Amended Current Report Filing (8-k/a)

April 29 2019 - 4:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

/ A

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 25, 2019

REPLIGEN CORPORATION

(Exact name of registrant as specified in charter)

|

|

|

|

|

|

|

Delaware

|

|

0-14656

|

|

04-2729386

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

41 Seyon Street, Bldg. 1, Suite 100, Waltham, MA 02453

(Address of Principal Executive Offices) (Zip Code)

(781)

250-0111

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17

CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter). Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

As previously disclosed in its Current Report on Form

8-K

filed with the Securities and Exchange Commission on

April 26, 2019 (the “

Original

8-K

”), Repligen Corporation, a Delaware corporation (the “

Company

”), entered into a Stock Purchase Agreement (the “

Purchase

Agreement

”) with C Technologies, Inc., a New Jersey corporation (“

C Technologies

” or the “

Seller

”), and Craig Harrison, an individual and the sole stockholder of the Seller (the

“

Stockholder

”, and together with the Seller, the “

Seller Parties

”) on April 25, 2019. Pursuant to the Purchase Agreement, the Company will purchase from the Stockholder all of the issued and outstanding capital

stock of the Seller (the “

Share Purchase

”) for an aggregate purchase price of $240 million. The aggregate purchase price consists of (i) $192 million in cash (the “

Cash Consideration

”), and (ii)

$48 million in shares of the Company’s common stock. The Cash Consideration is subject to adjustment based on (i) cash and working capital adjustments, (ii) the amount of the Seller Parties’ transaction expenses and

indebtedness that remain unpaid as of the closing of the Share Purchase (such date, the “

Closing

”), and (iii) indemnification obligations for certain claims made following the Closing. Approximately $3.4 million of the

Cash Consideration will be placed into a third party escrow account against which the Company may make claims for indemnification and purchase price adjustments. The Purchase Agreement contains customary representations, warranties and covenants of

the parties and contains customary conditions to closing. The above description of the Purchase Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Purchase Agreement, a copy of which

is filed as Exhibit 2.1 to the Original

8-K.

The Company is filing this Amendment to the Original

8-K

to disclose (i) the audited financial statements of C

Technologies, which comprise (A) the balance sheets as of December 31, 2018 and December 31, 2017, and the related statements of income, stockholders’ equity, and cash flows for the years then ended, and (B) the related notes to

the financial statements, and (ii) (A) the unaudited pro forma condensed combined consolidated balance sheet of the Company as of December 31, 2018, (B) the unaudited pro forma condensed combined consolidated statements of income of the

Company for the year ended December 31, 2018, and (C) the related notes to unaudited pro forma condensed combined consolidated financial statements, and (iii) Management’s Discussion and Analysis of Financial Conditions and

Results of Operations of C Technologies for the year ended December 31, 2018.

This Amendment to the Original

8-K

amends the Original

8-K

to provide the historical financial statements of C Technologies required under Item 9.01(a) and the pro forma financial information required

under Item 9.01(b).

Forward-Looking Statements

This

Current Report on Form

8-K,

as amended, contains forward-looking statements, which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding the timing of the consummation of the Share Purchase. These statements are neither promises nor guarantees, and are subject to a variety of risks and

uncertainties, many of which are beyond the control of the Company, which could cause actual results to differ materially from those contemplated in these forward-looking statements. In particular, the risks and uncertainties include, among other

things, the risk that the Share Purchase does not close. For additional disclosure regarding these and other risks faced by the Company, see the disclosures contained in the Company’s Annual Report on Form

10-K

on file with the Securities and Exchange Commission and the other reports that the Company periodically files with the Securities and Exchange Commission. Actual results may differ materially from those

contemplated by these forward-looking statements. These forward looking statements reflect management’s current views and the Company does not undertake to update any of these forward-looking statements to reflect a change in its views or

events or circumstances that occur after the date hereof except as required by law.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

2.1*†

|

|

Stock Purchase Agreement, dated April

25, 2019, by and among Repligen Corporation, C Technologies, Inc. and Craig Harrison (incorporated herein by reference to Exhibit 2.1 to Repligen Corporation’s Form

8-K

filed on April 26, 2019).

|

|

|

|

|

23.1

|

|

Consent of Independent Accountants (Friedman LLP).

|

|

|

|

|

99.1

|

|

Press Release by Repligen Corporation, dated April 26, 2019 (incorporated herein by reference to Exhibit 99.1 to Repligen Corporation’s Form

8-K filed on April 26, 2019).

|

|

|

|

|

99.2

|

|

Audited financial statements of C Technologies, which comprise the balance sheets as of December

31, 2018 and 2017, and the related statements of income, stockholders’ equity, and cash flows for the years then ended, and the related notes to the financial statements.

|

|

|

|

|

99.3

|

|

(A) Unaudited Pro Forma Condensed Combined Consolidated Statement of Income of Repligen for the year ended December

31, 2018, (B) Unaudited Pro Forma Condensed Combined Consolidated Balance Sheet of Repligen as of December 31, 2018 and (C) the related Notes to Unaudited Pro Forma Condensed Combined Consolidated Financial Statements.

|

|

|

|

|

99.4

|

|

C Technologies’ Management’s Discussion and Analysis of Financial Conditions and Results of Operations for the year ended December 31, 2018.

|

|

*

|

Schedules, exhibits, and similar supporting attachments or agreements to the Purchase Agreement are omitted

pursuant to Item 601(b)(2) of

Regulation S-K. Repligen

Corporation agrees to furnish a supplemental copy of any omitted schedule or similar attachment to the Securities and Exchange Commission upon

request.

|

|

†

|

Certain portions of this exhibit, marked by [***], have been omitted as the Company has determined (i) the

omitted information is not material and (ii) the omitted information would likely cause competitive harm to the Company if publicly disclosed.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

REPLIGEN CORPORATION

|

|

|

|

|

By:

|

|

/s/ Tony J. Hunt

|

|

|

|

Tony J. Hunt

President and Chief Executive

Officer

|

|

|

|

|

Date:

|

|

April 29, 2019

|

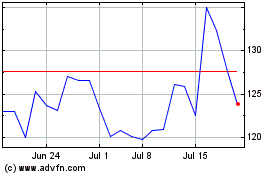

Repligen (NASDAQ:RGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Repligen (NASDAQ:RGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024