By Jonathan Randles

A pension fund covering about 90,000 coal workers and their

families is on the brink of insolvency while hundreds of these

miners also face losing medical benefits, part of mounting

financial stress on the larger safety net meant to protect sick or

out-of-work miners.

The United Mine Workers of America multiemployer pension plan is

projected to become insolvent during its 2022 plan year if Congress

doesn't authorize using public funds to buttress it for the first

time in a history tracing back more than 70 years. Murray Energy,

which filed for bankruptcy Tuesday, is the last major contributor

to the fund.

Large U.S. coal producers have used bankruptcy as a tool to

survive the industry's decadelong decline. Several companies have

successfully argued in chapter 11 that they must walk away from

pension and medical obligations to stay in business, keep mines

open and save jobs, according to court records, testimony and

interviews.

Since last October, at least eight coal companies employing

nearly 16,000 union and nonunion workers have filed for bankruptcy

protection.

The bankruptcies have coincided with a decline in the U.S. coal

market, which has grappled with environmental regulations during

the Obama administration and competition from alternative fuel

sources such as natural gas and renewable energy.

A Growing Shortfall

The use of chapter 11 has nearly eliminated coal company

contributions to the plan. During the 2018 plan year, the pension

fund collected $30 million in employer contributions, dwarfing its

$613.8 million in benefit payments. The fund's assets were valued

at about $2.4 billion, compared with $6.6 billion in liabilities.

For every active worker, the plan supports roughly 28 retirees,

UMWA Health and Retirement Funds Executive Director Lorraine Lewis

told House lawmakers in July.

The multiemployer pension plan was 38% funded, Ms. Lewis said at

the time, a significant fall from 2008, when the plan was 93%

funded before the financial crisis.

If the plan fails, it would likely mean cuts to monthly benefit

payments that average $596 for all pensioners and $368 for

surviving spouses. More than half of pensioners get less than $500

a month.

"Chapter 11 has clearly been used, by the coal industry at

least, as a convenient way for people to get out of living up to

their obligations," UMWA spokesman Phil Smith said.

Mining companies also have used chapter 11 powers to avoid the

costs that come with withdrawing from the pension plan. For

instance, Patriot Coal Corp, Alpha Natural Resources, Jim Walter

Resources and Mission Coal Corp. -- all of which have filed for

bankruptcy since 2012 -- have avoided paying nearly $4 billion in

combined withdrawal liabilities, according to Ms. Lewis's

testimony.

Murray Energy said in court papers Tuesday it paid about $15

million into the pension fund in 2018 and as a result of the

previous bankruptcies faces liabilities upward of $6.4 billion if

it withdraws from the plan. A restructuring support agreement

backed by Murray's senior lenders calls on the company to negotiate

modifications to its retiree benefits and reject collective

bargaining agreements.

The UMWA said Tuesday: "Our retirees should understand that

their health care will continue to be paid, at least until the

bankruptcy process is completed."

Seeking Solutions

The decline of the pension plan has prompted Congress to

consider remedies. The UMWA is lobbying Senate Majority Leader

Mitch McConnell (R., Ky.) to take up legislative proposals that

would send excess funds from an abandoned mine reclamation fund to

the pension plan. Mr. McConnell's spokesman said he "is concerned

about the insolvency issues facing a number of multiemployer

pension plans and he supports the ongoing process to find a

bipartisan solution for pension reform."

The Pension Benefit Guaranty Corp., the U.S. government's

pension insurer, would step in if the UMWA pension plan goes

insolvent. PBGC Director Gordon Hartogensis said the miners' plan

is one of roughly 125 multiemployer pension plans expected to run

out of money in the next 20 years, affecting nearly 1.4 million

people. The PBGC has said its multiemployer pension program could

itself run out of money by 2025.

Recent bankruptcies also have put medical benefits for hundreds

of retirees who worked at Mission Coal Co. and Westmoreland Coal

Co. in jeopardy. Former coal miners who spoke with The Wall Street

Journal said they agreed to do hazardous mine work because they

were promised a pension as well as medical benefits for after they

retired.

"You put your life at risk every day you go underground. You

don't know if you're going to make it out or not," said

Westmoreland retiree Gary Wells, 76 years old. "You put your health

and everything at risk for the company."

Westmoreland retirees and their dependents are expected to lose

medical benefits by year's end if Congress doesn't add them to a

UMWA health plan. The company's bankruptcy advisers said such a

plan was needed to avert liquidation and preserve jobs. Lenders

that took over Westmoreland provided $6 million to fund retiree

benefits temporarily.

Westmoreland retiree Bethel Brock, 79, said he has been notified

that he could lose medical benefits for himself and his wife at the

end of the year. Mr. Brock said he has been diagnosed with a

complicated form of black lung disease and relies on the

Westmoreland benefits, UMWA pension, Medicare and Social Security.

Westmoreland withdrew from the UMWA pension plan in 2004.

"When a coal company is through with you, you're just like a

used piece of equipment," Mr. Brock said.

Black Lung Resurgence

Since 2014, coal bankruptcies also have transferred more than

$310 million in corporate liabilities to the federal Black Lung

Disability Trust Fund, which compensates workers diagnosed with

black lung disease. The shift has come as researchers have

documented a resurgence of a severe form of the disease in

Appalachia.

"Our clients are younger and sicker than ever before," said

Rebecca Shelton, coordinator of policy and organizing at the

nonprofit Appalachian Citizens Law Center, which helps workers

seeking black lung benefits.

An excise tax to fund this trust fund was scaled back at the end

of last year because of Congress inaction, meaning the fund likely

will need to borrow more public funds to continue providing

benefits. A former miner could get between $660 and $1,320 in

monthly black lung benefit payments depending on the number of

their dependents, according to the Government Accountability

Office.

"A lot of people that are drawing black lung [benefits], they're

struggling to pay their bills," said Patty Amburgey, a member of a

black lung association in southeast Kentucky who lost her husband

to the disease.

Sen. Joe Manchin (D., W.Va.) has been a lead sponsor on proposed

legislation that would add affected retirees of Westmoreland and

Mission Coal to a UMWA health plan, direct excess reclamation funds

to the pension plan and restore the higher black lung excise tax.

That bill, introduced in January by Democrats, is co-sponsored by

presidential candidates Bernie Sanders, Elizabeth Warren and Kamala

Harris.

Write to Jonathan Randles at jonathan.randles@wsj.com

(END) Dow Jones Newswires

October 30, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

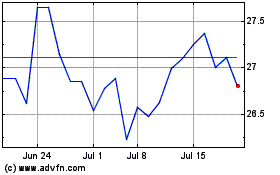

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

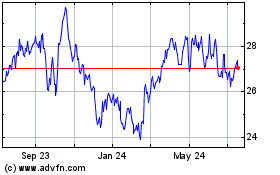

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Apr 2023 to Apr 2024