Statement of Changes in Beneficial Ownership (4)

October 01 2021 - 6:04PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Lousada Max |

2. Issuer Name and Ticker or Trading Symbol

Warner Music Group Corp.

[

WMG

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

CEO, Recorded Music |

|

(Last)

(First)

(Middle)

C/O WARNER MUSIC GROUP CORP., 1633 BROADWAY |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/29/2021 |

|

(Street)

NEW YORK, NY 10019

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 9/29/2021 | | S | | 510165 (1) | D | $41.05 | 1048784 (2) | I | By LLC (2)(3) |

| Class A Common Stock | | | | | | | | 2607026 (4) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Represents shares of the Issuer's Class A Common Stock sold pursuant to the redemption of 550,000 Class B Units of Management LLC, after taking into account a number of shares of Class B Common Stock having a value equal to $1,753,523 on the date of such redemption, which is the sum of the benchmark amounts of the Class B Units redeemed. |

| (2) | Shares of the Issuer's Class A Common Stock represented by 1,048,784 Class B Units of WMG Management Holdings, LLC ("Management LLC") pursuant to the terms of, and subject to the limitations and restrictions set forth in, the Second Amended and Restated Limited Liability Company Agreement of Management LLC, as amended, these Class B Units are redeemable for a number of shares of the Issuer's Class B Common Stock equal to 1,048,784 less a number of shares of Class B Common Stock having a value equal to $3,343,758 on the date of such redemption (the "Benchmark Shares"), which is the sum of the benchmark amounts of the Class B Units. The reporting person expressly disclaims beneficial ownership of the Benchmark Shares. |

| (3) | Any shares of the Issuer's Class B Common Stock issued to the reporting person upon a redemption of Class B Units will immediately and automatically convert to shares of the Issuer's Class A Common Stock on a one-for-one basis, and the corresponding Class B Units will be cancelled. |

| (4) | Represents vested Deferred Equity Units issued under the Second Amended and Restated Warner Music Group Corp. Senior Management Free Cash Flow Plan (the "Plan"). These Deferred Equity Units will be settled for shares of the Issuer's Class A Common Stock on a one-for-one basis by no later than December 31, 2025. Upon such settlement, the corresponding Deferred Equity Units will be cancelled. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Lousada Max

C/O WARNER MUSIC GROUP CORP.

1633 BROADWAY

NEW YORK, NY 10019 |

|

| CEO, Recorded Music |

|

Signatures

|

| /s/ Trent N. Tappe, as Attorney-in-Fact | | 10/1/2021 |

| **Signature of Reporting Person | Date |

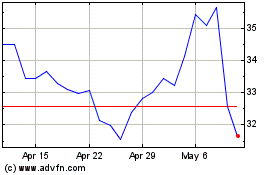

Warner Music (NASDAQ:WMG)

Historical Stock Chart

From May 2024 to Jun 2024

Warner Music (NASDAQ:WMG)

Historical Stock Chart

From Jun 2023 to Jun 2024