Personalis, Inc. (Nasdaq: PSNL), a leader in advanced genomics

for precision oncology, today reported financial results for the

first quarter ended March 31, 2023 and provided recent business

highlights.

Recent Business Updates

- Announced a collaboration with Cancer Research UK, University

College London, and the Francis Crick Institute to utilize our

ultra-sensitive NeXT Personal® tumor-informed liquid biopsy assay

for the TRACERx study, a groundbreaking lung cancer initiative, to

identify and track minimal residual disease (MRD) potentially

before recurrence is detected through standard of care

technologies

- Presented new data to highlight NeXT Personal’s unparalleled

sensitivity in four posters at the American Association for Cancer

Research (AACR) Annual Meeting 2023, including initial findings

from research with University Medical Center Hamburg-Eppendorf

(UKE), which showed that NeXT Personal may improve the ability to

predict responses or resistance to immunotherapy earlier than

imaging

- Extended partnership with AstraZeneca to use NeXT Personal to

explore ultra-sensitive MRD measurement, including clinically

relevant and personalized variant tracking, for clinical research

and drug development

- Partnered with Criterium and the Academic Breast Cancer

Consortium (ABRCC) to conduct a prospective clinical trial to

validate the clinical performance of the NeXT Personal assay to

evaluate MRD and subsequent recurrence in patients with

early-stage, resectable triple negative breast cancer (TNBC)

- Appointed Chris Hall as Chief Executive Officer (CEO) and a

member of the Board, in addition to his role as President; promoted

Aaron Tachibana to Chief Operating Officer (COO), in addition to

his role as Chief Financial Officer (CFO); and promoted Richard

Chen to Executive Vice President, Chief Medical Officer (CMO) and

R&D

“We grew revenue 24% in the first quarter relative to the first

quarter of last year, demonstrating consistent execution against

our sharpened strategic focus in both our clinical and biopharma

businesses,” said Chris Hall, President and CEO of Personalis. “We

are continuing to pursue revenue growth in three areas: winning in

the MRD space, enabling customers to develop personalized cancer

vaccines, and supporting biopharmaceutical customers with their

clinical trials. This focus paves the way for us to enter into the

clinical diagnostics market this year and become a critical partner

in cancer recurrence monitoring and detection.”

First Quarter Financial Highlights

- Reported total company revenue of $18.9 million for the first

quarter of 2023, representing a 24% increase compared with $15.2

million for the first quarter of 2022.

- Revenue from pharma tests, enterprise, and other customers of

$15.9 million in the first quarter of 2023, representing a 35%

increase compared with $11.7 million in the first quarter of 2022;

revenue from enterprise customers includes revenue from Natera of

$9.5 million in the first quarter of 2023

- Revenue from population sequencing for the U.S. Department of

Veterans Affairs Million Veterans Program (VA MVP) of $3.0 million

in the first quarter of 2023, compared with $3.5 million in the

first quarter of 2022

- Cash, cash equivalents, and short-term investments of $148.9

million as of March 31, 2023

- Net loss of $28.7 million, and net loss per share of $0.61

based on a weighted-average basic and diluted share count of 46.7

million in the first quarter of 2023

Second Quarter and Full Year 2023 Outlook

Personalis expects the following for the second quarter of

2023:

- Total company revenue of $16 million to $17 million

- Revenue from pharma tests, enterprise sales, and other

customers of $13 million to $14 million

- Revenue from population sequencing of approximately $3

million

Personalis expects the following for the full year of 2023:

- Total company revenue in the range of $68 million to $72

million

- Revenue from pharma tests, enterprise sales, and all other

customers in the range of $59 million to $63 million

- Revenue from population sequencing of approximately $9

million

- Net loss of approximately $103 million, reduced from $113

million in 2022 due to realization of headcount reduction savings,

partially offset by investments in clinical evidence generation and

non-cash depreciation expense for the new facility

- Cash usage of approximately $75 million, reduced from $119

million in 2022

Webcast and Conference Call Information

Personalis will host a conference call to discuss the first

quarter financial results after market close on Wednesday, May 3,

2023 at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time. The

conference call can be accessed live by dialing 877-451-6152 for

domestic callers or 201-389-0879 for international callers. The

live webinar can be accessed at https://investors.personalis.com. A

replay of the webinar will be available shortly after the

conclusion of the call and will be archived on the company's

website.

About Personalis, Inc.

At Personalis, we are transforming the active management of

cancer through breakthrough personalized testing. We aim to drive a

new paradigm for cancer management, guiding care from biopsy

through the life of the patient. Our highly sensitive assays

combine tumor-and-normal profiling with proprietary algorithms to

deliver advanced insights even as cancer evolves over time. Our

products are designed to detect minimal residual disease (MRD) and

recurrence at the earliest timepoints, enable selection of targeted

therapies based on ultra-comprehensive genomic profiling, and

enhance biomarker strategy for drug development. Personalis is

based in Fremont, California. To learn more, visit

www.personalis.com and connect with us on LinkedIn and Twitter.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Actual results may differ materially from the results

predicted and reported results should not be considered an

indication of future performance. Forward-looking statements

include all statements that are not historical facts and can

generally be identified by terms such as “aim,” “continue to,”

“expect,” “future,” “goal,” or “will” or similar expressions and

the negatives of those terms. These statements include, but are not

limited to, statements regarding NeXT Personal improving the

ability to predict responses or resistance to immunotherapy earlier

than imaging, the company entering into the clinical diagnostics

market in 2023 and becoming a critical partner in cancer recurrence

monitoring and detection, the company’s second quarter and full

year financial guidance, cash runway, the company’s business

outlook, and the company’s goals and aims. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause Personalis’ actual results, performance, or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. These risks, uncertainties and other

factors relate to, among others: the timing and pace of new orders

from customers, including from Natera, which accounted for 50% of

the company’s total revenue in the first quarter; the launch and

market adoption of new products and new product features, such as

NeXT Personal; the timing of tissue, blood, and other specimen

sample receipts from customers, which can materially impact revenue

quarter-over-quarter and year-over-year; whether orders for the

NeXT Platform and revenue from biopharmaceutical customers and

Natera increase or decrease in future periods; ability to

demonstrate attributes or advantages of NeXT Personal or the

Personalis NeXT Platform; the evolution of cancer therapies and

market adoption of the company’s services; risks associated with

COVID-19 or other health epidemics or pandemics; unstable market,

economic and geo-political conditions, which may significantly

impact the company’s business and operations and the business and

operations of Personalis’ customers and suppliers; and legal

proceedings to enforce patents, and the presumed validity or

enforceability of the company’s patents or other intellectual

property rights. These and other potential risks and uncertainties

that could cause actual results to differ materially from the

results predicted in these forward-looking statements are described

under the captions “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” in

Personalis’ Annual Report on Form 10-K for the year ended December

31, 2022, filed with the Securities and Exchange Commission (SEC)

on February 23, 2023, and its Quarterly Report on Form 10-Q for the

quarter ended March 31, 2023, being filed with the SEC later today.

All information provided in this release is as of the date of this

press release, and any forward-looking statements contained herein

are based on assumptions that we believe to be reasonable as of

this date. Undue reliance should not be placed on the

forward-looking statements in this press release, which are based

on information available to us on the date hereof. Personalis

undertakes no duty to update this information unless required by

law.

PERSONALIS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

(in thousands, except share and

per share data)

Three Months Ended March

31,

2023

2022

Revenue

$

18,860

$

15,227

Costs and expenses

Cost of revenue

14,130

10,949

Research and development

16,573

17,098

Selling, general and administrative

14,097

15,486

Restructuring and other charges

3,885

—

Total costs and expenses

48,685

43,533

Loss from operations

(29,825

)

(28,306

)

Interest income

1,253

144

Interest expense

(47

)

(59

)

Other income (expense), net

(26

)

19

Loss before income taxes

(28,645

)

(28,202

)

Provision for income taxes

14

7

Net loss

$

(28,659

)

$

(28,209

)

Net loss per share, basic and diluted

$

(0.61

)

$

(0.63

)

Weighted-average shares outstanding, basic

and diluted

46,740,270

44,995,752

PERSONALIS, INC.

SUPPLEMENTAL REVENUE

INFORMATION (unaudited)

(in thousands)

Three Months Ended March

31,

2023

2022

Pharma tests and services

$

6,333

$

7,562

Enterprise sales

9,458

4,116

Population sequencing

3,005

3,501

Other

64

48

Total revenue

$

18,860

$

15,227

PERSONALIS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited)

(in thousands, except share and

per share data)

March 31, 2023

December 31, 2022

Assets

Current assets

Cash and cash equivalents

$

87,172

$

89,128

Short-term investments

61,767

78,530

Accounts receivable, net

18,103

16,642

Inventory and other deferred costs

8,219

8,591

Prepaid expenses and other current

assets

7,511

6,808

Total current assets

182,772

199,699

Property and equipment, net

61,446

61,935

Operating lease right-of-use assets

23,971

26,480

Other long-term assets

3,991

4,586

Total assets

$

272,180

$

292,700

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

10,927

$

12,854

Accrued and other current liabilities

20,653

19,013

Contract liabilities

2,563

1,264

Total current liabilities

34,143

33,131

Long-term operating lease liabilities

40,309

41,041

Other long-term liabilities

4,096

389

Total liabilities

78,548

74,561

Commitments and contingencies

Stockholders’ equity

Preferred stock, $0.0001 par value —

10,000,000 shares authorized; none issued

—

—

Common stock, $0.0001 par value —

200,000,000 shares authorized; 46,774,490 and 46,707,084 shares

issued and outstanding at March 31, 2023 and December 31, 2022,

respectively

5

5

Additional paid-in capital

583,151

579,456

Accumulated other comprehensive loss

(455

)

(912

)

Accumulated deficit

(389,069

)

(360,410

)

Total stockholders’ equity

193,632

218,139

Total liabilities and stockholders’

equity

$

272,180

$

292,700

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230503005367/en/

Investor Relations Contact: Caroline Corner

investors@personalis.com 415-202-5678

Media: pr@personalis.com

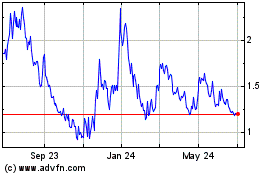

Personalis (NASDAQ:PSNL)

Historical Stock Chart

From Mar 2024 to Apr 2024

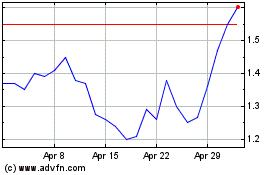

Personalis (NASDAQ:PSNL)

Historical Stock Chart

From Apr 2023 to Apr 2024