UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2022

Commission File Number: 001-37889

TOP SHIPS INC.

(Translation of registrant’s name into English)

1 VAS. SOFIAS & MEG.

ALEXANDROU STREET

151 24, MAROUSSI

ATHENS, GREECE

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover

of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): _______

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): _______

Note: Regulation S-T Rule 101(b)(7) only permits the submission

in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and

make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's

"home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as

the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders,

and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Information Contained in this

Form 6-K Report

Closing of Public Offering

On December 6, 2022, TOP Ships Inc. (the “Company,” “we,”

“our” or “us”) closed a public offering (the “Offering”) of 6,750,000 units, each consisting of one

of our common shares and one Class C warrant (a “Class C Warrant”), at a price of $2.00 per unit. Each Class C Warrant is

immediately exercisable for one common share at an exercise price of $2.00 per share and expires five years after the issuance date. In

connection with the offering, we entered into a securities purchase agreement with an unaffiliated institutional investor, dated December

4, 2022. The gross proceeds of the offering to us, before discounts and commissions and estimated offering expenses, are expected to be

approximately $13.5 million. The net proceeds of the offering, after discounts and commissions and offering expenses, will be used for

general corporate purposes, which may include, among other things, repayment of senior secured debt, redemption of preferred shares, or

the acquisition of additional vessels in accordance with our business strategy. However, we have not identified any potential acquisitions,

and we can provide no assurance that we will be able to complete the acquisition of any additional vessels that we are able to identify.

Update on Issued and Outstanding Common Shares

As of December 6, 2022, following the closing of the public offering

described above, 10,294,906 of our common shares were issued and outstanding.

As of December 6, 2022, the aggregate market value of our outstanding

common shares held by non-affiliates, computed pursuant to General Instruction I.B.5 of Form F-3, was approximately $82,001,289, based

on 10,294,906 common shares outstanding, of which 10,289,906 were held by non-affiliates, and a price of $7.9691, the average of the bid

and asked prices for our common shares on the Nasdaq Capital Market on October 7, 2022. We are thus currently eligible to offer and sell

securities under our effective registration statement on Form F-3 (File No. 333-267170), covering the sale of up to $200 million of our

securities, without regard to the limitation on sales specified in General Instruction I.B.5(a) of Form F-3.

The market price and trading volume of our common shares have very

recently and at certain other times in the past exhibited, and may continue to exhibit, extreme volatility, including within a single

trading day. Such volatility could cause purchasers of our common shares to incur substantial losses. For example, on October 5, 2022,

the trading price of our common shares ranged from an intra-day high of $11.60 to an intra-day low of $5.28, on trading volume of approximately

40.8 million shares. More recently, on November 30, 2022, the trading price of our common shares ranged from an intra-day high of $4.38

to an intra-day low of $2.03, on trading volume of approximately 23.6 million shares, and over the following three trading days, the trading

price of our common shares ranged from an intra-day high of $5.94 to an intra-day low of $1.73, on daily trading volume of between approximately

29.0 million shares and 44.3 million shares. By comparison, during the period from January 1, 2022 to November 30, 2022, the average daily

trading volume of our common shares was approximately 800,000 shares and the trading price of our common shares fluctuated from an intra-day

high of $32.80 on March 7, 2022 to an intra-day low of $2.02 on November 29, 2022. With respect to certain such instances of trading volatility,

including the period beginning on November 30, 2022, we are not aware of any material changes in our financial condition or results of

operations that would explain such price volatility or trading volume, which we believe reflect market and trading dynamics unrelated

to our operating business or prospects and outside of our control. We are thus unable to predict when such instances of trading volatility

will occur or how long such dynamics may last. Under these circumstances, we would caution you against investing in our common shares

unless you are prepared to incur the risk of incurring substantial losses.

Certain Risks Relating to our Common Shares

The risk factors set forth below supplement and should be read together

with those risk factors set forth under the heading “Risk Factors” in our Annual Report on Form 20-F for the year ended December

31, 2021, filed with the Commission on April 15, 2022.

The market price and trading volume of our common shares may

continue to be highly volatile, which could lead to a loss of all or part of a shareholder’s investment.

The market price of our common shares has fluctuated widely since our

common shares began trading in July of 2004 on Nasdaq. During the period from January 1, 2022 to December 12, 2022, the trading price

of our common shares has fluctuated from an intra-day high of $32.80 on March 7, 2022 to an intra-day low of $1.30 on December 12, 2022.

The market price of our common shares is affected by a variety of factors,

including:

| • | fluctuations

in interest rates; |

| • | fluctuations

in the availability or the price of oil and chemicals; |

| • | fluctuations

in foreign currency exchange rates; |

| • | announcements

by us or our competitors; |

| • | changes

in our relationships with customers or suppliers; |

| • | actual

or anticipated fluctuations in our semi-annual and annual results and those of other public companies in our industry; |

| • | changes

in United States or foreign tax laws; |

| • | international

sanctions, embargoes, import and export restrictions, nationalizations, piracy and wars or other conflicts, including the war in Ukraine. |

| • | actual

or anticipated fluctuations in our operating results from period to period; |

| • | shortfalls

in our operating results from levels forecast by securities analysts; |

| • | market

conditions in the shipping industry and the general state of the securities markets; |

| • | business

interruptions caused by the ongoing outbreak of COVID-19; |

| • | mergers

and strategic alliances in the shipping industry; |

| • | changes

in government regulation; |

| • | a

general or industry-specific decline in the demand for, and price of, shares of our common shares resulting from capital market conditions

independent of our operating performance; |

| • | the

loss of any of our key management personnel; |

| • | our

failure to successfully implement our business plan; |

| • | stock

splits / reverse stock splits. |

In addition, over the last few years, the stock market has experienced

price and volume fluctuations, including due to factors relating to the ongoing outbreak of COVID-19 and the war in Ukraine, and this

volatility has sometimes been unrelated to the operating performance of particular companies. As a result, there is a potential for rapid

and substantial decreases in the price of our common shares, including decreases unrelated to our operating performance or prospects.

This market and share price volatility relating to the effects of COVID-19 or the war in Ukraine, as well as general economic, market

or political conditions, has and could further reduce the market price of our common shares in spite of our operating performance and

could also increase our cost of capital, which could prevent us from accessing debt and equity capital on terms acceptable to us or at

all.

In addition, the market price and trading volume of our common shares

have very recently and at certain other times in the past exhibited, and may continue to exhibit, extreme volatility, including within

a single trading day. Such volatility could cause purchasers of our common shares to incur substantial losses. For example, on October

5, 2022, the trading price of our common shares ranged from an intra-day high of $11.60 to an intra-day low of $5.28, on trading volume

of approximately 40.8 million shares. More recently, on November 30, 2022, the trading price of our common shares ranged from an intra-day

high of $4.38 to an intra-day low of $2.03, on trading volume of approximately 23.6 million shares, and over the following three trading

days, the trading price of our common shares ranged from an intra-day high of $5.94 to an intra-day low of $1.73, on daily trading volume

of between approximately 29.0 million shares and 44.3 million shares. By comparison, during the period from January 1, 2022 to November

30, 2022, the average daily trading volume of our common shares was approximately 800,000 shares and the trading price of our common shares

fluctuated from an intra-day high of $32.80 on March 7, 2022 to an intra-day low of $2.02 on November 29, 2022. With respect to certain

such instances of trading volatility, including the period beginning on November 30, 2022, we are not aware of any material changes in

our financial condition or results of operations that would explain such price volatility or trading volume, which we believe reflect

market and trading dynamics unrelated to our operating business or prospects and outside of our control. We are thus unable to predict

when such instances of trading volatility will occur or how long such dynamics may last. Under these circumstances, we would caution you

against investing in our common shares unless you are prepared to incur the risk of incurring substantial losses.

A proportion of our common shares may be traded by short sellers which

may put pressure on the supply and demand for our common shares, creating further price volatility. In particular, a possible “short

squeeze” due to a sudden increase in demand of our common shares that largely exceeds supply may lead to sudden extreme price volatility

in our common shares. Investors may purchase our common shares to hedge existing exposure in our common shares or to speculate on the

price of our common shares. Speculation on the price of our common shares may involve long and short exposures. To the extent aggregate

short exposure exceeds the number of common shares available for purchase in the open market, investors with short exposure may have to

pay a premium to repurchase our common shares for delivery to lenders of our common shares. Those repurchases may in turn, dramatically

increase the price of our common shares until investors with short exposure are able to purchase additional common shares to cover their

short position. This is often referred to as a “short squeeze.” Following such a short squeeze, once investors purchase the

shares necessary to cover their short position, the price of our common shares may rapidly decline. A short squeeze could lead to volatile

price movements in our shares that are not directly correlated to the performance or prospects of our company and could cause purchasers

of our common shares to incur substantial losses.

Further, shareholders may institute securities class action litigation

following periods of market volatility. If we were involved in securities litigation, we could incur substantial costs and our resources

and the attention of management could be diverted from our business.

We issued common shares in the past through

various transactions, and we may do so in the future without shareholder approval, which may dilute our existing shareholders, depress

the trading price of our securities and impair our ability to raise capital through subsequent equity offerings.

We have already sold large quantities of our common

shares, and securities convertible into common shares, pursuant to previous public and private offerings of our equity and equity-linked

securities. We currently have an effective registration statement on Form F-3 (333-267170), for the registered sale of $200 million of

our securities.

We also have 13,452 Series E Preferred Shares

outstanding, which are convertible into 11,026,230 shares, calculated as of December 12, 2022. All of the Series E Preferred Shares and

the common shares issuable on conversion of the Series E Preferred Shares are beneficially owned by the Lax Trust, an irrevocable trust

established for the benefit of certain family members of Mr. Evangelos J. Pistiolis, our President, Chief Executive Officer and Director.

In addition, outstanding warrants issued in a

private placement in October 2022 are exercisable to purchase up to 1,072,725 common shares at an exercise price of $6.75 per share, and

the outstanding Class C Warrants are exercisable to purchase up to 6,750,000 common shares at an exercise price of $2.00 per share.

Purchasers of the common shares we sell, as well as our existing shareholders,

will experience significant dilution if we sell shares at prices significantly below the price at which they invested. In addition, we

may issue additional common shares or other equity securities of equal or senior rank in the future in connection with, among other things,

debt prepayments, future vessel acquisitions, redemptions of our Series E or Series F Preferred Shares, or any future equity incentive

plan, without shareholder approval, in a number of circumstances. Our existing shareholders may experience significant dilution if we

issue shares in the future at prices below the price at which previous shareholders invested.

Our issuance of additional shares of common shares or other equity

securities of equal or senior rank would have the following effects:

| • | our

existing shareholders’ proportionate ownership interest in us will decrease; |

| • | the

amount of cash available for dividends payable on the shares of our common shares may decrease; |

| • | the

relative voting strength of each previously outstanding common share may be diminished; and |

| • | the

market price of the shares of our common shares may decline. |

The market price of our common shares could decline due to sales, or

the announcements of proposed sales, of a large number of common shares in the market, including sales of common shares by our large shareholders

or by holders of securities convertible into common shares, or the perception that these sales could occur. These sales or the perception

that these sales could occur could also depress the market price of our common shares and impair our ability to raise capital through

the sale of additional equity securities or make it more difficult or impossible for us to sell equity securities in the future at a time

and price that we deem appropriate. We cannot predict the effect that future sales of common shares or other equity-related securities

would have on the market price of our common shares.

Our Third Amended and Restated Articles of Incorporation, as amended,

authorizes our Board of Directors to, among other things, issue additional shares of common or preferred stock or securities convertible

or exchangeable into equity securities, without shareholder approval. We may issue such additional equity or convertible securities to

raise additional capital. The issuance of any additional shares of common or preferred stock or convertible securities could be substantially

dilutive to our shareholders. Moreover, to the extent that we issue restricted stock units, stock appreciation rights, options or warrants

to purchase our common shares in the future and those stock appreciation rights, options or warrants are exercised or as the restricted

stock units vest, our shareholders may experience further dilution. Holders of shares of our common shares have no preemptive rights that

entitle such holders to purchase their pro rata share of any offering of shares of any class or series and, therefore, such sales or offerings

could result in increased dilution to our shareholders.

The issuance of common shares in this offering may trigger anti-dilution

provisions in our Series E Preferred Shares and affect the interests of our common shareholders.

The Series E Preferred Shares contain anti-dilution provisions that

have been triggered by securities we have issued, including common shares, convertible preferred shares, and warrants, and could further

be triggered by future issuances of the same or similar types of securities, depending on the offering price of equity issuances, the

conversion price or formula of convertible shares or the exercise price or formula of warrants. Any issuance of common shares, including

in this offering, below the applicable fixed conversion price of the Series E Preferred Shares would result in an adjustment downward

of the Series E Preferred Shares fixed conversion price and could result in a corresponding increase in the number of common shares each

Series E Share is converted into. Moreover, future issuance of other equity or debt convertible into or issuable or exchangeable for common

shares at a price per share less than the current fixed conversion price of the Series E Preferred Shares would result in similar adjustments.

These adjustments could increase the number of common shares issuable upon conversion of the Series E Preferred Shares, dilute the interests

of our common shareholders and affect the trading price for our common shares. Furthermore, the Series E Preferred Shares conversion price

is equal to the lesser of the fixed conversion price, subject to adjustment as described above, and a variable conversion price, namely

80% of the lowest daily Volume-Weighted Average Price of our common shares over the 20 consecutive trading days expiring on the trading

day immediately prior to the date of delivery of a conversion notice. However, in no case can the conversion price be less than $0.60.

As of December 12, 2022, because of the operation of this variable conversion price, the Series E Preferred Shares had a conversion price

equal to $1.22 and are convertible into 11,026,230 common shares.

This Report on Form 6-K does not constitute an offer to sell, or a

solicitation of an offer to buy, any securities of the Company, including, without limitation, the securities sold in the offering described

herein.

****

Attached to this report on Form 6-K as Exhibit 4.1 is a copy of the

Placement Agency Agreement dated December 4, 2022 between the Company and Maxim Group LLC, as sole placement agent.

Attached to this report on Form 6-K as Exhibit 4.2 is a copy of the

form of the Securities Purchase Agreement, between the Company and the purchasers named therein.

Attached to this report on Form 6-K as Exhibit 4.3 is a copy of the

Warrant Agency Agreement, dated December 6, 2022, between the Company and American Stock Transfer & Trust Company, LLC, as Warrant

Agent.

Attached to this report on Form 6-K as Exhibit 4.4 is a copy of the

form of the Class C Warrant.

Attached to this report on Form 6-K as Exhibit 99.1 is a copy of the

press release of the Company dated December 4, 2022, titled “TOP Ships Announces Pricing of $13.5 Million Public Offering.”

Attached to this report on Form 6-K as Exhibit 99.2 is a copy of the

press release of the Company dated December 6, 2022, titled “TOP Ships Announces Closing of $13.5 Million Public Offering.”

****

The information contained in this report on Form 6-K is hereby incorporated

by reference into the Company's registration statements on Form F-3 (File Nos. 333-267170 and 333-268475).

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

| |

TOP SHIPS INC. |

| |

(Registrant) |

|

| |

|

|

|

| |

By: |

/s/ Evangelos J. Pistiolis |

|

| |

Name: |

Evangelos J. Pistiolis |

| |

Title: |

Chief Executive Officer |

Date: December 13, 2022

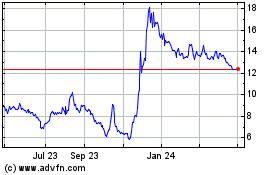

TOP Ships (NASDAQ:TOPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

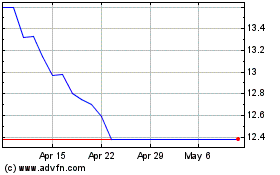

TOP Ships (NASDAQ:TOPS)

Historical Stock Chart

From Apr 2023 to Apr 2024