Securities Registration: Employee Benefit Plan (s-8)

July 24 2019 - 7:02AM

Edgar (US Regulatory)

Registration No. ______________

As filed with the Securities and Exchange Commission on July 24,

2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

___________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

___________________

REDHILL BIOPHARMA LTD.

(Exact name of registrant as specified in its charter)

|

Israel

|

|

Not

Applicable

|

|

(State or other

jurisdiction of

|

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

|

21 Ha'arba'a Street

Tel Aviv 6473921,

Israel

(Address of Principal Executive Offices) (Zip Code)

Redhill Biopharma Ltd. Amended and Restated Award Plan (2010)

(Full title of the plan)

RedHill Biopharma Inc.

8045 Arco Corporate Drive, Suite 200

Raleigh, NC 27617

(984) 444-7010

(Name and address of agent for service)

(Telephone number, including area code, of agent

for service)

Copy to:

Perry Wildes, Adv.

Gross, Kleinhendler, Hodak, Halevy, Greenberg, Shenhav & Co.

One Azrieli Center

Tel Aviv 67021, Israel

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions

of “large accelerated filter,” “accelerated filer,” “smaller reporting company,” and "emerging

growth company" in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☐

|

|

Accelerated Filer ☒

|

|

|

|

|

|

Non-Accelerated Filer ☐

|

Smaller reporting company ☐

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

Title of securities to

be registered

|

|

Amount to be

registered

(2)

|

|

Proposed maximum

offering price

per share

|

|

Proposed maximum

aggregate offering

price

|

|

Amount of

registration

fee

|

|

Ordinary Shares, par value NIS 0.01 per share, deposited as American Depositary Shares represented by American Depositary Receipts

(1)

|

|

|

15,000,000

|

(3)

|

|

$

|

0.793

|

(4)

|

|

$

|

11,895,000

|

|

|

$

|

1,441.67

|

|

(1) American Depositary Shares

(“ADSs”), evidenced by American Depositary Receipts, issuable upon deposit of the ordinary shares registered hereby,

par value NIS 0.01 per share (“Ordinary Shares”), of Redhill Biopharma Ltd. (the “Company”) are registered

on a separate registration statement on Form F-6 (File No. 333-185302). Each ADS represents ten (10) Ordinary Shares.

(2) Pursuant

to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall

also cover any additional Ordinary Shares that become issuable under the Redhill Biopharma Ltd. Amended and Restated Award Plan

(2010), as amended (the "Plan") by reason of any stock dividend, stock split, or other similar transaction.

(3) Represents the number of additional

Ordinary Shares reserved for future issuance under the Plan.

(4) Estimated solely for purposes

of calculating the registration fee pursuant to Rules 457(c) and 457(h) under the Securities Act, and based on the average of

the high and low prices of the Company's ADSs reported on the NASDAQ Global Market on July 19, 2019.

STATEMENT PURSUANT TO GENERAL INSTRUCTION E

OF FORM S-8

EXPLANATORY NOTE

This Registration Statement on Form

S-8 (this “Registration Statement”) registers an additional 15,000,000 ordinary shares, par value NIS 0.01 per share,

deposited as American Depositary Shares represented by American Depositary Receipts, of Redhill Biopharma Ltd. (the “Company”),

which may be issued under the Redhill Biopharma Ltd. Amended and Restated Award Plan (2010) (the "Plan").

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

|

ITEM 1.

|

PLAN INFORMATION.*

|

|

|

|

|

|

ITEM 2.

|

REGISTRANT INFORMATION AND EMPLOYEE PLAN ANNUAL INFORMATION. *

|

___________________

* Information required by Part I to

be contained in the Section 10(a) prospectus is omitted from this registration statement in accordance with Rule 428 under the

Securities Act of 1933, as amended, or the Securities Act, and the Introductory Note to Part I of Form S-8.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

|

|

ITEM 3.

|

INCORPORATION OF DOCUMENTS BY REFERENCE

|

The following documents filed with or furnished

to the Securities and Exchange Commission (the “

Commission

”) by RedHill Biopharma Ltd., a company organized

under the laws of Israel (the “

Company

” or the “

Registrant

”), are incorporated herein by

reference and made a part hereof:

|

|

(a)

|

the Company’s Annual Report on Form 20-F for the year ended December 31, 2018, filed with

the Commission on February 26, 2019, as amended on May 15, 2019;

|

|

|

(b)

|

The Company's report on Form 6-K furnished to the Commission on February 26, 2019, March 4, 2019,

May 7, 2019 (two filings), May 9, 2019, May 16, 2019, May 21, 2019, May 28, 2019, June 10, 2019, June 24, 2019, July 3, 2019, and

July 23, 2019 (two filings); and

|

|

|

(c)

|

the description of the Company’s ordinary shares, par value NIS 0.01 per share, included

in Item 10B of the Registration Statement on Form 20-F filed with the Commission on December 26, 2012

,

including any subsequent amendment or any report filed for purposes of updating such description

.

|

All documents or reports subsequently filed by

the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the

Securities Exchange Act

of 1934, as amended (the "

Exchange Act

"), and to the extent designated therein, certain reports on Form

6-K, furnished by the Company, after the date of this Registration Statement and prior to the filing of a post-effective amendment

which indicates that all securities offered hereby have been sold or which deregisters all securities offered hereby then remaining

unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing

of such documents or reports. Any statement in a document or report incorporated or deemed to be incorporated by reference herein

shall be deemed to be modified or superseded for the purposes of this Registration Statement to the extent that a statement contained

herein or in any other subsequently filed document or report which also is or is deemed to be incorporated by reference herein

modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this Registration Statement.

|

|

ITEM 4.

|

DESCRIPTION OF SECURITIES

|

Not applicable.

|

|

ITEM 5.

|

INTERESTS OF NAMED EXPERTS AND COUNSEL

|

Not applicable.

|

|

ITEM 6.

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

Exemption, Insurance, and Indemnification of Directors and Officers

Exemption of Officers and Directors

Under the Israeli Companies Law, 1999, or the Israeli Companies

Law, a company may not exempt an officer or director from liability with respect to a breach of his duty of loyalty, but may exempt

in advance an officer or director from liability to the company, in whole or in part, with respect to a breach of his duty of care,

except in connection with a prohibited distribution made by the company, if so provided in its articles of association. Our articles

of association provide for this exemption from liability for our directors and officers.

Directors’ and Officers’ Insurance

The Israeli Companies Law and our articles of association provide

that, subject to the provisions of the Israeli Companies Law, we may obtain insurance for our directors and officers for any liability

stemming from any act performed by an officer or director in his capacity as an officer or director, as the case may be with respect

to any of the following:

|

•

|

|

a breach of such officer’s or director’s duty of care to us or to another

person;

|

|

•

|

|

a breach of such officer’s or director’s duty of loyalty to us, provided that such officer or director acted in good faith and had reasonable cause to assume that his act would not prejudice our interests;

|

|

•

|

|

a financial liability imposed upon such officer or director in favor of another person;

|

|

•

|

|

financial liability imposed on the officer or director for payment to persons or entities harmed as a result of violations in administrative proceedings as described in Section 52(54)(a)(1)(a) of the Israeli Securities Law (the “Party Harmed by the Breach”);

|

|

•

|

|

expenses incurred by such officer or director in connection with an administrative proceeding conducted in this matter, including reasonable litigation expenses, including legal fees; or

|

|

•

|

|

a breach of any duty or any other obligation, to the extent insurance may be permitted by law.

|

Our shareholders approved our Compensation Policy for directors

and officers on June 24, 2019 (the “Compensation Plan”), which includes, among other things, provisions relating to

directors’ and officers’ liability insurance. Pursuant to the Compensation Policy, we may obtain a liability insurance

policy, which would apply to our and/or our subsidiaries' directors and officers, as they may be, from time to time, subject

to the following terms and conditions: (a) the total insurance coverage under the insurance policy may not exceed $100 million;

and (b) the annual premium payable by us for the insurance premium may not exceed $1 million annually. In addition, pursuant to

our Compensation Policy, should we sell our operations (in whole or in part) or in case of merger, spin-off or any other significant

business combination involving us or part or all of our assets, we may obtain a director’s and officers’ liability

insurance policy (run-off) for our directors and officers in office with regard to the relevant operations, subject to the following

terms and conditions: (a) the insurance term may not exceed seven years; (b) the coverage amount may not exceed $100 million; (c)

the premium payable by us may not exceed $1 million annually. The Compensation Policy is in effect for three years from the 2019

annual general meeting.

Our compensation committee and board of directors resolved to purchase

a directors’ and officers’ liability insurance policy, pursuant to which the total amount of insurance covered under

the policy is $50 million. This insurance is renewed on an annual basis. Pursuant to the foregoing approvals, we carry directors’

and officers’ liability insurance.

Indemnification of Officers and Directors

The Israeli Companies Law provides that a company may indemnify

an officer or director for payments or expenses associated with acts performed in his capacity as an officer or director of the

company, provided the company’s articles of association include the following provisions with respect to indemnification:

|

•

|

|

a provision authorizing the company to indemnify an officer or director for future events with respect to a monetary liability imposed on him in favor of another person pursuant to a judgment (including a judgment given in a settlement or an arbitrator’s award approved by the court), so long as such indemnification is limited to types of events which, in the board of directors’ opinion, are foreseeable at the time of granting the indemnity undertaking given the company’s actual business, and in such amount or standard as the board of directors deems reasonable under the circumstances. Such undertaking must specify the events that, in the board of directors’ opinion, are foreseeable in view of the company’s actual business at the time of the undertaking and the amount or the standards that the board of directors deemed reasonable at the time;

|

|

•

|

|

a provision authorizing the company to indemnify an

officer or director for future events with respect to reasonable litigation expenses, including counsel fees, incurred by an officer

or director in which he is ordered to pay by a court, in proceedings that the company institutes against him or instituted on

behalf of the company or by another person, or in a criminal charge of which he was acquitted, or a criminal charge in which he

was convicted of a criminal offense that does not require proof of criminal intent;

|

|

•

|

|

a provision authorizing the company to indemnify an

officer or director for future events with respect to reasonable litigation fees, including attorney’s fees, incurred by

an officer or director due to an investigation or proceeding filed against him by an authority that is authorized to conduct such

investigation or proceeding, and that resulted without filing an indictment against him and without imposing on him financial

obligation in lieu of a criminal proceeding, or that resulted without filing an indictment against him but with imposing on him

a financial obligation as an alternative to a criminal proceeding in respect of an offense that does not require the proof of

criminal intent or in connection with a monetary sanction;

|

|

•

|

|

a provision authorizing the company to indemnify an

officer or director for future events with respect to a Party Harmed by the Breach;

|

|

•

|

|

a provision authorizing the company to indemnify an

officer or director for future events with respect to expenses incurred by such officer or director in connection with an administrative

proceeding, including reasonable litigation expenses, including legal fees; and

|

|

•

|

|

a provision authorizing the company to indemnify an

officer or director retroactively.

|

Limitations on Insurance, Exemption and Indemnification

The Israeli Companies Law and our articles of association provide

that a company may not exempt or indemnify a director or an officer nor enter into an insurance contract, which would provide coverage

for any monetary liability incurred as a result of any of the following:

|

•

|

|

a breach by the officer or director of his duty of loyalty,

except for insurance and indemnification where the officer or director acted in good faith and had a reasonable basis to believe

that the act would not prejudice the company;

|

|

•

|

|

a breach by the officer or director of his duty of care

if the breach was done intentionally or recklessly, except if the breach was solely as a result of negligence;

|

|

•

|

|

any act or omission done with the intent to derive an

illegal personal benefit; or

|

|

•

|

|

any fine, civil fine, monetary sanctions, or forfeit

imposed on the officer or director.

|

In addition, under the Israeli Companies Law, exemption of, indemnification

of, and procurement of insurance coverage for, our directors and officers must be approved by our audit committee and board of

directors and, in specified circumstances, by our shareholders.

Letters of Indemnification

We may provide a commitment to indemnify in advance any director

or officer of ours in the course of such person’s position as our director or officer, all subject to the letter of indemnification,

as approved by our shareholders from time to time and in accordance with our articles of association. We may provide retroactive

indemnification to any officer to the extent allowed by the Israeli Companies Law. As approved by our shareholders on July 18,

2013, the amount of the advance indemnity is limited to the higher of 25% of our then shareholders’ equity, per our most

recent annual financial statements, or $5 million.

As part of the indemnification letters, we exempted our directors

and officers, in advance, to the extent permitted by law, from any liability for any damage incurred by them, either directly or

indirectly, due to the breach of an officer’s or director’s duty of care

vis-à-vis

us, within

his acts in his capacity as an officer or director. The letter provides that so long as not permitted by law, we do not exempt

an officer or director in advance from his liability to us for a breach of the duty of care upon distribution, to the extent applicable

to the officer or director, if any. The letter also exempts an officer or director from any liability for any damage incurred by

him, either directly or indirectly, due to the breach of the officer or director’s duty of care

vis-à-vis

us,

by his acts in his capacity as an officer or director prior to the letter of exemption and indemnification becoming effective.

|

|

ITEM 7.

|

EXEMPTION FROM REGISTRATION CLAIMED

|

Not applicable.

See Exhibit Index.

|

|

(a)

|

The undersigned Registrant hereby undertakes:

|

|

|

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment

to this registration statement:

|

|

|

(i)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

(ii)

|

to reflect in the prospectus any facts or events arising after the effective date of the Registration

Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental

change in the information set forth in the Registration Statement; and

|

|

|

(iii)

|

to include any material information with respect to the plan of distribution not previously disclosed

in the Registration Statement or any material change to such information in the Registration Statement;

|

provided, however,

that paragraphs (a)(1)(i)

and (a)(1)(ii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs

is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of

the Exchange Act that are incorporated by reference in the registration statement;

|

|

(2)

|

That, for the purpose of determining any liability under the Securities

Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein,

and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof

.

|

|

|

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being

registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

To file a post-effective amendment to the registration statement to include any financial statements

required by Item 8.A of Form 20-F at the start of any delayed offering or throughout a continuous offering. Financial statements

and information otherwise required by Section 10(a)(3) of the Act need not be furnished,

provided

, that the registrant

includes in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4)

and other information necessary to ensure that all other information in the prospectus is at least as current as the date of those

financial statements.

|

|

|

(b)

|

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under

the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange

Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange

Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

|

|

|

(c)

|

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to

directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant

has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as

expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant

in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection

with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by

controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

|

EXHIBIT INDEX

|

Exhibit

Number

|

Description

|

|

|

|

|

4.1

|

Articles of Association of the Company, as amended (unofficial English translation) (incorporated by reference as Exhibit 1.1 to Annual Report on Form 20-F disseminated with the Securities and Exchange Commission on February 26, 2019).

|

|

|

|

|

4.2

|

Form of Deposit Agreement among the Registrant, the Bank of New York Mellon, as Depositary, and all Owners and Holders from time to time of American Depositary Shares issued hereunder (incorporated by reference as Exhibit 1 to the Registration Statement on Form F-6 filed by The Bank of New York Mellon with the Securities and Exchange Commission on December 6, 2012).

|

|

|

|

|

4.3

|

RedHill Biopharma Ltd. Amended and Restated Award Plan (2010) (incorporated by reference as Appendix B to the proxy statement submitted on Form 6-K disseminated with the Securities and Exchange Commission on April 3, 2017).

|

|

|

|

|

5.1*

|

Opinion of Gross, Kleinhendler, Hodak, Halevy, Greenberg, Shenhav & Co.

|

|

|

|

|

23.1*

|

Consent of Gross, Kleinhendler, Hodak, Halevy, Greenberg, Shenhav & Co. (included in Exhibit 5.1).

|

|

|

|

|

23.2*

|

Consent of Kesselman & Kesselman.

|

|

|

|

|

24.1*

|

Power of Attorney (included on signature page).

|

|

|

|

|

* Filed herewith.

|

|

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing

on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in the City of Tel Aviv, State of Israel, on this 24

th

day of July, 2019.

|

|

|

REDHILL BIOPHARMA LTD.

|

|

|

|

|

|

|

|

By: /s/ Dror Ben-Asher

|

|

|

|

Dror Ben-Asher

|

|

|

|

Chief Executive Officer and Chairman of the Board

of Directors

|

|

|

|

|

|

|

|

By: /s/ Micha Ben Chorin

|

|

|

|

Micha Ben-Chorin

|

|

|

|

Chief Financial Officer

|

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each individual

whose signature appears below constitutes and appoints Dror Ben-Asher and Micha Ben-Chorin his true and lawful attorney-in-fact

and agent with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities,

to sign this registration statement and any and all future amendments (including post-effective amendments) to the registration

statement, and to file the same with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange

Commission, granting unto said attorney-in-fact and agent, and each of them, full power and authority to do and perform each and

every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might

or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent or any of them, or their or his

substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, as amended this registration statement has been signed by the following persons in the capacities and on the dates

indicated:

|

Signatures

|

Title

|

Date

|

|

|

|

|

|

/s/ Dror Ben-Asher

|

Chief Executive Officer and

|

July 24, 2019

|

|

Dror Ben-Asher

|

Chairman of the Board of

|

|

|

|

Directors

|

|

|

|

|

|

|

/s/ Micha Ben Chorin

|

Chief Financial Officer

|

July 24, 2019

|

|

Micha Ben Chorin

|

|

|

|

|

|

|

|

/s/ Eric Swenden

|

Director

|

July

24, 2019

|

|

Eric Swenden

|

|

|

|

|

|

|

|

/s/ Dr. Kenneth Reed

|

Director

|

July

24, 2019

|

|

Dr. Kenneth Reed

|

|

|

|

/s/ Ofer Tsimchi

|

Director

|

July

24, 2019

|

|

Ofer Tsimchi

|

|

|

|

|

|

|

|

/s/ Rick D. Scruggs

|

Director

|

July

24, 2019

|

|

Rick D. Scruggs

|

|

|

|

|

|

|

|

/s/ Alla Felder

|

Director

|

July

24, 2019

|

|

Alla Felder

|

|

|

|

|

|

|

|

/s/ Nicolas A. Weinstein

|

Director

|

July

24, 2019

|

|

Nicolas A. Weinstein

|

|

|

|

|

|

|

|

|

|

REDHILL BIOPHARMA INC.

|

|

|

|

|

Authorized U.S. Representative

|

|

|

|

|

|

|

|

|

|

By /s/ Micha Ben Chorin

|

|

|

|

|

Name: Micha Ben Chorin

|

|

|

|

|

Title: July 24, 2019

|

|

9

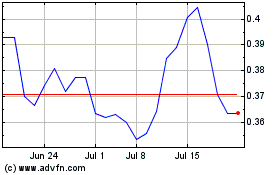

Redhill Biopharma (NASDAQ:RDHL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Redhill Biopharma (NASDAQ:RDHL)

Historical Stock Chart

From Apr 2023 to Apr 2024