Filed by Stratasys Ltd.

(Commission File No. 001-35751)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Desktop Metal, Inc. (Commission

File No. 001-38835)

The following is a transcript of a conference call held on May 25,

2023:

Operator

Hello and welcome to

the Stratasys and Desktop Metal Combination Conference Call and Webcast. If anyone should require operator assistance, please press star-zero

on your telephone keypad. A question and answer session will follow the formal presentation. You may press star-one at any time to be

placed into the question queue. As a reminder, this conference is being recorded.

It’s now my pleasure

to turn the call over to Yonah Lloyd, Chief Communications Officer and Vice President, Investor Relations. Please go ahead, Yonah.

Yonah Lloyd –

Stratasys Ltd. – Chief Communications Officer and Vice President of Investor Relations

Thank you, Kevin, and

welcome, everyone. We appreciate you joining us on short notice to discuss today’s announcement that Stratasys and Desktop Metal will

combine to create a premier global provider of industrial additive manufacturing solutions. Before we begin, I would like to call your

attention to our legal disclaimers here on slide two.

With that, today I am

joined by Ric Fulop, Chairman and CEO of Desktop Metal, and Dr. Yoav Zeif, CEO of Stratasys. Yoav will kick off today’s call by discussing

the highlights of the transaction and our excitement for the future as a combined company. Ric will then provide an overview of the combined

companies’ capabilities and significant opportunity ahead. There are substantial financial benefits to this combination, and Yoav will

discuss our expectations for synergies and combined financial profile. We will then open the call to questions.

As you may have seen in our press release, Stratasys today reaffirmed

the guidance provided on May 16, 2023, when the company reported its first quarter earnings results, including its medium-term financial

forecast. Desktop Metal also reaffirmed full year 2023 guidance provided with its first quarter earnings results on May 10.

I will now turn the call over to Yoav. Yoav?

Yoav Zeif – Stratasys Ltd. – Chief Executive Officer

Thank you, and good afternoon, everyone. This is an important milestone

for Stratasys and Desktop Metal. We are excited to create a next-generation additive manufacturing company delivering industrial polymer,

metal, sand and ceramic solutions from design to mass production. This compelling strategic combination delivers significant value for

shareholders.

In light of how we have grown and developed our technology, as we discussed

this transaction with Desktop Metal, it was clear that the combination of our companies would significantly accelerate our growth trajectories,

creating a uniquely scaled industrial additive manufacturing company. This is a landmark moment that will transform our companies and

help us to drive long-term sustainable growth.

Together, we will have a diversified and wholesome product portfolio

and one of the largest global go to market networks in 3D printing. Our combined materials library is highly differentiated. Our more

than 3,400 patents, granted and pending, representing years of investment, will enable us to continue to drive innovation for our customers.

We believe there is significant potential to unlock additional value by providing customers’ access to recognizable brands backed

up by premier customer support capabilities.

This transaction also creates an opportunity to realize approximately

$50 million in annual run rate cost synergies and approximately $50 million in annual run rate revenue synergies across the business by

2025. Combined, we expect to deliver approximately 10% to 12% of adjusted EBITDA margin in 2025.

The combined company will unite the polymer capabilities of Stratasys

with the complementary industrial production leadership of Desktop Metal brands to serve the evolving needs of customers in the fastest-growing

verticals. I know the industry very well. Stratasys and Desktop Metal have watched each other innovate and grow over the years.

We have gotten to know the Desktop Metal team even better while evaluating

this opportunity, and those discussions have led us to this milestone announcement today. This combination presents our shareholders,

customers and employees with a unique opportunity with the potential for robust value creation.

We are bringing together complementary products and technologies that

cover a wide range of industry verticals and use cases. Stratasys brings our position in polymer 3D printing and exceptional strength

in aerospace, automotive, consumer products, healthcare and dental verticals. And Desktop Metal brings its leadership in mass production

of metal, sand, ceramic, and restorative dental 3D printing solutions.

Let’s turn to slide six for an overview of the transaction. The combination

of Stratasys and Desktop Metal is structured as a stock for stock merger valued at approximately $1.8 billion. After the transaction closes,

Desktop Metal stockholders will receive 0.123 ordinary shares of Stratasys for each share of Desktop Metal Class A common stock. This

represents a value of approximately $1.88 per share of Desktop Metal Class A common stock based on the closing price of a Stratasys ordinary

share of $15.26 on May 23rd, 2023. This structure will enable both companies to participate in what we believe is significant upside potential

as a larger, stronger combined company.

Following the closing of the transaction, existing Stratasys shareholders

will own approximately 59% of the combined company and legacy Desktop Metal stockholders will own approximately 41% on a fully diluted

basis. We look forward to working together toward the closing of the transaction, which is expected to occur in the fourth quarter of

2023, subject to approval by both companies’ shareholders and other customary closing conditions, including the receipt of certain governmental

and regulatory approvals.

After the close, I will serve as CEO of the combined company and Ric

will be the chairman of the board. We will have an experienced and dedicated team leading the combined company. I know this team well

from both sides, and we all share a common objective of delivering for our stakeholders.

For Stratasys’ customers and shareholders, this combination will enable

us to expand use cases, grow revenue and enhance profitability. For Desktop Metal customers and shareholders, this is an opportunity to

combine best in class additive manufacturing technology with our top global distribution capabilities. Together, we will be one of the

only profitable public 3D printing companies in the world.

I will now turn the call over to Ric to discuss the opportunity in

more detail. Ric?

Ric Fulop – Desktop Metal, Inc. – Chief Executive Officer

Thanks, Yoav, and hello, everyone. We’ll go into more detail into the

combined technological and R&D platform and global go to market network in the coming slides, but I want to briefly highlight the

significant size of this opportunity.

As shown on slide seven, the additive manufacturing capabilities of

our combined company will directly serve a rapidly growing market opportunity that is projected to reach more than $100 billion by 2032.

And while we project significant growth in the AM market, the overall manufacturing opportunity is much, much larger.

We have seen 10X growth in 3D printing in the past decade through penetration

of prototyping and tooling use cases. But even as an $18 billion market, as I noted earlier, it still only represents about 0.1% of global

spend on manufacturing. We’re just scratching the surface, and are very excited for what we can achieve together with Stratasys as the

industry continues to evolve towards mass production using additive manufacturing.

The combined company is expected to offer customers end to end solutions,

from designing to prototyping to tooling to mass production and aftermarket operations across the entire manufacturing lifecycle, providing

an opportunity to drive growth. As shown on slide nine, the combination also shifts our revenue mix towards high-growth verticals across

a broad product portfolio.

More than half of the pro forma combined company is expected to be

derived from revenue of end-use parts manufacturing and mass production. End-use parts are the fastest-growing segment in the additive

manufacturing space, with more than 29% compound annual growth rate expected through 2027. This compares to polymer research and preproduction

CAGRs that are under 14%, which will become a smaller part of the Stratasys mix as we move forward.

Turning to slide 10, this transaction establishes a very unique, scaled

additive manufacturing company. Our breadth of offerings and strong technical talent and expertise will help us win growth while we also

benefit from an overall TAM expansion. Pro forma, we’re going to be one of the largest companies in our industry, with attractive positions

across critical additive manufacturing technologies and segments. And together, we’re going to build an even more resilient offering with

a diversified customer base across industries and applications in order to drive long-term sustainable growth.

Slide 11 is an overview of our comprehensive suite of combined offerings,

which are broad and complementary and reflect some of the top brands in our industry. Our combined capabilities span materials, technologies

and use cases, and especially notable is the further expansion into mass production that Desktop Metal provides for Stratasys across metals,

polymers, ceramics, sand, carbon fiber, and wood.

We see a significant growth opportunity to drive outsize growth in

dental restorative mass production. Through our strategic partnerships, leading materials, and world-class team, we’re very well positioned

to capitalize on the $35 billion growth opportunity in dental mass production, as shown on slide 12.

We also have a significant opportunity in metal, carbides and ceramics.

We have the industry’s leading global position in binder jet. That’s the fastest 3D printing process for materials like metals, technical

ceramics and carbides, and we have the largest and growing customer base in this segment, with over 1,200 customers.

High penetration in mass production of carbide cutting tools, leadership

in 3D printing of nuclear materials via binder jet, best in class technology for mass production of technical ceramics enables us to bring

true high-volume mass production to the metal additive manufacturing space.

Both Stratasys and Desktop Metal have existing applications in production

that include spare parts, foam solutions, large parts and polymers in aerospace and automotive, industrial replacement of injection molding

tools and accurate parts, as you can see on slide 14. Together, we expect to transform the polymer industry and bring it into a world

of mass production.

And finally, as we go into slide 15, the combination of our technologies

and distribution capabilities are going to drive significant benefits for our stakeholders. We’re going to have an extensive global go

to market network, with enhanced market access in recognizable brands to our customers. Fitting for our company of our combined offerings

and reach, we’re going to have truly global footprint and a presence in over 65 countries.

With more than 400 support personnel and application engineers, we

will be backed by premier customer support capabilities to ensure that, as we deliver innovation to our customers, we can make our customers

successful.

Our innovation will be driven by a powerful combined R&D engine,

with substantial investment and firepower. Together, our companies invested nearly half a billion dollars, let me say that again, half

a billion dollars, in cumulative R&D spend in the past four years. That’s a significant investment for innovation, and it’s going

to remain a key area for us going forward.

Bolstered by our deep technical expertise, we’re very well positioned

to deliver on the promise of our existing technology and create new products to serve this expanded customer base. As a combined company,

we’re going to have one of the largest and most experienced R&D and engineering teams in this entire industry.

And finally, on slide 17, we have a very large customer base across

industries, materials and applications such as aerospace, automotive, medical and dental, consumer products and heavy materials. We have

a total of more than 27,000 customers at closing that are going to drive significant recurring revenue from consumables.

And now I’m going to turn it over to my partner, Yoav, so he can continue

the presentation.

Yoav Zeif – Stratasys Ltd. – Chief Executive Officer

Thank you, Ric. Turning to slide 18, the combined company is expected

to generate approximately $50 million in annual run rate cost synergies by 2025. We will achieve this by leveraging relationships with

existing customers and our leading go to market channels. This includes costs of goods sold savings driven by efficiencies from optimized

sourcing strategies and organizations.

We also see opportunities to optimize our technology infrastructure.

In addition, we expect to realize savings by combining our shared internal infrastructure. Of note, these are cost savings over and above

what Desktop Metal has already announced on a standalone basis.

On slide 19, the result of this combination is a strong pro forma business

with robust financials that will hit the ground running. We expect the combined company to generate $1.1 billion in 2025 revenue, and

target 10% to 12% adjusted EBITDA margin in 2025.

The synergy opportunities are significant and contribute to an attractive

combined financial profile, as evidenced by the improved pro forma adjusted EBITDA margin. Together, the company has approximately $437

million of cash and cash equivalents as of the first quarter of 2023, and this transaction accelerates the combined company financial

flexibility through a well-capitalized balance sheet to drive future growth.

We are confident this combination will drive substantial value for

our shareholders, employees and customers. Our shareholders will benefit as we execute on this compelling opportunity to capture the value

of AM for mass production, paired with the cost and revenue synergies and attractive financial profile.

Employees will have significant career development opportunities and

will be part of a combined company that remains committed to innovation and customer success. Our customers will benefit from our full

end to end solution’s superior value, with innovation driven by our unmatched team. There is tremendous value potential here, and we are

confident that, as a combined company, we will be positioned to capture it.

We hope you share our excitement for the future of the combined company

and what we can achieve together. With that, we will open the call to your questions.

Operator

Thank you. We’ll now be conducting a question and answer session. If

you’d like to be placed in the question queue, please press star-one on your telephone keypad. A confirmation tone will indicate your

line is in the question queue. You may press star-two if you’d like to remove your question from the queue. For participants using speaker

equipment, it may be necessary to pick up your handset before pressing star-one. One moment, please, while we poll for questions.

Our first question today is coming from Greg Palm from Craig Hallum.

Your line is now live.

Greg Palm – Craig Hallum

Hey. Thanks for taking the questions here and congrats on the announcement.

I guess my first one is what do you think it means for the industry overall? It’s clearly one of the most important announcements

to date and I just wanted to get your thoughts on the broader impact that the additive industry and whether this could help accelerate

overall adoption rates of the technology in general.

Yoav Zeif – Stratasys Ltd. – Chief Executive Officer

Thank you, Greg. It’s Yoav. It’s about transformation.

We are reshaping the industry. I’ve been here for three and a half years and I’m struggling with the position of additive

globally. Coming from manufacturing, there are so many manufacturing challenges today, sustainability, the ability to add mass personalization,

the logistics, whatever, onshoring – so many, so many challenges

And when I stepped into Stratasys, I said OK, 3D printing is a solution

because we can mass personalize. We can print what we want where we want. We can replace production line with a file and a printer. We

have great materials. But as you - we all know, we are the only profitable company in this industry, so something doesn’t work.

And what doesn’t work is the fact that we as an industry failed to

deliver quality of part, cost per part and a real workflow. Those are the facts. And then we ask ourselves how we can solve it. And we

started to do it in polymers, but it was clear to us that we need also to have a metal offering and we need to have a metal offering and

we need to keep innovating. And Desktop Metal is the real deal.

So, together we are going, really, to check the boxes to make sure

that we are going to customers. There is no silver bullet, but we will deliver on the value. You combine the establishment of Stratasys

with the innovation and the visionary – the vision of Desktop Metal, it’s a win.

Greg Palm – Craig Hallum

Yeah, understand that and that’s good to hear. I guess my sort of follow-up

question is, I think what probably what I and a lot of others – I know this call is focused the transaction with Desktop Metal –

but what I think a lot of us are probably wondering is given the requirement of shareholder approval and in light of this morning’s

tender offer news, how are you thinking about the risk, whether this deal can actually get done. Maybe you can just offer some perspective

there as well.

Yoav Zeif – Stratasys Ltd. – Chief Executive Officer

Thank you, Greg. We believe in this transaction. This is the best alternative

for our shareholders to create value. Nothing here is an accident. Nothing here was done, you know, just for the sake of whatever. We

are working on this deal for more than a year, and we believe that this is strategic both for the two companies and for the industry.

In terms of Nano and the tender offer, of course, I cannot relate to

it. It’s very clear that our Board, which is committed to its fiduciary duties, with our advisors, will look at it very seriously, and

we’ll come back with an answer.

Greg Palm – Craig Hallum

Okay, fair enough. I’ll hop back in the queue. Thanks.

Operator

Thank you. Next question is coming from Ananda Baruah from Loop Capital.

Your line is now live.

Ananda Baruah – Loop Capital

Hey, yeah. Good morning or good afternoon, guys, and thanks for taking

the questions. Congratulations on the combination here.

Yoav Zeif – Stratasys Ltd. – Chief Executive Officer

Thank you.

Ananda Baruah – Loop Capital

Yeah, you’re welcome. You touched a little bit on, combined capability

of the companies a few times in the prepared remarks. But I was wondering if you could talk to what the opportunities for technology sharing

and collaboration could be across the various teams, at the core technology level, maybe at the core IP level as you go forward. What

some of the leverage points there might be and how they might show up, in the offerings and in the marketplace. Thanks.

Ric Fulop – Desktop Metal, Inc. – Chief Executive Officer

Thank you. This is Ric. I’m super excited about not just the business

synergies, but the technical synergies here are significant. This is a merger that is going to drive accelerated innovation to the two

companies.

We have materials on the DM side that are going to really help improve

and push the capabilities of PolyJet into more of a mass production capability in the future. We’ve got technology synergies on the software

side between the two companies. There’s significant go to market synergies as well.

But these technical teams are primarily in non-overlapping segments

of the additive manufacturing space. This allows us to cover a broader portfolio of solutions to our customers, and so that is significant.

And obviously, we have 7,000 customers that are now going to be introduced to a distribution network that’s larger - much larger than

ours that is a powerhouse in the industry.

And we also at DM have a very large key accounts team that can help

the high-end systems from Stratasys penetrate in the manufacturing floor where you do mass production. So, this is a fantastic combination.

I can’t imagine a better partnership between two companies. And it’s highly synergistic across all fronts.

Yoav Zeif – Stratasys Ltd. – Chief Executive Officer

To add, we could identify, and it was already demonstrated, those,

amazing technical synergies already through the due diligence, because our teams met. We had a deep dive into the technology, a super

deep dive into the technology. And we found out that the flow of ideas can generate so much innovation and so much efficiencies and effectiveness

only through the due diligence.

But let’s put this aside for a minute. The reason we are with Desktop

Metal, because there are technological synergies, because we selected high-speed technologies based on ink jet. If someone in this industry

knows, jet ink is Stratasys. If someone in this industry knows, high-speed binding is Desktop Metal. Now combine the two. Everything’s

going here with printers. We know printers. We know the electronics around printers. So, you put this together, I’m very optimistic.

Ananda Baruah – Loop Capital

That’s super helpful. I really appreciate the context. I’ll get back

in the queue from here. Really appreciate it.

Operator

Thank you. Next question is coming from Shannon Cross from Credit Suisse.

Your line is now live.

Operator

Thank you. Next question is coming from Shannon Cross from Credit Suisse.

Your line is now live.

Shannon Cross – Crédit Suisse AG

Thank you very much and congrats on the deal. I’m curious about is

there a breakup fee involved with this? I know it’s a merger, but I was just wondering, now that, you know, it’s apparent that Desktop

Metal, you know, is potentially up for acquisition, is there any kind of, I don’t know, agreement in that scheme? And then I have a couple

others.

Ric Fulop – Desktop Metal, Inc. – Chief Executive Officer

I think this is a public to public merger with standard customary terms.

There is - but, you know, nothing out of the ordinary. I think our goal is to get this transaction completed, and both parties are committed

and look - can’t look - I mean, can’t wait to start doing work together. So, we’re excited.

Yoav Zeif – Stratasys Ltd. – Chief Executive Officer

Same here.

Shannon Cross – Crédit Suisse

Okay. And then, I guess when I add the - I’m just trying to think about

how you built up your revenue assumptions for, you know, 2025 and beyond. As you’re thinking about it, are there any dis-synergies? Because

when we add our numbers together, we kind of get there just with the two companies. And it seems like, you know, there is obviously the

revenue synergy—synergies you’re talking about. So, maybe if you could be a little bit more granular in terms of specific

areas you think you’re going to be able to sell more, whether it’s on metal or polymers or, I don’t know, anything dental,

if you want to talk about, you know, specific verticals and increased opportunity. Thank you.

Yoav Zeif – Stratasys Ltd. – Chief Executive Officer

Thank you. Thank you, Shannon. Thank you for the question. You know

us very well, and you know the infrastructure of Stratasys. We have much more capacity than we are currently leveraging. And from the

get-go almost three and a half years ago, I said manufacturing, manufacturing, manufacturing, because manufacturing is growing between

25% to 30% every year. We know it.

And we had the infrastructure to push it, but we had to build the portfolio.

And we did a great job on the polymer side, but we had to find the metal partner that will take us there, and also to make sure that we

are closing gaps that we have in dental, both in restorative and in also in liners.

So, it’s so complementary, almost no parallel offering. So, if you

take - if you combine this together, it means that there are no dis-synergies. And there are synergies on the infrastructure. There are

synergies on the infrastructure, both on the operations and the SG&A.

And as you know us as well, we are not building anything here top-down.

Everything is bottom-up by geographies, by offering, by machine, and then we came to this calculation of 10% to 12% adjusted EBITDA margin

in 2025. It’s a joint plan. I’m more - you know, just between us, I’m more optimistic on the revenue side that what we put.

But for us, it’s very important, and you know also our track record.

Over the last three and a half years, we put a number. We pass it. We touch it. We want to make sure that we are also delivering, you

know, on at least $1.1 billion. But I believe that - we all believe that the revenue synergies are bigger because of our infrastructure,

the global one.

Shannon Cross – Crédit Suisse AG

Okay. And then just how do we think about where you might have competing

technologies, like EnvisionTEC versus Origin? Are there ways to leverage the technologies that each company has or the production capabilities

that they each have? I’m just wondering. I don’t think there’s a ton of overlap on your portfolio, but there’s

some.

Ric Fulop – Desktop Metal, Inc. –

Chief Executive Officer

Yeah, I’m happy to take this. Look, the

overlap, I would say, is minimal and it’s probably in the most competitive segment that we’ve got. We have positioned our

EnvisionTEC products since the acquisition to be almost exclusively dental or large format DLP for high volume industry, while Origin

is sort of in the medium format DLP segment for production. So there’s very little overlap. If you look at even on a revenue basis, I

would say it’s a minimal percentage of our overall revenue, but it is a market where we have a heritage.

We are the inventors of DLP with E-TEC. This

is an industry we created. Today, there’s many people that use DLP, but we bring a lot of heritage, competence, as, sort of, Stratasys

Origin is a fantastic technology, and I think we have best in class solutions across our portfolio and better solutions to help our customers

be successful and go into production. So I’m very, very excited by the combination and everything we’re going to be able to do for our

customers to make them more successful.

Shannon Cross – Crédit Suisse AG

Great, Thank you very much.

Operator

Thank you. Next question is coming from Jim Ricchiuti

from the Needham and Company. Your line is now live.

Jim Ricchiuti – Needham & Company

Hi. Thank you. So I’m wondering if the cost synergy

targets, any assumptions with respect to possible changes in either the Desktop Metal or the Stratasys product portfolio? Just in terms

as you review the hardware categories as a result of the combination, are there some that may now be viewed as non-strategic for the combined

company on a go forward basis?

Ric Fulop – Desktop Metal, Inc. –

Chief Executive Officer

Not at all.

Yoav Zeif – Stratasys Ltd. – Chief

Executive Officer

So hi, Jim.

Jim Ricchiuti – Needham & Company

Hi.

Yoav Zeif – Stratasys Ltd. – Chief

Executive Officer

Our offer is very strategic. That’s why we selected

Desktop Metal. There’s so many synergies across the different portfolios both on the technical side but also in terms of offering and

being this one stop shop for our customers on the same platforms, which is amazing and we heard it from our customers.

As for the synergies, again as we shared up the

slide, significant amount from COGS both on operation and side, significant amount from G&A and some from sales and marketing. But

innovation for us is key. I want to emphasize it.

Jim Ricchiuti – Needham & Company

And a follow up question, Ric you alluded to the

strength of the materials business for the combined company. Yeah, I’m wondering how we should think about this materials business on

a pro forma basis and maybe just how you see that relative as you guys talk about that fiscal, that 2025 target.

Ric Fulop – Desktop Metal, Inc. –

Chief Executive Officer

Yeah, I will let Yoav answer the pro forma question.

But technically, we have incredible technology with our photo induced phase separation polymerization materials portfolio, and Stratasys

has incredible technology on the photopolymer side with the Covestro acquisition. It is highly complementary. We’ve got really, really,

really good print platforms. And even outside of photopolymers, we’ve got the largest library of materials on the metal, ceramics, carbides

side of the market. And Stratasys is an industry leading portfolio on the thermoplastic side.

So across the board, I think we’ve got really

highly differentiated material science-driven innovation here that is difficult to replicate as a huge moat. There’s a very large IP portfolio

component on it. And as you know, materials are the recurring revenue component that’s at the heart of the innovation in the 3D printing

business. So we have a, you know, this really turns it into a fantastic, highly complementary capability that’s actually going to make

our customers more excited and more successful with 3D printing in mass production.

Yoav Zeif – Stratasys Ltd. – Chief

Executive Officer

And maybe just to add on the how it impacts the

pro forma, you cannot reach 10 to 12% EBITDA, adjusted EBITDA margin without a strong material portfolio and sales. Materials service

software has to come together with the hardware. This is what we’ve been doing for three-and-a-half years. We have more materials,

we’re selling more materials, and that’s the only way to finance the innovation and be profitable with decent EBITDA margins.

Jim Ricchiuti – Needham & Company

Guys, thank you. Congratulations.

Operator

Thank you. As a reminder, that “*” “1” to be

placed in the question queue. Our next question is coming from Brian Drab from William Blair. Your line is now live.

Brian Drab

Hi. Thanks for taking my questions, and congratulations on the announcement.

I haven’t…

Ric Fulop – Desktop Metal, Inc. – Chief Executive Officer

Thank you.

Brian Drab – William Blair & Company L.L.C.

You’re welcome. I haven’t followed Desktop Metal as closely as I would

if I formally covered it, but I guess there’s some questions that I think a financial analyst has to ask here just to get a little more

clarity. I mean, it looks like Desktop had about $190 million in cash and investments and operating loss in 2022 of $233 million, use

of cash and operating activities $182 million.

I know there’s a lot of cost cutting opportunity, but you know that

combined with I think I saw a $498 million goodwill impairment last year. It’s just, it feels like I want to be more excited about

the acquisition, but those numbers aren’t, you know, they’re not that promising on the surface. So I was wondering if you could talk a

little bit to maybe inspire a little more confidence because it feels like Stratasys is acquiring a company that needed a lifeline.

Ric Fulop – Desktop Metal, Inc. – Chief Executive Officer

That’s absolutely not accurate, Brian. So let me set the record here.

DM, as currently constituted, has been continually decreasing its cash burn on a quarter over quarter basis and is projected to be EBITDA

breakeven in the fourth quarter of this year. We’re still committed to that goal and reaffirm that.

We have taken a lot of costs from M&A activities that we did in

2020. We’ve taken all that out and we are very well into our process to hit our targets and believe we will hit them on the schedule that

we laid out to Wall Street. So any synergies here are over and above the one instead that were described before in our conference calls,

which I encourage you to listen to.

If you go and, again, look at our cash burn, it was approximately,

you know, dramatically lower approximately half of like what it was Q1 of the previous year and is projected to be in the single digits

in the second half of the year on a quarter over quarter basis as we get closer to profitability and fully consolidate the facilities

that are burdening our COGS. So I am bullish that we’re going to be able to continue to execute that plan on schedule, as previously stated.

And with regards to the goodwill, you know, when we did some of the

M&A early on and our stock was at very high valuations and we used stock for those transactions, as you know, there’s accounting tests

that you have to hit and when, you know, that is really triggered by the stock price of our company. It’s a noncash event. And it

is something that the auditors make you do as you kind of close a quarter at a particular stock price.

But it has nothing to do with the value of those assets or our view

of the discounted cash flow that those are going to generate in the future. So anyway, I could go on and on, but I’ll let my colleagues

take it over.

Yoav Zeif – Stratasys Ltd. – Chief Executive Officer

Thank you, Ric. I would like to add one thing, Brian. Greg started

with a question about how we will change the industry, and I want to take a step back. The problem of this industry, and you know it,

we have hundreds of companies. Only in metal there are more than 200 companies. But no one has scale.

So we want to scale, we want an inflection point, we want to be in

manufacturing. But at the same time, we don’t have the scale to do it. Not the resource nor the scale to do it. It’s all about scale.

And we can’t, as an industry wait for this scale, but we need to empower us in order to be able really to scale.

And that’s what we are doing here. We are shortening the time period

to be heavily into manufacturing and to lead this industry into manufacturing. And the scale is solving all those challenges that you

mentioned. All of them. Without the scale, we would never be in 10 to 12% EBITDA margin. Never.

Brian Drab – William Blair & Company L.L.C.

Thanks, and can I just ask, I’m just trying to get a better understanding

of what you’re acquiring and what Desktop Metal is composed of now. I know that there’s, you know, $210 million or so in revenue in 2022.

Like maybe $40, or $50 million was related to the EnvisionTEC business, you know, I guess like $70 to $80 million was the run rate for

ExOne, maybe $30 to $40 million for Dental Arts and, you know, that leaves maybe like $50 million from core desktop metal. And I’m just

wondering, like, what the $50 million, and $50 million I know is my number, I don’t know what the real - what’s the exact number

is…

Ric Fulop – Desktop Metal, Inc. – Chief Executive Officer

I’m happy to…

Brian Drab – William Blair & Company L.L.C.

How does that break down across–How does that break down across

the production system, shop system, and other systems? I’m curious if you could disclose anything there. Thanks.

Ric Fulop – Desktop Metal, Inc. – Chief Executive Officer

I mean, we don’t break out our revenue by segments that way,

but why don’t we have a call whenever is good for you and we could walk you through our model and how we’re growing our business.

Brian Drab – William Blair & Company L.L.C.

Okay, sounds good. Thanks.

Ric Fulop – Desktop Metal, Inc. – Chief Executive Officer

Great.

Operator

Thank you. Next question is coming from Josh Sullivan from the Benchmark

Company. Your line is now live.

Josh Sullivan – The Benchmark Company

Hey, good morning. Following up on that comment about it’s all

about scale, I want to get an idea of how impactful customer interest was a factor in the combination. You know are customers communicating

a combination of your capabilities would increase adoption? Any specific examples you have, you know, or is the combination more on that

feature product flow and the cost dynamics you’re talking about.

Ric Fulop – Desktop Metal, Inc. – Chief Executive Officer

This is a great point. And you know, Stratasys has a larger industrial

customer base in the end that’s going to help introduce that customer base to a broader set of technologies of a much larger go

to market capability than DM has. A commercial, we have also key accounts capability that can be very helpful for them to penetrate a

different segment on the manufacturing floor.

I think that, that it is going to be extremely

helpful. I mean, I think customers look at who they’re doing business with when they look at a strategic element in that in a company,

and especially if it’s going part of their production capabilities. And I think that this is only going to be seen as a very, very

positive. We’re going to have much larger customer support and applications engineering capability. I believe one of the largest

in our industry.

And I think that we’ll be able to respond

to customer needs faster than other companies. And I think this team is committed to stay working together to make this transaction successful.

And we are looking at this not just as managers, but also as shareholders of the business. And we feel this is the best for stakeholders.

It’s also the best for shareholders and we are excited about the possibilities of making customers more successful with this transaction.

I think you’ll see a lot of innovation,

a lot of cross-sell, a lot of technology that can be leveraged across the platforms that are going to make customers more successful.

So, I am super excited about what this means for the future and can’t wait to have a call like this in 5 or 10 years and show you

how this was a seminal moment in our industry.

Yoav Zeif – Stratasys Ltd. – Chief

Executive Officer

Definitely. Just to add to it, I always believe

the best is to ask the customer. If you don’t know something, ask the customer. And in the process of strategically analyzing what’s

the best match for Stratasys and then when strategically analyzing Desktop Metal, we talked with customers and they told us, we want Stratasys

there to get there because it makes you both stronger partners to really take the risk in stepping into additive manufacturing. It’s not

simple at all, what I’m saying. Many companies are having concerns to take this step and transform production line, because the

other side is not strong enough, but together will be significantly stronger. This is huge.

The second thing is about the one platform, the

one stop shop. We have the largest, I would say, the most user-friendly operating system in our industry, the GrabCAD. We’re going to

put everything on this. The innovative software that Desktop Metal has. And suddenly you have a software offering, which makes the life

of the customer much easier. So, we hear it from the customer, this was - by the way, the customer analysis was a pillar in our decision.

Josh Sullivan – The Benchmark Company

Got it. And then is this combination enough scale

to achieve those dynamics you’re talking about, or are there other elements that you might see down the road that would be needed to kind

of complete the thought process?

Ric Fulop – Desktop Metal, Inc. –

Chief Executive Officer

No, I think we are very, very excited. We have

a lot to do here with what we’ve got. So, we have extremely good bones in this combination, and I think we’re going to create something

incredible that will forever change the AM industry for much better.

Josh Sullivan – The Benchmark Company

Thank you for the time.

Operator

Thank you. Our next question is a follow up from

Greg Palm from Craig-Hallum. Your line is now live.

Greg Palm – Craig Hallum

Yeah. Thanks for taking the follow up. Maybe kind

of a two-part question. Maybe I’ll ask it in two separate questions. But Yoav, as I think back when you joined Stratasys and sort of the

thought of making Stratasys a leader in polymer, as you kind of think back on that and the combination with Desktop, which does polymers,

but also has a lot of exposure in metals and ceramics, I guess sort of what changed from that initial thinking? And I guess the second

part of that question is, is there a certain technology from Desktop Metal that you’re maybe especially excited about on the non-polymer

side?

Yoav Zeif – Stratasys Ltd. – Chief

Executive Officer

Thank you, Greg. I guess you know me by now, probably

14 or 15 quarter. I don’t do anything on the spur of the moment or shooting from the hip. Everything here is strategic. When I started

the journey with Stratasys and with the great teams that we have here, we put together strategy, and we communicated the strategy to the

market. It was a very clear strategy. We said, stop the bleeding on our core technologies, then become a leading player in polymer, which

means practically, that you sell more. You have a higher share in different segments. Then, to make sure that we are in use cases. And

then on the same slide there was metal.

And we said, we need to focus because if we go

sort of metal, we’ll not have enough scale in polymer. So, we created the focus, but we knew all the time that we need the metal. And

the reason that we stop producing metal and putting R&D on metal, was that our metal was not differentiated. So, we stopped stepping

and checking the boxes. We stopped the bleeding. We are growing both in FDM and foliage. Then we acquired training technologies, almost

triple our addressable market. Then we start introducing significant use cases like the TrueDent, the dentures, the fashion, etcetera.

But to be honest, it was faster than we planned. So, we reached the situation where we need the metal, but we were not willing to compromise

on a metal which is not differentiated.

And those are great technologies out there with

laser and they are very accurate and a great technology, but they are not differentiated. The only highspeed manufacturing differentiated

technology is metal by energy. And that’s what makes me so excited because we searched. We looked around. We asked the customers, and

this technology is highly exciting, because we’re going to transform many, many different industries. And it’s very hard to do it, but

Desktop Metal, with their holistic approach of not just investing in the printer but investing in the software and investing in the sintering

process and connecting all of them, this is differentiated. So you when you put a differentiated industrial manufacturing technology of

metal together with Stratasys, which has a significant position in polymer, going more or less to the same customers, this is a win. I’m

excited about this technology.

Greg Palm – Craig Hallum

Okay. Got it. And then I guess my last question is just, it feels based

on the commentary, that you almost feel like consolidation is definitely needed, just from a scale standpoint. It sounds like it’s a major

underlying reason here. As you look further ahead, and I’m thinking more post-close and whatnot, I mean, do you feel like the combined

company can be a platform for additional acquisitions? Is that something that you intend on making, especially considering it should have

a pretty strong balance sheet?

Ric Fulop – Desktop Metal, Inc. –

Chief Executive Officer

Look, I would say this is going to make our industry healthier. Scale

is the most important thing in reaching a high level of profitability. And we have a core competency and a very experienced team that

is able to look at the right opportunities and evaluate them from a strategic lens, probably before other people realize that something

is going to be a critical technology or area in the market. We have a vision combined of how this industry is going to evolve over the

next decade or two, that I think is proprietary and unique. And we want to build this company through profitable organic growth, but we

are also going to look at key strategic opportunities that we think can help us really continue to differentiate our portfolio and our

platform to make our customers more successful.

Yoav Zeif – Stratasys Ltd. – Chief

Executive Officer

Yeah, exactly. And just to add to it, if I may, both companies have

a track record of integration. We acquired five companies, Stratasys, over the last three years. We integrated all of them. None of them

is sitting somewhere and is not part of One Stratasys. That’s what makes us profitable, otherwise, we will not be there. So we have the

track record. But I have a core belief, everything is about focus. That’s why we started focusing on polymer. It’s all about focus. Now

we will take this track record and capabilities and focus on the integration, then we will be the best platform to do many, many other

things. But the focus now is on integration, capturing the synergies. We are going to deliver for our shareholders.

Greg Palm – Craig Hallum

Appreciate you taking all the questions. Thanks.

Operator

Thank you. Next question is a follow up from Shannon Cross from Credit

Suisse. Please hold. Your line is now live.

Shannon Cross – Credit Suisse

Thanks. I just had a quick question on metal. Is there any capability,

technology that you have at Stratasys from your prior investment in metal that can be leveraged within DM’s technology portfolio,

or is this just purely going to be replacing what you have?

Yoav Zeif – Stratasys Ltd. – Chief

Executive Officer

Thank you, Shannon. If you remember - I don’t know if you remember

that we acquired Riven, AI company. This is a perfect technology for high-speed manufacturing in additives. We started with - we actually

acquired it because we needed it for our (inaudible) technology, because we want to make sure that we have a great first print, and that

we can close the loop. I think it will have a great contribution to the metal technology. By the way, the sub-metal is already there,

in terms of the best sintering simulation software, no doubt, but adding our capabilities will definitely help. And I see in metal, this

is the real bottleneck, controlling the sintering.

Ric Fulop – Desktop Metal, Inc. –

Chief Executive Officer

I think that, building on what Yoav said, there is a lot of IP and

capabilities that Stratasys has from their past activities that are also applicable to future products that we can develop together. So,

we’re very excited by how these two things can come together. We’ve got large frames in powder bed that go all the way to 1,800 liters,

which is far better than all other companies in the market. We’ve got the highest speed hydrogenic solutions. We’ve got scale in inkjet,

which is very, very critical. So, there’s lots of synergies here from a technological platform and operational and product roadmap point

of view.

Shannon Cross – Credit Suisse

All right. Thank you very much.

Operator

Thank you. We reached the end of our question and answer session. I’d

like to turn the floor back over for any further closing comments.

Yoav Zeif – Stratasys Ltd. – Chief

Executive Officer

Thank you very much for joining us and we are looking forward to updating

you on how we are capturing value and creating value for our shareholders.

Ric Fulop – Desktop Metal, Inc. –

Chief Executive Officer

Awesome. Thank you.

Yoav Zeif – Stratasys Ltd. – Chief

Executive Officer

Thank you.

Operator

Thank you. That does conclude today’s teleconference and webcast. You

may disconnect your line at this time and have a wonderful day. We thank you for your participation today.

Forward-Looking Statements

This communication contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements include statements

relating to the proposed transaction between Stratasys Ltd. (“Stratasys”) and Desktop Metal, Inc. (“Desktop Metal”),

including statements regarding the benefits of the transaction and the anticipated timing of the transaction, and information regarding

the businesses of Stratasys and Desktop Metal, including expectations regarding outlook and all underlying assumptions, Stratasys’

and Desktop Metal’s objectives, plans and strategies, information relating to operating trends in markets where Stratasys and Desktop

Metal operate, statements that contain projections of results of operations or of financial condition and all other statements other than

statements of historical fact that address activities, events or developments that Stratasys or Desktop Metal intends, expects, projects,

believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs and assumptions made

based on information currently available to management. All statements in this communication, other than statements of historical fact,

are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,”

“believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward-looking

statements involve known and unknown risks and uncertainties, which may cause Stratasys’ or Desktop Metal’s actual results

and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may

impact future results and performance include, but are not limited to those factors and risks described in Item 3.D “Key Information

- Risk Factors”, Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects”

in Stratasys’ Annual Report on Form 20-F for the year ended December 31, 2022 and Part 1, Item 1A, “Risk Factors” in

Desktop Metal’s Annual Report on Form 10-K for the year ended December 31, 2022, each filed with the Securities and Exchange Commission

(the “SEC”), and in other filings by Stratasys and Desktop Metal with the SEC. These include, but are not limited to: the

ultimate outcome of the proposed transaction between Stratasys and Desktop Metal, including the possibility that Stratasys or Desktop

Metal shareholders will reject the proposed transaction; the effect of the announcement of the proposed transaction on the ability of

Stratasys and Desktop Metal to operate their respective businesses and retain and hire key personnel and to maintain favorable business

relationships; the timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise

to the termination of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction

(including any necessary shareholder approvals); other risks related to the completion of the proposed transaction and actions related

thereto; changes in demand for Stratasys’ or Desktop Metal’s products and services; global market, political and economic

conditions, and in the countries in which Stratasys and Desktop Metal operate in particular; government regulations and approvals; the

extent of growth of the 3D printing market generally; the global macro-economic environment, including headwinds caused by inflation,

rising interest rates, unfavorable currency exchange rates and potential recessionary conditions; the impact of shifts in prices or margins

of the products that Stratasys or Desktop Metal sells or services Stratasys or Desktop Metal provides, including due to a shift towards

lower margin products or services; the potential adverse impact that recent global interruptions and delays involving freight carriers

and other third parties may have on Stratasys’ or Desktop Metal’s supply chain and distribution network and consequently,

Stratasys’ or Desktop Metal’s ability to successfully sell both existing and newly-launched 3D printing products; litigation

and regulatory proceedings, including any proceedings that may be instituted against Stratasys or Desktop Metal related to the proposed

transaction; impacts of rapid technological change in the additive manufacturing industry, which requires Stratasys and Desktop Metal

to continue to develop new products and innovations to meet constantly evolving customer demands and which could adversely affect market

adoption of Stratasys’ or Desktop Metal’s products; and disruptions of Stratasys’ or Desktop Metal’s information

technology systems.

These risks, as well as other risks related to

the proposed transaction, will be included in the registration statement on Form F-4 and joint proxy statement/prospectus that will be

filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. While the list of factors

presented here is, and the list of factors to be presented in the registration statement on Form F-4 are, considered representative, no

such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other

factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to Stratasys’

and Desktop Metal’s respective periodic reports and other filings with the SEC, including the risk factors identified in Stratasys’

and Desktop Metal’s Annual Reports on Form 20-F and Form 10-K, respectively, and Stratasys’ Form 6-K reports that published

its results for the quarter ended March 31, 2023, which it furnished to the SEC on May 16, 2023, and Desktop Metal’s most recent

Quarterly Reports on Form 10-Q. The forward-looking statements included in this communication are made only as of the date hereof. Neither

Stratasys nor Desktop Metal undertakes any obligation to update any forward-looking statements to reflect subsequent events or circumstances,

except as required by law.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or

approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by

means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction and Where to Find It

In connection with the proposed transaction, Stratasys

intends to file with the SEC a registration statement on Form F-4 that will include a joint proxy statement of Stratasys and Desktop Metal

and that also constitutes a prospectus of Stratasys. Each of Stratasys and Desktop Metal may also file other relevant documents with the

SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement/prospectus or registration statement

or any other document that Stratasys or Desktop Metal may file with the SEC. The definitive joint proxy statement/prospectus (if and when

available) will be mailed to shareholders of Stratasys and Desktop Metal. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION

STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the registration

statement and joint proxy statement/prospectus (if and when available) and other documents containing important information about Stratasys,

Desktop Metal and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov.

Copies of the documents filed with, or furnished, to the SEC by Stratasys will be available free of charge on Stratasys’ website

at https://investors.stratasys.com/sec-filings. Copies of the documents filed with the SEC by Desktop Metal will be available free of

charge on Desktop Metal’s website at https://ir.desktopmetal.com/sec-filings/all-sec-filings.

Participants in the Solicitation

Stratasys, Desktop Metal and certain of their

respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed

transaction. Information about the directors and executive officers of Stratasys, including a description of their direct or indirect

interests, by security holdings or otherwise, is set forth in Stratasys’ proxy statement for its 2022 Annual General Meeting of

Shareholders, which was filed with the SEC on August 8, 2022, and Stratasys’ Annual Report on Form 20-F for the fiscal year ended

December 31, 2022, which was filed with the SEC on March 3, 2023. Information about the directors and executive officers of Desktop Metal,

including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Desktop Metal’s

proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2023 and Desktop Metal’s

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 1, 2023. Other information

regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or

otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the

proposed transaction when such materials become available. Investors should read the joint proxy statement/prospectus carefully when it

becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Stratasys or Desktop

Metal using the sources indicated above.

19

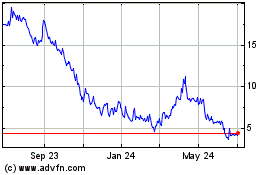

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Mar 2024 to Apr 2024

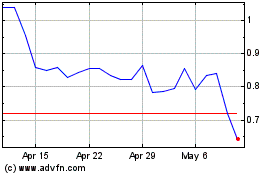

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Apr 2023 to Apr 2024