Forum Energy Technologies, Inc. Announces Commencement of Exchange Offer & Consent Solicitation for 6.250% Senior Notes due 2...

July 06 2020 - 6:16AM

Business Wire

Forum Energy Technologies, Inc. (“Forum” or the “Company”)

(NYSE: FET) today announced it has commenced an offer to exchange

its existing notes for new 9.00% convertible secured notes due

2025. The new notes will pay interest at the rate of 9.00% (as

compared to the rate of 6.25% on the existing notes). Of such

interest, 6.25% will be payable in cash and 2.75% will be payable

in cash or additional notes, at the Company’s option. The new notes

will mature five years from issuance (as compared to the maturity

of October 1, 2021 on the existing notes). The new notes will be

secured by a first lien on substantially all of the Company’s

assets, except for revolving credit facility collateral, which will

secure the new notes on a second lien basis (while the existing

notes will remain unsecured). The new notes will also be

convertible into common stock as described in more detail

below.

Investors who participate in the exchange offer will receive

$1,000 principal amount of new notes for each $1,000 principal

amount of existing notes tendered; provided, that the tenders are

submitted by 5:00 p.m. ET on July 17, 2020, unless extended. In

addition, Holders who submit tenders by 5:00 p.m. ET on July 17,

2020 will receive a pro rata portion of a total payment of

$3,500,000 in cash. Holders who tender after July 17, 2020 will not

be eligible to receive any cash fee and will only receive $950 of

new notes per $1,000 of existing notes. Holders who participate in

the exchange offer will also be giving their consents to eliminate

certain restrictive covenants and events of default in the existing

notes. The exchange offer will expire on July 31, 2020, unless

extended. Accrued and unpaid interest on the existing notes that

are exchanged will be paid in cash.

The exchange offer is conditioned on minimum participation of at

least 95% of the outstanding existing notes. Unless this minimum

condition is satisfied or waived, the Company will not be obligated

to consummate the exchange. Holders of approximately $217 million

principal amount, or 66.14%, of the Company’s $328 million of

existing 6.25% Senior Notes due 2021 have agreed to support the

exchange offer by the Company.

Any existing notes that remain outstanding after closing of the

exchange offer will be effectively subordinated to the new notes

with respect to substantially all the assets of the Company. In

addition, the covenants for the existing notes will be eliminated

upon the receipt of the requisite majority consents.

A portion of the new notes equal to $150 million total principal

amount (or 46% of the new notes minimum aggregate principal amount,

subject to certain adjustments) will be mandatorily convertible

into common stock on a pro rata basis at a conversion price of

$1.35 per share, subject, however, to the condition that the

average of the daily trading prices for the common stock over the

preceding 20-trading day period is at least $1.50 per share. The

conversion price of $1.35 per share represents a premium of 178.4%

to the closing price of the Company’s common stock on July 2, 2020.

Investors in the new notes will also have optional conversion

rights in the event that the Company elects to redeem the new notes

in cash and at the final maturity of the new notes. The conversion

of the new notes into more than 20% of the Company’s common stock

will require shareholder approval. A failure to obtain such

approval by June 30, 2021 will constitute an event of default under

the new notes.

The description above includes only a summary of certain key

terms of the exchange offer. The complete terms and conditions of

the exchange offer are contained in a registration statement on

Form S-4 for the new notes, including a prospectus, which is

subject to change, filed today by the Company with the Securities

and Exchange Commission, which registration statement is not yet

effective. Investors are urged to carefully read the prospectus

before making any decision with respect to the exchange offer.

BofA Securities, Wells Fargo Securities, LLC, Citigroup Global

Markets Inc. and J.P. Morgan Securities LLC are acting as the

dealer managers for the exchange offer. The exchange offer is being

made, and the new notes are being offered and issued, only to

holders of existing notes. Copies of the prospectus pursuant to

which the exchange offer is being made may be obtained from D.F.

King & Co., Inc., the information agent and exchange agent for

the exchange offer, at (866) 864-7961 (toll-free) or (212) 269-5550

(for banks and brokers), email forum@dfking.com or access the

website www.dfking.com/forum. Questions regarding the terms and

conditions of the exchange offer should be directed to BofA

Securities at (980) 388-3646 or debt_advisory@bofa.com.

The Company will also pay a retail broker’s fee of $2.50 in cash

per $1,000 principal amount of tendered notes, subject to a cap of

$1,000 in cash per investor and subject to completion of the

required documentation.

None of the Company, the dealer managers, the trustee with

respect to the existing notes and the new notes, the information

and exchange agent or any affiliate of any of them makes any

recommendation as to whether holders of the existing notes should

exchange their existing notes for new notes in the exchange offer,

and no one has been authorized by any of them to make such a

recommendation. Holders must make their own decision as to whether

to tender existing notes and, if so, the principal amount of

existing notes to tender.

A registration statement relating to these securities has been

filed with the Securities and Exchange Commission but has not yet

become effective. These securities may not be sold nor may offers

to buy be accepted prior to the time the registration statement

becomes effective. This press release is for informational purposes

only and is not an offer to purchase or a solicitation of an offer

to purchase or sell any securities, nor shall there be any sale of

any securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction.

About Forum

Forum Energy Technologies, Inc. is a global oilfield products

company, serving the drilling, downhole, subsea, completions and

production sectors of the oil and natural gas industry. The

Company’s products include highly engineered capital equipment as

well as products that are consumed in the drilling, well

construction, production and transportation of oil and natural gas.

Forum is headquartered in Houston, TX with manufacturing and

distribution facilities strategically located around the globe. For

more information, please visit www.f-e-t.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200706005218/en/

Investor Contact Lyle Williams 713.351.7920

lyle.williams@f-e-t.com

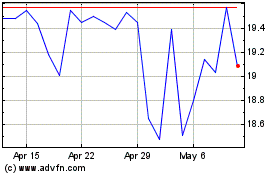

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From Apr 2024 to May 2024

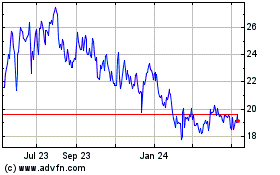

Forum Energy Technologies (NYSE:FET)

Historical Stock Chart

From May 2023 to May 2024