Crédit Agricole CIB acts as the Sole Lead Green Structuring Agent on O-I Glass’s Green Bond Issuance

June 06 2023 - 1:45PM

Business Wire

Crédit Agricole CIB has advised O-I Glass on structuring its

refreshed Green Financing Framework and Green Bond issuance (USD

690m 8NC3 at 7.25%, EUR 600m 5NC2 at 6.25%).

O-I Glass, Inc. is an American company that specializes in

container glass products. It is one of the world's leading

manufacturers of packaging products, and is the largest

manufacturer of glass containers in North America, South America,

Asia-Pacific and Europe.

The Green Bond issuance provides for an amount equal to the net

proceeds to be allocated to certain eligible green projects,

including:

- Projects and investments aimed at increasing utilization of

renewable energy

- Investments in energy efficient solutions in offices, plants

and warehouses

- Use of new technologies aimed at reducing potable water

consumption in manufacturing processes

- Projects, investments, and R&D aimed at improving the

production technologies and processes in manufacturing facilities,

and facilitating the use of alternative resources

- Projects involving waste collection and/or glass recycling

processing

- Projects aimed at decreasing the use of raw materials, and

using sustainable raw materials to produce environmentally friendly

products

“O-I, the first ever glass packaging company to issue a green

bond, issued its second green bond marking the largest ever green

bond from a US packaging company. Our bank is thrilled to have

acted as Sole Lead Green Structuring Agent on the transaction

supporting OI’s thought-leadership and commitment to driving

meaningful environmental change.” says Romina Reversi, Head of

Sustainable Investment Banking Americas at Crédit Agricole CIB.

About Crédit Agricole Corporate and Investment Bank (Crédit

Agricole CIB)

Crédit Agricole CIB is the corporate and investment banking arm

of Credit Agricole Group, the 10th largest banking group worldwide

in terms of balance sheet size (The Banker, July 2022). More than

8,900 employees across Europe, the Americas, Asia-Pacific, the

Middle East and Africa support the Bank's clients, meeting their

financial needs throughout the world. Crédit Agricole CIB offers

its large corporate and institutional clients a range of products

and services in capital markets activities, investment banking,

structured finance, commercial banking and international trade. The

Bank is a pioneer in the area of climate finance, and is currently

a market leader in this segment with a complete offer for all its

clients.

For many years Crédit Agricole CIB has been committed to

sustainable development. The Bank was the first French bank to sign

the Equator Principles in 2003. It has also been a pioneer in Green

Bond markets with the arrangement of public transactions from 2012

for a wide array of issuers (supranational banks, corporates, local

authorities, banks) and was one of the co-drafter of Green Bond

Principles and of the Social Bond Guidance. Relying on the

expertise of a dedicated sustainable banking team and on the strong

support of all bankers, Crédit Agricole CIB is one of the most

active banks in the Green bonds market.

For more information, please visit www.ca-cib.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230606005920/en/

Crédit Agricole Corporate and Investment Bank

Jenna Lee Head of Communications for the Americas Email:

jenna.lee@ca-cib.com Tel: +1 212 261 7328

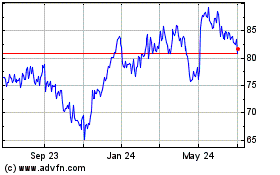

Arcosa (NYSE:ACA)

Historical Stock Chart

From Apr 2024 to May 2024

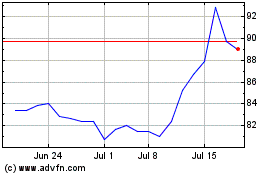

Arcosa (NYSE:ACA)

Historical Stock Chart

From May 2023 to May 2024