0001574235

false

0001574235

2023-08-10

2023-08-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 10, 2023

PULMATRIX,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-36199 |

|

46-1821392 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification

No.) |

99

Hayden Avenue, Suite 390

Lexington,

MA 02421

(Address

of principal executive offices) (Zip Code)

(781)

357-2333

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange

on

which registered |

| Common

Stock, par value $0.0001 per share |

|

PULM |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

August 10, 2023, Pulmatrix, Inc. issued a press release announcing its financial results for the second fiscal quarter ended June 30,

2023 and provided a corporate update. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, being

furnished pursuant to Item 2.02, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated

by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act,

except as shall be expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

*

This exhibit is furnished pursuant to Item 2.02 and shall not be deemed to be “filed.”

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

PULMATRIX,

INC. |

| |

|

|

| Date:

August 10, 2023 |

By: |

/s/

Teofilo Raad |

| |

|

Teofilo

Raad |

| |

|

Chief

Executive Officer |

Exhibit

99.1

Pulmatrix

Announces Second Quarter 2023 Financial Results and Provides Corporate Update

Subject

enrollment for the Phase 2b study of PUR1900 is ongoing with five additional sites added during Q2, totaling thirteen active sites to

date in four countries, and topline data anticipated in Q3 2024

Submitted

an IND for a Phase 2 study of PUR3100 for Acute Migraine

$25.8

million in cash and cash equivalents at the end of Q2 2023 providing projected cash runway into Q1 2025

Bedford,

Mass., August 10, 2023 – Pulmatrix, Inc. (NASDAQ: PULM), a clinical-stage biopharmaceutical company developing innovative inhaled

therapies to address serious pulmonary and central nervous system disease using its patented iSPERSE™ technology, today announced

second quarter financial results for 2023 and provided a corporate update on its development programs.

Ted

Raad, Chief Executive Officer of Pulmatrix commented,

“With our first quarter initiation of the PUR1900 Phase 2b study in allergic bronchopulmonary aspergillosis, or ABPA, our focus

for the second quarter was both to continue our work on the PUR1900 trial as well as to file an Investigational New Drug Application,

or IND, for a Phase 2 trial for PUR3100 for the treatment of acute migraine, which we achieved in June 2023. We anticipate starting the

PUR3100 trial once appropriate financing or partnerships have been arranged. While we advance all of our programs clinically, we have

focused on driving operational efficiencies and have extended our projected cash runway into the first quarter of 2025.”

Second

Quarter 2023 and Recent Program and Corporate Highlights

PUR1900

| |

● |

PUR1900

is currently in a Phase 2 trial for the treatment of ABPA in patients with asthma (NCT05667662). In February 2023, Pulmatrix

began dosing patients for its proof-of-concept Phase 2b study of PUR1900 (itraconazole, administered as a dry powder for inhalation

using iSPERSE™). This Phase 2b trial is a randomized, double-blind, multi-center, placebo-controlled study to evaluate PUR1900’s

efficacy and safety. The multi-center study is being conducted in the United States, United Kingdom, Australia and France. Endpoints

include safety, tolerability, and potential efficacy outcomes to identify potential registrational endpoints in adult patients with

asthma and ABPA. Pulmatrix anticipates topline data from this study in the third quarter of 2024. |

PUR3100

| |

● |

The

Company submitted an IND to the United States Food and Drug Administration for PUR3100 in June 2023. PUR3100 is under development

as an orally inhaled dihydroergotamine (DHE) engineered with iSPERSE™ for the acute treatment of migraine. The IND includes

a Phase 2 clinical protocol where safety and preliminary efficacy of PUR3100 will be investigated in patients with acute migraine.

The Company is pursuing potential partnership opportunities. |

| |

|

|

| |

● |

Data

from the Phase 1 study, completed last year, was presented at the American Headache Society 65th Annual Meeting in June 2023. Results

showed a lower incidence of nausea, and no vomiting was observed in PUR3100 dose groups compared to intravenously (IV) administered

DHE. The study also showed that PUR3100 achieved peak exposures in the targeted therapeutic range and time to maximum concentration

occurred at five minutes after dosing at all dosing levels. |

PUR1800

| |

● |

In

February 2023, Pulmatrix presented complete results from a Phase 1b study of PUR1800 for acute exacerbations of chronic obstructive

pulmonary disease (AECOPD). The topline data was initially announced in March 2022, at the American Academy of Allergy, Asthma &

Immunology annual conference. The completed data analysis will inform the study design of a potential Phase 2 study in patients with

AECOPD. Pulmatrix plans to pursue partnership opportunities to advance PUR1800 into a potential Phase 2 clinical trial. |

Second

Quarter 2023 Financial Results

Revenues

increased $0.5 million to $1.8 million for the three months ended June 30, 2023 compared to $1.3 million for the three months ended June

30, 2022. The increase is related to the Company’s revenues recognized in accordance with the Cipla Agreement for PUR1900 during

the period.

Research

and development expenses decreased approximately $0.2 million to $4.2 million for the three months ended June 30, 2023 compared to $4.3

million for the three months ended June 30, 2022. The decrease was primarily due to decreased spend of $0.8 million in costs related

to the Company’s PUR3100 program and $0.1 million in costs related to the Company’s PUR1800 program, partially offset by

increases in spending of $0.5 million in costs related to the Company’s PUR1900 program and $0.2 million of employment and operating

costs.

General

and administrative expenses increased $0.1 million to $1.7 million for the three months ended June 30, 2023, compared to $1.6 million

for the three months ended June 30, 2022. The increase was primarily due to increased professional services costs.

Pulmatrix’s

total cash and cash equivalents balance as of June 30, 2023 was $25.8 million. The Company anticipates that its cash position, based

on operational efficiencies and prioritization of spending, is sufficient to fund its operations into the first quarter of 2025.

PULMATRIX,

INC.

Consolidated

Balance Sheets

(in

thousands, except share and per share data)

| | |

June

30, 2023 | | |

December

31, 2022 | |

| | |

(unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 25,791 | | |

$ | 35,628 | |

| Restricted cash | |

| 153 | | |

| 153 | |

| Accounts receivable | |

| 418 | | |

| 1,298 | |

| Prepaid expenses and other current assets | |

| 1,019 | | |

| 1,068 | |

| Total current assets | |

| 27,381 | | |

| 38,147 | |

| Property and equipment, net | |

| 279 | | |

| 235 | |

| Operating lease right-of-use asset | |

| 277 | | |

| 710 | |

| Long-term restricted cash | |

| 1,472 | | |

| 1,472 | |

| Other long-term assets | |

| 1,984 | | |

| 389 | |

| Total assets | |

$ | 31,393 | | |

$ | 40,953 | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 929 | | |

$ | 1,188 | |

| Accrued expenses and other current liabilities | |

| 1,201 | | |

| 1,638 | |

| Operating lease liability | |

| 358 | | |

| 857 | |

| Deferred revenue | |

| 1,109 | | |

| 1,339 | |

| Total current liabilities | |

| 3,597 | | |

| 5,022 | |

| Deferred revenue, net of current portion | |

| 4,347 | | |

| 4,822 | |

| Total liabilities | |

| 7,944 | | |

| 9,844 | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.0001 par value — 500,000 shares authorized; 6,746 shares designated Series A convertible preferred stock; no shares issued and outstanding at June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| Common stock, $0.0001 par value — 200,000,000 shares authorized; 3,652,285 and 3,639,185 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | |

| - | | |

| - | |

| Additional paid-in capital | |

| 305,189 | | |

| 304,585 | |

| Accumulated deficit | |

| (281,740 | ) | |

| (273,476 | ) |

| Total stockholders’ equity | |

| 23,449 | | |

| 31,109 | |

| Total liabilities and stockholders’ equity | |

$ | 31,393 | | |

$ | 40,953 | |

PULMATRIX,

INC.

Consolidated

Statements of Operations

(in

thousands, except share and per share data)

(unaudited)

| | |

Three

Months Ended June 30, | | |

Six

Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 1,844 | | |

$ | 1,331 | | |

$ | 3,343 | | |

$ | 2,491 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 4,165 | | |

| 4,337 | | |

| 8,039 | | |

| 8,486 | |

| General and administrative | |

| 1,670 | | |

| 1,553 | | |

| 3,880 | | |

| 3,527 | |

| Total operating expenses | |

| 5,835 | | |

| 5,890 | | |

| 11,919 | | |

| 12,013 | |

| Loss from operations | |

| (3,991 | ) | |

| (4,559 | ) | |

| (8,576 | ) | |

| (9,522 | ) |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 236 | | |

| 15 | | |

| 458 | | |

| 16 | |

| Other expense, net | |

| (61 | ) | |

| (51 | ) | |

| (146 | ) | |

| (62 | ) |

| Total other income (expense), net | |

| 175 | | |

| (36 | ) | |

| 312 | | |

| (46 | ) |

| Net loss | |

$ | (3,816 | ) | |

$ | (4,595 | ) | |

$ | (8,264 | ) | |

$ | (9,568 | ) |

| Net loss per share attributable to common stockholders – basic and diluted | |

$ | (1.04 | ) | |

$ | (1.36 | ) | |

$ | (2.26 | ) | |

$ | (2.87 | ) |

| Weighted average common shares outstanding – basic and diluted | |

| 3,652,285 | | |

| 3,372,090 | | |

| 3,651,531 | | |

| 3,334,891 | |

About

Pulmatrix, Inc.

Pulmatrix

is a clinical-stage biopharmaceutical company developing innovative inhaled therapies to address serious pulmonary diseases and central

nervous system (“CNS”) disorders using its patented iSPERSE™ technology. The Company’s proprietary product pipeline

includes treatments for lung diseases, such as allergic bronchopulmonary aspergillosis (“ABPA”), Chronic Obstructive Pulmonary

Disease (“COPD”) and CNS disorders such as acute migraine. Pulmatrix’s product candidates are based on its proprietary

engineered dry powder delivery platform, iSPERSE™, which seeks to improve therapeutic delivery to the lungs by maximizing local

concentrations and reducing systemic side effects to improve patient outcomes.

For

more on our inhaled product candidates please visit: https://www.pulmatrix.com/pipeline.html.

Forward-Looking

Statements

Certain

statements in this press release that are forward-looking and not statements of historical fact are forward-looking statements within

the meaning of the federal securities laws. Such forward-looking statements include, but are not limited to, statements of historical

fact and may be identified by words such as “anticipates,” “assumes,” “believes,” “can,”

“could,” “estimates,” “expects,” “forecasts,” “guides,” “intends,”

“is confident that”, “may,” “plans,” “seeks,” “projects,” “targets,”

and “would,” and their opposites and similar expressions are intended to identify forward-looking statements. Such forward-looking

statements are based on the beliefs of management as well as assumptions made by and information currently available to management. Actual

results could differ materially from those contemplated by the forward-looking statements as a result of certain factors, including,

but not limited to, the impact of the novel coronavirus (COVID-19) on the Company’s ongoing and planned clinical trials; the geographic,

social and economic impact of COVID-19 on the Company’s ability to conduct its business and raise capital in the future when needed;

delays in planned clinical trials; the ability to establish that potential products are efficacious or safe in preclinical or clinical

trials; the ability to establish or maintain collaborations on the development of therapeutic candidates; the ability to obtain appropriate

or necessary governmental approvals to market potential products; the ability to obtain future funding for developmental products and

working capital and to obtain such funding on commercially reasonable terms; the Company’s ability to manufacture product candidates

on a commercial scale or in collaborations with third parties; changes in the size and nature of competitors; the ability to retain key

executives and scientists; the ability to secure and enforce legal rights related to the Company’s products, including patent protection.

A discussion of these and other factors, including risks and uncertainties with respect to the Company, is set forth in the Company’s

filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K, as may be supplemented or

amended by the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The Company disclaims any intention or

obligation to revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required

by law.

Investor

Contact:

Timothy

McCarthy, CFA

917-679-9282

tim@lifesciadvisors.com

v3.23.2

Cover

|

Aug. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 10, 2023

|

| Entity File Number |

001-36199

|

| Entity Registrant Name |

PULMATRIX,

INC.

|

| Entity Central Index Key |

0001574235

|

| Entity Tax Identification Number |

46-1821392

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

99

Hayden Avenue

|

| Entity Address, Address Line Two |

Suite 390

|

| Entity Address, City or Town |

Lexington

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02421

|

| City Area Code |

(781)

|

| Local Phone Number |

357-2333

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.0001 per share

|

| Trading Symbol |

PULM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

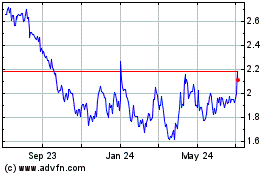

Pulmatrix (NASDAQ:PULM)

Historical Stock Chart

From Jun 2024 to Jul 2024

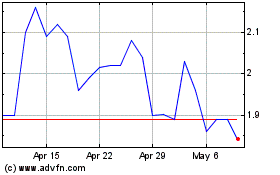

Pulmatrix (NASDAQ:PULM)

Historical Stock Chart

From Jul 2023 to Jul 2024