,061,754 | |

| Aframax | |

| 4 | | |

| - | | |

| 4 | | |

| 452,375 | |

| Crude Tankers | |

| 21 | | |

| 9 | | |

| 30 | | |

| 6,424,701 | |

| | |

| | | |

| | | |

| | | |

| | |

| LR2 | |

| 1 | | |

| - | | |

| 1 | | |

| 112,691 | |

| LR1 | |

| 6 | | |

| 1 | | |

| 7 | | |

| 522,698 | |

| MR | |

| 31 | | |

| 4 | | |

| 35 | | |

| 1,750,854 | |

| Product Carriers | |

| 38 | | |

| 5 | | |

| 43 | | |

| 2,386,243 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Operating Fleet | |

| 59 | | |

| 14 | | |

| 73 | | |

| 8,810,944 | |

| | |

| | | |

| | | |

| | | |

| | |

| Newbuild Fleet | |

| | | |

| | | |

| | | |

| | |

| LR1 | |

| 4 | | |

| - | | |

| 4 | | |

| 294,400 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Newbuild Fleet | |

| 4 | | |

| - | | |

| 4 | | |

| 294,400 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Operating and Newbuild Fleet | |

| 63 | | |

| 14 | | |

| 77 | | |

| 9,105,344 | |

Reconciliation to Non-GAAP Financial Information

The Company believes that, in addition to conventional measures prepared

in accordance with GAAP, the following non-GAAP measures may provide certain investors with additional information that will better enable

them to evaluate the Company’s performance. Accordingly, these non-GAAP measures are intended to provide supplemental information,

and should not be considered in isolation or as a substitute for measures of performance prepared with GAAP.

(A) Adjusted Net Income

Adjusted Net Income consists of Net Income adjusted for the impact

of certain items that we do not consider indicative of our ongoing operating performance. This measure does not represent or substitute

net income or any other financial item that is determined in accordance with GAAP. While Adjusted Net Income is frequently used as a measure

of operating results and performance, it may not be necessarily comparable with other similarly titled captions of other companies due

to differences in methods of calculation. The following table reconciles net income, as reflected in the consolidated statement of operations,

to Adjusted Net Income:

| | |

Three Months Ended

December 31, | | |

Fiscal Year Ended

December 31, | |

| ($ in thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net income | |

$ | 132,114 | | |

$ | 218,429 | | |

$ | 556,446 | | |

$ | 387,891 | |

| Third-party debt modification fees | |

| - | | |

| - | | |

| 568 | | |

| 1,158 | |

| Loss on sale of investments in affiliated companies | |

| - | | |

| - | | |

| - | | |

| 9,513 | |

| Gain on disposal of vessels and other assets, net of impairments | |

| (25,286 | ) | |

| (10,308 | ) | |

| (35,934 | ) | |

| (19,647 | ) |

| Gain on sale of interest in DASM | |

| - | | |

| - | | |

| - | | |

| (135 | ) |

| Write-off of deferred financing costs | |

| 734 | | |

| 656 | | |

| 2,686 | | |

| 1,266 | |

| Loss on extinguishment of debt | |

| - | | |

| - | | |

| 1,323 | | |

| - | |

| Adjusted Net Income | |

$ | 107,562 | | |

$ | 208,777 | | |

$ | 525,089 | | |

$ | 380,046 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding (diluted) | |

| 49,343,856 | | |

| 49,619,307 | | |

| 49,428,967 | | |

| 49,844,904 | |

| Adjusted Net Income per diluted share | |

$ | 2.18 | | |

$ | 4.19 | | |

$ | 10.62 | | |

$ | 7.62 | |

(B) EBITDA and Adjusted EBITDA

EBITDA represents net income before interest expense, income taxes,

and depreciation and amortization expense. Adjusted EBITDA consists of EBITDA adjusted for the impact of certain items that we do not

consider indicative of our ongoing operating performance. EBITDA and Adjusted EBITDA do not represent, and should not be a substitute

for, net income or cash flows from operations as determined in accordance with GAAP. Some of the limitations are: (i) EBITDA and Adjusted

EBITDA do not reflect our cash expenditures, or future requirements for capital expenditures or contractual commitments; (ii) EBITDA and

Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; and (iii) EBITDA and Adjusted EBITDA do

not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt.

While EBITDA and Adjusted EBITDA are frequently used as a measure of operating results and performance, neither of them is necessarily

comparable to other similarly titled captions of other companies due to differences in methods of calculation. The following table reconciles

net income as reflected in the consolidated statements of operations, to EBITDA and Adjusted EBITDA:

| | |

Three Months Ended December 31, | | |

Fiscal Year Ended December 31, | |

| ($ in thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net income | |

$ | 132,114 | | |

$ | 218,429 | | |

$ | 556,446 | | |

$ | 387,891 | |

| Income tax provision | |

| 3,446 | | |

| 25 | | |

| 3,878 | | |

| 88 | |

| Interest expense | |

| 14,081 | | |

| 17,091 | | |

| 65,759 | | |

| 57,721 | |

| Depreciation and amortization | |

| 33,682 | | |

| 28,404 | | |

| 129,038 | | |

| 110,388 | |

| EBITDA | |

| 183,323 | | |

| 263,949 | | |

| 755,121 | | |

| 556,088 | |

| Amortization of time charter contracts acquired | |

| - | | |

| - | | |

| - | | |

| 842 | |

| Third-party debt modification fees | |

| - | | |

| - | | |

| 568 | | |

| 1,158 | |

| Loss on sale of investments in affiliated companies | |

| - | | |

| - | | |

| - | | |

| 9,513 | |

| Gain on disposal of vessels and other assets, net of impairments | |

| (25,286 | ) | |

| (10,308 | ) | |

| (35,934 | ) | |

| (19,647 | ) |

| Gain on sale of interest in DASM | |

| - | | |

| - | | |

| - | | |

| (135 | ) |

| Write-off of deferred financing costs | |

| 734 | | |

| 656 | | |

| 2,686 | | |

| 1,266 | |

| Loss on extinguishment of debt | |

| - | | |

| - | | |

| 1,323 | | |

| - | |

| Adjusted EBITDA | |

$ | 158,771 | | |

$ | 254,297 | | |

$ | 723,764 | | |

$ | 549,085 | |

(C) Cash

| | |

December 31, | | |

December 31, | |

| ($ in thousands) | |

2023 | | |

2022 | |

| Cash and cash equivalents | |

$ | 126,760 | | |

$ | 243,744 | |

| Short-term investments | |

| 60,000 | | |

| 80,000 | |

| Total Cash | |

$ | 186,760 | | |

$ | 323,744 | |

(D) Time Charter Equivalent (TCE) Revenues

Consistent with general practice in the shipping industry, the Company

uses TCE revenues, which represents shipping revenues less voyage expenses, as a measure to compare revenue generated from a voyage charter

to revenue generated from a time charter. Time charter equivalent revenues, a non-GAAP measure, provides additional meaningful information

in conjunction with shipping revenues, the most directly comparable GAAP measure, because it assists Company management in making decisions

regarding the deployment and use of its vessels and in evaluating their financial performance. Reconciliation of TCE revenues of the segments

to shipping revenues as reported in the consolidated statements of operations follow:

| | |

Three Months Ended December 31, | | |

Fiscal Year Ended December 31, | |

| ($ in thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Time charter equivalent revenues | |

$ | 247,912 | | |

$ | 335,650 | | |

$ | 1,055,519 | | |

$ | 853,710 | |

| Add: Voyage expenses | |

| 2,822 | | |

| 2,507 | | |

| 16,256 | | |

| 10,955 | |

| Shipping revenues | |

$ | 250,734 | | |

$ | 338,157 | | |

$ | 1,071,775 | | |

$ | 864,665 | |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=insw_RightscommonstockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

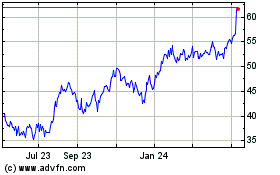

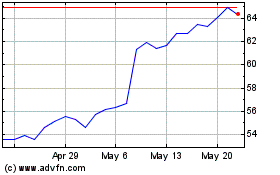

International Seaways (NYSE:INSW)

Historical Stock Chart

From Apr 2024 to May 2024

International Seaways (NYSE:INSW)

Historical Stock Chart

From May 2023 to May 2024