Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

November 23 2022 - 5:10PM

Edgar (US Regulatory)

|

November 2022 MOBU Focus ER Index Supplement Addendum to the MOBU Focus ER Index Supplement, the Prospectus Supplement and the Prospectus, each as may be amended from time to time, that form a part of Registration Statement No. 333-253421 |

Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-253421 |

|

|

GS Finance Corp.

Medium-Term Notes, Series F

guaranteed by

The Goldman Sachs Group, Inc. |

|

Goldman Sachs Momentum Builder® Focus ER Index |

The Goldman Sachs Momentum Builder® Focus ER Index (the index) measures the performance of a “base index” and non-interest bearing cash positions subject to certain deductions, as described in further detail below. On each index business day, exposure to the base index will be reduced and exposure to the non-interest bearing cash positions increased if (i) the realized volatility of the base index exceeds a volatility control limit of 5% (we refer to the base index, after applying this volatility control limit, as the “volatility controlled index”) or (ii) the volatility controlled index has exhibited negative price momentum.

The base index is composed of underlying assets, which consist of (i) nine underlying indices, potentially providing exposure to the following asset classes: focused U.S. equities; other developed market equities; developed market fixed income; emerging market equities; and commodities; and (ii) a money market position that accrues interest at a rate equal to the federal funds rate (the “return-based money market position”). The base index rebalances on each index business day based on historical returns of the underlying assets, subject to a limitation on realized volatility (which is separate from the volatility control mechanism described in the paragraph above) and minimum and maximum weights for the underlying assets and asset classes. As a result of the rebalancing, the base index may include as few as 2 underlying assets (including the return-based money market position) and may never include some of the underlying indices or asset classes.

The daily base index return is subject to a deduction equal to the return on the federal funds rate and, in addition, the entire index is subject to a deduction of 0.65% per annum (accruing daily).

The net effect of the deduction for the federal funds rate on the base index and the 0.65% deduction on the full index means that any aggregate exposure to the return-based money market position or the non-interest bearing cash positions will reduce the index performance on a pro rata basis by 0.65%. A very significant portion of the index has been, and may be in the future, allocated to the return-based money market position and the non-interest bearing cash positions.

|

Historical Information and Hypothetical Data |

|

The following chart and table provide a comparison between the index (using historical information and hypothetical data, as explained below) and certain asset classes (in each case, represented by a benchmark ETF or a benchmark index, which are distinct from the asset classes in which the 10 underlying assets have been categorized for purposes of this index) from January 1, 2017 to November 14, 2022.

|

Your investment in securities linked to the index involves certain risks. See “Selected Risk Factors” on page S-5 to read about investment risks relating to such securities.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this index supplement addendum, the applicable pricing supplement, the applicable product supplement, if any, the accompanying MOBU Focus ER index supplement, the accompanying prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The securities are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Goldman Sachs & Co. LLC

November 2022 MOBU Focus ER Index Supplement Addendum dated November 22, 2022.

S-1

November 2022 MOBU Focus ER Index Supplement Addendum

Dated November 22, 2022

|

|

|

As of November 14, 2022 |

Goldman Sachs Momentum Builder® Focus ER Index (GSMBFC5) |

US Equities (SPY Excess Return) |

Global Equities (MSCI ACWI Excess Return) |

US Bonds (AGG Excess Return) |

Commodities (S&P GSCI Excess Return) |

|

Effective Performance (1 Month) |

0.43% |

10.17% |

11.14% |

1.61% |

1.40% |

|

Effective Performance (6 Month) |

-0.49% |

-1.49% |

-2.27% |

-6.22% |

-10.77% |

|

Annualized* Performance (since January 2017) |

2.63% |

10.82% |

7.33% |

-0.81% |

5.97% |

|

Annualized* Realized Volatility (since January 2017)** |

3.82% |

19.55% |

15.90% |

5.20% |

23.24% |

|

Return over Risk (since January 2017)*** |

0.69 |

0.55 |

0.46 |

-0.16 |

0.26 |

|

Maximum Peak-to-Trough Drawdown**** |

-5.65% |

-33.79% |

-33.82% |

-19.32% |

-59.02% |

|

* |

Calculated on a per annum percentage basis. |

|

** |

Calculated on the same basis as realized volatility used in calculating the index. |

|

*** |

Calculated by dividing the annualized performance by the annualized realized volatility since January 1, 2017. |

|

**** |

The largest percentage decline experienced in the relevant measure from a previously occurring maximum level. |

|

|

|

Benchmark ETF data and benchmark index data is based on the historical levels of the benchmark ETFs and benchmark indices, respectively. The historical index information from January 12, 2021 (the index launch date) to November 14, 2022 reflects the actual performance of the index. (In the chart, this historical index information can be found to the right of the vertical solid line marker.) The hypothetical index data from January 1, 2017 to January 11, 2021 is based on the historical levels of the eligible underlying assets, using the same methodology that is used to calculate the index. As a result, the above chart and table do not reflect the global financial crisis which began in 2008, which had a materially negative impact on certain of the benchmark ETFs, benchmark indices and eligible underlying assets and would have had a materially negative impact on the index. Please also note that the benchmark ETFs and benchmark indices that are used to represent asset classes for purposes of the above table and chart may not be eligible underlying assets for purposes of the index and in some cases differ from the eligible underlying assets that are used to represent asset classes with the same or similar titles for purposes of the index. You should not take the historical index information, hypothetical index data or historical benchmark ETF and benchmark index data as an indication of the future performance of the index. |

|

|

Monthly Performance Since January 2017 |

The following chart sets forth hypothetical and historical monthly index performance data during the period from January 1, 2017 to October 31, 2022 based on the historical index information and hypothetical index data previously supplied above. You should not take the historical index information or hypothetical index data as an indication of the future performance of the index.

|

Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Annual |

|

2022 |

-0.96% |

-0.13% |

0.17% |

-0.54% |

-0.33% |

-0.43% |

0.21% |

-0.27% |

-0.52% |

0.30% |

|

|

-2.50%* |

|

2021 |

-0.40%** |

-0.46% |

1.64% |

0.67% |

0.62% |

0.19% |

0.89% |

0.83% |

-2.69% |

0.94% |

-1.14% |

0.59% |

1.60% |

|

2020 |

1.31% |

-2.09% |

-0.59% |

0.82% |

0.48% |

0.53% |

0.43% |

0.88% |

-0.94% |

-0.85% |

2.51% |

0.85% |

3.30% |

|

2019 |

0.55% |

-0.01% |

0.43% |

0.66% |

-0.99% |

3.14% |

0.80% |

1.72% |

-1.25% |

0.78% |

0.12% |

1.18% |

7.31% |

|

2018 |

2.79% |

-1.95% |

-0.73% |

-0.06% |

0.55% |

0.08% |

-0.15% |

1.39% |

-0.69% |

-2.96% |

0.11% |

-0.35% |

-2.05% |

|

2017 |

0.25% |

1.12% |

0.45% |

1.28% |

1.10% |

-1.84% |

1.27% |

0.65% |

0.07% |

2.07% |

0.77% |

0.70% |

8.14% |

* To October 31, 2022

** Historical Performance begins January 12, 2021 (the index launch date)

S-2

November 2022 MOBU Focus ER Index Supplement Addendum

Dated November 22, 2022

As of November 14, 2022, the following chart sets forth the weighting of each eligible base index underlying asset in the base index as of November 14, 2022 and the hypothetical and historical average percentage weightings of the eligible base index underlying assets, the highest percentage weightings of the eligible base index underlying assets and the percentage of index business days with positive weightings for the eligible base index underlying assets in the base index from January 1, 2017 to November 14, 2022 (the period for which eligible base index underlying assets is available). This data reflects the same historical information and hypothetical data as in the previous tables. You should not take the historical information or hypothetical data as an indication of the future performance of the index.

|

Eligible Base Index Underlying Asset |

Weighting (as of November 14, 2022)* |

Average Weighting |

Highest Weighting |

Percentage of Index Business Days When Eligible Base Index Underlying Asset is Included as a Base Index Underlying Asset |

|

US Equity Futures Rolling Strategy Index |

20.00% |

14.37% |

30.00% |

94.75% |

|

US Technology Equity Futures Rolling Strategy Series Q Total Return Index |

0.00% |

9.58% |

29.58% |

86.00% |

|

European Equity Futures Rolling Strategy Index |

0.03% |

4.38% |

24.49% |

63.46% |

|

Japanese Equity Futures Rolling Strategy Index |

1.48% |

5.68% |

27.44% |

78.99% |

|

US Government Bond Futures Rolling Strategy Index |

0.00% |

11.59% |

59.57% |

64.70% |

|

European Government Bond Futures Rolling Strategy Index |

0.00% |

17.65% |

58.91% |

74.69% |

|

Japanese Government Bond Futures Rolling Strategy Index |

0.57% |

8.05% |

56.21% |

64.55% |

|

Emerging Markets Equity Futures Rolling Strategy Index |

0.00% |

1.52% |

19.67% |

38.15% |

|

Bloomberg Gold Subindex Total Return |

0.00% |

5.96% |

25.00% |

77.10% |

|

Money Market Position |

77.92% |

21.22% |

78.97% |

83.66% |

|

|

Eligible Base Index Underlying Assets |

The following is a list of the eligible base index underlying assets for the index, including the related base index asset classes, base index asset class minimum and maximum weights and base index underlying asset minimum and maximum weights.

|

Base Index Asset Class |

Base Index Asset Class Minimum Weight |

Base Index Asset Class Maximum

Weight |

Eligible Base Index Underlying

Asset |

Ticker |

Base Index Underlying Asset Minimum Weight |

Base Index Underlying Asset Maximum Weight |

|

Focused US Equities |

20% |

50% |

US Equity Futures Rolling Strategy Index |

FRSIUSE |

0%** |

30% |

|

US Technology Equity Futures Rolling Strategy Series Q Total Return Index |

GSISNQET |

0%** |

30% |

|

Other Developed Market Equities |

0% |

50% |

European Equity Futures Rolling Strategy Index |

FRSIEUE |

0% |

30% |

|

Japanese Equity Futures Rolling Strategy Index |

FRSIJPE |

0% |

30% |

|

Developed Market Fixed Income |

0% |

80% |

US Government Bond Futures Rolling Strategy Index |

FRSIUSB |

0% |

60% |

|

European Government Bond Futures Rolling Strategy Index |

FRSIEUB |

0% |

60% |

|

Japanese Government Bond Futures Rolling Strategy Index |

FRSIJPB |

0% |

60% |

|

Emerging Market Equities |

0% |

20% |

Emerging Markets Equity Futures Rolling Strategy Index |

FRSIEME |

0% |

20% |

|

Commodities |

0% |

25% |

Bloomberg Gold Subindex Total Return |

BCOMGCTR |

0% |

25% |

|

Cash Equivalent |

0% |

80%* |

Return-Based Money Market Position |

N/A |

0% |

80%* |

* The base index asset class maximum weight and base index underlying asset maximum weight applicable to the Cash Equivalent in the table only apply to the return-based money market position in the base index, and not the deleverage cash position or the momentum risk control cash position (which are outside of the base index). As a result of the volatility control and momentum risk control adjustment features, the index may allocate nearly its entire exposure to hypothetical cash positions.

S-3

November 2022 MOBU Focus ER Index Supplement Addendum

Dated November 22, 2022

** Although the underlying asset weight of each of the US Large-Cap Equities (US Equity Futures Rolling Strategy Index) and US Technology Equities (US Technology Equity Futures Rolling Strategy Series Q Total Return Index) may be as low as 0%, their minimum combined weight must equal at least 20%.

S-4

November 2022 MOBU Focus ER Index Supplement Addendum

Dated November 22, 2022

An investment in securities linked to the index is subject to the risks described below as well as the risks and considerations described in the accompanying MOBU Focus ER index supplement no. 21, the applicable pricing supplement, the applicable product supplement, if any, the accompanying prospectus supplement and the accompanying prospectus. The following risk factors are discussed in greater detail in the applicable pricing supplement and the accompanying MOBU Focus ER index supplement no. 21

Risks Related to the Index

|

▪ |

The Index Measures the Performance of the Underlying Assets on an Excess Return Basis Less the Deduction Rate |

|

▪ |

Your Investment in the Securities May Be Subject to Concentration Risks. The assets underlying an eligible underlying asset may represent a particular market or commodity sector, a particular geographic region or some other sector or asset class. As a result, your investment in the securities may be concentrated in a single sector or asset class even though there are maximum weights for each base index underlying asset and each base index asset class. |

|

▪ |

You May Not Have Exposure to One or More of the Eligible Underlying Assets During the Term of the Securities |

|

▪ |

The Weight of Each Underlying Asset in the Base Index Reflects the Average of the Average of the Weights of Such Underlying Asset Over Three Look-Back Periods and Over the Weight Averaging Period |

|

▪ |

The Index May Not Successfully Capture Price Momentum |

|

▪ |

Base Index Asset Class Maximum Weights May in Many Cases Prevent All of the Eligible Base Index Underlying Assets in a Base Index Asset Class From Being Included in the Base Index at Their Base Index Underlying Asset Maximum Weights |

|

▪ |

The Index’s Exposure to the Performance of Underlying Indices May Be Limited by Deleveraging and the Weight and Volatility Constraints |

|

▪ |

If the Level of the Index Changes, the Market Value of Your Securities May Not Change in the Same Manner |

|

▪ |

Past Index Performance is No Guide to Future Performance |

|

▪ |

The Lower Performance of One Underlying Asset May Offset an Increase in the Other Underlying Assets |

|

▪ |

Because Historical Returns and Realized Volatility Are Measured on an Aggregate Basis, the Index Could Include Eligible Underlying Assets With a High Realized Volatility and Could Exclude Eligible Underlying Assets With a High Historical Return |

|

▪ |

Correlation of Performances Among the Underlying Assets May Reduce the Performance of the Index |

|

▪ |

The Index May Have a Very Substantial Allocation to Hypothetical Cash Positions and Other Potentially Low-Yielding Assets on Any or All Days During the Term of the Securities |

|

▪ |

The Index’s Momentum Risk Control Adjustment Mechanism May Not Work as Intended and May Limit Returns |

|

▪ |

Base Index Allocations May Be Affected by the Methodology Algorithm |

|

▪ |

The Eligible Underlying Indices are Linked to Futures Strategies |

|

▪ |

Certain Eligible Underlying Assets are Subject to an Internal Currency Hedge, Which May Not be Effective |

|

▪ |

The Index May Perform Poorly During Periods Characterized by Increased Short-Term Volatility |

|

▪ |

Index Market Disruption Events Could Affect the Level of the Index on Any Date |

|

▪ |

The Index Has a Limited Operating History |

|

▪ |

The Historical Levels of the Notional Interest Rate Are Not an Indication of the Future Levels of the Notional Interest Rate |

|

▪ |

The Policies of the Index Sponsor, Index Committee and Index Calculation Agent, and Changes That Affect the Index or the Underlying Indices, Could Affect the Amount Payable on Your Securities and Their Market Value |

|

▪ |

The Index Calculation Agent Will Have Authority to Make Determinations that Could Affect the Value of Your Securities and the Amount You Receive at Maturity. The Goldman Sachs Group, Inc. Owns a Non-Controlling Interest in the Index Calculation Agent |

|

▪ |

As Index Sponsor, GS&Co. Can Replace the Index Calculation Agent at Any Time |

|

▪ |

The Index Calculation Agent Can Resign Upon Notification to the Index Sponsor |

Risks Related to the Eligible Underlying Indices

Risks related to eligible underlying indices comprised of futures contracts (including the US Equity Futures Rolling Strategy Index, the US Technology Equity Futures Rolling Strategy Series Q Total Return Index, the European Equity Futures Rolling Strategy Index, the Japanese Equity Futures Rolling Strategy Index, the US Government Bond Futures Rolling Strategy Index, the European Government Bond Futures Rolling Strategy Index, the Japanese Government Bond Futures Rolling Strategy Index, the Emerging Markets Equity Futures Rolling Strategy Index and the Bloomberg Gold Subindex Total Return)

|

▪ |

Suspension or Disruptions of Market Trading in Futures Contracts Included in an Eligible Underlying Index May Adversely Affect the Level of the Index |

|

▪ |

A Negative Roll Yield Could Reduce the Level of an Eligible Underlying Index and Therefore the Level of the Index |

S-5

November 2022 MOBU Focus ER Index Supplement Addendum

Dated November 22, 2022

|

▪ |

Futures Contracts Are Not Assets with Intrinsic Value |

Risks related to eligible underlying indices sponsored by Goldman Sachs International (including the US Equity Futures Rolling Strategy Index, the US Technology Equity Futures Rolling Strategy Series Q Total Return Index, the European Equity Futures Rolling Strategy Index, the Japanese Equity Futures Rolling Strategy Index, the US Government Bond Futures Rolling Strategy Index, the European Government Bond Futures Rolling Strategy Index, the Japanese Government Bond Futures Rolling Strategy Index and the Emerging Markets Equity Futures Rolling Strategy Index)

|

▪ |

The Calculation Agent of an Eligible Underlying Index Will Have Authority to Make Determinations that Could Affect the Level of the Index |

|

▪ |

The Policies of Goldman Sachs International, the Sponsor of Certain Eligible Underlying Indices, and Policy Changes That Affect Such Eligible Underlying Indices Could Affect the Level of the Index |

Risks related to eligible underlying indices comprised of futures contracts on reference equity indices (including the US Equity Futures Rolling Strategy Index, the US Technology Equity Futures Rolling Strategy Series Q Total Return Index, the European Equity Futures Rolling Strategy Index, the Japanese Equity Futures Rolling Strategy Index and the Emerging Markets Equity Futures Rolling Strategy Index)

|

▪ |

Except to the Extent the Goldman Sachs Group, Inc. Is One of the Companies Whose Common Stock Comprises the S&P 500® Index, and Except to the Extent That We or Our Affiliates May Currently or in the Future Own Assets of, or Engage in Business With, the Issuers of Assets Comprising a Reference Equity Index That Is the Subject of a Futures Contract that Comprises One of the Equity Futures Rolling Strategy Indices, There is No Affiliation Between Us and Any Issuer of Assets Comprising Any Reference Equity Index That Is the Subject of a Futures Contract that Comprises One of the Equity Futures Rolling Strategy Indices |

Risks related to eligible underlying indices comprised of foreign assets (including the US Technology Equity Futures Rolling Strategy Series Q Total Return Index, the European Equity Futures Rolling Strategy Index, the Japanese Equity Futures Rolling Strategy Index and the Emerging Markets Equity Futures Rolling Strategy Index)

|

▪ |

Your Securities Will Be Subject to Foreign Currency Exchange Rate Risk |

|

▪ |

Regulators Are Investigating Potential Manipulation of Published Currency Exchange Rates |

|

▪ |

Even Though Currencies Trade Around-The-Clock, Your Securities Will Not |

|

▪ |

Intervention in the Foreign Currency Exchange Markets by the Countries Issuing Any Currency In Which an Asset Comprising an Eligible Underlying Index Trades or Is Denominated Could Adversely Affect the Level of the Index |

|

▪ |

Suspensions or Disruptions of Market Trading in One or More Foreign Currencies May Adversely Affect the Value of Your Securities |

|

▪ |

Your Investment in the Securities Will Be Subject to Risks Associated with Foreign Securities Markets |

|

▪ |

Government Regulatory Action, Including Legislative Acts and Executive Orders, Could Result in Material Changes to the Composition of a Reference Equity Index with Assets from One or More Foreign Securities Markets and Could Negatively Affect the Level of the Index |

Risks related to underlying indices comprised of debt securities (including the US Government Bond Futures Rolling Strategy Index, the European Government Bond Futures Rolling Strategy Index and the Japanese Government Bond Futures Rolling Strategy Index)

|

▪ |

Your Investment is Subject to Interest Rate Risk |

|

▪ |

Your Investment is Subject to Investment-Grade Credit Risk |

|

▪ |

Your Investment is Subject to Concentration Risks. The US Government Bond Futures Rolling Strategy Index is comprised of futures on U.S. Treasury bonds that are obligations of the United States, the European Government Bond Futures Rolling Strategy Index is comprised of futures on Euro bonds issued by the Federal Republic of Germany and the Japanese Government Bond Futures Rolling Strategy Index is comprised of futures on Japanese government bonds that are obligations of Japan (each such debt security, a “reference bond”). As a result, each such eligible underlying index is concentrated in the performance of bonds issued by a single issuer and having the same general tenor and terms. |

Risks related to the US Technology Equity Futures Rolling Strategy Series Q Total Return Index

|

▪ |

As Compared to Other Index Sponsors, Nasdaq, Inc. Retains Significant Control and Discretionary Decision-Making Over the Nasdaq-100 Index®, Which May Have an Adverse Effect on the Level of the Nasdaq-100 Index® and on Your Securities |

Risks related to the Japanese Equity Futures Rolling Strategy Index

|

▪ |

TOPIX Recently Implemented Methodology Changes That Are Being Carried Out In Stages Through January 2025; Limited Historical Japanese Equity Futures Rolling Strategy Index Performance Information Is Available Incorporating the Changes to TOPIX That Have Been Carried Out To Date |

Risks related to the Bloomberg Gold Subindex Total Return

|

▪ |

The Policies of the Sponsor of the Bloomberg Gold Subindex Total Return and Changes that Affect the Bloomberg Gold Subindex Total Return Could Affect the Level of the Index |

|

▪ |

Your Investment is Subject to Concentration Risks. The Bloomberg Gold Subindex Total Return is concentrated |

S-6

November 2022 MOBU Focus ER Index Supplement Addendum

Dated November 22, 2022

|

in a single commodity. As a result, the performance of the Bloomberg Gold Subindex Total Return will be concentrated in the performance of that specific commodity. |

|

▪ |

Legal and Regulatory Changes Could Adversely Affect the Level of the Index |

|

▪ |

Ongoing Commodities-Related Regulatory Investigations And Private Litigation Could Affect Prices for Commodities, Which Could Adversely Affect Your Securities |

|

▪ |

Various Unpredictable Factors May Affect the Performance of the Bloomberg Gold Subindex Total Return |

|

▪ |

The Sponsor of the Bloomberg Gold Subindex Total Return May Be Required to Replace a Designated Contract If the Existing Commodities Contract Is Terminated or Replaced |

|

▪ |

Linking to a Commodity Futures Contract is Different From Linking to the Spot Price of the Applicable Physical Commodity |

|

▪ |

There Are Risks Associated with an Investment Linked to the Prices of Commodities Generally |

|

▪ |

Economic or Political Events or Crises Could Result in Large-Scale Purchases or Sales of the Bloomberg Gold Subindex Total Return, Which Could Affect the Price of the Bloomberg Gold Subindex Total Return and May Adversely Affect the Level of the Index |

|

▪ |

Substantial Sales of the Bloomberg Gold Subindex Total Return by Governments or Public Sector Entities Could Result in Price Decreases, Which Would Adversely Affect the Level of the Index |

|

|

About This Index Supplement Addendum |

GS Finance Corp. may use this index supplement addendum in the initial sale of the securities. In addition, Goldman Sachs & Co. LLC (GS&Co.), or any other affiliate of GS Finance Corp., may use this index supplement addendum in a market-making transaction in a security after its initial sale. Unless GS Finance Corp. or its agent informs the purchaser otherwise in the confirmation of sale, this index supplement addendum is being used in a market-making transaction.

S-7

We have not authorized anyone to provide any information or to make any representations other than those contained in or incorporated by reference in this index supplement addendum, the accompanying index supplement no. 21, the accompanying prospectus supplement or the accompanying prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide. This index supplement addendum is an offer to sell only the notes offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this index supplement addendum, the accompanying index supplement no. 21, the accompanying prospectus supplement and the accompanying prospectus is current only as of the respective dates of such documents.

TABLE OF CONTENTS

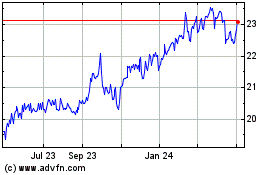

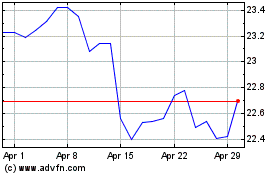

Goldman Sachs (NYSE:GS-A)

Historical Stock Chart

From Mar 2024 to Apr 2024

Goldman Sachs (NYSE:GS-A)

Historical Stock Chart

From Apr 2023 to Apr 2024