Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

May 25 2022 - 5:22PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-255582

PROSPECTUS SUPPLEMENT

(To Prospectus Supplement June 14, 2021)

PREDICTIVE ONCOLOGY INC.

15,520,911 Shares of Common Stock

Warrants to Purchase up to 15,520,911 Shares

of Common Stock

Placement Agent Warrants to Purchase up to 1,164,068

Shares of Common Stock

(and the shares of Common Stock underlying such

Warrants and Placement Agent Warrants)

This prospectus supplement (“Supplement”)

modifies, supersedes and supplements certain information contained in, and should be read in conjunction with, that certain prospectus

supplement filed with the Securities and Exchange Commission (the “SEC”) by Predictive Oncology Inc. (the “Company”),

dated June 14, 2021 (the “Original Prospectus Supplement”), and the accompanying base prospectus, dated May 5, 2021 (the “Base

Prospectus” and together with the Original Prospectus Supplement, the “Prospectus”), related to a registered direct

offering of an aggregate of 15,520,911 shares of the Company’s common stock, par value $0.01 per share (“Common Stock”),

and warrants to purchase up to an aggregate of 15,520,911 shares of Common Stock at an original exercise price of $1.25 per share (the

“Existing Warrants”). Some of the Existing Warrants have been amended as described below under “Amendments to Existing

Warrants.”

The Common Stock is listed on the Nasdaq Capital

Market under the symbol “POAI.” On May 18, 2022, the last reported sale price of the Common Stock on the Nasdaq Capital Market

was $0.336 per share.

The information contained in this Supplement modifies

and supersedes, in part, the information in the Prospectus. This Supplement is not complete without, and may not be delivered or used

except in connection with, the Prospectus. Any information that is modified or superseded in the Prospectus shall not be deemed to constitute

a part of the Prospectus, except as modified or superseded by this Supplement.

We may amend or supplement the Prospectus from time

to time by filing amendments or supplements as required. You should read the entire Prospectus and any amendments or supplements carefully

before you make an investment decision.

Investing in our securities involves risks. See

“Risk Factors” on page S-4 of the Original Prospectus Supplement, page 7 of the Base Prospectus and in the documents incorporated

by reference into the Prospectus, including the risks described under “Risk Factors” in our Annual Report on Form 10-K for

the year ended December 31, 2021.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this Supplement or the Prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

FORWARD-LOOKING STATEMENTS

You should carefully consider the risk factors set

forth in or incorporated by reference into the Prospectus, as well as the other information contained in or incorporated by reference

into this Supplement and the Prospectus. This Supplement, the Prospectus and documents incorporated therein by reference contain forward-looking

statements regarding events, conditions, and financial trends that may affect our plan of operation, business strategy, operating results,

and financial position. You are cautioned that any forward-looking statements are not guarantees of future performance and are subject

to risks and uncertainties. Actual results may differ materially from those included within the forward-looking statements as a result

of various factors. Cautionary statements in the “Risk Factors” section of the Original Prospectus Supplement, the Base Prospectus

and the reports incorporated by reference therein identify important risks and uncertainties affecting our future, which could cause actual

results to differ materially from the forward-looking statements made or included in this Supplement and the Prospectus.

AMENDMENTS TO EXISTING WARRANTS

This Supplement is being filed to disclose the following:

On May 18, 2022, in connection with a securities purchase agreement

entered into by the Company with certain institutional and accredited investors, including certain holders of the Existing Warrants, the

Company filed a prospectus supplement (the “Registered Direct Prospectus Supplement”) and the accompanying base prospectus

with the SEC under the Company’s registration statement on Form S-3 (Registration No. 333-254309). Pursuant to the securities purchase

agreement and the Registered Direct Prospectus Supplement, the Company offered and sold an aggregate of 8,162,720 shares of its Common

Stock, at a purchase price of $0.60 per share (the “Registered Direct Offering”). In connection with the Registered Direct

Offering, the Company entered into a warrant amendment agreement (the “Warrant Amendment Agreement”) with each of the purchasers

in the Registered Direct Offering under which the Company agreed to amend certain outstanding warrants to purchase up to an aggregate

of 16,325,435 shares of Common Stock that were previously issued in 2020 and 2021 to the purchasers, with exercise prices ranging from

$1.00 to $2.00 per share, in consideration for their purchase of approximately $4.9 million of Common Stock in the Registered Direct Offering.

Under the Warrant Amendment Agreement, with respect to Existing Warrants

to purchase up to an aggregate of 9,332,667 shares of Common Stock held by the several investors in the Registered Direct Offering and

covered by the Warrant Amendment Agreement, the Company agreed to (i) lower the exercise price of such Existing Warrants to $0.70 per

share, (ii) provide that such Existing Warrants, as amended, will not be exercisable until November 18, 2022 (six months following the

closing date of the Registered Direct Offering) and (iii) extend the original expiration date of such Existing Warrants to November 18,

2027 (five and one-half years following the close of the Registered Direct Offering). These amendments became effective on May 18, 2022,

when the closing of the Registered Direct Offering occurred and each of such purchasers satisfied its purchase commitment to the Company.

No changes have been made to the other Existing Warrants to purchase up to an aggregate of 6,188,244 shares of Common Stock, which shares

may be resold under the Prospectus, as amended by this supplement.

The date of this Prospectus Supplement is May 18,

2022.

2

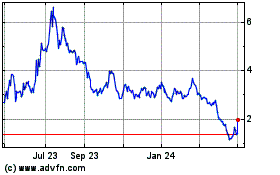

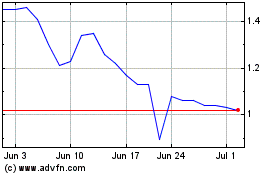

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Apr 2023 to Apr 2024