Current Report Filing (8-k)

March 24 2022 - 5:16PM

Edgar (US Regulatory)

0001812727

false

0001812727

2022-03-23

2022-03-23

0001812727

RELI:CommonStock0.086ParValuePerShareMember

2022-03-23

2022-03-23

0001812727

RELI:SeriesWarrantsToPurchaseSharesOfCommonStockParValue0.086PerShareMember

2022-03-23

2022-03-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

March

23, 2022

(Date

of earliest event reported)

RELIANCE

GLOBAL GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Florida |

|

001-40020 |

|

46-3390293 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification No.) |

| 300

Blvd. of the Americas, Suite 105 Lakewood, NJ |

|

08701 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

732-380-4600

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transmission period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.086 par value per share |

|

RELI |

|

The

Nasdaq Capital Market |

| Series

A Warrants to purchase shares of common stock, par value $0.086 per share |

|

RELIW |

|

The

Nasdaq Capital Market |

Item

1.01 Amendment to a Material Definitive Agreement.

On

January 4, 2022, pursuant to that certain Securities Purchase Agreement, dated as of December 22, 2021, by and among the Company and

the investors party thereto (each an “Other Holder”, and together with the Holder, the “Holders”)

(the “Securities Purchase Agreement”), the Company issued to the Holder, among other things, shares (the “Existing

Common Shares”) of common stock, par value $0.086 per share (the “Common Stock”). On January 11, 2022, pursuant

to a certain Purchase Agreement, between the Company and Medigap, Inc. an aggregate of 606,037 shares were issued to Medigap as part

of the purchase price for the assets of Medigap purchased thereunder by the Company. On January 31, 2022, the Company received a deficiency

notification from Nasdaq regarding the issuance of shares of its common stock to the sellers in closing of the January 10, 2022 Medigap

acquisition, which Nasdaq determined to aggregate with its shares of common stock issued in the Company’s January 6, 2022 private

placement in violation of Nasdaq Listing Rule 5635(a). The Company provided Nasdaq with a remediation plan which was accepted by Nasdaq

as previously disclosed.

Pursuant

to this plan of remediation, the Holders have entered into Exchange Agreements with the Company pursuant to which they have exchanged

a total of 2,670,892 shares of Company common stock for 2,670,892 Series C Warrants and 1,222,498 Series D Warrants. Medigap has also

entered into an exchange agreement with the Company pursuant to which Medigap has exchanged 606,037 shares of common stock issued to

it for 606,037 Series C Warrants. The Series C Warrants are exercisable into Company common stock on a one-for-one basis immediately

upon effectiveness of shareholder approval of the January 4, 2022 financing and January 11, 2022 Medigap transaction. Nine shareholders

constituting a majority of the issued and outstanding shares of the Company signed a written consent approving the January 4, 2022 financing

and January 11, 2022 Medigap transaction on March 18, 2022, which shall become effective on the 20th calendar day subsequent

to filing a Definitive Schedule 14C for which the Preliminary Schedule 14C shall be filed on or before April 1, 2022.

Item

3.02 Unregistered Sale of Equity Securities

See

Item 1.01 above.

Item

9.01 Exhibits

4.1 Form of Series C Warrant

4.2 Form of Series D Warrant

10.1 Form of Investor Exchange Agreement

10.2 Form of Medigap Exchange Agreement

104 Cover Page Interactive Data

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

RELIANCE

GLOBAL GROUP, INC. |

| |

|

|

| Dated:

March 24, 2022 |

By: |

/s/

Ezra Beyman |

| |

|

Ezra

Beyman

Chief

Executive Officer |

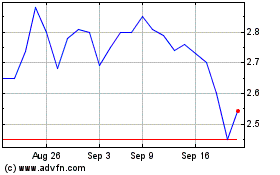

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Mar 2024 to Apr 2024

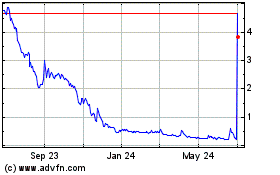

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Apr 2023 to Apr 2024