00015779166/302024Q1falsehttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpenseP3Yhttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrent00015779162023-07-012023-09-3000015779162023-11-02xbrli:shares00015779162023-09-30iso4217:USD00015779162023-06-300001577916us-gaap:RelatedPartyMember2023-09-300001577916us-gaap:RelatedPartyMember2023-06-300001577916us-gaap:NonrelatedPartyMember2023-09-300001577916us-gaap:NonrelatedPartyMember2023-06-300001577916us-gaap:CommonClassAMember2023-09-30iso4217:USDxbrli:shares0001577916us-gaap:CommonClassAMember2023-06-300001577916pinc:AdministrativeFeesMember2023-07-012023-09-300001577916pinc:AdministrativeFeesMember2022-07-012022-09-300001577916pinc:SoftwareLicensesOtherServicesAndSupportMember2023-07-012023-09-300001577916pinc:SoftwareLicensesOtherServicesAndSupportMember2022-07-012022-09-300001577916pinc:ServicesAndSoftwareLicensesMember2023-07-012023-09-300001577916pinc:ServicesAndSoftwareLicensesMember2022-07-012022-09-300001577916us-gaap:ProductMember2023-07-012023-09-300001577916us-gaap:ProductMember2022-07-012022-09-3000015779162022-07-012022-09-300001577916us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-06-300001577916us-gaap:TreasuryStockCommonMember2023-06-300001577916us-gaap:AdditionalPaidInCapitalMember2023-06-300001577916us-gaap:RetainedEarningsMember2023-06-300001577916us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-06-300001577916us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-07-012023-09-300001577916us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001577916us-gaap:RetainedEarningsMember2023-07-012023-09-300001577916us-gaap:CommonClassAMember2023-07-012023-09-300001577916us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-07-012023-09-300001577916us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-09-300001577916us-gaap:TreasuryStockCommonMember2023-09-300001577916us-gaap:AdditionalPaidInCapitalMember2023-09-300001577916us-gaap:RetainedEarningsMember2023-09-300001577916us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-09-300001577916us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-06-300001577916us-gaap:TreasuryStockCommonMember2022-06-300001577916us-gaap:AdditionalPaidInCapitalMember2022-06-300001577916us-gaap:RetainedEarningsMember2022-06-300001577916us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-06-3000015779162022-06-300001577916us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-07-012022-09-300001577916us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001577916us-gaap:RetainedEarningsMember2022-07-012022-09-300001577916us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-07-012022-09-300001577916us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-09-300001577916us-gaap:TreasuryStockCommonMember2022-09-300001577916us-gaap:AdditionalPaidInCapitalMember2022-09-300001577916us-gaap:RetainedEarningsMember2022-09-300001577916us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-09-3000015779162022-09-30pinc:segment0001577916pinc:PerformanceServicesMember2023-09-30pinc:brand0001577916pinc:TRPNTransferredAssetsAndDevonHealthIncAssetsTRPNMember2022-10-13pinc:provider0001577916pinc:TRPNTransferredAssetsAndDevonHealthIncAssetsTRPNMember2022-10-132022-10-130001577916pinc:PerformanceServicesMember2023-06-300001577916pinc:ContigoHealthReportingUnitMember2022-07-012023-06-300001577916pinc:FFFEnterprisesInc.Member2023-09-300001577916pinc:FFFEnterprisesInc.Member2023-06-300001577916pinc:FFFEnterprisesInc.Member2023-07-012023-09-300001577916pinc:FFFEnterprisesInc.Member2022-07-012022-09-300001577916pinc:ExelaHoldingsIncMember2023-09-300001577916pinc:ExelaHoldingsIncMember2023-06-300001577916pinc:ExelaHoldingsIncMember2023-07-012023-09-300001577916pinc:ExelaHoldingsIncMember2022-07-012022-09-300001577916pinc:QventusIncMember2023-09-300001577916pinc:QventusIncMember2023-06-300001577916pinc:QventusIncMember2023-07-012023-09-300001577916pinc:QventusIncMember2022-07-012022-09-300001577916pinc:PrestigeAmeritechLtd.Member2023-09-300001577916pinc:PrestigeAmeritechLtd.Member2023-06-300001577916pinc:PrestigeAmeritechLtd.Member2023-07-012023-09-300001577916pinc:PrestigeAmeritechLtd.Member2022-07-012022-09-300001577916pinc:OtherMember2023-09-300001577916pinc:OtherMember2023-06-300001577916pinc:OtherMember2023-07-012023-09-300001577916pinc:OtherMember2022-07-012022-09-30xbrli:pure0001577916pinc:ExelaHoldingsIncMemberpinc:ExPreHoldingsLLCMember2023-09-300001577916pinc:ExPreHoldingsLLCMember2023-09-30pinc:health_system0001577916pinc:PrestigeAmeritechLtd.Memberpinc:PRAMHoldingsLLCMember2023-09-300001577916pinc:PRAMHoldingsLLCMember2023-09-300001577916us-gaap:FairValueMeasurementsRecurringMember2023-09-300001577916us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001577916us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001577916us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-09-300001577916us-gaap:FairValueMeasurementsRecurringMember2023-06-300001577916us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001577916us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001577916us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-06-300001577916us-gaap:FairValueInputsLevel1Memberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001577916us-gaap:FairValueInputsLevel1Memberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-06-300001577916us-gaap:IncomeApproachValuationTechniqueMemberus-gaap:MeasurementInputCreditSpreadMemberpinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-09-300001577916us-gaap:IncomeApproachValuationTechniqueMemberus-gaap:MeasurementInputCreditSpreadMemberpinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-06-300001577916pinc:AcurityInc.AcurityandNexeraInc.NexeraMembersrt:MinimumMember2023-09-300001577916pinc:AcurityInc.AcurityandNexeraInc.NexeraMembersrt:MinimumMember2023-06-300001577916pinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-09-300001577916pinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-06-300001577916us-gaap:IncomeApproachValuationTechniqueMemberpinc:MeasurementInputProbabilityOfTransferredMemberRenewalPercentageRangeOneMemberpinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-09-300001577916us-gaap:IncomeApproachValuationTechniqueMemberpinc:MeasurementInputProbabilityOfTransferredMemberRenewalPercentageRangeOneMemberpinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-06-300001577916pinc:MeasurementInputProbabilityofTransferredMemberRenewalPercentageRangeTwoMemberus-gaap:IncomeApproachValuationTechniqueMemberpinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-09-300001577916pinc:MeasurementInputProbabilityofTransferredMemberRenewalPercentageRangeTwoMemberus-gaap:IncomeApproachValuationTechniqueMemberpinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-06-300001577916pinc:MeasurementInputProbabilityofTransferredMemberRenewalPercentageRangeThreeMemberus-gaap:IncomeApproachValuationTechniqueMemberpinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-09-300001577916pinc:MeasurementInputProbabilityofTransferredMemberRenewalPercentageRangeThreeMemberus-gaap:IncomeApproachValuationTechniqueMemberpinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-06-300001577916us-gaap:IncomeApproachValuationTechniqueMemberpinc:MeasurementInputProbabilityofTransferredMemberRenewalPercentageRangeFourMemberpinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-09-300001577916us-gaap:IncomeApproachValuationTechniqueMemberpinc:MeasurementInputProbabilityofTransferredMemberRenewalPercentageRangeFourMemberpinc:AcurityInc.AcurityandNexeraInc.NexeraMember2023-06-300001577916pinc:ContingentConsiderationEarnOutMember2023-06-300001577916pinc:ContingentConsiderationEarnOutMember2023-07-012023-09-300001577916pinc:ContingentConsiderationEarnOutMember2023-09-300001577916pinc:ContingentConsiderationEarnOutMember2022-06-300001577916pinc:ContingentConsiderationEarnOutMember2022-07-012022-09-300001577916pinc:ContingentConsiderationEarnOutMember2022-09-300001577916pinc:DeferredTRANotesPayableMemberus-gaap:NotesPayableOtherPayablesMember2020-08-310001577916us-gaap:FairValueInputsLevel2Member2020-08-310001577916pinc:DeferredTRANotesPayableMemberus-gaap:NotesPayableOtherPayablesMember2023-09-300001577916pinc:DeferredTRANotesPayableMemberus-gaap:NotesPayableOtherPayablesMember2023-06-3000015779162023-10-012023-09-3000015779162024-10-012023-09-300001577916pinc:SupplyChainServicesMember2023-09-300001577916pinc:SupplyChainServicesMember2023-06-300001577916pinc:DirectSourcingReportingUnitMember2022-07-012023-06-300001577916pinc:MemberRelationshipsMember2023-09-300001577916pinc:MemberRelationshipsMember2023-06-300001577916pinc:ProviderNetworkMember2023-09-300001577916pinc:ProviderNetworkMember2023-06-300001577916us-gaap:DevelopedTechnologyRightsMember2023-09-300001577916us-gaap:DevelopedTechnologyRightsMember2023-06-300001577916us-gaap:CustomerRelationshipsMember2023-09-300001577916us-gaap:CustomerRelationshipsMember2023-06-300001577916us-gaap:TradeNamesMember2023-09-300001577916us-gaap:TradeNamesMember2023-06-300001577916us-gaap:NoncompeteAgreementsMember2023-09-300001577916us-gaap:NoncompeteAgreementsMember2023-06-300001577916us-gaap:OtherIntangibleAssetsMember2023-09-300001577916us-gaap:OtherIntangibleAssetsMember2023-06-300001577916us-gaap:OtherIntangibleAssetsMember2023-06-300001577916us-gaap:OtherIntangibleAssetsMember2023-09-300001577916us-gaap:RevolvingCreditFacilityMember2023-09-300001577916us-gaap:RevolvingCreditFacilityMember2023-06-300001577916us-gaap:NotesPayableOtherPayablesMemberpinc:OtherNotesPayableMember2023-09-300001577916us-gaap:NotesPayableOtherPayablesMemberpinc:OtherNotesPayableMember2023-06-300001577916us-gaap:RevolvingCreditFacilityMember2022-12-12pinc:extension0001577916us-gaap:RevolvingCreditFacilityMember2022-12-122022-12-120001577916us-gaap:LetterOfCreditMember2022-12-120001577916pinc:RevolvingCreditFacilitySwingLineLoanMember2022-12-120001577916us-gaap:RevolvingCreditFacilityMember2023-09-300001577916us-gaap:RevolvingCreditFacilityMember2023-06-300001577916us-gaap:RevolvingCreditFacilityMember2023-07-012023-09-300001577916us-gaap:RevolvingCreditFacilityMember2022-12-122023-09-300001577916us-gaap:NotesPayableOtherPayablesMembersrt:MinimumMember2023-07-012023-09-300001577916srt:MaximumMemberus-gaap:NotesPayableOtherPayablesMember2023-07-012023-09-300001577916pinc:NonHealthcareHoldingsLLCMembersrt:MinimumMember2023-07-250001577916srt:MaximumMemberpinc:NonHealthcareHoldingsLLCMember2023-07-250001577916pinc:NonHealthcareHoldingsLLCMember2023-07-252023-09-300001577916pinc:NonHealthcareHoldingsLLCMember2023-09-300001577916us-gaap:SubsequentEventMemberpinc:NonHealthcareHoldingsLLCMember2023-10-012023-10-310001577916pinc:NonHealthcareHoldingsLLCMember2023-07-252023-07-250001577916pinc:NonHealthcareHoldingsLLCMember2023-07-250001577916pinc:NonHealthcareHoldingsLLCMemberpinc:LiabilityRelatedToTheSaleOfFutureRevenuesMember2023-07-250001577916pinc:NonHealthcareHoldingsLLCMember2023-07-012023-09-300001577916us-gaap:SubsequentEventMember2023-10-262023-10-260001577916us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001577916us-gaap:EmployeeStockOptionMember2022-07-012022-09-300001577916us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001577916us-gaap:RestrictedStockUnitsRSUMember2022-07-012022-09-300001577916us-gaap:PerformanceSharesMember2023-07-012023-09-300001577916us-gaap:PerformanceSharesMember2022-07-012022-09-300001577916pinc:OptionsAndRestrictedStockUnitsMember2023-07-012023-09-300001577916pinc:OptionsAndRestrictedStockUnitsMember2022-07-012022-09-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMember2023-09-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-06-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:PerformanceSharesMember2023-06-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-06-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:PerformanceSharesMember2023-07-012023-09-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-07-012023-09-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-09-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:PerformanceSharesMember2023-09-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-09-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberpinc:EmployeeMemberus-gaap:RestrictedStockUnitsRSUMember2023-05-312023-05-310001577916srt:DirectorMemberpinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2023-05-312023-05-310001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-07-012023-09-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2023-07-012023-09-300001577916pinc:TwoThousandThirteenEquityIncentivePlanMember2023-07-012023-09-300001577916us-gaap:EmployeeStockOptionMember2023-09-300001577916pinc:AdministrativeFeesMemberpinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300001577916pinc:AdministrativeFeesMemberpinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300001577916pinc:SoftwareLicensesOtherServicesAndSupportMemberpinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300001577916pinc:SoftwareLicensesOtherServicesAndSupportMemberpinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300001577916pinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMemberpinc:ServicesAndSoftwareLicensesMember2023-07-012023-09-300001577916pinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMemberpinc:ServicesAndSoftwareLicensesMember2022-07-012022-09-300001577916us-gaap:ProductMemberpinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300001577916us-gaap:ProductMemberpinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300001577916pinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300001577916pinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300001577916us-gaap:OperatingSegmentsMemberpinc:SAASBasedProductsSubscriptionsMemberpinc:PerformanceServicesMember2023-07-012023-09-300001577916us-gaap:OperatingSegmentsMemberpinc:SAASBasedProductsSubscriptionsMemberpinc:PerformanceServicesMember2022-07-012022-09-300001577916pinc:ConsultingServicesMemberus-gaap:OperatingSegmentsMemberpinc:PerformanceServicesMember2023-07-012023-09-300001577916pinc:ConsultingServicesMemberus-gaap:OperatingSegmentsMemberpinc:PerformanceServicesMember2022-07-012022-09-300001577916pinc:SoftwareLicensesMemberus-gaap:OperatingSegmentsMemberpinc:PerformanceServicesMember2023-07-012023-09-300001577916pinc:SoftwareLicensesMemberus-gaap:OperatingSegmentsMemberpinc:PerformanceServicesMember2022-07-012022-09-300001577916pinc:OtherMemberus-gaap:OperatingSegmentsMemberpinc:PerformanceServicesMember2023-07-012023-09-300001577916pinc:OtherMemberus-gaap:OperatingSegmentsMemberpinc:PerformanceServicesMember2022-07-012022-09-300001577916us-gaap:OperatingSegmentsMemberpinc:PerformanceServicesMember2023-07-012023-09-300001577916us-gaap:OperatingSegmentsMemberpinc:PerformanceServicesMember2022-07-012022-09-300001577916us-gaap:OperatingSegmentsMember2023-07-012023-09-300001577916us-gaap:OperatingSegmentsMember2022-07-012022-09-300001577916srt:ConsolidationEliminationsMember2023-07-012023-09-300001577916srt:ConsolidationEliminationsMember2022-07-012022-09-300001577916us-gaap:CorporateNonSegmentMember2023-07-012023-09-300001577916us-gaap:CorporateNonSegmentMember2022-07-012022-09-300001577916pinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMember2023-09-300001577916pinc:SupplyChainServicesMemberus-gaap:OperatingSegmentsMember2023-06-300001577916us-gaap:OperatingSegmentsMemberpinc:PerformanceServicesMember2023-09-300001577916us-gaap:OperatingSegmentsMemberpinc:PerformanceServicesMember2023-06-300001577916us-gaap:CorporateNonSegmentMember2023-09-300001577916us-gaap:CorporateNonSegmentMember2023-06-300001577916pinc:OperatingSegmentsandCorporateNonSegmentMemberus-gaap:OperatingSegmentsMember2023-09-300001577916pinc:OperatingSegmentsandCorporateNonSegmentMemberus-gaap:OperatingSegmentsMember2023-06-300001577916us-gaap:IntersegmentEliminationMember2023-09-300001577916us-gaap:IntersegmentEliminationMember2023-06-300001577916pinc:EmployeeStockPurchasePlanESPPMember2022-07-012022-09-300001577916pinc:EmployeeStockPurchasePlanESPPMember2023-07-012023-09-30

| | | | | | | | | | | | | | |

| UNITED STATES | |

SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 | |

FORM 10-Q

| | | | | | | | | | | | | | |

(Mark One) | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

| | | | | | | | | | | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36092

| | | | | | | | | | | | | | |

| | Premier, Inc. | | |

| | (Exact name of registrant as specified in its charter) | | |

| | | | | | | | | | | |

| Delaware | | 35-2477140 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

13034 Ballantyne Corporate Place | | |

Charlotte, | North Carolina | | 28277 |

| (Address of principal executive offices) | | (Zip Code) |

(704) 357-0022

(Registrant’s telephone number, including area code)

| | | | | | | | | | | | | | |

| | | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

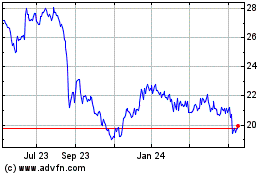

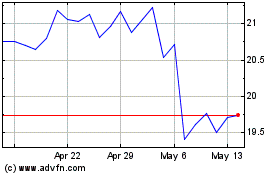

| Class A Common Stock, $0.01 Par Value | PINC | NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ | | Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ | | Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 2, 2023, there were 119,672,451 shares of the registrant’s Class A common stock, par value $0.01 per share outstanding.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements made in this Quarterly Report on Form 10-Q for the three months ended September 30, 2023 for Premier, Inc. (this “Quarterly Report”) that are not statements of historical or current facts, such as those under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from historical results or from any future results or projections expressed or implied by such forward-looking statements. In addition to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements in conditional or future tenses or that include terms such as “believes,” “belief,” “expects,” “estimates,” “intends,” “anticipates” or “plans” to be uncertain and forward-looking. Forward-looking statements may include comments as to our beliefs and expectations regarding future events and trends affecting our business and are necessarily subject to uncertainties, many of which are outside our control. Factors that could cause actual results to differ materially from those indicated in any forward-looking statement include, but are not limited to:

•competition which could limit our ability to maintain or expand market share within our industry;

•consolidation in the healthcare industry;

•potential delays in recognizing or increasing revenue if the sales cycle or implementation period takes longer than expected;

•the impact to our business if members of our group purchasing organization (“GPO”) programs reduce activity levels or terminate or elect not to renew their contracts on substantially similar terms or at all;

•our reliance on administrative fees that we receive from GPO suppliers;

•the rate at which the markets for our software as a service (“SaaS”) or licensed-based clinical analytics products and services develop;

•the dependency of our members on payments from third-party payers;

•our ability to maintain third-party provider and strategic alliances or enter into new alliances;

•our ability to timely offer new and innovative products and services;

•the portion of our revenues that we receive from our largest members and other customers;

•risks and expenses related to future acquisition opportunities and integration of previous or future acquisitions;

•the impact on our business and stock price due to our evaluation of potential strategic alternatives;

•financial and operational risks associated with non-controlling investments in other businesses or other joint ventures that we do not control, particularly early-stage companies;

•pending and potential litigation;

•our reliance on Internet infrastructure, bandwidth providers, data center providers and other third parties and our own systems for providing services to our users;

•data loss or corruption due to failures or errors in our systems and service disruptions at our data centers, or breaches or failures of our security measures;

•the financial, operational, legal and reputational consequences of cyber-attacks or other data security breaches that disrupt our operations or result in the dissemination of proprietary or confidential information about us or our members or other third parties;

•our ability to use, disclose, de-identify or license data and to integrate third-party technologies;

•our use of “open source” software;

•our dependency on contract manufacturing facilities located in various parts of the world;

•inventory risk we face in the event of a potential material decline in demand or price for the personal protective equipment or other products we may have purchased at elevated market prices or fixed prices;

•our ability to attract, hire, integrate and retain key personnel;

•the impact of continuing uncertain economic conditions to our business operations due to, but not limited to, inflation and the risk of global recession;

•the impact of the continuing financial and operational uncertainty due to pandemics, epidemics or public health emergencies and associated supply chain disruptions;

•the financial and operational uncertainty due to global economic and political instability and conflicts;

•the impact of global climate change or by regulatory responses to such change;

•changes and uncertainty in the political, economic or regulatory environment affecting healthcare organizations, including with respect to the status of the Patient Protection and Affordable Care Act, as amended by the Healthcare and Education Reconciliation Act of 2010 and pandemic-related public health and reimbursement measures;

•our compliance with complex international, federal and state laws, rules and regulations governing financial relationships among healthcare providers and the submission of false or fraudulent healthcare claims;

•interpretation and enforcement of current or future antitrust laws and regulations;

•compliance with complex federal, state and international privacy, security and breach notification laws;

•compliance with current or future laws, rules or regulations relating to information blocking provisions of the 21st Century Cures Act issued by the Office of the National Coordinator for Health Information Technology (the “ONC Rules”) that may cause our certified Health Information Technology products to be regulated by the ONC Rules;

•compliance with current or future laws, rules and regulations adopted by the Food and Drug Administration applicable to our software applications that may be considered medical devices;

•adequate protection of our intellectual property and potential claims against our use of the intellectual property of third parties;

•potential sales and use, franchise and income tax liability in certain jurisdictions;

•changes in tax laws that materially impact our tax rate, income tax expense, anticipated tax benefits, deferred tax assets, cash flows and profitability and potential material tax disputes;

•the impact of payments required under notes payable to former limited partners related to the early termination of the Unit Exchange and Tax Receivable Acceleration Agreements (the “Unit Exchange Agreements”) issued in connection with our August 2020 Restructuring on our overall cash flow and our ability to fully realize the expected tax benefits to match such fixed payment obligations under those notes payable;

•provisions in our certificate of incorporation and bylaws and provisions of Delaware law and other applicable laws that discourage or prevent strategic transactions, including a takeover of us;

•our indebtedness and our ability to obtain additional financing on favorable terms, including our ability to renew or replace our existing long-term credit facility at or before maturity;

•fluctuation of our quarterly cash flows, revenues and results of operations;

•failure to maintain an effective system of internal controls over financial reporting or an inability to remediate any weaknesses identified and the related costs of remediation;

•the impact on the price of our Class A common stock if we cease paying dividends or reduce dividend payments from current levels;

•the number of shares of Class A common stock repurchased by us pursuant to any then existing Class A common stock repurchase program and the timing of any such repurchases;

•the number of shares of Class A common stock eligible for sale after the issuance of Class A common stock in our August 2020 Restructuring and the potential impact of such sales; and

•the risk factors discussed under the heading “Risk Factors” under Item 1A of our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 (the “2023 Annual Report”) filed with the Securities and Exchange Commission (“SEC”), as updated by our Quarterly Reports on Form 10-Q (including this Quarterly Report) filed with the SEC.

More information on potential factors that could affect our financial results is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” or similarly captioned sections of this Quarterly Report and our other periodic and current filings made from time to time with the SEC, which are available on our website at http://investors.premierinc.com (the contents of which are not part of this Quarterly Report). You should not place undue reliance on any of our forward-looking statements, which speak only as of the date they are made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Furthermore, we cannot guarantee future results, events, levels of activity, performance or achievements.

Certain Definitions

For periods on or after August 11, 2020, references to “members” are references to health systems and other customers that utilize any of our programs or services, some of which were formerly member owners who participated in our GPO programs and were also limited partners of Premier Healthcare Alliance L.P. (“Premier LP”).

References to the “August 2020 Restructuring” are references to our corporate restructuring on August 11, 2020 in which we (i) eliminated our dual-class ownership structure through an exchange under which member owners who were limited partners of

Premier LP converted their Class B common units in Premier LP and corresponding Class B common shares of Premier, Inc. into our Class A common stock, on a one-for-one basis, and (ii) exercised our right to terminate the Tax Receivable Agreement (the “TRA”) by providing all former limited partners a notice of termination and the amount of the expected payment to be made to each limited partner pursuant to the early termination provisions of the TRA with a determination date of August 10, 2020. For additional information and details regarding the August 2020 Restructuring, see our Annual Report on Form 10-K for the fiscal year ended June 30, 2021.

References to the “Subsidiary Reorganization” are references to an internal legal reorganization of our corporate subsidiaries in December 2021 for the purpose of simplifying our subsidiary reporting structure. For additional information and details regarding the Subsidiary Reorganization, see our Quarterly Report on Form 10-Q for the period ended December 31, 2021.

References to “adjacent markets” are references to the non-traditional markets penetrated by Premier, Inc.’s businesses and brands that are designed to diversify revenue for the Company. This includes PINC AI Clinical Decision Support serving providers and payers; PINC AI Applied Sciences serving biotech, pharmaceutical and medical device companies; Contigo Health that serves self-insured employers, including healthcare providers that are also payers (“payviders”); and Remitra that serves healthcare suppliers and providers.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

PREMIER, INC.

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands, except share data)

| | | | | | | | | | | |

| September 30, 2023 | | June 30, 2023 |

| Assets | | | |

| Cash and cash equivalents | $ | 453,261 | | | $ | 89,793 | |

Accounts receivable (net of $1,970 and $2,878 allowance for credit losses, respectively) | 102,122 | | | 115,295 | |

Contract assets (net of $1,079 and $885 allowance for credit losses, respectively) | 311,557 | | | 299,219 | |

| Inventory | 69,868 | | | 76,932 | |

| Prepaid expenses and other current assets | 65,566 | | | 60,387 | |

| Total current assets | 1,002,374 | | | 641,626 | |

Property and equipment (net of $682,882 and $662,554 accumulated depreciation, respectively) | 210,519 | | | 212,308 | |

Intangible assets (net of $278,372 and $265,684 accumulated amortization, respectively) | 417,342 | | | 430,030 | |

| Goodwill | 1,012,355 | | | 1,012,355 | |

| Deferred income tax assets | 797,064 | | | 653,629 | |

| Deferred compensation plan assets | 44,029 | | | 50,346 | |

| Investments in unconsolidated affiliates | 230,080 | | | 231,826 | |

| Operating lease right-of-use assets | 26,871 | | | 29,252 | |

| Other assets | 108,938 | | | 110,115 | |

| Total assets | $ | 3,849,572 | | | $ | 3,371,487 | |

| | | |

| Liabilities and stockholders' equity | | | |

| Accounts payable | $ | 48,545 | | | $ | 54,375 | |

| Accrued expenses | 46,193 | | | 47,113 | |

| Revenue share obligations | 265,832 | | | 262,288 | |

| Accrued compensation and benefits | 45,807 | | | 60,591 | |

| Deferred revenue | 20,730 | | | 24,311 | |

| Current portion of notes payable to former limited partners | 100,130 | | | 99,665 | |

| Line of credit and current portion of long-term debt | 1,199 | | | 216,546 | |

| Current portion of liability related to the sale of future revenues | 32,827 | | | — | |

| Other current liabilities | 209,263 | | | 50,574 | |

| Total current liabilities | 770,526 | | | 815,463 | |

| Long-term debt, less current portion | — | | | 734 | |

| Liability related to the sale of future revenues, less current portion | 541,834 | | | — | |

| Notes payable to former limited partners, less current portion | 76,317 | | | 101,523 | |

| Deferred compensation plan obligations | 44,029 | | | 50,346 | |

| | | |

| | | |

| Operating lease liabilities, less current portion | 18,916 | | | 21,864 | |

| Other liabilities | 45,245 | | | 47,202 | |

| Total liabilities | 1,496,867 | | | 1,037,132 | |

| Commitments and contingencies (Note 14) | | | |

| Stockholders' equity: | | | |

Class A common stock, $0.01 par value, 500,000,000 shares authorized; 126,101,826 shares issued and 119,672,451 shares outstanding at September 30, 2023 and 125,587,858 shares issued and 119,158,483 shares outstanding at June 30, 2023 | 1,261 | | | 1,256 | |

Treasury stock, at cost; 6,429,375 shares at both September 30, 2023 and June 30, 2023 | (250,129) | | | (250,129) | |

| Additional paid-in capital | 2,177,324 | | | 2,178,134 | |

| Retained earnings | 424,260 | | | 405,102 | |

| Accumulated other comprehensive loss | (11) | | | (8) | |

| Total stockholders' equity | 2,352,705 | | | 2,334,355 | |

| Total liabilities and stockholders' equity | $ | 3,849,572 | | | $ | 3,371,487 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

PREMIER, INC.

Condensed Consolidated Statements of Income and Comprehensive Income

(Unaudited)

(In thousands, except per share data)

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| September 30, | | |

| 2023 | | 2022 | | | | |

| Net revenue: | | | | | | | |

| Net administrative fees | $ | 149,027 | | | $ | 150,006 | | | | | |

| Software licenses, other services and support | 119,140 | | | 105,006 | | | | | |

| Services and software licenses | 268,167 | | | 255,012 | | | | | |

| Products | 50,585 | | | 58,861 | | | | | |

| Net revenue | 318,752 | | | 313,873 | | | | | |

| Cost of revenue: | | | | | | | |

| Services and software licenses | 64,132 | | | 54,014 | | | | | |

| Products | 44,038 | | | 57,874 | | | | | |

| Cost of revenue | 108,170 | | | 111,888 | | | | | |

| Gross profit | 210,582 | | | 201,985 | | | | | |

| Operating expenses: | | | | | | | |

| Selling, general and administrative | 138,060 | | | 132,050 | | | | | |

| Research and development | 863 | | | 975 | | | | | |

| Amortization of purchased intangible assets | 12,688 | | | 10,452 | | | | | |

| Operating expenses | 151,611 | | | 143,477 | | | | | |

| Operating income | 58,971 | | | 58,508 | | | | | |

| Equity in net (loss) income of unconsolidated affiliates | (1,726) | | | 8,243 | | | | | |

| Interest income (expense), net | 195 | | | (2,859) | | | | | |

| Other expense, net | (1,092) | | | (2,164) | | | | | |

| Other (expense) income, net | (2,623) | | | 3,220 | | | | | |

| Income before income taxes | 56,348 | | | 61,728 | | | | | |

| Income tax expense | 13,938 | | | 18,769 | | | | | |

| Net income | 42,410 | | | 42,959 | | | | | |

| Net loss (income) attributable to non-controlling interest | 2,351 | | | (243) | | | | | |

| | | | | | | |

| Net income attributable to stockholders | $ | 44,761 | | | $ | 42,716 | | | | | |

| | | | | | | |

| Comprehensive income: | | | | | | | |

| Net income | $ | 42,410 | | | $ | 42,959 | | | | | |

| Comprehensive loss (income) attributable to non-controlling interest | 2,351 | | | (243) | | | | | |

| Foreign currency translation loss | (3) | | | (10) | | | | | |

| Comprehensive income attributable to stockholders | $ | 44,758 | | | $ | 42,706 | | | | | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 119,344 | | | 118,351 | | | | | |

| Diluted | 120,133 | | | 120,033 | | | | | |

| | | | | | | |

| Earnings per share attributable to stockholders: | | | | | | | |

| Basic | $ | 0.38 | | | $ | 0.36 | | | | | |

| Diluted | $ | 0.37 | | | $ | 0.36 | | | | | |

See accompanying notes to the unaudited condensed consolidated financial statements.

PREMIER, INC.

Condensed Consolidated Statements of Stockholders' Equity

Three Months Ended September 30, 2023 and 2022

(Unaudited)

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

Common Stock | | | | Treasury Stock | | Additional Paid-In Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity |

| Shares | | Amount | | | | | | Shares | | Amount | | | | |

| Balance at June 30, 2023 | 119,158 | | | $ | 1,256 | | | | | | | 6,429 | | | $ | (250,129) | | | $ | 2,178,134 | | | $ | 405,102 | | | $ | (8) | | | $ | 2,334,355 | |

| Issuance of Class A common stock under equity incentive plan | 514 | | | 5 | | | | | | | — | | | — | | | — | | | — | | | — | | | 5 | |

| | | | | | | | | | | | | | | | | | | |

| Stock-based compensation expense | — | | | — | | | | | | | — | | | — | | | 6,692 | | | — | | | — | | | 6,692 | |

| Repurchase of vested restricted units for employee tax-withholding | — | | | — | | | | | | | — | | | — | | | (5,178) | | | — | | | — | | | (5,178) | |

| Net income | — | | | — | | | | | | | — | | | — | | | — | | | 42,410 | | | — | | | 42,410 | |

| Net income attributable to non-controlling interest | — | | | — | | | | | | | — | | | — | | | (2,351) | | | 2,351 | | | — | | | — | |

| Change in ownership of consolidated entity | — | | | — | | | | | | | — | | | — | | | 27 | | | — | | | — | | | 27 | |

Dividends ($0.21 per share) | — | | | — | | | | | | | — | | | — | | | — | | | (25,603) | | | — | | | (25,603) | |

| | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | — | | | — | | | | | | | — | | | — | | | — | | | — | | | (3) | | | (3) | |

| Balance at September 30, 2023 | 119,672 | | | $ | 1,261 | | | | | | | 6,429 | | | $ | (250,129) | | | $ | 2,177,324 | | | $ | 424,260 | | | $ | (11) | | | $ | 2,352,705 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A

Common Stock | | | | Treasury Stock | | Additional Paid-In Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Stockholders' Equity |

| Shares | | Amount | | | | | | Shares | | Amount | | | | |

| Balance at June 30, 2022 | 118,052 | | | $ | 1,245 | | | | | | | 6,429 | | | $ | (250,129) | | | $ | 2,166,047 | | | $ | 331,690 | | | $ | (3) | | | $ | 2,248,850 | |

| Issuance of Class A common stock under equity incentive plan | 694 | | | 7 | | | | | | | — | | | — | | | 637 | | | — | | | — | | | 644 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Stock-based compensation expense | — | | | — | | | | | | | — | | | — | | | 7,136 | | | — | | | — | | | 7,136 | |

| Repurchase of vested restricted units for employee tax-withholding | — | | | — | | | | | | | — | | | — | | | (13,089) | | | — | | | — | | | (13,089) | |

| Net income | — | | | — | | | | | | | — | | | — | | | — | | | 42,959 | | | — | | | 42,959 | |

| Net income attributable to non-controlling interest | — | | | — | | | | | | | — | | | — | | | 243 | | | (243) | | | — | | | — | |

| Change in ownership of consolidated entity | — | | | — | | | | | | | — | | | — | | | 26 | | | — | | | — | | | 26 | |

Dividends ($0.21 per share) | — | | | — | | | | | | | — | | | — | | | — | | | (25,097) | | | — | | | (25,097) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | — | | | — | | | | | | | — | | | — | | | — | | | — | | | (10) | | | (10) | |

| Balance at September 30, 2022 | 118,746 | | | $ | 1,252 | | | | | | | 6,429 | | | $ | (250,129) | | | $ | 2,161,000 | | | $ | 349,309 | | | $ | (13) | | | $ | 2,261,419 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

See accompanying notes to the unaudited condensed consolidated financial statements.

PREMIER, INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands) | | | | | | | | | | | |

| Three Months Ended September 30, |

| 2023 | | 2022 |

| Operating activities | | | |

| Net income | $ | 42,410 | | | $ | 42,959 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 33,016 | | | 33,891 | |

| Equity in net loss (income) of unconsolidated affiliates | 1,726 | | | (8,243) | |

| Deferred income taxes | (143,435) | | | 2,156 | |

| Stock-based compensation | 6,692 | | | 7,136 | |

| | | |

| Other, net | 3,459 | | | 10,035 | |

| Changes in operating assets and liabilities, net of the effects of acquisitions: | | | |

| Accounts receivable | 13,173 | | | 8,903 | |

| Contract assets | (16,838) | | | (11,856) | |

| Inventory | 7,064 | | | (4,229) | |

| Prepaid expenses and other assets | 9,216 | | | 17,821 | |

| Accounts payable | (3,099) | | | 15,172 | |

| Revenue share obligations | 3,544 | | | 2,435 | |

| Accrued expenses, deferred revenue and other liabilities | 124,948 | | | (41,429) | |

| Net cash provided by operating activities | 81,876 | | | 74,751 | |

| Investing activities | | | |

| Purchases of property and equipment | (21,270) | | | (18,930) | |

| | | |

| | | |

| Other | — | | | (1,300) | |

| Net cash used in investing activities | (21,270) | | | (20,230) | |

| Financing activities | | | |

| Payments on notes payable | (25,823) | | | (26,387) | |

| Proceeds from credit facility | — | | | 100,000 | |

| Payments on credit facility | (215,000) | | | — | |

| Proceeds from sale of future revenues | 578,983 | | | — | |

| Payments on liability related to the sale of future revenues | (4,322) | | | — | |

| | | |

| Cash dividends paid | (25,827) | | | (25,218) | |

| | | |

| Other, net | (5,146) | | | (12,419) | |

| Net cash provided by financing activities | 302,865 | | | 35,976 | |

| Effect of exchange rate changes on cash flows | (3) | | | (10) | |

| Net increase in cash and cash equivalents | 363,468 | | | 90,487 | |

| Cash and cash equivalents at beginning of period | 89,793 | | | 86,143 | |

| Cash and cash equivalents at end of period | $ | 453,261 | | | $ | 176,630 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

PREMIER, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(1) ORGANIZATION AND BASIS OF PRESENTATION

Organization

Premier, Inc. (“Premier” or the “Company”) is a publicly held, for-profit Delaware corporation located in the United States. The Company is a holding company with no material business operations of its own. The Company’s primary asset is its equity interest in its wholly owned subsidiary Premier Healthcare Solutions, Inc., a Delaware corporation (“PHSI”). The Company conducts substantially all of its business operations through PHSI and its other consolidated subsidiaries. The Company, together with its subsidiaries and affiliates, is a leading technology-driven healthcare improvement company that unites hospitals, health systems, physicians, employers, product suppliers, service providers, and other healthcare providers and organizations to improve and innovate in the clinical, financial and operational areas of their businesses to meet the demands of a rapidly evolving healthcare industry and continues to expand its capabilities to more fully address and coordinate care improvement and standardization in the employer, payer and life sciences markets. Additionally, the Company also provides some of the various products and services noted above to non-healthcare businesses, including through its direct sourcing activities as well as continued access to its group purchasing organization (“GPO”) programs for non-healthcare members whose contracts were sold to OMNIA Partners, LLC (“OMNIA”) (see Note 9 - Liability Related to the Sale of Future Revenues).

The Company’s business model and solutions are designed to provide its members and other customers access to scale efficiencies, spread the cost of their development, provide actionable intelligence derived from anonymized data in the Company’s enterprise data warehouse, mitigate the risk of innovation and disseminate best practices to help the Company’s members and other customers succeed in their transformation to higher quality and more cost-effective healthcare.

The Company, together with its subsidiaries and affiliates, delivers its integrated platform of solutions through two business segments: Supply Chain Services and Performance Services. See Note 15 - Segments for further information related to the Company’s reportable business segments. The Company has no significant foreign operations or revenues. The Supply Chain Services segment includes one of the largest national healthcare GPO programs in the United States and provides supply chain co-management, purchased services and direct sourcing activities. The Performance Services segment consists of three sub-brands: PINC AITM, the Company’s technology and services platform with offerings that help optimize performance in three main areas – clinical intelligence, margin improvement and value-based care – using advanced analytics to identify improvement opportunities, consulting and managed services for clinical and operational design, and workflow solutions to hardwire sustainable change in the provider, payer and life sciences markets; Contigo Health®, the Company’s direct-to-employer business which provides third-party administrator services and management of health-benefit programs that enable healthcare providers that are also payers (e.g., payviders) and employers to contract directly with healthcare providers as well as partner with healthcare providers to provide employers access to a specialized care network through Contigo Health’s centers of excellence program and cost containment and wrap network; and Remitra®, the Company’s digital invoicing and payables automation business which provides financial support services to healthcare suppliers and providers.

Principles of Consolidation

The accompanying condensed consolidated financial statements have been prepared pursuant to the rules and regulations of the SEC and in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information and include the assets, liabilities, revenues and expenses of all majority-owned subsidiaries over which the Company exercised control and when applicable, entities for which the Company had a controlling financial interest or was the primary beneficiary. All intercompany transactions have been eliminated upon consolidation. Accordingly, certain information and disclosures normally included in annual financial statements have been condensed or omitted. The accompanying condensed consolidated financial statements reflect all adjustments that, in the opinion of management, are necessary for a fair presentation of results of operations and financial condition for the interim periods shown, consisting of normal recurring adjustments, unless otherwise disclosed. Certain amounts in prior periods have been reclassified to conform to the current period presentation. The Company believes that the disclosures are adequate to make the information presented not misleading and should be read in conjunction with the audited consolidated financial statements and related footnotes contained in the 2023 Annual Report.

Supplementary Cash Flows Information

The following table presents supplementary cash flows information for the three months ended September 30, 2023 and 2022 (in thousands):

| | | | | | | | | | | |

| Three Months Ended September 30, |

| 2023 | | 2022 |

| | | |

| | | |

| | | |

| Supplemental schedule of non-cash investing and financing activities: | | | |

| | | |

| | | |

| Accrued dividend equivalents | $ | 472 | | | $ | 156 | |

Use of Estimates in the Preparation of Financial Statements

The preparation of the Company’s condensed consolidated financial statements in accordance with GAAP requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosure of contingent assets and liabilities. Significant estimates are evaluated on an ongoing basis, including, but not limited to, estimates for net administrative fees revenue, software licenses, other services and support revenue, contract assets, deferred revenue, contract costs, allowances for credit losses, reserves for net realizable value of inventory, obsolete inventory, useful lives of property and equipment, stock-based compensation, deferred tax balances including valuation allowances on deferred tax assets, uncertain tax positions, values of investments not publicly traded, projected future cash flows used in the evaluation of asset impairments, values of call rights, values of earn-out liabilities and the allocation of purchase prices. These estimates are based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

(2) SIGNIFICANT ACCOUNTING POLICIES

There have been no material changes to the Company’s significant accounting policies as described in the 2023 Annual Report, except as described below.

Liability Related to the Sale of Future Revenues

The Company accounts for the sale of future revenues as a liability, with both current and non-current portions. In order to determine the timing of the reduction in debt associated with the sale of future revenues, the Company estimates the total future revenues expected to be remitted to the purchaser. The Company recognizes interest expense based on an estimated effective annual interest rate. The Company determines the effective interest rate based on recognized and expected future revenue and maintains a consistent interest rate throughout the life of the agreement. This estimate contains significant assumptions that impact both the amount of debt and the interest expense recorded over the life of the agreement. To the extent the amount or timing of future payments varies materially from the original estimate, the Company will make a cumulative adjustment to the carrying amount of the debt, which will be recorded as a non-cash gain or loss in other income in the Condensed Consolidated Statements of Income and Comprehensive Income.

(3) BUSINESS ACQUISITIONS

Acquisition of TRPN Direct Pay, Inc. and Devon Health, Inc. Assets

On October 13, 2022, the Company, through its consolidated subsidiary Contigo Health, LLC (“Contigo Health”), acquired certain assets (the “TRPN Transferred Assets”) of TRPN Direct Pay, Inc. and Devon Health, Inc. (collectively, “TRPN”), including contracts with more than 900,000 providers (collectively, the “Assumed Contracts”), and agreed to assume certain liabilities and obligations of TRPN with regard to the Assumed Contracts (referred to as the “TRPN acquisition”). The TRPN Transferred Assets relate to businesses of TRPN focused on improving access to quality healthcare and reducing the cost of medical claims through pre-negotiated discounts with network providers, including acute care hospitals, surgery centers, physicians and other continuum of care providers in the United States. Contigo Health also agreed to license proprietary cost containment technology of TRPN.

The purchase price paid by the Company to complete the TRPN acquisition consisted of cash of $177.5 million, funded with borrowings under the Company’s Credit Facility (as defined in Note 8 - Debt and Notes Payable) and cash on hand, of which $17.8 million was placed in escrow to satisfy indemnification obligations of TRPN to Contigo Health and its affiliates and other parties related thereto under the purchase agreement governing the TRPN acquisition.

The Company has accounted for the TRPN acquisition as a business combination whereby the purchase price was allocated to tangible and intangible assets acquired and liabilities assumed based on their fair values. The total fair value assigned to intangible assets acquired was $116.6 million, consisting primarily of the provider network.

The TRPN acquisition resulted in the initial recognition of $60.9 million of goodwill attributable to the anticipated profitability of TRPN, based on the purchase price paid in the acquisition compared to the fair value of the net assets acquired. The TRPN acquisition was considered an asset acquisition for income tax purposes. Accordingly, the Company expects tax goodwill to be deductible for tax purposes. TRPN has been integrated within Premier under Contigo Health and is reported as part of the Performance Services Segment. In fiscal year 2023, the Company recorded a pre-tax goodwill impairment charge of $54.4 million related to the Contigo Health reporting unit including goodwill recognized as a result of the TRPN acquisition.

Pro forma results of operations for the acquisition have not been presented because the effects on revenue and net income were not material to the Company’s historical consolidated financial statements.

(4) INVESTMENTS

Investments in Unconsolidated Affiliates

The Company’s investments in unconsolidated affiliates consisted of the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Equity in Net Income |

| | | Three Months Ended | | |

| Carrying Value | | September 30, | | |

| September 30, 2023 | | June 30, 2023 | | 2023 | | 2022 | | | | |

| FFF | $ | 136,080 | | | $ | 136,080 | | | $ | — | | | $ | 7,187 | | | | | |

| Exela | 31,487 | | | 32,905 | | | (1,419) | | | 138 | | | | | |

| Qventus | 16,000 | | | 16,000 | | | — | | | — | | | | | |

| Prestige | 15,623 | | | 15,503 | | | 119 | | | 180 | | | | | |

| Other investments | 30,890 | | | 31,338 | | | (426) | | | 738 | | | | | |

| Total investments | $ | 230,080 | | | $ | 231,826 | | | $ | (1,726) | | | $ | 8,243 | | | | | |

The Company, through its indirect, wholly owned subsidiary Premier Supply Chain Improvement, Inc. (“PSCI”), held a 49% interest in FFF Enterprises, Inc. (“FFF”) through its ownership of stock of FFF at September 30, 2023 and June 30, 2023. On March 3, 2023, the Company and the majority shareholder of FFF amended the FFF shareholders’ agreement and as of the date of the amendment, the Company accounts for its investment in FFF at cost less impairments, if any, plus or minus any observable changes in fair value (refer to the 2023 Annual Report for additional information and details regarding the March 2023 amendment). The Company accounts for its investment in FFF as part of the Supply Chain Services segment.

The Company, through its consolidated subsidiary, ExPre Holdings, LLC (“ExPre”), held an approximate 6% interest in Exela Holdings, Inc. (“Exela”) through its ownership of Exela Class A common stock at September 30, 2023. At September 30, 2023, the Company owned approximately 15% of the membership interest of ExPre, with the remainder of the membership interests held by 11 member health systems or their affiliates.

The Company, through its consolidated subsidiary, PRAM Holdings, LLC (“PRAM”), held an approximate 20% interest in Prestige Ameritech Ltd. (“Prestige”) through its ownership of Prestige limited partnership units at September 30, 2023. At September 30, 2023, the Company owned approximately 26% of the membership interest of PRAM, with the remainder of the membership interests held by 16 member health systems or their affiliates.

The Company accounts for its investments in Exela and Prestige using the equity method of accounting and includes each investment as part of the Supply Chain Services segment.

The Company, through PHSI, purchased an approximate 7% interest in Qventus, Inc. (“Qventus”) through its ownership of Qventus Series C preferred stock. The Company accounts for its investment in Qventus at cost less impairments, if any, plus or minus any observable changes in fair value. The Company includes Qventus as part of the Performance Services segment.

(5) FAIR VALUE MEASUREMENTS

Recurring Fair Value Measurements

The following table represents the Company’s financial assets and liabilities, which are measured at fair value on a recurring basis (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value of Financial Assets and Liabilities | | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs

(Level 3) |

| September 30, 2023 | | | | | | | |

| Cash equivalents | $ | 232,342 | | | $ | 232,342 | | | $ | — | | | $ | — | |

| Deferred compensation plan assets | 49,911 | | | 49,911 | | | — | | | — | |

| Total assets | 282,253 | | | 282,253 | | | — | | | — | |

| | | | | | | |

| Earn-out liabilities | 29,861 | | | — | | | — | | | 29,861 | |

| | | | | | | |

| Total liabilities | $ | 29,861 | | | $ | — | | | $ | — | | | $ | 29,861 | |

| | | | | | | |

| June 30, 2023 | | | | | | | |

| Cash equivalents | $ | 77 | | | $ | 77 | | | $ | — | | | $ | — | |

| Deferred compensation plan assets | 55,566 | | | 55,566 | | | — | | | — | |

| Total assets | 55,643 | | | 55,643 | | | — | | | — | |

| | | | | | | |

| Earn-out liabilities | 26,603 | | | — | | | — | | | 26,603 | |

| | | | | | | |

| Total liabilities | $ | 26,603 | | | $ | — | | | $ | — | | | $ | 26,603 | |

Deferred compensation plan assets consisted of highly liquid mutual fund investments, which were classified as Level 1. The current portion of deferred compensation plan assets ($5.9 million and $5.2 million at September 30, 2023 and June 30, 2023, respectively) was included in prepaid expenses and other current assets in the accompanying Condensed Consolidated Balance Sheets.

Financial Instruments Measured at Fair Value on a Recurring Basis Using Significant Unobservable Inputs (Level 3)

Earn-out liabilities

Earn-out liabilities have been established in connection with certain acquisitions, including the acquisition of substantially all of the assets and certain liabilities of Acurity, Inc. and Nexera, Inc. (the “Acurity and Nexera asset acquisition”) in February 2020 as well as other immaterial acquisitions. The earn-out liability related to the Acurity and Nexera asset acquisition was based upon the Company’s achievement of a range of member renewals on terms to be agreed to by the Company and Greater New York Hospital Association based on prevailing market conditions in December 2023. Earn-out liabilities are classified as Level 3 of the fair value hierarchy.

Acurity and Nexera Earn-out (a)

The earn-out liability arising from expected earn-out payments related to the Acurity and Nexera asset acquisition was measured on the acquisition date using a probability-weighted expected payment model and is remeasured periodically due to changes in management’s estimates of the number of transferred member renewals and market conditions. In determining the fair value of the contingent liabilities, management reviews the current results of the acquired business, along with projected results for the remaining earn-out period, to calculate the expected earn-out payment to be made based on the contractual terms set out in the acquisition agreement. The Acurity and Nexera earn-out liability utilized a credit spread of 1.4% at September 30, 2023 and 1.6% at June 30, 2023. As of September 30, 2023 and June 30, 2023, the undiscounted range of outcomes is between $0 and $30.0 million. A significant decrease in the probability could result in a significant decrease in the value of the earn-out liability. The fair value of the Acurity and Nexera earn-out liability at September 30, 2023 and June 30, 2023 was $23.5 million and $23.1 million, respectively.

| | | | | | | | | | | |

| Input assumptions | As of September 30, 2023 | | As of June 30, 2023 |

| Probability of transferred member renewal percentage < 50% | 5.0 | % | | 5.0 | % |

| Probability of transferred member renewal percentage between 50% and 65% | 10.0 | % | | 10.0 | % |

| Probability of transferred member renewal percentage between 65% and 80% | 25.0 | % | | 25.0 | % |

| Probability of transferred member renewal percentage > 80% | 60.0 | % | | 60.0 | % |

| Credit spread | 1.4 | % | | 1.6 | % |

_________________________________

(a)The Acurity and Nexera earn-out liability was initially valued as of February 28, 2020.

A reconciliation of the Company’s earn-out liabilities is as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Beginning Balance | | Purchases (Settlements) | | (Gain)/Loss (a) | | Ending Balance |

| Three Months Ended September 30, 2023 | | | | | | | |

| Earn-out liabilities | $ | 26,603 | | | $ | — | | | $ | 3,258 | | | $ | 29,861 | |

| | | | | | | |

| Total Level 3 liabilities | $ | 26,603 | | | $ | — | | | $ | 3,258 | | | $ | 29,861 | |

| | | | | | | |

| Three Months Ended September 30, 2022 | | | | | | | |

| Earn-out liabilities | $ | 22,789 | | | $ | — | | | $ | (428) | | | $ | 22,361 | |

| | | | | | | |

| Total Level 3 liabilities | $ | 22,789 | | | $ | — | | | $ | (428) | | | $ | 22,361 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

_________________________________

(a)Gains on level 3 liability balances will decrease the liability ending balance, and losses on level 3 liability balances will increase the liability ending balance.

Non-Recurring Fair Value Measurements

As a result of the August 2020 Restructuring, the Company recorded non-interest bearing notes payable to former limited partners during the three months ended September 30, 2020. Although these notes are non-interest bearing, they include a Level 2 input associated with an implied fixed annual interest rate of 1.8% (see Note 8 - Debt and Notes Payable). As of September 30, 2023 and June 30, 2023, the notes payable to former limited partners were recorded net of discounts of $3.3 million and $4.2 million, respectively.

During the three months ended September 30, 2023, no non-recurring fair value measurements were required relating to the measurement of goodwill and intangible assets for impairment.

Financial Instruments For Which Fair Value Only is Disclosed

The fair values of non-interest bearing notes payable, classified as Level 2, were equal to the carrying value at both September 30, 2023 and June 30, 2023 based on an assumed market interest rate of 1.6%.

Other Financial Instruments

The fair values of cash, accounts receivable, accounts payable, accrued liabilities and the Credit Facility (as defined in Note 8 - Debt and Notes Payable) approximated carrying value due to the short-term nature of these financial instruments.

(6) CONTRACT BALANCES

Deferred Revenue

Revenue recognized during the three months ended September 30, 2023 that was included in the opening balance of deferred revenue at June 30, 2023 was $13.8 million, which is a result of satisfying certain performance obligations.

Performance Obligations

A performance obligation is a contractual obligation to transfer a distinct good or service to a customer. A contract’s transaction price is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied. Contracts may have a single performance obligation as the agreement to transfer individual goods or services is not separately identifiable from other contractual obligations and, therefore, not distinct, while other contracts may have multiple

performance obligations, most commonly due to the contract covering multiple phases or deliverable arrangements (licensing fees, SaaS subscription fees, maintenance and support fees, and professional fees for consulting services).

Refer to the Company’s significant accounting policies in the 2023 Annual Report for discussion of revenue recognition on contracts with customers.

Net revenue of $5.3 million was recognized during the three months ended September 30, 2023 from certain performance obligations that were satisfied or partially satisfied in prior periods. The net revenue recognized was driven by an increase of $3.8 million associated with revised forecasts from underlying contracts that include variable consideration components and additional fluctuations due to input method contracts which occur in the normal course of business and an increase of $1.5 million in net administrative fees revenue related to under-forecasted cash receipts received in the current period.

Net revenue of $3.0 million was recognized during the three months ended September 30, 2022 from certain performance obligations that were satisfied or partially satisfied in prior periods. The net revenue recognized was driven by an increase of $4.7 million in net administrative fees revenue related to under-forecasted cash receipts received in the current period partially offset by a reduction of $1.7 million associated with revised forecasts from underlying contracts that include variable consideration components as well as additional fluctuations due to input method contracts which occur in the normal course of business.

Remaining performance obligations represent the portion of the transaction price that has not yet been satisfied or achieved. As of September 30, 2023, the aggregate amount of the transaction price allocated to remaining performance obligations was $705.8 million. The Company expects to recognize approximately 41% of the remaining performance obligations over the next twelve months and an additional 24% over the following twelve months, with the remainder recognized thereafter.

(7) GOODWILL AND INTANGIBLE ASSETS

Goodwill

At both September 30, 2023 and June 30, 2023, the Company had goodwill balances recorded at Supply Chain Services and Performance Services of $386.2 million and $626.1 million, respectively. At both September 30, 2023 and June 30, 2023, the Company had accumulated impairment losses to goodwill at Supply Chain Services and Performance Services of $2.3 million and $54.4 million, respectively.

Fiscal 2023 Goodwill Impairment

During the year ended June 30, 2023, the Company recorded pre-tax goodwill impairment charges of $54.4 million and $2.3 million related to the Contigo Health and Direct Sourcing reporting units, respectively. No events or circumstances occurred during the three months ended September 30, 2023 that would suggest there are additional indicators of impairment, and accordingly, the Company determined that goodwill impairment testing was not needed at September 30, 2023.

Intangible Assets, Net

Intangible assets, net consisted of the following (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | September 30, 2023 | | June 30, 2023 |

| Useful Life | | Gross | | Accumulated Amortization | | Net | | Gross | | Accumulated Amortization | | Net |

| Member relationships | 14.7 years | | $ | 386,100 | | | $ | (143,291) | | | $ | 242,809 | | | $ | 386,100 | | | $ | (136,751) | | | $ | 249,349 | |

| Provider network | 15.0 years | | 106,500 | | | (6,804) | | | 99,696 | | | 106,500 | | | (5,029) | | | 101,471 | |

| Technology | 7.1 years | | 99,317 | | | (69,203) | | | 30,114 | | | 99,317 | | | (67,581) | | | 31,736 | |

| Customer relationships | 9.4 years | | 57,930 | | | (33,070) | | | 24,860 | | | 57,930 | | | (31,846) | | | 26,084 | |

| Trade names | 6.7 years | | 18,920 | | | (12,506) | | | 6,414 | | | 18,920 | | | (11,983) | | | 6,937 | |

| Non-compete agreements | 5.2 years | | 17,715 | | | (10,439) | | | 7,276 | | | 17,715 | | | (9,738) | | | 7,977 | |

Other (a) | 9.3 years | | 9,232 | | | (3,059) | | | 6,173 | | | 9,232 | | | (2,756) | | | 6,476 | |

| Total | | | $ | 695,714 | | | $ | (278,372) | | | $ | 417,342 | | | $ | 695,714 | | | $ | (265,684) | | | $ | 430,030 | |

_________________________________

(a)Includes a $1.0 million indefinite-lived asset.

The net carrying value of intangible assets by segment was as follows (in thousands):

| | | | | | | | | | | |

| September 30, 2023 | | June 30, 2023 |

| Supply Chain Services | $ | 261,779 | | | $ | 269,710 | |

Performance Services (a) | 155,563 | | | 160,320 | |

| Total intangible assets, net | $ | 417,342 | | | $ | 430,030 | |

_________________________________

(a)Includes a $1.0 million indefinite-lived asset.

The estimated amortization expense for each of the next five fiscal years and thereafter is as follows (in thousands):

| | | | | |

2024 (a) | $ | 37,074 | |

2025 | 48,136 | |

2026 | 46,892 | |

2027 | 44,240 | |

2028 | 39,197 | |

| Thereafter | 200,803 | |

| Total amortization expense | $ | 416,342 | |

(a)As of September 30, 2023, estimated amortization expense is for the period from October 1, 2023 to June 30, 2024.

(8) DEBT AND NOTES PAYABLE

Long-term debt and notes payable consisted of the following (in thousands):

| | | | | | | | | | | |

| September 30, 2023 | | June 30, 2023 |

Credit Facility | $ | — | | | $ | 215,000 | |

Notes payable to former limited partners, net of discount | 176,447 | | | 201,188 | |

| Other notes payable | 1,199 | | | 2,280 | |

| Total debt and notes payable | 177,646 | | | 418,468 | |

| Less: current portion | (101,329) | | | (316,211) | |

| Total long-term debt and notes payable | $ | 76,317 | | | $ | 102,257 | |

Credit Facility

PHSI, along with its consolidated subsidiaries, Premier LP and PSCI (“Co-Borrowers”), and certain domestic subsidiaries of the Co-Borrowers, as guarantors, entered into a senior unsecured Amended and Restated Credit Agreement, dated as of December 12, 2022 (the “Credit Facility”). The Credit Facility has a maturity date of December 12, 2027, subject to up to two one-year extensions, and provides for borrowings of up to $1.0 billion with (i) a $50.0 million sub-facility for standby letters of credit and (ii) a $100.0 million sub-facility for swingline loans. The Credit Facility also provides that Co-Borrowers may from time to time (i) incur incremental term loans and (ii) request an increase in the revolving commitments under the Credit Facility, together up to an aggregate of $350.0 million, subject to the approval of the lenders providing such term loans or revolving commitment increase. The Credit Facility contains an unconditional and irrevocable guaranty of all obligations of Co-Borrowers under the Credit Facility by the current and future guarantors. Premier is not a guarantor under the Credit Facility.

At September 30, 2023, the Company had no outstanding borrowings under the Credit Facility with $995.0 million of available borrowing capacity after reductions for outstanding letters of credit. At June 30, 2023, the Company had $215.0 million in outstanding borrowings under the Credit Facility with $785.0 million of available borrowing capacity after reductions for outstanding borrowings and outstanding letters of credit. For the three months ended September 30, 2023, the Company had no new borrowings and repaid $215.0 million of outstanding borrowings under the Credit Facility. At September 30, 2023, the annual commitment fee, based on the actual daily unused amount of commitments under the Credit Facility, was 0.125%. At June 30, 2023, the weighted average interest rate on outstanding borrowings under the Credit Facility was 6.470%. The Company was in compliance with all covenants at September 30, 2023 and June 30, 2023.

Notes Payable

Notes Payable to Former Limited Partners

At September 30, 2023, the Company had $176.4 million of notes payable to former LPs, net of discounts on notes payable of $3.3 million, of which $100.1 million was recorded to current portion of notes payable to former limited partners in the accompanying Condensed Consolidated Balance Sheets. At June 30, 2023, the Company had $201.2 million of notes payable to former LPs, net of discounts on notes payable of $4.2 million, of which $99.7 million was recorded to current portion of notes payable to former limited partners in the accompanying Condensed Consolidated Balance Sheets. The notes payable to former LPs were issued in connection with the early termination of the TRA as part of the August 2020 Restructuring. Although the notes payable to former LPs are non-interest bearing, pursuant to GAAP requirements, they were recorded net of imputed interest at a fixed annual rate of 1.8%.

Other