0001726173FALSE12/31FY202100017261732021-01-012021-12-310001726173us-gaap:CommonClassAMember2021-01-012021-12-310001726173us-gaap:CommonClassBMember2021-01-012021-12-3100017261732021-06-30iso4217:USD0001726173us-gaap:CommonClassAMember2022-02-21xbrli:shares0001726173us-gaap:CommonClassBMember2022-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| | | | | | | | |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

or

| | | | | | | | |

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission file number 001-38477

BIGLARI HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Indiana | | 82-3784946 |

| (State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 17802 IH 10 West, | Suite 400 | |

| San Antonio, | Texas | 78257 |

| (Address of principal executive offices) | (Zip Code) |

(210) 344-3400

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbols | Name of each exchange on which registered |

| Class A Common Stock, no par value | BH.A | New York Stock Exchange |

| Class B Common Stock, no par value | BH | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ¨ | Accelerated filer | x | Non-accelerated filer | ¨ | Smaller reporting company | ¨ | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 2021 was approximately $173,487,448.

Number of shares of common stock outstanding as of February 21, 2022:

| | | | | |

| Class A common stock – | 206,864 | |

| Class B common stock – | 2,068,640 | |

DOCUMENTS INCORPORATED BY REFERENCE

None

Table of Contents

Page

PART IV

| | | | | |

| |

Independent Auditors’ Report (PCAOB ID No 34) | |

| |

| |

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K of Biglari Holdings Inc. (“Biglari Holdings”, “we”, “us”, “our”, the “Company” or the “Corporation”) for the fiscal year ended December 31, 2021, originally filed with the Securities and Exchange Commission (the “SEC”) on February 28, 2022 (the “Original Filing”), to include separate audited financial statements of The Lion Fund II, L.P. (the “Lion Fund II”) pursuant to Rule 3-09 of Regulation S-X (“Rule 3-09”) in Part IV, Item 15. The audited financial statements of the Lion Fund II (the “Lion Fund II Financial Statements”) were not available at the time of the Original Filing. In accordance with Rule 3-09(b)(2), the Lion Fund II Financial Statements are being filed as an amendment to the Original Filing within 90 days after the end of the Lion Fund II’s fiscal year.

In addition, in connection with the filing of this Amendment and pursuant to the rules of the SEC, we are including with this Amendment certain currently dated certifications. Accordingly, Item 15 of Part IV has also been amended to reflect the filing of these currently dated certifications.

This Form 10-K/A does not attempt to modify or update any other disclosures set forth in the Original Filing, except as required to reflect the additional information included in Part IV, Item 15 of this Form 10-K/A. Additionally, this Form 10-K/A, except for the additional information included in Part IV, speaks as of the filing date of the Original Filing and does not update or discuss any other Company developments subsequent to the date of the Original Filing. Accordingly, this Form 10-K/A should be read in conjunction with our filings made with the SEC subsequent to the Original Filing.

Item 15. Exhibits and Financial Statement Schedules

INDEPENDENT AUDITORS’ REPORT

To the Partners of The Lion Fund II, L.P.

San Antonio, Texas

Opinion

We have audited the financial statements of The Lion Fund II, L.P. (a Delaware Limited Partnership) (the “Fund”), which comprise the statement of assets and liabilities as of December 31, 2021 and 2020, and the related statements of operations, changes in partners’ capital, and cash flows for the years ended, December 31, 2021, 2020, and 2019 and the related notes to the financial statements (collectively referred to as the “financial statements”).

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of The Lion Fund II as of December 31, 2021 and 2020, and the results of its operations, changes in partners’ capital, and its cash flows for the years then ended December 31, 2021, 2020, and 2019 in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

•Exercise professional judgment and maintain professional skepticism throughout the audit.

•Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

•Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed.

•Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

•Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

/s/ DELOITTE & TOUCHE LLP

Indianapolis, Indiana

March 31, 2022

| | | | | | | | | | | |

| THE LION FUND II, L.P. |

| (A Delaware Limited Partnership) |

| | | |

| STATEMENT OF ASSETS AND LIABILITIES |

| | | |

| | | |

| December 31, 2021 | | December 31, 2020 |

| ASSETS: | | | |

| Investments in securities — at fair value | $ | 534,365,480 | | | $ | 460,785,669 | |

| Cash and cash equivalents | 29,656,370 | | | 105,877,306 | |

| Total assets | $ | 564,021,850 | | | $ | 566,662,975 | |

| | | |

| LIABILITIES: | | | |

| Due to broker | $ | 100,384,135 | | | $ | — | |

| Investments sold short — at fair value | 29,922,480 | | | 23,554,440 | |

| Derivatives — at fair value | 55,855 | | | 1,807,518 | |

| Accounts payable | 54,313 | | | 91,413 | |

| Total liabilities | $ | 130,416,783 | | | $ | 25,453,371 | |

| | | |

| PARTNERS’ CAPITAL | $ | 433,605,067 | | | $ | 541,209,604 | |

| | | |

| See notes to financial statements. | | | |

| | | | | | | | | | | | | | | | | |

| THE LION FUND II, L.P. |

| (A Delaware Limited Partnership) |

| | | | | |

| STATEMENT OF OPERATIONS |

| FOR THE YEARS ENDED DECEMBER 31, 2021, 2020 AND 2019 |

| | | | | |

| 2021 | | 2020 | | 2019 |

| INVESTMENT INCOME: | | | | | |

| Dividends and interest | $ | 4,508,351 | | | $ | 7,057,996 | | | $ | 31,829,049 | |

| | | | | |

| EXPENSES: | | | | | |

| Professional fees | 44,000 | | | 185,413 | | | 187,220 | |

| Interest expense | 820,530 | | | 1,103,146 | | | 7,039,956 | |

| Other expense | 1,137 | | | — | | | — | |

| | | | | |

| NET INVESTMENT INCOME | 3,642,684 | | | 5,769,437 | | | 24,601,873 | |

| | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | | | | | |

| Net realized gains from investments | 13,236,938 | | | 11,123,194 | | | 185,900,988 | |

| Net change in unrealized appreciation - investments | 23,740,919 | | | (66,724,702) | | | (131,898,804) | |

| | | | | |

NET INCREASE (DECREASE) IN PARTNERS'

CAPITAL RESULTING FROM OPERATIONS | $ | 40,620,541 | | | $ | (49,832,071) | | | $ | 78,604,057 | |

| | | | | |

| See notes to financial statements. | | | | | |

| | | | | | | | | | | | | | | | | |

| THE LION FUND II, L.P. |

| (A Delaware Limited Partnership) |

| | | | | |

| STATEMENT OF CHANGES IN PARTNERS' CAPITAL |

| FOR THE YEARS ENDED DECEMBER 31, 2021, 2020 AND 2019 |

| | | | | |

| General Partner | | Limited Partners | | Total |

| PARTNERS' CAPITAL - December 31, 2018 | $ | 48,990,763 | | | $ | 649,989,427 | | | $ | 698,980,190 | |

| Capital contributions | — | | | 40,000,000 | | | 40,000,000 | |

| Capital distributions | (14,135,000) | | | (159,425,000) | | | (173,560,000) | |

| Net increase from operations | 4,611,853 | | | 73,992,204 | | | 78,604,057 | |

| PARTNERS' CAPITAL - December 31, 2019 | $ | 39,467,616 | | | $ | 604,556,631 | | | $ | 644,024,247 | |

| Capital contributions | — | | | 62,130,003 | | | 62,130,003 | |

| Capital distributions | (14,762,572) | | | (100,350,003) | | | (115,112,575) | |

| Net decrease from operations | (6,156,302) | | | (43,675,769) | | | (49,832,071) | |

| Performance fee | 986,561 | | | (986,561) | | | — | |

| PARTNERS' CAPITAL - December 31, 2020 | $ | 19,535,303 | | | $ | 521,674,301 | | | $ | 541,209,604 | |

| Capital contributions | — | | | 12,300,000 | | | 12,300,000 | |

| Capital distributions | (400,000) | | | (160,125,078) | | | (160,525,078) | |

| Net increase from operations | 1,507,875 | | | 39,112,666 | | | 40,620,541 | |

| Performance fee | — | | | — | | | — | |

| PARTNERS' CAPITAL - December 31, 2021 | $ | 20,643,178 | | | $ | 412,961,889 | | | $ | 433,605,067 | |

| | | | | |

| See notes to financial statements. | | | | | |

| | | | | | | | | | | | | | | | | |

| THE LION FUND II, L.P. |

| (A Delaware Limited Partnership) |

| | | | | |

| STATEMENT OF CASH FLOWS |

| FOR THE YEARS ENDED DECEMBER 31, 2021, 2020 AND 2019 |

| | | | | |

| 2021 | | 2020 | | 2019 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | |

| Net increase (decrease) in partners' capital resulting from operations | $ | 40,620,541 | | | $ | (49,832,071) | | | $ | 78,604,057 | |

| Adjustments to reconcile net increase (decrease) in partners' capital | | | | | |

| resulting from operations to net cash provided by operating activities: | | | | | |

| Net realized gains from investments | (13,236,938) | | | (11,123,194) | | | (185,900,988) | |

| Net change in unrealized appreciation - investments | (23,740,919) | | | 66,724,702 | | | 131,898,804 | |

| Proceeds from sale of investments | 44,804,123 | | | 106,114,804 | | | 416,063,175 | |

| Purchases of investments in securities | (76,789,700) | | | (116,304,051) | | | (28,386,587) | |

| Amortization of loan origination fees | — | | | — | | | 327,181 | |

| Changes in due to broker | 100,384,135 | | | — | | | — | |

| Changes in interest payable | — | | | (370,215) | | | (483,427) | |

| Changes in receivables | — | | | 19,889,744 | | | (19,889,744) | |

| Changes in accounts payable | (37,100) | | | 49,413 | | | (107,987) | |

| | | | | |

| Net cash provided by operating activities | 72,004,142 | | | 15,149,132 | | | 392,124,484 | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | |

| Contributions from partners | 12,300,000 | | | 62,130,003 | | | 40,000,000 | |

| Distributions to partners | (160,525,078) | | | (103,910,003) | | | (183,560,000) | |

| Payments of long-term debt | — | | | (112,000,000) | | | (88,000,000) | |

| | | | | |

| Net cash used in financing activities | (148,225,078) | | | (153,780,000) | | | (231,560,000) | |

| | | | | |

| NET INCREASE (DECREASE) IN CASH | (76,220,936) | | | (138,630,868) | | | 160,564,484 | |

| | | | | |

| CASH and CASH EQUIVALENTS - Beginning of year | 105,877,306 | | | 244,508,174 | | | 83,943,690 | |

| | | | | |

| CASH and CASH EQUIVALENTS - End of year | $ | 29,656,370 | | | $ | 105,877,306 | | | $ | 244,508,174 | |

| | | | | |

| See notes to financial statements. | | | | | |

| | | | | | | | | | | |

| THE LION FUND II, L.P. |

| (A Delaware Limited Partnership) |

| | | |

| CONDENSED SCHEDULE OF INVESTMENTS |

|

| | | |

| AS OF DECEMBER 31, 2021: | Shares | | Amount |

| | | |

| INVESTMENTS IN COMMON STOCK AT FAIR VALUE: | | | |

| United States: | | | |

| Diversified: | | | |

Biglari Holdings Inc. Class A common stock (13.4%) | 83,465 | | | $ | 58,008,175 | |

Biglari Holdings Inc. Class B common stock (29.3%) | 890,272 | | | 126,926,079 | |

| Restaurant: | | | |

Cracker Barrel Old Country Store, Inc. (59.3%) | 2,000,000 | | | 257,280,000 | |

| Financial: | | | |

Berkshire Hathaway Class A common stock (10.4%) | 100 | | | 45,066,200 | |

Other securities (10.9%) | | | 47,085,026 | |

| | | |

TOTAL SECURITIES OWNED (cost $602,113,996) (123.2%) | | | $ | 534,365,480 | |

| | | |

As of December 31, 2021, The Lion Fund II, L.P. held $29,922,480 (6.9%) in short positions tied to its arbitrage operation. |

| | | |

Percentages shown are computed based on the classification value compared to partners' capital at December 31, 2021. |

| | | |

| AS OF DECEMBER 31, 2020: | Shares | | Amount |

| | | |

| INVESTMENTS IN COMMON STOCK AT FAIR VALUE: | | | |

| United States: | | | |

| Diversified: | | | |

Biglari Holdings Inc. Class A common stock (8.3%) | 76,707 | | | $ | 44,873,595 | |

Biglari Holdings Inc. Class B common stock (16.8%) | 816,360 | | | 90,779,232 | |

| Restaurant: | | | |

Cracker Barrel Old Country Store, Inc. (48.8%) | 2,000,000 | | | 263,840,000 | |

| Financial: | | | |

Berkshire Hathaway Class A common stock (8.0%) | 125 | | | 43,476,875 | |

Other securities (3.3%) | | | 17,815,967 | |

| | | |

TOTAL SECURITIES OWNED (cost $560,617,885) (85.1%) | | | $ | 460,785,669 | |

| | | |

As of December 31, 2020, The Lion Fund II, L.P. held $23,554,440 (4.4%) in short positions tied to its arbitrage operation. |

| | | |

Percentages shown are computed based on the classification value compared to partners' capital at December 31, 2020. |

| | | |

| See notes to financial statements. | | | |

THE LION FUND II, L.P.

(A Delaware Limited Partnership)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2021, 2020 AND 2019

1.ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Lion Fund II, L.P. (the “Fund”) is an investment fund organized as a limited partnership under the laws of the State of Delaware. The Fund is managed by Biglari Capital Corp. (the “General Partner”). The Fund commenced operations in July 2013 to provide investors with a professionally managed fund with the objective of achieving above-average, long-term growth of capital. In meeting this objective, the Fund will seek to find investments that the General Partner believes offer exceptional value.

Basis of Accounting — The accompanying financial statements of the Fund have been presented on the accrual basis of accounting, in accordance with generally accepted accounting principles (“GAAP”). The Fund is an investment company and therefore complies with accounting and reporting guidance presented in Accounting Standards Codification 946, Financial Services – Investment Companies.

Investments in Securities — Security transactions are accounted for on the date the securities are purchased or sold (trade date). Gains or losses from sales of investments are computed on the specific identification basis. Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis.

Exchange-listed securities are valued at the last sale price on the principal exchange on which they are traded.

Income Taxes — In accordance with federal income tax regulations, no income taxes are levied on a partnership, but rather on the individual partners. Consequently, no provision or liability for federal income taxes has been reflected in the accompanying financial statements.

There were neither liabilities nor deferred tax assets relating to uncertain income tax positions taken or expected to be taken on the tax returns. The Fund has reviewed open tax years and has concluded that there is no significant tax liability resulting from uncertain tax provisions. 2020, 2019 and 2018 remain open for both federal and state jurisdictions.

Cash and Cash Equivalents — Any highly liquid investments with a maturity of three months or less at the date of acquisition are considered cash equivalents. The cash and cash equivalent balances as of December 31, 2021 and 2020 represent cash held by the custodians of the Fund’s investments.

Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Allocation of Net Increase (Decrease) from Operations — The Fund’s income and losses, including unrealized gains or losses and realized gains or losses from the sale of investments, are allocated to the partners in proportion to their respective capital accounts as of the end of each month.

Due to Broker — Due to broker represents margin debit balances.

2.CONCENTRATIONS OF CREDIT RISK

The Fund does not clear its own securities transactions. It has established accounts with financial institutions for this purpose. This can, and often does, result in concentration of credit risk with one or more of these firms. Such risk, however, is mitigated by the obligation of U.S. financial institutions to comply with rules and regulations governing broker/dealers and futures commission merchants. These rules and regulations generally require maintenance of net capital, as defined, and segregation of customers’ funds and securities from holdings of the firm.

3.RELATED-PARTY TRANSACTIONS

The General Partner is entitled to receive a performance reallocation of 25% of the increase in net assets annually. This reallocation is subject to a 6% performance hurdle rate that the Fund’s performance must exceed in order for the General Partner to be entitled to such reallocation. Additionally, this reallocation is subject to a high-water mark provision. The General Partner did not earn a performance reallocation during 2021. The General Partner earned a performance reallocation of $986,561 during 2020.

Sardar Biglari is the Chairman, Chief Executive Officer and sole owner of the General Partner. Mr. Biglari is also the Chairman and Chief Executive Officer of Biglari Holdings Inc. (“Biglari Holdings”). Biglari Holdings is a limited partner in the Fund and is subject to a performance reallocation.

During 2021, the Fund purchased 6,758 shares of Biglari Holdings Class A common stock and 73,912 shares of Biglari Holdings Class B common stock. The Fund did not distribute any shares of Biglari Holdings Class A common stock or Biglari Holdings Class B common stock to the General Partner during 2021. During 2020, the Fund purchased 5,770 shares of Biglari Holdings Class A common stock and 106,983 shares of Biglari Holdings Class B common stock. Also during 2020, the Fund distributed 1,684 shares of Biglari Holdings Class A common stock and 16,841 shares of Biglari Holdings Class B common stock to the General Partner. There were no purchases or distributions of Biglari Holdings common stock in 2019.

The General Partner of the Fund also serves as the General Partner of The Lion Fund, L.P. The Lion Fund, L.P. is a limited partner in the Fund and is not subject to a performance reallocation.

4.FAIR VALUE MEASUREMENTS

Exchange-listed securities are valued at the last sale price on the principal exchange on which they are traded.

Level 1 securities in accordance with the GAAP established fair value hierarchy are based on unadjusted quoted prices in active markets for identical assets and liabilities. As of December 31, 2021 and 2020, total securities were $534,365,480 and $460,785,669, respectively. As of December 31, 2021 and 2020, derivative balances were liabilities of $55,855 and $1,807,518, respectively. As of December 31, 2021 and 2020, short positions were liabilities of $29,922,480 and $23,554,440, respectively. The securities, derivatives and short positions are classified as Level 1 inputs within the GAAP established hierarchy.

5.SUBSEQUENT EVENTS

We have evaluated subsequent events for recognition or disclosure through the time of issuance of these financial statements on March 31, 2022.

6.FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | |

| 2021 | | 2020 | | 2019 |

| | | | | |

| Total return before performance reallocation | 7.43 | % | | (6.73) | % | | 11.99 | % |

| Performance reallocation | 0.00 | | | (0.18) | | | 0.00 | |

| Total return after performance reallocation | 7.43 | % | | (6.91) | % | | 11.99 | % |

Supplemental Data | | | | | | | | | | | | | | | | | |

| 2021 | | 2020 | | 2019 |

| | | | | |

| Annual gross partnership return | 9.91 | % | | (7.92) | % | | 12.93 | % |

| Annual net partnership return | 9.70 | % | | (8.13) | % | | 11.84 | % |

Total return for limited partners is calculated for the limited partners as a whole and is measured by dividing the increase or decrease in net assets, net of the expenses and performance reallocation to the General Partner, into the weighted average limited partners’ capital measured at the end of each month. An individual limited partner’s return may vary from these returns based on the timing of capital transactions.

Gross partnership return is calculated for the Fund as a whole and is measured by dividing the total increase or decrease in net assets, before expenses, into the weighted average partners’ capital measured at the end of each month. The net partnership return is calculated in similar fashion, after expenses.

| | | | | | | | | | | | | | | | | |

| 2021 | | 2020 | | 2019 |

| Ratio to average partners' capital: | | | | | |

| Expenses before performance reallocation | 0.18 | % | | 0.26 | % | | 1.01 | % |

| Performance reallocation | 0.00 | | | 0.21 | | | 0.00 | |

| Expenses including performance reallocation | 0.18 | % | | 0.47 | % | | 1.01 | % |

| | | | | |

| Net investment income | 0.74 | % | | 1.17 | % | | 3.45 | % |

Average partners’ capital is determined using the Fund’s partners’ capital measured at the end of each month. The performance reallocation to the General Partner is not included in the net investment income ratio.

Expenses include accounting fees, interest and other expenses. Net investment income is computed as investment income from dividends and interest, less expenses.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on March 31, 2022.

| | | | | | | | | | | | | | | | | |

| |

| |

|

| | BIGLARI HOLDINGS INC. |

| | | | |

| | | By: | | /s/ Bruce Lewis |

| | | | Bruce Lewis

Controller |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities indicated, on March 31, 2022.

| | | | | | | | |

| |

|

| Signature | | Title |

| | |

/s/ SARDAR BIGLARI | | Chairman of the Board and Chief Executive Officer (Principal Executive Officer) |

| Sardar Biglari | | |

| | |

/s/ BRUCE LEWIS | | Controller (Principal Financial and Accounting Officer) |

| Bruce Lewis | | |

| | |

/s/ JOHN G. CARDWELL | | Director |

| John G. Cardwell | | |

| | |

/s/ PHILIP COOLEY | | Director – Vice Chairman |

| Philip Cooley | | |

| | |

/s/ KENNETH R. COOPER | | Director |

| Kenneth R. Cooper | | |

| | |

/s/ RUTH J. PERSON | | Director |

| Ruth J. Person | | |

| | |

/s/ EDMUND B. CAMPBELL, III | | Director |

| Edmund B. Campbell, III | | |

| | |

INDEX TO EXHIBITS

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| | |

| | |

| | |

| 104 | | Cover page Interactive Data File (embedded within the Inline XBRL document) |

The Lion Fund II Financial Statements are filed under Item 15(c).

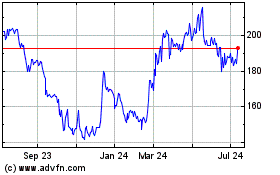

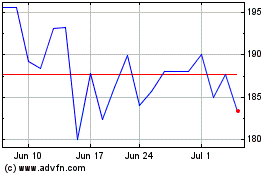

Biglari (NYSE:BH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Biglari (NYSE:BH)

Historical Stock Chart

From Apr 2023 to Apr 2024