Current Report Filing (8-k)

September 11 2019 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 10, 2019

Build-A-Bear Workshop, Inc.

-------------------------------------------------

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

---------------------------

(State or Other Jurisdiction

of Incorporation)

|

001-32320

-------------------

(Commission

File Number)

|

43-1883836

---------------------------

(IRS Employer

Identification No.)

|

|

1954 Innerbelt Business Center Drive

St. Louis, Missouri

----------------------------------------------------

(Address of Principal Executive Offices)

|

63114

------------------

(Zip Code)

|

(314) 423-8000

------------------------------------------

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which

registered

|

|

Common Stock, par value $0.01 per share

|

BBW

|

New York Stock Exchange

|

Item 1.01. Entry into a Material Definitive Agreement.

On September 11, 2019, Build-A-Bear Workshop, Inc. (the “Company”) and all of its domestic subsidiaries (collectively with the Company, the “Borrower”) entered into a Twentieth Amendment to Loan Documents (the “Twentieth Amendment”) with U.S. Bank National Association (“U.S. Bank”), which amends the Company’s Fourth Amended and Restated Loan Agreement (the “Credit Agreement”) and the Fourth Amended and Restated Revolving Credit Note (the “Revolving Credit Note” and, together with the Credit Agreement, the “Loan Documents”) with U.S. Bank.

Among other revisions, the Twentieth Amendment:

|

|

●

|

reduces the total facility amount from $35 million to $20 million;

|

|

|

●

|

increases the commitment fee on the difference between the borrowings plus outstanding letters of credit and the total facility amount from 0.075% to 0.25%;

|

|

|

●

|

reduces the minimum cumulative EBITDA covenant for the first three quarters of fiscal 2019 from $6.6 million to $4.0 million;

|

|

|

●

|

revises the methodology for calculating the funded debt ratio, commencing with the fourth fiscal quarter of 2019, to be funded debt to EBITDA, calculated on a rolling historical 12-month basis, while leaving unchanged the minimum required ratio of no less than 1.50 to 1.00;

|

|

|

●

|

revises the fixed charge coverage ratio for the fourth quarter of fiscal 2019 to reduce the required ratio from 1.20 to 1.00 to 1.10 to 1.00, while leaving unchanged the required minimum fixed charge coverage ratio for each fiscal quarter thereafter at 1.20 to 1.00;

|

|

|

●

|

revises the minimum liquidity covenant to require the Borrower to have at least $5 million at all times of consolidated cash in North America plus the maximum amount available to be drawn under the Revolving Credit Note (without violating the funded debt ratio covenant);

|

|

|

●

|

prohibits Borrower from maintaining aggregate cash or cash equivalents either outside North America or on-hand in stores within North America in excess of $5 million;

|

|

|

●

|

increases the interest rate on advances from the LIBOR rate plus 1.25% to the LIBOR rate plus 3.25%;

|

|

|

●

|

requires Borrower to repay the lesser of $5 million or the amount outstanding under the Revolving Credit Note if at the end of any business day Borrower’s consolidated cash balance in North America, after giving effect to Borrower’s projected use and receipt of cash within the following three business days, exceeds $5 million;

|

|

|

●

|

prohibits Borrower from borrowing more than $10 million unless at the time of and immediately after giving effect to such advance the Borrower’s funded debt to unadjusted EBITDA ratio as of the most recent month-end on a trailing 12-month basis is less than 1.50 to 1.00 and the Borrower’s fixed charge coverage ratio using unadjusted EBITDA as of the most recent month-end on a trailing 12-month basis is greater than 1.20 to 1.00;

|

|

|

●

|

prohibits Borrower from requesting to borrow under the Revolving Credit Note if such borrowing would cause Borrower’s consolidated North American cash balance, after giving effect to such advance and the use of the proceeds therefrom within three business days, to exceed $5 million; and

|

|

|

●

|

modifies the Loan Documents to provide that Lender has no obligation to issue any additional letters of credit and, commencing October 1, 2019, Borrower will pay Lender a fee of 3.25% per annum on the aggregate undrawn face amount of any existing letters of credit.

|

Except as amended by the Twentieth Amendment, the terms and conditions of the Loan Documents remain unchanged. The Borrower currently does not have any outstanding borrowings under the Loan Documents and is in compliance with the Credit Agreement covenants.

Relationship to U.S. Bank

The Company has or may have had customary banking relationships with U.S. Bank based on the provision of a variety of financial services, including lending, commercial banking and other advisory services.

The foregoing description of the Twentieth Amendment is only a summary of material terms and conditions of such document and is qualified in its entirety by reference to the Twentieth Amendment, which has been filed as Exhibit 10.1 hereto and which is incorporated by reference herein. In addition, the Company has previously filed the Credit Agreement, the Revolving Credit Note, and all previous amendments thereto, which documents have been incorporated by reference in the Company’s Annual Report on Form 10-K for the year ended February 2, 2019 (File No. 001-32320), filed on April 18, 2019; the foregoing description of those documents is also only a summary of certain terms and conditions therein and is qualified in its entirety to such documents as previously filed.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(b) On September 10, 2019, Anne Parducci resigned from the Board of Directors (the “Board”) of the Company, effective immediately, so that she can devote more time to her new role as the Chief Content Officer of MGA Entertainment, Inc. Ms. Parducci, who has served on the Board since 2017, was a Class III director with a term expiring at the Company’s 2022 Annual Meeting of Stockholders. At the time of her resignation, Ms. Parducci served as a member of the Compensation and Development Committee of the Board and as a member of the Nominating and Corporate Governance Committee of the Board. Ms. Parducci’s resignation is not due to any disagreements with the Company.

Item 8.01. Other Events.

On September 10, 2019, immediately following the resignation of Ms. Parducci, the Board decreased the size of the Board to seven (7) members. In order to maintain the number of directors in each class as nearly equal as possible, the classification of directors was changed to three members in Class I and two members in each of Class II and Class III. Robert Dixon, who had served as a Class II director prior to that time, was appointed as a Class III director to serve for the balance of Ms. Parducci’s term.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit Number

|

Description of Exhibit

|

|

|

|

|

10.1

|

Twentieth Amendment to Loan Documents between Build-A-Bear Workshop, Inc., Build-A-Bear Workshop Franchise Holdings, Inc., Build-A-Bear Entertainment, LLC, Build-A-Bear Retail Management, Inc., and Build-A-Bear Card Services, LLC, as Borrowers, and U.S. Bank National Association, as Lender, entered into effective as of September 11, 2019

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BUILD-A-BEAR WORKSHOP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 11, 2019

|

By:

|

/s/ Voin Todorovic

|

|

|

|

Name:

|

Voin Todorovic

|

|

|

|

|

Title: Chief Financial Officer

|

|

4

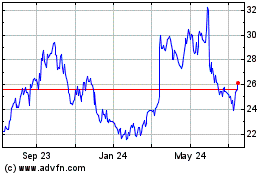

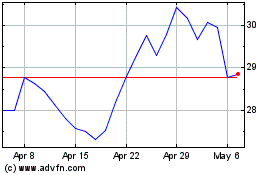

Build A Bear Workshop (NYSE:BBW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Build A Bear Workshop (NYSE:BBW)

Historical Stock Chart

From Apr 2023 to Apr 2024