Siebert Reports Third Quarter 2022 Financial Results

November 14 2022 - 5:16PM

Business Wire

Siebert Financial Corp. (NASDAQ: SIEB)

(“Siebert”), a mission-driven provider of financial services,

today reported financial results for the third quarter ended

September 30, 2022.

Third Quarter 2022 Financial Highlights

- Revenue of $14.3 million compared to $17.1 million in the third

quarter of 2021

- Operating income* of $1.4 million compared to operating income

of $1.1 million in the third quarter of 2021

- Operating margin of 10.0% compared to 6.7% in the third quarter

of 2021

- Net income available to common stockholders of $1.1 million

compared to net income available to common stockholders of $0.9

million in the third quarter of 2021

- Earnings per share of $0.03 compared to $0.03 in the third

quarter of 2021

Management Commentary

“We’ve made significant progress this year building the

foundation for future growth and the diversity of our business

offerings helped to deliver another strong quarter despite the

volatile environment,” said Gloria E. Gebbia, controlling

shareholder and board member of Siebert. “Siebert’s mission-driven

culture and client-focused approach has enabled our success over

the years and allowed us to overcome a myriad of obstacles and

challenges. Our efforts to build a stronger, more diversified

business are already showing momentum and we will continue to

evolve as a company. We are well-positioned to capitalize on the

evolving needs of our clients as a mission-driven company with a

robust offering and strong financial position to execute on our

growth strategy.”

Andrew Reich, CFO of Siebert, commented: “We delivered another

quarter of solid financial results as our business has adapted to

challenging market conditions. Strong performance in our Securities

Finance division and higher interest income helped partially

counter weaker revenues related to commissions and fees, principal

transactions, and market making relative to the prior year period.

Our Securities Finance division continues to be a key growth driver

for Siebert and achieved another record quarter delivering

year-over-year revenue growth of 21% in the third quarter and 58%

year-to-date relative to the first nine month of 2021. We delivered

an improvement to both our operating income and margins in the

third quarter as we continue to improve profitability. Operating

income for the third quarter grew 27% year-over-year and included a

temporary unrealized loss of $1.4 million on our U.S. government

securities portfolio compared to $0.6 million in the second quarter

of 2022. Looking ahead, we remain focused on sustained growth and

continue to benefit from the rising interest rate environment and

expect that trend to continue in the fourth quarter and throughout

2023.” **

*Operating income represents the line item captioned “Income

(loss) before provision for (benefit from) income taxes” in the

statements of operations in Siebert’s 2022 Q3 10-Q.

**Refer to Siebert’s 2022 Q3 10-Q, Item 2. Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

Notice to Investors

This communication is provided for informational purposes only

and is neither an offer to sell nor a solicitation of an offer to

buy any securities in the United States or elsewhere.

About Siebert Financial Corp.

Siebert is a diversified financial services company that has

been in business and a member of the NYSE since 1967 when Muriel

Siebert became the first woman to own a seat on the NYSE and the

first to head one of its member firms.

Siebert operates through its subsidiaries Muriel Siebert &

Co., Inc., Siebert AdvisorNXT, Inc., Park Wilshire Companies, Inc.,

Rise Financial Services, LLC, Siebert Technologies, LLC and

StockCross Digital Solutions, Ltd. Through these entities, Siebert

provides a full range of brokerage and financial advisory services

including securities brokerage, investment advisory and insurance

offerings, prime brokerage, capital intro, and corporate stock plan

administration solutions. For over 50 years, Siebert has been a

mission-driven company that values its clients, shareholders, and

employees. More information is available at www.siebert.com.

Cautionary Note Regarding Forward-Looking Statements

The statements contained in this press release, that are not

historical facts, including statements about our beliefs and

expectations, are “forward-looking statements” within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements preceded by, followed

by or that include the words “may,” “could,” “would,” “should,”

“believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,”

“project,” “intend” and similar words or expressions. In addition,

any statements that refer to expectations, projections, or other

characterizations of future events or circumstances are

forward-looking statements.

These forward-looking statements, which reflect our management’s

beliefs, objectives, and expectations as of the date hereof, are

based on the best judgement of our management. All forward-looking

statements speak only as of the date on which they are made. Such

forward-looking statements are subject to certain risks,

uncertainties and assumptions relating to factors that could cause

actual results to differ materially from those anticipated in such

statements, including, without limitation, the following: economic,

social and political conditions, global economic downturns

resulting from extraordinary events such as the COVID-19 pandemic

and other securities industry risks; interest rate risks; liquidity

risks; credit risk with clients and counterparties; risk of

liability for errors in clearing functions; systemic risk; systems

failures, delays and capacity constraints; network security risks;

competition; reliance on external service providers; new laws and

regulations affecting our business; net capital requirements;

extensive regulation, regulatory uncertainties and legal matters;

failure to maintain relationships with employees, customers,

business partners or governmental entities; the inability to

achieve synergies or to implement integration plans and other

consequences associated with risks and uncertainties detailed in

our filings with the SEC, including our most recent filings on

Forms 10-K and 10-Q.

We caution that the foregoing list of factors is not exclusive,

and new factors may emerge, or changes to the foregoing factors may

occur, that could impact our business. We undertake no obligation

to publicly update or revise these statements, whether as a result

of new information, future events or otherwise, except to the

extent required by the federal securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221114006017/en/

Investor Relations: Alex Kovtun and Matt Glover Gateway

Group, Inc. 949-574-3860 sieb@gatewayir.com

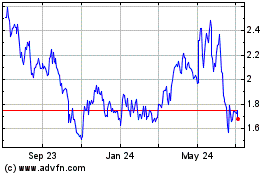

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

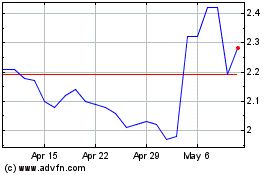

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Apr 2023 to Apr 2024