Filed

Pursuant to Rule 424(b)(5)

Registration Statement No. 333-261427

|

PROSPECTUS SUPPLEMENT

(To Prospectus dated December 16, 2021) |

|

|

|

|

SOLUNA HOLDINGS, INC.

1,142,857 Shares of 9.0% Series A Cumulative Perpetual Preferred Stock

Liquidation

Preference $25.00 per Share

Soluna Holdings, Inc. (the “Company”,

“we”, “us” or “our”) is offering directly to certain institutional lenders (the “Lenders”)

holding promissory notes of the Company in the aggregate principal amount of $20 million (the “Notes”), pursuant to

this prospectus supplement and the accompanying base prospectus, an aggregate of 1,142,857 shares (the “Shares”) of

our 9.0% Series A Cumulative Perpetual Preferred Stock, par value $0.001 per share, with a $25.00 liquidation preference per share

(the “Series A Preferred Stock”), at an offering price of $17.50 per Share. Pursuant to the terms of the Notes, the

Shares are being offered as repayment of the Notes in full satisfaction of the Company’s obligations thereunder.

Concurrently with this offering of Shares

(the “Offering”), and pursuant to a separate prospectus supplement, we offered to sell up to an aggregate of 525,714

shares of Series A Preferred Stock (604,571 shares of Series A Preferred Stock in the event that the over-allotment option is fully

exercised the underwriters for such offering) for aggregate gross proceeds of approximately $9.2 million in an underwritten public

offering, prior to deducting underwriting discounts and commissions and estimated offering expenses payable by us (the “Underwritten

Offering”, and together with the Offering, the “Offerings”). The public offering price of the shares of Series

A Preferred Stock we are offering in connection with the Underwritten Offering is the same as the offering price of the Shares

offered hereby. The closing of each of the Offerings is not contingent upon the other. See “Plan of Distribution” for

more information.

The Offerings are a re-opening of our original

issuance of Series A Preferred Stock, which occurred on August 23, 2021, and our follow-on issuances of Series A Preferred Stock,

which occurred on December 28, 2021 and January 5, 2022. The additional shares of Series A Preferred Stock offered hereby and in

connection with the Underwritten Offering will form a single series with such prior issuances, and be fully fungible, with the

outstanding shares of our Series A Preferred Stock. As of the date of this prospectus supplement, there were 1,319,156 shares of

our Series A Preferred Stock issued and outstanding, excluding the shares of Series A Preferred Stock to be issued in this Offering

and the Underwritten Offering.

Subject to the preferential rights, if

any, of the holders of any class or series of our capital stock ranking senior to the Series A Preferred Stock as to the dividends

(of which none exist at this time), dividends on the Series A Preferred Stock, when, as and if declared by our board of directors

(the “Board”) or a duly authorized committee thereof, will be payable in cash on the $25.00 liquidation preference

amount (based on an annual rate of 9.0% of such liquidation preference per year, equivalent to $2.25 per year), on a cumulative

basis, monthly in arrears on the final day of each month (each, a “Dividend Payment Date”), if a business day, and

if such Dividend Payment Date is not a business day, then such next succeeding business day. The first dividend on the shares of

Series A Preferred Stock offered pursuant to this prospectus supplement will be paid on or about May 31, 2022, which will include

the period from May 1, 2022 through May 31, 2022. We expect that the settlement for any dividend that may be due for the period

from the first date we issue and sell such shares of Series A Preferred Stock pursuant to this prospectus supplement through, but

not including, May 1, 2022, will be paid at the closing of this Offering to the extent this Offering closes before May 1, 2022.

The

Series A Preferred Stock is perpetual, has no maturity date and is not redeemable prior to August 23, 2026, except under the circumstances

described under “Description of the Series A Preferred Stock—Special Optional Redemption.” On or after August

23, 2026, the Series A Preferred Stock may be redeemed at our option, in whole or in part, from time to time, at a redemption

price of $25.00 per share of Series A Preferred Stock, plus all dividends accumulated and unpaid (whether or not declared) on

the Series A Preferred Stock up to, but not including, the date of such redemption, upon the giving of notice, as described below

under “Description of the Series A Preferred Stock—Optional Redemption.”

Upon the occurrence of a Delisting Event

or a Change of Control (each as defined below), as applicable, each holder of Series A Preferred Stock will have the right (unless

we have provided or provide notice of our election to redeem the Series A Preferred Stock pursuant to the certificate of designations,

preferences and rights of the Series A Preferred Stock, as amended (the “Certificate of Designations”)) to convert

some or all of the shares of Series A Preferred Stock held by such holder on the Delisting Event Conversion Date or Change of Control

Conversion Date (each defined below), as applicable, into a number of shares of our common stock, par value $0.001 per share (the

“Common Stock”) (or equivalent value of alternative consideration), per share of Series A Preferred Stock according

to the formula provided in the Certificate of Designations and as described under “Description of the Series A Preferred

Stock — Limited Conversion Rights”. In addition, upon a Change of Control, we may, at our option, redeem the Series

A Preferred Stock, in whole or in part and within 120 days after the first date on which such Change of Control occurs, by paying

$25.00 per share of Series A Preferred Stock, plus all dividends accumulated and unpaid (whether or not declared) on the Series

A Preferred Stock up to, but not including, the date of such redemption.

The

Series A Preferred Stock will not have voting rights, subject to certain exceptions provided in the Certificate of Designations

and described further under “Description of the Series A Preferred Stock—Limited Voting Rights.”

Investing in shares of Series A Preferred

Stock involves a high degree of risk. See “Risk Factors” beginning on page S-8 of this prospectus supplement, page

4 of the accompanying base prospectus and the risks discussed in the documents incorporated by reference in this prospectus supplement

and the accompanying base prospectus, as they may be amended, updated or modified periodically in our reports filed with the Securities

and Exchange Commission. You should carefully read and consider these risk factors before you invest in our Series A Preferred

Stock.

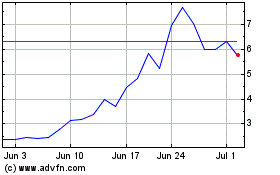

Our Common Stock and our Series A Preferred

Stock are currently listed on The Nasdaq Capital Market (“Nasdaq”) under the symbols “SLNH” and “SLNHP”,

respectively. On April 25, 2022, the last reported sale price of our Common Stock was $8.82 per share and the last reported sale

price of our Series A Preferred Stock was $18.0251 per share.

We expect to deliver the shares of Series

A Preferred Stock to Lenders against each Lender’s tender of its respective Notes on or before April 29, 2022.

Neither the Securities and Exchange

Commission (the “SEC”) nor any state securities commission has approved or disapproved of the securities offered hereby

or passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is April 26, 2022

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts, this prospectus supplement and the accompanying base prospectus, both of which are part of a registration

statement on Form S-3, as amended (File No. 333-261427) (the “Registration Statement”), that we filed with the SEC

using a “shelf” registration process and which was declared effective by the SEC on December 16, 2021.

The

two parts of this document include: (1) this prospectus supplement, which describes the specific details regarding this Offering

of the shares of Series A Preferred Stock; and (2) the accompanying base prospectus included in the Registration Statement,

which provides a general description of the securities that we may offer, some of which may not apply to this Offering. Generally,

when we refer to this “prospectus,” we are referring to both documents combined. If information in this prospectus

supplement is inconsistent with the accompanying base prospectus, you should rely on this prospectus supplement. You should read

this prospectus supplement together with the additional information described below under the heading “Where You Can Find

More Information” and “Incorporation of Documents by Reference.”

Any

statement made in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this

prospectus supplement, the accompanying base prospectus and the Registration Statement will be deemed to be modified or superseded

for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement or in any other

subsequently filed document that is also incorporated by reference into this prospectus supplement modifies or supersedes that

statement. Any statements so modified or superseded will be deemed not to constitute a part of this prospectus supplement except

as so modified or superseded. In addition, to the extent of any inconsistencies between the statements in this prospectus supplement

and similar statements in any previously filed report incorporated by reference into this prospectus supplement, the accompanying

base prospectus and the Registration Statement, the statements in this prospectus supplement will be deemed to modify and supersede

such prior statements.

The

Registration Statement that contains the accompanying base prospectus and this prospectus supplement, including the exhibits to

the Registration Statement and the information incorporated by reference herein and therein, contains additional information about

the shares of Series A Preferred Stock offered under this prospectus supplement. The Registration Statement can be read on the

SEC’s website or at the SEC’s offices mentioned below under the heading “Where You Can Find More Information.”

We are responsible for

the information contained and incorporated by reference in this prospectus supplement, the accompanying base prospectus and any

related free writing prospectus that we prepare or authorize. We have not authorized anyone to provide you with different or additional

information, and we take no responsibility for any other information that others may give you. If you receive any other information,

you should not rely on it.

This

prospectus supplement and the accompanying base prospectus do not constitute an offer to sell or the solicitation of an offer

to buy any securities other than the shares of Series A Preferred Stock to which this prospectus supplement relates, nor do this

prospectus supplement and the accompanying base prospectus constitute an offer to sell or the solicitation of an offer to buy

securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You

should not assume that the information in this prospectus supplement and the accompanying base prospectus is accurate at any date

other than the date indicated on the cover page of this prospectus supplement or that any information that we have incorporated

by reference in this prospectus supplement and the accompanying base prospectus is correct on any date subsequent to the date

of the document incorporated by reference. Our business, financial condition, results of operations or prospects may have changed

since that date.

You

should not rely on or assume the accuracy of any representation or warranty in any agreement that we have filed in connection

with this Offering or that we may otherwise publicly file in the future because any such representation or warranty may be subject

to exceptions and qualifications contained in separate disclosure schedules, may represent the applicable parties’ risk

allocation in the particular transaction, may be qualified by materiality standards that differ from what may be viewed as material

for securities law purposes or may no longer continue to be true as of any given date.

Unless

the context requires otherwise, references in this prospectus supplement to “SHI”, the “Company”, “we”,

“us” and “our” refer to Soluna Holdings, Inc. together with its consolidated subsidiaries. SHI, our logo

and our other registered or common law trademarks, trade names or service marks, to the extent any such marks have been registered,

appearing in this prospectus supplement and the accompanying base prospectus are owned by us. Solely for convenience, trademarks

and trade names referred to in this prospectus supplement and the accompanying base prospectus, including logos, artwork and other

visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate in any way

that we will not assert, to the fullest extent under applicable law, our rights of the applicable licensor to these trademarks

and trade names. Unless otherwise stated in this prospectus supplement and the accompanying base prospectus, we do not intend

our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship

of us by, any other companies.

PROSPECTUS

SUPPLEMENT SUMMARY

Unless

the context requires otherwise in this prospectus, the terms “SHI”, the “Company”, “we”, “us”,

or “our” refer to Soluna Holdings, Inc. together with its consolidated subsidiaries, and “SCI” refers

to Soluna Computing, Inc., formerly known as EcoChain, Inc.

The

Company

SHI

currently conducts our business through our wholly-owned subsidiary, SCI. SCI is presently engaged in the mining of cryptocurrency

through data centers that can be powered by renewable energy sources. Recently, SCI has built, and intends to continue to develop

and build, modular data centers that are currently used for cryptocurrency mining and that in the future can be used for computing

intensive, batchable applications, such as artificial intelligence and machine learning, with the goal of providing a cost-effective

alternative to battery storage or transmission lines. Headquartered in Albany, New York, the Company uses technology and intentional

design to solve complex, real-world challenges.

SCI was incorporated in Delaware on January

8, 2020 as EcoChain, Inc., which has a cryptocurrency mining facility that integrates with the cryptocurrency blockchain network

in the State of Washington. Through the October 2021 acquisition by EcoChain, Inc. of an entity at the time named Soluna

Computing, Inc., SCI also has a pipeline of certain cryptocurrency mining projects previously owned by Harmattan

Energy, Ltd. (“HEL”) (formerly known as Soluna Technologies, Ltd.), a Canadian corporation incorporated under the

laws of the Province of British Colombia that develops vertically-integrated, utility-scale computing facilities focused on cryptocurrency

mining and cutting-edge blockchain applications. Following such acquisition, on November 15, 2021,

SCI completed its conversion and redomicile to Nevada and changed its name from “EcoChain, Inc.” to “Soluna

Computing, Inc.”. The following day , the acquired entity, Soluna Computing, Inc.,

changed its name to “Soluna Callisto Holdings Inc.” (“Soluna Callisto”).

Until

the April 11, 2022 sale described under “ – Recent Developments – Sale of MTI Instruments”, we also operated

though our wholly owned subsidiary, MTI Instruments, Inc. (“MTI Instruments”), an instruments business engaged in

the design, manufacture and sale of vibration measurement and system balancing solutions, precision linear displacement sensors,

instruments and system solutions, and wafer inspection tools. MTI Instruments was incorporated in New York on March 8, 2000. MTI

Instruments’ products consist of engine vibration analysis systems for both military and commercial aircraft and electronic

gauging instruments for position, displacement and vibration application within the industrial manufacturing markets, as well

as in the research, design and process development markets. These systems, tools and solutions are developed for markets and applications

that require consistent operation of complex machinery and the precise measurements and control of products, processes, and the

development and implementation of automated manufacturing and assembly. On December 17, 2021, we announced that we had entered

into a non-binding letter of intent with a potential buyer (the “Buyer”) regarding the potential sale of MTI Instruments

(the “LOI”) to an unrelated third party. Pursuant to the LOI, the Buyer would acquire 100% of the issued and outstanding

common stock of MTI Instruments (the “Sale”). As a result of the foregoing, the MTI Instruments business was reported

as discontinued operations in our financial statements as of December 31, 2021 and prior periods included in our Annual Report

on Form 10-K for the year ended December 31, 2021, filed with the SEC on March 31, 2022 (our “Annual Report”). On

April 11, 2022, we consummated the Sale, MTI Instruments ceased to be our wholly-owned subsidiary and, as a result, we have exited

the instruments business.

Corporate

Information

Soluna

Holdings, Inc., formerly known as Mechanical Technology, Incorporated, was incorporated in Nevada on March 24, 2021, and is the

successor to Mechanical Technology, Inc., which was incorporated in the State of New York in 1961, as a result of a merger which

became effective on March 29, 2021, and is headquartered in Albany, New York. Effective November 2, 2021, the Company changed

its name from “Mechanical Technology, Incorporated” to “Soluna Holdings, Inc.” Our principal executive

offices are located at 325 Washington Avenue Extension, Albany, NY 12205 and our website is http://www.solunacomputing.com. Information

contained on our website does not constitute part of and is not incorporated into this prospectus supplement, the accompanying

base prospectus or the Registration Statement.

Recent

Developments

Sale

of MTI Instruments

On

April 11, 2022, we entered into a stock purchase agreement (the “SPA”) with NKX Acquiror, Inc. (the “Acquiror”),

pursuant to which the Company consummated the Sale on such date for approximately $9.25 million in cash, subject to certain adjustments

as set forth in the SPA, which was based on an aggregate enterprise value of approximately $10.75 million. As a result of the

Sale, we exited the instruments business and expect that we will continue to focus on developing and monetizing green, zero carbon

computing and cryptocurrency mining facilities. In connection with the Sale, Moshe Binyamin, the President of MTI Instruments,

received a bonus payment of approximately $40,000 from MTI Instruments pursuant to the terms of an existing employment agreement

by and between MTI Instruments and Mr. Benyamin, dated as of January 20, 2022, and the compensation committee of our board of

directors approved the full vesting of all unvested stock options and restricted stock units of the Company held by Mr. Binyamin.

For further information regarding the Sale and the SPA, see our Current Report on Form 8-K filed with the SEC on April 15, 2022.

Issuance of the Notes and Repayment

in Shares of Series A Preferred Stock

As previously disclosed in our public filings

with the SEC, on February 22, 2022, in connection with a financing transaction pursuant to which we agreed to issue to the Lenders

the Notes, we issued the Lenders a first tranche of promissory notes in the aggregate principal amount of $7.6 million in consideration

for an aggregate of $7.6 million, and subsequently, on March 10, 2022, we issued the Lenders the second tranche of promissory notes

in the aggregate principal amount of $2.4 million in consideration for an aggregate of $2.4 million. On April 13, 2022, we issued

the third tranche of promissory notes to the Lenders in the aggregate principal amount of $10 million in consideration for an aggregate

of $10 million. In connection with the issuance of the Notes, we issued the Lenders warrants to purchase up to an aggregate of

1,000,000 shares of Common Stock at an exercise price of $11.50 per share (the “Class D Warrants”).

The Notes have maturity dates ranging from

February 22, 2027 to April 13, 2027, upon which dates the applicable Notes shall be payable in full, and may be repaid at the Lenders’

election in cash or in shares of Series A Preferred Stock. If not repaid by May 2, 2022, the Notes will automatically be repaid

in shares of Series A Preferred Stock. On April 26, 2022, in connection with the consummation of the concurrent Offerings of Series

A Preferred Stock pursuant to this prospectus supplement and the separate prospectus supplement filed with the SEC in connection

with the Underwritten Offering, the Lenders notified us of their election to receive an aggregate of 1,142,857 Shares in connection

with the Offering at a per Share price equal to the public offering price of the shares of Series A Preferred Stock being sold

in the Underwritten Offering.

For additional information regarding the terms of the Notes, the Class D Warrants and the other transaction

documents entered into with the Lenders in connection with the issuance of the Notes, see our Annual Report and our Current Reports

on Form 8-K filed with the SEC on March 1, 2022 and April 19, 2022, respectively.

ABOUT

THIS OFFERING

| Series

A Preferred Stock offered by us in this Offering |

|

1,142,857

shares at an

offering price of $17.50 per Share . The Shares will be consolidated, form a single series,

and be fully fungible with the outstanding shares of our Series A Preferred Stock and

the shares of Series A Preferred Stock issued in connection with the Underwritten Offering.

Subject to the shares of Series A Preferred Stock issued in connection with the Underwritten

Offering, we reserve the right to further reopen this series and issue additional shares

of Series A Preferred Stock either through public or private sales at any time and from

time to time.

|

| |

|

|

Number

of shares of Series A Preferred Stock Issued and Outstanding Immediately Prior to this

Offering and the Underwritten Offering

|

|

1,319,156

shares. |

| |

|

|

Number of shares of

Series A Preferred Stock Issued and Outstanding Immediately After this Offering and the

Underwritten Offering

|

|

2,987,727 shares (3,066,584

shares if the underwriters for the Underwritten Offering fully exercise their over-allotment).

|

| |

|

|

| Dividends |

|

Subject

to the preferential rights, if any, of the holders of any class or series of capital

stock of the Company ranking senior to the Series A Preferred Stock as to dividends,

the holders of the Series A Preferred Stock will be entitled to receive, when, as and

if declared by the Board (or a duly authorized committee of the Board), only out of funds

legally available for the payment of dividends, cumulative cash dividends at the annual

rate of 9.0% of the $25.00 liquidation preference per year (equivalent to $2.25

per year). Dividends on the Series A Preferred Stock will accumulate and be cumulative

from, and including, the date of original issue by us of the Series A Preferred Stock.

Such dividends will be payable monthly

in arrears on each any Dividend Payment Date, and if such Dividend Payment Date is not a business day, then such next succeeding

business day. No interest, additional dividends or other sums will accumulate on the amounts so payable for the period from and

after that Dividend Payment Date to the next succeeding business day. The first dividend on

the shares of Series A Preferred Stock offered pursuant to this prospectus supplement will be paid on or about May 31,

2022, which will include the period from May 1, 2022 through May 31, 2022. We expect that the settlement for any dividend that

may be due for the period from the first date we issue and sell such shares of Series A Preferred Stock pursuant to this prospectus

supplement through, but not including, May 1, 2022, will be paid at the closing of this Offering to the extent this Offering closes

before May 1, 2022.

See

“Description of the Series A Preferred Stock—Dividends”. |

| |

|

|

| Restrictions

on Dividends, Redemption and Repurchases |

|

So

long as any share of Series A Preferred Stock remains outstanding, unless we also have

either paid or declared and set apart for payment full cumulative dividends on the Series

A Preferred Stock for all past completed dividend periods, we will not during any dividend

period:

● pay

or declare and set apart for payment any dividends or declare or make any distribution of cash or other property on Common

Stock or other capital stock that ranks junior to or on parity with the Series A Preferred Stock with respect to dividend

rights and rights to the distribution of assets upon our voluntary or involuntary liquidation, dissolution or winding

up (other than, in each case, (a) a dividend paid in Common Stock or other stock ranking junior to the Series A Preferred

Stock with respect to dividend rights and rights to the distribution of assets upon our voluntary or involuntary liquidation,

dissolution or winding up or (b) any declaration of a Common Stock dividend in connection with any stockholders’

rights plan, or the issuance of rights, stock or other property under any stockholders’ rights plan, or the redemption

or repurchase of rights pursuant to such plan); |

| |

|

● redeem,

purchase or otherwise acquire Common Stock or other capital stock that ranks junior to

or on parity with the Series A Preferred Stock (other than the Series A Preferred Stock)

with respect to dividend rights and rights to the distribution of assets upon our voluntary

or involuntary liquidation, dissolution or winding up (other than (a) by conversion into

or exchange for Common Stock or other capital stock ranking junior to the Series A Preferred

Stock with respect to dividend rights and rights to the distribution of assets upon our

voluntary or involuntary liquidation, dissolution or winding up, (b) the redemption of

shares of capital stock pursuant to the provisions of our articles of incorporation,

as amended (“Articles of Incorporation”), relating to the restrictions upon

ownership and transfer of our capital stock, (c) a purchase or exchange offer made on

the same terms to holders of all outstanding shares of Series A Preferred Stock and any

other capital stock that ranks on parity with the Series A Preferred Stock with respect

to dividend rights and rights to the distribution of assets upon our voluntary or involuntary

liquidation, dissolution or winding up, (d) purchases, redemptions or other acquisitions

of shares of our capital stock ranking junior to the Series A Preferred Stock with respect

to dividend rights and rights to the distribution of assets upon our voluntary or involuntary

liquidation, dissolution or winding up pursuant to any employment contract, dividend

reinvestment and stock purchase plan, benefit plan or other similar arrangement with

or for the benefit of employees, officers, directors, consultants or advisors, (e) through

the use of the proceeds of a substantially contemporaneous sale of stock ranking junior

to the Series A Preferred Stock with respect to dividend rights and rights to the distribution

of assets upon our voluntary or involuntary liquidation, dissolution or winding up, or

(f) purchases or other acquisitions of shares of our capital stock pursuant to a contractually

binding stock repurchase plan existing prior to the preceding Dividend Payment Date on

which dividends were not paid in full); or

● redeem,

purchase or otherwise acquire Series A Preferred Stock (other than (a) by conversion into or exchange for Common Stock

or other capital stock ranking junior to the Series A Preferred Stock with respect to dividend rights and rights to the

distribution of assets upon our voluntary or involuntary liquidation, dissolution or winding up, (b) a purchase or exchange

offer made on the same terms to holders of all outstanding shares of Series A Preferred Stock or (c) with respect to redemptions,

a redemption pursuant to which all shares of Series A Preferred Stock are redeemed).

See

“Description of the Series A Preferred Stock—Restrictions on Dividends, Redemption and Repurchases”. |

| |

|

|

| Optional

Redemption |

|

The

Series A Preferred Stock is not redeemable prior to August 23, 2026, except under the

circumstances described under “—Special Optional Redemption.”

On or after August 23, 2026, the Series A Preferred Stock may be redeemed at our option, in whole or in

part, from time to time, at a redemption price of $25.00 per share of Series A Preferred Stock, plus all dividends accumulated

and unpaid (whether or not declared) on the Series A Preferred Stock up to, but not including, the date of such redemption, upon

the giving of notice. See “Description of the Series A Preferred Stock – Redemption — Optional Redemption.” |

| Special

Optional Redemption |

|

During

any Delisting Event (defined below), whether before or after August 23, 2026, we may,

at our option, redeem the Series A Preferred Stock, in whole or in part and within 90

days after the date of the Delisting Event, by paying $25.00 per share of Series A Preferred

Stock, plus all dividends accumulated and unpaid (whether or not declared) on the Series

A Preferred Stock up to, but not including, the date of such redemption.

In

addition, during any period of time (whether before or after August 23, 2026), upon the occurrence of a Change of Control

(defined below), we may, at our option, redeem the Series A Preferred Stock, in whole or in part and within 120 days after

the first date on which such Change of Control occurred, by paying $25.00 per share of Series A Preferred Stock, plus

all dividends accumulated and unpaid (whether or not declared) on the Series A Preferred Stock up to, but not including,

the date of such redemption.

If,

prior to the Delisting Event Conversion Date or Change of Control Conversion Date (each defined below), as applicable,

we have provided or provide notice of redemption with respect to the Series A Preferred Stock (whether pursuant to our

optional redemption right described above under “Description of the Series A Preferred Stock—Optional Redemption”

or our special optional redemption described here), the holders of Series A Preferred Stock will not be permitted to exercise

the conversion right described below under “— Conversion Right Upon a Change of Control” in respect

of their shares called for redemption. See “Description of the Series A Preferred Stock—Special Optional Redemption.” |

| |

|

|

| Ranking |

|

The

Series A Preferred Stock will, with respect to dividend rights and rights as to the distribution

of assets upon our liquidation, dissolution or winding-up, rank:

●

senior to all classes or series of our Common Stock and to all other capital stock issued by us expressly designated as

ranking junior to the Series A Preferred Stock;

● on

parity with any future class or series of our capital stock expressly designated as ranking on parity with the Series

A Preferred Stock, none of which exist on the date hereof (“Parity Stock”);

●

junior to any future class or series of our capital stock expressly designated as ranking senior to the Series

A Preferred Stock, none of which exist on the date hereof (“Senior Stock”); and

●

junior to all of our existing and future indebtedness (including subordinated indebtedness and any indebtedness

convertible into Common Stock or preferred stock) and other liabilities with respect to assets available to satisfy claims

against us and structurally subordinated to the indebtedness and other liabilities of (as well as any preferred equity

interests held by others in) our existing or future subsidiaries. |

| |

|

We

may issue junior capital stock described in the first bullet above and parity capital stock described in the second bullet

above at any time and from time to time in one or more series without the consent of the holders of the Series A Preferred

Stock. Our ability to issue any Senior Stock described in the third bullet above is limited as described under “Description

of the Series A Preferred Stock—Limited Voting Rights.” |

| Liquidation

Rights |

|

In

the event of the voluntary or involuntary liquidation, dissolution or winding up of our affairs, the holders of shares of

Series A Preferred Stock will be entitled to be paid out of our assets legally available for distribution to our stockholders

(i.e., after satisfaction of all our liabilities to creditors, if any) and, subject to the rights of holders of any

shares of each other class or series of capital stock ranking, as to rights to the distribution of assets upon our voluntary

or involuntary liquidation, dissolution or winding-up, senior to the Series A Preferred Stock, a liquidation preference of

$25.00 per share, plus an amount equal to any accumulated and unpaid dividends to the date of payment (whether or not declared),

before any distribution or payment may be made to holders of shares of Common Stock or any other class or series of our capital

stock ranking, as to rights to the distribution of assets upon any voluntary or involuntary liquidation, dissolution or winding

up, junior to the Series A Preferred Stock. See “Description of the Series A Preferred Stock—Liquidation Preference”. |

| |

|

|

| Limited

Voting Rights |

|

Holders of

Series A Preferred Stock generally will have no voting rights, except with respect to certain amendments to the terms of the Series

A Preferred Stock and as otherwise applicable by law. See “Description of the Series A Preferred Stock — Limited Voting

Rights” beginning on page S-18 of this prospectus supplement.

|

| |

|

|

| No

Maturity Date |

|

The

Series A Preferred Stock is perpetual and has no maturity date, and we are not required to redeem the Series A Preferred Stock.

Accordingly, all shares of Series A Preferred Stock will remain outstanding indefinitely, unless and until we decide to redeem

such shares or they are converted in connection with a Delisting Event or Change of Control. |

| |

|

|

| Preemptive

and Conversion Rights |

|

Holders

of Series A Preferred Stock will have no preemptive rights, nor any conversion rights, except as described under “Description

of the Series A Preferred Stock—Conversion”. |

| |

|

|

| Conversion

Right Upon a Change of Control or Delisting Event |

|

Upon

the occurrence of a Delisting Event or a Change of Control, as applicable, each holder of Series A Preferred Stock will have

the right (unless, prior to the Delisting Event Conversion Date or Change of Control Conversion Date, as applicable, we have

provided or provide notice of our election to redeem the Series A Preferred Stock as described above under “—

Special Optional Redemption” or “—Optional Redemption”) to convert some or all of the shares of Series

A Preferred Stock held by such holder on the Delisting Event Conversion Date or Change of Control Conversion Date (each

defined below), as applicable, into a number of shares of our Common Stock (or equivalent value of alternative consideration)

per share of Series A Preferred Stock equal to Common Stock Conversion Consideration (defined below). See “Description

of the Series A Preferred Stock—Limited Conversion Rights”. |

| |

|

|

| Concurrent Underwritten Offering |

|

Concurrently with this Offering, and pursuant to a separate prospectus supplement, we intend to sell up

to an aggregate of 525,714 shares Series A Preferred Stock in the Underwritten Offering (604,571 shares if the underwriters for

the Underwritten Offering fully exercise their over-allotment) at $17.50 per share, the same price per share of Series A Preferred

Stock as the offering price per Share, for aggregate gross proceeds of approximately $9.2 million, without giving effect to any

discounts and commissions. The closing of each of the Offerings is not contingent upon the other. See “Plan of Distribution”

for more information.

|

| Listing |

|

The

Series A Preferred Stock is listed on Nasdaq under the symbol “SLNHP”. |

| |

|

|

| Use

of Proceeds |

|

We estimate that we will receive net proceeds,

after deducting estimated underwriting discounts and fees and estimated expenses payable by us, of approximately $7.8 million

from the Offerings, assuming no exercise of the underwriters’ over-allotment option in connection with the Underwritten Offering,

and approximately $9.1 million, assuming full exercise of such over-allotment option. However, we can offer no assurance that the

Underwritten Offering will close, and if it does not close, we will not receive any cash proceeds from the Offerings, as the Shares

are being offered in this Offering will be used as repayment of the Notes in full satisfaction of the Company’s obligations

thereunder, upon which the outstanding debt represented by the Notes would be extinguished.

We intend to use the net proceeds received from the Offerings for the acquisition, development and growth

of data centers, including cryptocurrency mining processors, other computer processing equipment, data storage, electrical infrastructure,

software and real property (i.e., land and buildings) and business, and for working capital and general corporate

purposes, which include, but are not limited to, operating expenses. See “Use of Proceeds” on page S-15 for more information.

|

| |

|

|

| Transfer

Agent and Registrar for the Series A Preferred Stock |

|

American

Stock Transfer & Trust Company, LLC |

| |

|

|

| Risk

Factors |

|

Investing

in our shares of Series A Preferred Stock involves a high degree of risk. As an investor you should be prepared to lose your entire

investment See “Risk Factors” beginning on page S-8, page 4 of the accompanying base prospectus, and the risks

discussed in the documents incorporated by reference in this prospectus supplement and the accompanying base prospectus, as they

may be amended, updated or modified periodically in our reports filed with the SEC and other information herein and therein. Additional

risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and

operations. |

RISK

FACTORS

Investing

in our Series A Preferred Stock involves a high degree of risk. Before deciding whether to invest in the Series A Preferred Stock,

you should consider carefully the risks and uncertainties described under the heading “Risk Factors” contained in

this prospectus supplement and in the accompanying base prospectus, described under the section entitled “Risk Factors”

contained in our Annual Report, as well as any amendments thereto reflected in subsequent filings with the SEC, which are incorporated

by reference into this prospectus supplement, together with other information in this prospectus supplement and the accompanying

base prospectus (including the documents incorporated by reference herein and therein). The risks described in these documents

are not the only ones we face, but are those that we consider to be material. There may be other unknown or unpredictable economic,

business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial

performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results

or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations,

cash flow or prospects could be seriously harmed. This could cause the trading price of our Common Stock and/or Series A Preferred

Stock to decline, resulting in a loss of all or part of your investment. Please also carefully read the section below entitled

“Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to the

Shares of Series A Preferred Stock Offered Hereby and the Underwritten Offering

The

market price of the Series A Preferred Stock may be volatile and may fluctuate in a way that is disproportionate to our operating

performance.

The

market price of the Series A Preferred Stock may experience substantial volatility as a result of a number of factors, including:

| |

● |

sales

or potential sales of substantial amounts of the Series A Preferred Stock; |

| |

|

|

| |

● |

conditions

in the energy or cryptocurrency industries; |

| |

|

|

| |

● |

changes

in our financial condition or results of operations, such as in earnings, revenues or other measure of company value; |

| |

|

|

| |

● |

announcements

by us regarding liquidity, significant acquisitions, equity investments and divestitures, addition or loss of significant

customers and contracts, capital expenditure commitments and litigation; |

| |

|

|

| |

● |

governmental

regulation and legislation; |

| |

|

|

| |

● |

increases

in prevailing interest rates; |

| |

● |

trading

prices of similar securities; |

| |

|

|

| |

● |

our

history of timely dividend payments; |

| |

|

|

| |

● |

the

annual yield from dividends on the Series A Preferred Stock as compared to yields on

other financial instruments; |

| |

|

|

| |

● |

general

economic and financial market conditions, both domestic and worldwide, including, but

not limited, to the recent inflation in the United States, global supply-chain disruptions

and semiconductor shortages, and the foreign and domestic government sanctions imposed

on Russia as a result of its recent invasion of Ukraine; |

| |

|

|

| |

● |

the

financial condition, performance and prospects of us compared to our competitors; |

| |

|

|

| |

● |

market

volatility and business operation changes brought on by epidemics, pandemics and other

health crises, including, but not limited to, the COVID-19 pandemic; |

| |

|

|

| |

● |

our

issuance of additional preferred equity or debt securities, particularly if in connection

with acquisition activities; and |

| |

● |

actual

or anticipated variations in quarterly operating results of us and our competitors. |

| |

|

|

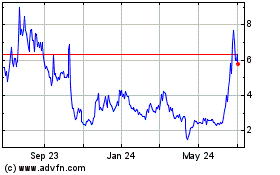

Finally,

our relatively small public float and daily trading volume have in the past caused, and may in the future result in, significant

volatility in the price of our Series A Preferred Stock. As of April 25, 2022, we had 1,319,156 shares of our Series A Preferred

Stock outstanding held by non-affiliates, excluding any shares of Series A Preferred Stock issued in connection with this Offering

and the Underwritten Offering, and our daily trading volume between January 1, 2022 and April 25, 2022 averaged 16,349 shares

of Series A Preferred Stock.

Many

of these factors are beyond our control. The stock market has historically experienced extreme price and volume fluctuations.

These fluctuations often have been unrelated or disproportionate to the operating performance of companies. These broad market

and industry factors could reduce the market price of the Series A Preferred Stock, regardless of our actual operating performance.

We

may not have sufficient cash from our operations to enable us to pay dividends on the Series A Preferred Stock following the payment

of expenses.

Although

dividends on the Series A Preferred Stock will be cumulative, the Board must approve the actual payment of the dividends. We will

pay monthly dividends on the Series A Preferred Stock from funds legally available for such purpose when, as and if declared by

the Board or any authorized committee thereof. The Board can elect at any time or from time to time, and for an indefinite duration,

not to pay any or all accumulated dividends. The Board could do so for any reason. We may not have sufficient cash available each

quarter to pay dividends. The amount of dividends we can pay depends upon the amount of cash we generate from and use in our operations,

which may fluctuate significantly based on, among other things:

| |

● |

the

level of our revenues and our results of operations; |

| |

|

|

| |

● |

prevailing

global and regional economic and political conditions; |

| |

|

|

| |

● |

the

effect of domestic and foreign governmental regulations on the conduct of our business; |

| |

|

|

| |

● |

our

ability to service and refinance our current and future indebtedness; |

| |

|

|

| |

● |

our

ability to raise additional funds through future offerings of securities to satisfy our capital needs; and |

| |

|

|

| |

● |

our

ability to draw on our existing credit facilities and the ability of our lenders to perform their obligations under their

agreements with us. |

| |

|

|

In

addition, if payment of dividends on the Series A Preferred Stock for any dividend period would cause us to fail to comply with

any applicable law, including the requirement under the Nevada Revised Statutes (“NRS”) that dividends be paid out

of surplus or net profits, we will not declare or pay a dividend for such dividend period. Our ability to pay dividends on the

Series A Preferred Stock may also be restricted or prohibited by the terms of any senior equity securities or indebtedness. The

instruments governing the terms or future financings or refinancing of any borrowings may contain covenants that restrict our

ability to pay dividends on the Series A Preferred Stock. The Series A Preferred Stock places no restrictions on our ability to

incur indebtedness with such restrictive covenants. In the event that the payment of a dividend on the Series A Preferred Stock

would cause us to fail to comply with any applicable law or would be restricted or prohibited by the terms of any senior equity

securities or indebtedness, holders of the Series A Preferred Stock will not be entitled to receive any dividend for that dividend

period, and the unpaid dividend will cease to accrue or be payable.

The

amount of cash that we will have available for dividends on the Series A Preferred Stock will not depend solely on our profitability.

The

actual amount of cash that we will have available for dividends on the Series A Preferred Stock also depends on many factors,

including, among others:

| |

● |

changes

in our operating cash flow, capital expenditure requirements, working capital requirements and other cash needs; |

| |

|

|

| |

● |

restrictions

under our existing or future credit, capital lease and operating lease facilities or any future debt securities; and |

| |

|

|

| |

● |

the

amount of any reserves established by our board of directors. |

| |

|

|

The

amount of cash that we generate from our operations may differ materially from our net income or loss for the period, which is

affected by non-cash items, and the Board in its discretion may elect not to declare any dividends. As a result of these and the

other factors mentioned above, we may pay dividends during periods when we record losses and may not pay dividends during periods

when we record net income.

Our

ability to meet our obligations under the Series A Preferred Stock depends on the earnings and cash flows of our subsidiaries

and the ability of our subsidiaries to pay dividends or advance or repay funds to us.

We

conduct all of our business operations through our subsidiaries. In servicing dividend payments to be made on the Series A Preferred

Stock, we will rely on cash flows from these subsidiaries, mainly dividend payments and other distributions. The ability of these

subsidiaries to make dividend payments to us will be affected by, among other factors, the obligations of these entities to their

creditors, requirements of corporate and other law, and restrictions contained in agreements entered into by or relating to these

entities.

We

may incur additional indebtedness, which may impact our financial position, cash flow and ability to pay dividends on the Series

A Preferred Stock.

As of the date of this

prospectus supplement, the Company has a $1.0 million unsecured line of credit from KeyBank National Association, all of which

is currently drawn and outstanding. We may incur additional indebtedness and become more highly leveraged, which may negatively

impact our financial position, cash flow and ability to pay dividends on the Series A Preferred Stock. Increases in our borrowing

could affect our financial condition and make it more difficult for us to comply with the financial covenants governing our indebtedness.

While

there are no restrictions under our current indebtedness on our ability to pay dividends to our shareholders, our future indebtedness

may restrict payments of dividends on the Series A Preferred Stock. Only the Change of Control conversion right relating to the

Series A Preferred Stock protects the holders of the Series A Preferred Stock in the event of a highly leveraged or other transaction,

including a merger, amalgamation or the sale, lease or conveyance of all or substantially all of our assets or business, which

might adversely affect the holders of the Series A Preferred Stock.

The

Series A Preferred Stock represent perpetual equity interests.

The

Series A Preferred Stock represent perpetual equity interests in us and, unlike our indebtedness, will not give rise to a claim

for payment of a principal amount at a particular date. As a result, holders of the Series A Preferred Stock may be required to

bear the financial risks of an investment in the Series A Preferred Stock for an indefinite period of time.

If

the Series A Preferred Stock is delisted from Nasdaq, the ability to transfer or sell shares of the Series A Preferred Stock may

be limited and the market value of the Series A Preferred Stock will likely be materially adversely affected.

The

Series A Preferred Stock is currently listed on Nasdaq and does not contain provisions that are intended to protect investors

if the Series A Preferred Stock is delisted from Nasdaq. In order to maintain that listing, we must satisfy minimum financial

and other continued listing requirements and standards, including those regarding director independence and independent committee

requirements, minimum stockholders’ equity, minimum share price, and certain corporate governance requirements. There can

be no assurances that we will be able to comply with the applicable listing standards. If the Series A Preferred Stock is delisted

from Nasdaq, investors’ ability to transfer or sell shares of the Series A Preferred Stock will be limited and the market

value of the Series A Preferred Stock will likely be materially adversely affected. Moreover, since the Series A Preferred Stock

has no stated maturity date, investors may be forced to hold shares of the Series A Preferred Stock indefinitely while receiving

stated dividends thereon when, as and if authorized by the Board and paid by us with no assurance as to ever receiving the liquidation

value thereof.

We

may incur additional indebtedness and obligations to pay dividends on preferred stock, some of which may be senior to the rights

of the Series A Preferred Stock.

We

and our subsidiaries may incur additional indebtedness and obligations to pay cumulative dividends on preferred stock, some of

which may be senior to the rights of the Series A Preferred Stock. The terms of the Series A Preferred Stock do not prohibit us

or our subsidiaries from incurring additional indebtedness or issuing additional series of preferred stock. Any such indebtedness

will in all cases be senior to the rights of holders of Series A Preferred Stock. We may also issue additional series of preferred

stock that contain dividend rights and liquidation preferences that are senior to the rights of holders of Series A Preferred

Stock. Our subsidiaries may also incur indebtedness that is structurally senior to the Series A Preferred Stock, and we and our

subsidiaries could incur indebtedness secured by a lien on our assets, entitling the holders of such indebtedness to be paid first

from the proceeds of such assets. If we issue any additional preferred stock that ranks senior or pari passu with the Series A

Preferred Stock, the holders of those shares will be entitled to a senior or ratable share with the holders of the Series A Preferred

Stock in any proceeds distributed in connection with our insolvency, liquidation, reorganization or dissolution. This may have

the effect of reducing the amount of proceeds paid to the holders of Series A Preferred Stock.

Market

interest rates may adversely affect the value of the Series A Preferred Stock.

One

of the factors that continues to influence the price of the Series A Preferred Stock will be the dividend yield on the Series

A Preferred Stock (as a percentage of the price of the Series A Preferred Stock) relative to market interest rates. An increase

in market interest rates may lead prospective purchasers of the Series A Preferred Stock to expect a higher dividend yield, and

higher interest rates would likely increase our borrowing costs and potentially decrease funds available for dividends. Accordingly,

higher market interest rates could cause the market price of the Series A Preferred Stock to decrease.

The

amount of the liquidation preference on the Series A Preferred Stock is fixed and investors in this Offering that receive shares

of Series A Preferred Stock will have no right to receive any greater payment.

The

payment due upon liquidation on the Series A Preferred Stock is fixed at the liquidation preference of $25.00 per share, plus

an amount equal to all accumulated and unpaid dividends thereon to the date of liquidation, whether or not declared. If, in the

case of our liquidation, there are remaining assets to be distributed after payment of this amount, you will have no right to

receive or to participate in these amounts. In addition, if the market price of a holder’s Series A Preferred Stock is greater

than the liquidation preference, such holder will have no right to receive the market price from us upon our liquidation.

There

may be future sales of Series A Preferred Stock or similar securities, which may adversely affect the market price of the Series

A Preferred Stock.

Subject to the terms

of the Certificate of Designations, our Articles of Incorporation and the NRS, we are not restricted from issuing additional Series

A Preferred Stock or securities similar to the Series A Preferred Stock, including any securities that are convertible into or

exchangeable for, or that represent the right to receive, Series A Preferred Stock. Holders of the Series A Preferred Stock have

no preemptive rights that entitle holders to purchase their pro rata share of any offering of shares of any class or series. The

market price of the Series A Preferred Stock could decline as a result of sales of Series A Preferred Stock, sales of other securities

made after this Offering or the Underwritten Offering, or as a result of the perception that such sales could occur. Because our

decision to issue securities in any future offering will depend on market conditions and other factors beyond our control, we cannot

predict or estimate the amount, timing or nature of any future offerings. Thus, holders of the Series A Preferred Stock bear the

risk of our future offerings reducing the market price of the Series A Preferred Stock and diluting their holdings in the Series

A Preferred Stock.

We have broad discretion

in the use of the net proceeds from the Offerings and may not use them effectively.

We will not receive any

cash proceeds in this Offering as a result of our repayment of the Notes with the Shares in accordance with the terms of the Notes.

Our management will have broad discretion in the application of the net proceeds from the Offerings, including for any of the purposes

described in the section of this prospectus supplement entitled “Use of Proceeds.” The Underwritten Offering is not

contingent upon this Offering and we can offer no assurance that the Underwritten Offering will close. If the Underwritten Offering

does not close, we will not receive any cash proceeds from the Offerings, as we are issuing the Shares to the Lenders as full repayment

of the Notes. The failure by our management to apply such funds effectively could harm our business. Pending their use, we may

invest the net proceeds from the Underwritten Offering in short-term, investment-grade, interest-bearing securities. These investments

may not yield a favorable return to our shareholders.

Raising

additional funds through debt or equity financing could be dilutive and may cause the market price of the Series A Preferred Stock

to decline. We still may need to raise additional funding which may not be available on acceptable terms, or at all. Failure to

obtain additional capital may force us to delay, limit, or terminate our product development efforts or other operations.

To

the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest

may be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights

as a shareholder. Furthermore, any additional fundraising efforts may divert our management from their day-to-day activities,

which may adversely affect our ability to develop and commercialize our products and services. In addition, the sale of a significant

number of our shares of Series A Preferred Stock by us could depress the price of our securities.

We estimate that our

current cash and cash equivalents, along with the extinguishment of the debt represented by the Notes in connection with this Offering

and the net proceeds received from the Underwritten Offering, will be sufficient for us to fund our operating expenses and capital

expenditure requirements for at least the next 12 months. We may continue to seek funds through equity or debt financings, collaborative

or other arrangements with corporate sources, or through other sources of financing. Additional funding may not be available to

us on acceptable terms, or at all. Any failure to raise capital as and when needed, as a result of insufficient authorized shares

or otherwise, could have a negative impact on our financial condition and on our ability to pursue our business plans and strategies.

If

we are not paying full dividends on any future Parity Stock or Senior Stock, we will not be able to pay full dividends on the

Series A Preferred Stock.

When

dividends are not paid in full on any shares of issued and outstanding Parity Stock for a dividend period, all dividends declared

with respect to Series A Preferred Stock and all shares of issued and outstanding Parity Stock for such dividend period shall

be declared pro rata so that the respective amounts of such dividends declared bear the same ratio to each other as all accumulated

but unpaid dividends per share of Series A Preferred Stock and all shares of issued and outstanding Parity Stock for such dividend

period bear to each other. Therefore, if we are not paying full dividends on any issued and outstanding shares of Parity Stock,

we will not be able to pay full dividends on the Series A Preferred Stock. Similarly, if we issue any series of Senior Stock,

we expect that if we do not pay any amount of stated dividends thereon, we will not be able to pay any dividends on the Series

A Preferred Stock.

We

are permitted to make certain payments even after dividend periods for which we do not declare and pay, or set aside funds for,

full cumulative dividends on all outstanding shares of the Series A Preferred Stock.

The

terms of the Series A Preferred Stock generally restrict us from making certain payments, such as paying dividends on all other

capital stock issued by us expressly designated as ranking junior to the Series A Preferred Stock and repurchasing or redeeming

junior or capital stock expressly designated as ranking on parity with the Series A Preferred Stock or shares of the Series A

Preferred Stock, unless dividends on all outstanding shares of the Series A Preferred Stock for all past completed dividend periods

have been paid in full or declared and a sum sufficient for the payment thereof has been set aside for payment. These restrictions,

however, are subject to multiple exceptions which permit us to, among other things, (i) pay or declare dividends on our capital

stock, (ii) redeem, purchase or otherwise acquire junior stock or parity stock or (iii) redeem, purchase or otherwise acquire

the Series A Preferred Stock. These exceptions are described in “Description of the Series A Preferred Stock—Restrictions

on Dividends, Redemption and Repurchases” and may result in payments being made, whether as the result of a dividend, redemption

or repurchase, on junior stock or parity stock after we have failed to pay full cumulative dividends on all outstanding shares

of the Series A Preferred Stock. Additionally, in certain circumstances, our ability to make payments on junior stock and parity

stock, whether as the result of a redemption, repurchase or other acquisition of such capital stock, is more extensive than our

ability to make payments, whether as the result of a redemption, repurchase or other acquisition, of the Series A Preferred Stock.

The

Series A Preferred Stock may not continue have an active trading market.

The

Series A Preferred Stock are a recent issue of securities and do not have a long-established trading market. Although the Series

A Preferred Stock is listed, we cannot assure you that an active market for the Series A Preferred Stock will be sustained or

that holders of the Series A Preferred Stock will be able to sell their shares of Series A Preferred Stock at favorable prices

or at all. The difference between bid and ask prices in any secondary market for the Series A Preferred Stock could be substantial.

Accordingly, no assurance can be given as to the liquidity of, or trading market for, the Series A Preferred Stock, and holders

of the Series A Preferred Stock may be required to bear the financial risks of an investment in the Series A Preferred Stock for

an indefinite period of time.

The

voting rights of holders of the Series A Preferred Stock are limited.

Holders

of the Series A Preferred Stock have no voting rights with respect to matters that generally require the approval of voting shareholders.

The limited voting rights of holders of the Series A Preferred Stock include the right to vote as a single class on certain matters

that may affect the preference or special rights of the Series A Preferred Stock, as described under “Description of the

Series A Preferred Stock—Limited Voting Rights”.

Dividends

or other payments with respect to the Series A Preferred Stock may be subject to withholding taxes in circumstances where we are

not obliged to make gross up payments, and this could result in holders receiving less than expected in such circumstances.

In

the event of certain changes to current tax law that require tax to be withheld from dividends or other payments on the Series

A Preferred Stock, we are not required to make gross up payments in respect of such taxes. This would result in holders of Series

A Preferred Stock receiving less than expected and could materially adversely affect the return on your investment.

This Offering is

not conditioned on the consummation of any other financing, including the Underwritten Offering.

Neither the completion

of this Offering nor the concurrent Underwritten Offering is contingent on the completion of the other, so it is possible that

this Offering occurs and the Underwritten Offering does not occur, and vice versa. This prospectus supplement and accompanying

base prospectus is not an offer to sell or a solicitation of an offer to buy any shares of Series A Preferred Stock being offered

in the Underwritten Offering. We cannot assure you that the Underwritten Offering will be completed on the terms described herein,

or at all.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying base prospectus and the documents incorporated by reference into this prospectus supplement

and the accompanying base prospectus, and the documents that we reference herein and therein and have filed as exhibits to the

Registration Statement, including the sections entitled “Risk Factors,” contain “forward-looking statements”

within the meaning of Section 21(E) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Section

27A of the Securities Act. These forward-looking statements include, without limitation: statements regarding proposed new products

or services; statements concerning litigation or other matters; statements concerning projections, predictions, expectations,

estimates, or forecasts for our business, financial and operating results and future economic performance; statements of management’s

goals and objectives; statements concerning our competitive environment, availability of resources and regulation; trends affecting

our financial condition, results of operations or future prospects; our financing plans or growth strategies; and other similar

expressions concerning matters that are not historical facts. Words such as “may”, “will”, “should”,

“could”, “would”, “predicts”, “potential”, “continue”, “expects”,

“anticipates”, “future”, “intends”, “plans”, “believes” and “estimates,”

and variations of such terms or similar expressions, are intended to identify such forward-looking statements.

Forward-looking

statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications

of the times at, or by which, that performance or those results will be achieved. Forward-looking statements are based on information

available at the time they are made and/or management’s good faith belief as of that time with respect to future events

and are subject to risks and uncertainties that could cause actual performance or results to differ materially from what is expressed

in or suggested by the forward-looking statements. The sections in this prospectus supplement and the accompanying base prospectus

entitled “Risk Factors” and the sections in our periodic reports, including the sections entitled “Business”

in our most recent Annual Report on Form 10-K and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in our most recent Annual Report on Form 10-K and subsequent quarterly reports filed with the SEC,

as well as other sections in this prospectus supplement, the accompanying base prospectus and the documents or reports incorporated

by reference herein and therein, and any other prospectus supplement and the documents that we reference herein and therein and

have filed as exhibits to the Registration Statement, discuss some of the factors that could contribute to these differences.

Forward-looking

statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume

no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors

affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more

forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking

statements. Investors should review our subsequent reports filed with the SEC described in the sections entitled “Where

You Can Find More Information” and “Incorporation of Certain Information by Reference” of this prospectus supplement

and the accompanying base prospectus and incorporated by reference into herein and therein, and the documents that we reference

herein and therein and have filed as exhibits to the Registration Statement, all of which are accessible on the SEC’s website

at www.sec.gov.

USE

OF PROCEEDS

Assuming no exercise

of the underwriters’ over-allotment option in connection with the Underwritten Offering, and the sale of all 2,987,727 shares

of Series A Preferred Stock in the Offerings, we estimate that the net proceeds from the Offerings will be approximately $7.8

million, after deducting estimated underwriting discounts and fees and estimated offering fees and expenses of $1.4 million payable

by us. Assuming the underwriters’ over-allotment option is exercised in full and the sale of all 3,066,584 shares of Series

A Preferred Stock in the Offerings, we estimate that our net proceeds from the Offerings will be approximately $9.1 million, after

deducting the same estimated underwriting discounts and fees and estimated offering fees and expenses. However, we can offer

no assurance that the Underwritten Offering will close, and if it does not close, we will not receive any cash proceeds from this

Offering as a result of our repayment of the Notes with the Shares in accordance with the terms of the Notes. Pursuant to the

Notes, the Shares are being offered to the Lenders as repayment of the Notes in full satisfaction of the Company’s obligations

thereunder, upon which the outstanding debt represented by the Notes would be extinguished.

We

intend to use the net proceeds of the Offerings for the acquisition, development and growth of data centers, including cryptocurrency

mining processors, other computer processing equipment, data storage, electrical infrastructure, software and real property (i.e. land

and buildings) and business, and for working capital and general corporate purposes, which include, but are not limited to, operating

expenses.

For a description of

the maturity dates and interest rates of each of the Notes, see the section above entitled “Prospectus Supplement Summary

— Recent Developments” as well as our Annual Report and our Current Reports on Form 8-K filed with the SEC on March

1, 2022 and April 19, 2022, respectively, which filings are incorporated by reference into the Registration Statement of which

this prospectus supplement and accompanying base prospectus form a part. The proceeds previously received from the Lenders in consideration

for the Notes were used for the same purposes as those for which the net proceeds from the Offerings are intended to be used.

The amounts and timing

of any expenditures will vary depending on the amount of cash generated by our operations, and the rate of growth, if any, of

our business, and our plans and business conditions. The foregoing represents our intentions as of the date of this prospectus

supplement based upon our current plans and business conditions to use and allocate the net proceeds of the Offerings. However,

our management will have significant flexibility and discretion in the timing and application of the net proceeds of the Offerings.

Unforeseen events or changed business conditions may result in application of the net proceeds in a manner other than as described

in this prospectus supplement.

To

the extent that the net proceeds we receive from the Offerings are not immediately applied for the above purposes, we plan to

invest the net proceeds in short-term, interest-bearing debt instruments or bank deposits.

Management believes

that our current cash and cash equivalents, along with the extinguishment of the debt represented by the Notes in connection with

this Offering and the net proceeds received from the Underwritten Offering, will be sufficient to satisfy the Company’s

cash needs for at least the next 12 months.

CAPITALIZATION

The

following table sets forth our cash and capitalization as of December 31, 2021:

| |

● |

on

an actual basis; |

| |

● |

on a pro forma basis after giving effect to (i) our issuance of: (a) an aggregate of 66,857 shares of

Series A Preferred Stock and warrants to purchase up to an aggregate of 3,343 shares of Common Stock on January 5, 2022, in connection

with the full over-allotment exercise by the underwriters for our December 2021 public offering of shares of Series A Preferred

Stock (the “December Offering”), for gross proceeds of approximately $1,170,000

less applicable underwriter discounts and other offering fees and expenses; (b) Notes for an aggregate principal amount

of $20 million to the Lenders between February 2022 and April 2022, in consideration for

an aggregate purchase price of $20 million; (c) Class D Warrants to purchase up to 1,000,000 shares of Common Stock at an exercise

price of $11.50 per share to the Lenders in connection with the issuance of the Notes; (d) warrants to purchase up to an

aggregate of 85,000 shares of Common Stock at an exercise price of $13.26 per share issued to

an institutional investor on January 14, 2022; (e) an aggregate of 94,500 shares of Common Stock issued upon exercise of

warrants between January 1, 2022 and April 25, 2022 at a per share price of $8.24, resulting in gross proceeds to us of $778,680;

and (f) an aggregate of 146,165 shares of Common Stock issued upon conversion between January 1, 2022 and April 25, 2022 of convertible

promissory notes at a per share conversion price of $9.18; (ii) the borrowing by Soluna MC Borrowing 2021-1 LLC, our indirect

wholly-owned-subsidiary (“Borrower”), from NYDIG ABL LLC (“NYDIG”) pursuant to a master equipment finance

agreement, dated December 30, 2021 (“Master Agreement”), of an aggregate principal amount of approximately $4.6 million

on January 14, 2022, and the subsequent borrowing of an additional $9.6 million by Borrower pursuant to the Master Agreement on