Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a‑12

|

NORTHWEST PIPE COMPANY

(Name of Registrant as Specified in Its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

|

☐

|

Fee paid previously with preliminary materials

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a‑6(i)(1) and 0‑11

|

201 NE Park Plaza Drive, Suite 100

Vancouver, WA 98684

April 18, 2022

Dear Fellow Shareholder:

You are cordially invited to attend the 2022 Annual Meeting of Shareholders (“Annual Meeting”) on Thursday, June 16, 2022, at 7:00 a.m. Pacific Time. As part of our effort to encourage broader participation in the Annual Meeting, the Board of Directors has determined that this year’s Annual Meeting will be conducted virtually via webcast instead of in-person. You will be able to attend the meeting, vote your shares, and submit questions by logging in at www.virtualshareholdermeeting.com/NWPX2022.

YOUR VOTE IS IMPORTANT. As a shareholder of Northwest Pipe Company, you can play an important role in our Company by considering and taking action on the matters set forth in the attached Proxy Statement. We appreciate the time and attention you invest in making thoughtful decisions.

This year we have made considerable edits to our Proxy Statement with the goal of being more transparent. We have created new sections in the Proxy and added a ‘Proxy Summary’ that recaps each of the Proxy sections. One of the new sections ‘Creating Stakeholder Value’ includes information on our Company’s culture, performance, and transforming initiatives that illustrate programs of value within Northwest Pipe Company’s operations.

It has been a rewarding year, but not without its challenges. Thank you for your support and continued interest in Northwest Pipe Company.

| |

Sincerely,

|

| |

|

| |

Scott Montross

President and Chief Executive Officer

|

|

| Notice and Proxy Statement | 2022 |

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| DATE |

Thursday, June 16, 2022 |

| TIME |

7:00 a.m. Pacific Time |

| PLACE |

VIRTUAL: www.virtualshareholdermeeting.com/NWPX2022

|

| RECORD DATE |

Close of business on April 14, 2022 |

| MAILING DATE |

This Proxy Statement, together with the enclosed proxy card and the Company’s Annual Report on Form 10‑K for the year ended December 31, 2021 (“2021 Annual Report to Shareholders”) are first being mailed to shareholders of the Company on or about May 5, 2022 |

| |

1.

|

To elect one director, to serve for a three-year term;

|

| |

2.

|

To hold an advisory vote on the Company’s executive compensation;

|

| |

3.

|

To ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022;

|

| |

4.

|

To approve the Company’s 2022 Stock Incentive Plan; and

|

| |

5.

|

To transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

|

The 2022 Annual Meeting of Shareholders (the “Annual Meeting”) of Northwest Pipe Company (collectively with its subsidiaries, the “Company”) will be held via webcast on Thursday, June 16, 2022, at 7:00 a.m. Pacific Time at www.virtualshareholdermeeting.com/NWPX2022. To participate in the Annual Meeting, you will need your unique 16‑digit control number printed in the box and marked by the arrow on your proxy card or on the voting instructions from your stockbroker, bank, or other nominee that accompanied your proxy materials. On the record date, there were 9,915,980 shares of Common Stock then outstanding, with each share of Common Stock being entitled to one vote.

Only shareholders of record at the close of business on April 14, 2022 are entitled to receive notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the meeting. It is important that your shares be represented and voted at the meeting. Please complete, sign, and return your proxy card, or use the Internet or telephone voting systems.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

This Proxy Statement and the Company’s 2021 Annual Report to Shareholders for the Annual Meeting to be held on June 16, 2022 are also available at www.materials.proxyvote.com.

|

| Notice and Proxy Statement | 2022 |

|

FORWARD LOOKING STATEMENTS

Certain statements in this Proxy Statement, other than purely historical information, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), that are based on current expectations, estimates, and projections about Northwest Pipe Company's business, management’s beliefs, and assumptions made by management. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “forecasts,” “should,” “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements as a result of a variety of important factors. Such forward-looking statements speak only as of the date on which they are made, and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this Proxy Statement. If the Company does update or correct one or more forward-looking statements, investors and others should not conclude that it will make additional updates or corrections with respect thereto or with respect to other forward-looking statements.

|

| Notice and Proxy Statement | 2022 |

|

TABLE OF CONTENTS

|

| Notice and Proxy Statement | 2022 |

|

CREATING STAKEHOLDER VALUE

‘Creating Stakeholder Value’ Section starts on page 7.

Founded in 1966, Northwest Pipe Company is a leading manufacturer for water-related infrastructure products. In addition to being the largest manufacturer of engineered steel water pipeline systems in North America, the Company manufactures high-quality precast and reinforced concrete products; water, wastewater, and stormwater equipment; steel casing pipe, bar-wrapped concrete cylinder pipe, and one of the largest offerings of pipeline system joints, fittings, and specialized components.

|

| Notice and Proxy Statement | 2022 |

|

A combination of new population centers, rising demand on developed water sources, substantial underinvestment in water infrastructure over the past several decades, and increasingly stringent regulatory policies are driving demand for water infrastructure projects in the United States. The Company’s core market is the large-diameter, high-pressure portion of a water transmission pipeline which it believes has a total addressable market of approximately $1.8 billion over the next three years.

With the Company’s goal of creating growth and profitability to drive shareholder value, Northwest Pipe Company looks beyond the engineered welded steel pipeline market to achieve that growth. Currently the Company holds approximately 49% of the engineered steel pressure pipe addressable market. In addition to maximizing the steel pressure pipe water transmission business by being opportunistic with the limited but identified potential acquisition opportunities, it is essential to look to the precast concrete and engineered solutions market for growth through expansion or acquisition.

|

| Notice and Proxy Statement | 2022 |

|

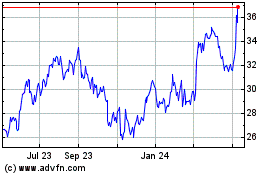

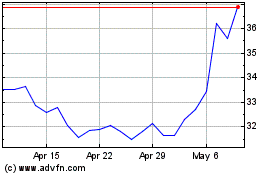

In 2021, despite a general trend of economic downturn, Northwest Pipe Company outperformed comparative groups of common stock, which was largely due, in part, to the Company’s expansion in the precast market.

CORPORATE GOVERNANCE

‘Corporate Governance’ Section starts on page 16.

CORPORATE GOVERNANCE HIGHLIGHTS

|

SHAREHOLDER

EMPOWERMENT

AND ENGAGEMENT |

✔

|

10% threshold for shareholder to call a special meeting

|

| ✔ |

Robust year-round shareholder engagement |

| ✔ |

No poison pill |

|

SKILLED AND

INDEPENDENT

BOARD OF

DIRECTORS |

✔

|

All directors are independent, except the Chief Executive Officer ("CEO")

|

| ✔ |

Range of tenures enables balance between historical experience and fresh perspectives |

| ✔ |

Skills and background aligned to the Company’s strategic direction |

| ✔ |

Director recruitment and selection process that formally prioritizes skills and qualifications and emphasizes leadership traits, work ethic, independence, business experience, and diversity of background |

| |

✔ |

Diverse experience (industry, profession, public service, geography) |

|

| Notice and Proxy Statement | 2022

|

|

|

DEFINED BOARD

STRUCTURE AND

PROCESSES |

✔

|

Independent Lead Director elected by independent directors, with expanded responsibilities, including formal responsibilities relative to director candidate selection and the Board of Directors ("Board") self-evaluation processes

|

| ✔ |

Regular executive sessions of independent directors |

| ✔ |

All members of all committees are independent directors |

| |

✔ |

All members empowered to call special Board meetings at any time for any reason |

| |

✔ |

Annual self-assessment to enable adequate Board refreshment and appropriate evolution of Board skills, experience, and perspectives; results shared and discussed in executive session of independent directors |

| |

✔ |

Annual refresh of Corporate Governance Guidelines to ensure alignment with best practices |

|

ROBUST OVERSIGHT

OF RISKS AND

OPPORTUNITIES |

✔

|

Board responsible for risk oversight, with specific risk areas delegated to relevant Board committees

|

| ✔ |

Purposeful inclusion of key risk areas on Board and/or committee agendas |

| ✔ |

Engagement with business leaders to review short-term plans, long-term strategies, and associated risks |

| |

✔ |

Incentive compensation not overly leveraged and with maximum payout caps and design features intended to balance pay for performance with the appropriate level of risk-taking |

| |

✔ |

Robust stock ownership requirements and prohibition from hedging and pledging Company securities |

| |

✔ |

Equity clawbacks in the event of a significant financial restatement |

|

COMMITMENT TO

SUSTAINABILITY AND

CORPORATE

RESPONSIBILITY |

✔

|

Dedicated adherence to principles of Integrity and Ethics, Inclusion and Diversity, and Workplace Respect, while fostering a performance culture based on Company behaviors

|

| ✔ |

No use of corporate funds for political contributions; robust oversight of and transparency into political activities |

PROPOSAL #1: ELECTION OF DIRECTOR

‘Proposal #1: Election of Director’ Section starts on page 23.

|

Nominee

|

Title

|

Years of Service

|

Independent

|

Committee Membership

|

|

Michael Franson

|

Retired Managing Director and Global Head of Technology M&A at KPMG Corporate Finance LLC

|

17

|

Yes

|

Compensation Committee – chairperson

Audit Committee

|

|

|

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THIS PROPOSAL. |

The Board of Directors unanimously recommends that shareholders vote “FOR” the election of its nominee for director. Proxies solicited by the Board will be voted “FOR” the election of the Board’s nominee unless a vote withholding authority is specifically indicated.

|

| Notice and Proxy Statement | 2022 |

|

PROPOSAL #2: ADVISORY VOTE ON EXECUTIVE COMPENSATION

‘Proposal #2: Advisory Vote on Executive Compensation’ Section starts on page 31.

EXECUTIVE COMPENSATION

The following table reflects compensation awarded to the Company’s CEO, Chief Financial Officer (“CFO”), and each of the three other most highly compensated executive officers (“Named Executive Officers”) in 2021. More detailed information regarding Executive Compensation can be found on page 31 under “Executive Compensation Discussion and Analysis” and on page 39 under "Summary Compensation."

|

Name

|

Principal Position

|

|

Salary

|

|

|

Stock Awards

|

|

|

Non-Equity Incentive Plan Compensation

|

|

|

All Other Compensation

|

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott Montross

|

Director, CEO, and President

|

|

$ |

607,331 |

|

|

$ |

876,489 |

|

|

$ |

446,907 |

|

|

$ |

13,148 |

|

|

$ |

1,943,875 |

|

|

Aaron Wilkins

|

Senior Vice President and CFO

|

|

|

320,000 |

|

|

|

259,241 |

|

|

|

168,195 |

|

|

|

10,717 |

|

|

|

758,153 |

|

|

William Smith

|

Executive Vice President

|

|

|

337,500 |

|

|

|

280,486 |

|

|

|

177,393 |

|

|

|

15,982 |

|

|

|

811,361 |

|

|

Miles Brittain

|

Executive Vice President

|

|

|

327,417 |

|

|

|

255,012 |

|

|

|

172,093 |

|

|

|

13,981 |

|

|

|

768,503 |

|

|

Eric Stokes

|

Senior Vice President

|

|

|

297,515 |

|

|

|

231,635 |

|

|

|

156,377 |

|

|

|

12,277 |

|

|

|

697,804 |

|

|

|

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THIS PROPOSAL. |

The Board of Directors unanimously recommends voting “FOR” the approval of the compensation of the Named Executive Officers as disclosed in this proxy statement and as described pursuant to the compensation disclosure rules of the Exchange Act.

PROPOSAL #3: RATIFICATION OF THE APPOINTMENT OF MOSS ADAMS LLP

‘Proposal #3: Ratification of the Appointment of Moss Adams LLP’ Section starts on page 46.

AUDIT SERVICES AND FEES

Audit fees include fees for audits of the annual financial statements, including required quarterly reviews, the audit of the Company’s internal control over financial reporting, and services in connection with other regulatory filings. Fees for services billed by the Company’s principal accountant, Moss Adams LLP ("Moss Adams"), for the years ended December 31, 2021 and 2020 were as follows:

2021 $1,232,500

2020 $1,132,500

|

|

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THIS PROPOSAL. |

The Board of Directors unanimously recommends voting “FOR” the ratification of the Audit Committee’s appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022.

|

| Notice and Proxy Statement | 2022 |

|

PROPOSAL #4: APPROVAL OF THE 2022 STOCK INCENTIVE PLAN

‘Proposal #4: Approval of the 2022 Stock Incentive Plan’ Section starts on page 47.

2022 STOCK INCENTIVE PLAN

On April 7, 2022, the Board of Directors adopted the Northwest Pipe Company 2022 Stock Incentive Plan (the “2022 Plan”), subject to shareholder approval at the Annual Meeting. The 2022 Plan, if approved, will replace the Company’s existing 2007 Stock Incentive Plan, as amended (the “2007 Plan”) and authorize the grant of future equity awards up to 1,000,000 shares.

As of April 14, 2022, there were 213,668 shares remaining available for future awards under the 2007 Plan and the Company has reserved 92,550 shares for future issuance pursuant to previously awarded but unvested restricted stock units (“RSUs”) and performance share awards (“PSAs”), with PSAs being reserved for at target. There are no options or stock appreciation rights outstanding under the 2007 Plan. Outstanding awards under the 2007 Plan are discussed further under “Outstanding Equity Awards at 2021 Fiscal Year End.” As of April 14, 2022, no new awards have been granted under the 2007 Plan since June 2021 and the Company has committed to not grant any further awards under the 2007 Plan unless the 2022 Plan is not approved by shareholders.

|

|

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THIS PROPOSAL. |

The Board of Directors unanimously recommends voting “FOR” the approval of the 2022 Stock Incentive Plan.

ADDITIONAL INFORMATION

‘Additional Information’ Section starts on page 54.

|

| Notice and Proxy Statement | 2022 |

|

|

|

CREATING STAKEHOLDER VALUE |

CREATING STAKEHOLDER VALUE

COMPANY CULTURE

Northwest Pipe Company’s core values are Accountability, Commitment, and Teamwork, or ACT for short, which it seeks to demonstrate in all of its behaviors and daily interactions, both internally and externally, and with all of its stakeholders.

Ethics and Compliance

Northwest Pipe Company takes pride in the high standards of conduct that it identifies with as a Company. The Company has controls in place relating to compliance with its Code of Business Conduct and Ethics (“Code”), including a requirement for employees and the Board of Directors to review and understand the requirements of the Code, as well as an established whistleblower hotline and related procedures.

The Company conducts training on the Code upon hire, and in regular intervals during the employee’s life cycle. The most recent ethics training for all salaried employees was conducted in the fourth quarter of 2019, and the next ethics training is scheduled for the fourth quarter of 2022.

The Company also conducts anti-trust training annually. The most recent anti-trust training for certain senior management and sales employees was the first quarter of 2022.

|

| Notice and Proxy Statement | 2022 |

|

|

|

CREATING STAKEHOLDER VALUE |

2021 PERFORMANCE HIGHLIGHTS

In 2021, the Company performed with its usual level of operational vigor through the challenges of the global pandemic and economic downturn. With the pandemic, many anticipated engineered steel pressure pipe projects were put on hold or delayed, causing a slowdown in net sales and gross profit over the last two years. The sales uptick in 2021 is due mainly to completing two strategic acquisitions during the last two years. Backlog has been relatively strong over the last few years. In 2020, backlog levels staggered slightly, but saw an upturn in 2021 largely due to increases in steel input prices.

EXPANSION INTO PRECAST MARKET

Over the years, Northwest Pipe Company has implemented a growth strategy that benefits from the Company’s foothold in the water infrastructure market. Careful assessment of market activity has guided the Company through recent expansions as well as termination of certain business lines. The economic conditions of the early 2000s significantly affected the tubular products segment resulting in facility closures to redeploy capital into more compelling business lines.

Northwest Pipe Company’s growth strategy continues to diversify into a broader water market and capitalize on the unique attributes of its market position, capabilities, reputation, nationwide sales, and distribution footprint. The Company’s goal is to create transformational growth and profitability in order to drive shareholder value. This strategy is two prong. First, the Company intends to maximize the limited opportunities within the engineered steel pressure pipe water transmission business by identifying potential acquisition opportunities, while making significant progress in cost reduction measures and Lean manufacturing, the practice of maximizing productivity while simultaneously minimizing waste within manufacturing through continuous process improvement. Second, the Company is growing through expansion into adjacent market segments including precast concrete and water infrastructure. These neighboring water segments offer a much larger addressable market.

|

| Notice and Proxy Statement | 2022

|

|

|

|

CREATING STAKEHOLDER VALUE |

On January 31, 2020, the Company completed the acquisition of Geneva Pipe and Precast Company (“Geneva”) (fka Geneva Pipe Company, Inc.) for a purchase price of $49.4 million in cash. Geneva is a concrete pipe and precast concrete products manufacturer based in Utah. This acquisition expanded the Company’s water infrastructure product capabilities by adding additional reinforced concrete pipe capacity and a full line of precast concrete products including storm drains and manholes, catch basins, vaults, and curb inlets as well as innovative lined products that extend the life of concrete pipe and manholes for sewer applications. Operations continue with Geneva's previous management and workforce at its three Utah manufacturing facilities located in Salt Lake City, Orem, and St. George.

On October 5, 2021, the Company completed the acquisition of Park Environmental Equipment, LLC (“ParkUSA”) for a purchase price of approximately $88.4 million in cash, subject to a post-closing adjustment based on changes in net working capital. ParkUSA is a precast concrete and steel fabrication-based company that develops and manufactures water, wastewater, and environmental solutions. Operations continue with ParkUSA’s previous management and workforce at its three Texas manufacturing facilities located in San Antonio, Houston, and Dallas. This strategic acquisition provides a foothold into the water infrastructure technology market. Operations employ similar capabilities to the Company’s existing facilities and, looking forward, the Company intends to expand production of ParkUSA's products to its other facilities.

In addition to the most recent acquisition that added three manufacturing facilities in the ever-growing Texas market, the Company is solidifying its commitment to the precast market with over $18 million in new capital improvement projects at its Geneva facilities. The Company has recently invested in a new batch plant at the St. George, Utah facility; replaced a concrete mixer and controls in the Salt Lake City, Utah facility; and has negotiated terms with a major supplier to purchase a new automated reinforced concrete pipe (“RCP”) machine with associated concrete batching and mixing equipment. The new state-of-the-art pipe equipment will improve efficiency and increase capacity to meet growing market demand for RCP as well as increase production capacity for other concrete products.

Starting in 2022, the Company intends to scale ParkUSA’s success by producing some of the more popular, higher-selling products at other Company manufacturing facilities. Expansion will likely start at the Geneva facilities and roll out to other facilities. The Company also plans to expand the sales team in the Texas market to capitalize on the growth near the Dallas and San Antonio facilities.

TRANSFORMING INITIATIVES

Northwest Pipe Company’s performance culture enables it to be agile in response to the fast-changing needs of its customers and is supported by its three core ACT principles: Accountability, Commitment, and Teamwork. In addition to these key components, core drivers to its manufacturing operations include safety, quality, innovation, lean manufacturing, and reducing its impact on the environment through all phases of its business. This unwavering commitment underlies the principle that good business, economic growth, and social responsibility flourish together.

|

| Notice and Proxy Statement | 2022

|

|

|

|

CREATING STAKEHOLDER VALUE |

PRIORITIZING HEALTH AND SAFETY

Northwest Pipe Company’s goal is to send each employee home safe at the end of the day. As such, safety is at the central core of the Company’s culture, and is infused at every level of its organization. More than just policy and procedure, the Company’s safety program gives equal focus to the human side of safety, integrating coaching and mentoring efforts with compliance-driven approaches. By instilling a deep commitment to safety that reaches from the Company’s CEO to general laborers, the Company has achieved industry-leading safety performance. Over the last four years, the Company’s average total recordable incident rate was 2.48 and its average days away rate was 0.52, including its newly acquired facilities, calculated in accordance with the Occupational Safety and Health Administration’s record keeping requirements.

| Notice and Proxy Statement | 2022

|

|

|

|

CREATING STAKEHOLDER VALUE |

Northwest Pipe Company is very proud that two of its 13 facilities exceeded one million work hours without a lost time accident. The Saginaw and Portland facilities achieved this important milestone and ten of the Company's 13 facilities exceed one year since their last lost time accident. This commendable result is a testament to the ACT culture. Additionally, the integration of the Company’s safety culture has been critical to its two successful acquisitions in the past two years, and the Company expects to experience improved safety performance rates at these acquired facilities, especially as coronavirus disease 2019 ("COVID‑19") travel restrictions are lifting and the team is able to work with these facilities in-person.

|

|

As a manufacturer, the Company works hard to eliminate hazards associated with high-risk work and focus on personal safety issues, such as complacency and fatigue. However, the Company believes the key to success is through direct engagement with employees. Employees work collaboratively with management within Process Improvement Teams to maintain continuous improvement in safety. During the COVID‑19 pandemic, the Company continues to focus on keeping employees healthy by taking proactive and precautionary steps to ensure the safety of employees. Increased safety measures include frequent cleaning and disinfection of workspaces, providing personal protective equipment, instituting social distancing measures, staggering employee schedules, offering remote working environments for certain employees, encouraging vaccination, and guiding employees on preemptive measures as outlined by the Center for Disease Control (CDC).

For more detail on the Company’s safety culture, please visit its website at www.nwpipe.com under "About" — "Culture" — "Safety."

|

Employee Wellness

Historically, the U.S. manufacturing industry has been known for subpar mental health support. Northwest Pipe Company is dedicated to bucking this trend with a robust benefits program prioritizing the physical and mental well-being of its team. On top of mental health services covered by its medical insurance plans, the Company has a comprehensive Employee Assistance Program (“EAP”) in place to help team members navigate times of crisis and support everyday wellness. Available to all employees, dependents, and household family members, EAP services include confidential counseling for issues such as stress, burnout, depression, anxiety, relationship and family issues; work/life balance services; diversity awareness and LBGTQIA+ resources; legal assistance; financial coaching; discounted gym memberships and health counseling; and access to an EAP member site with additional resources available 24/7. By encouraging healthy habits and active lifestyles, these services support the overall well-being of employees. This translates to healthier, happier team members bringing their best selves—and best performance—to work.

DIVERSITY AND INCLUSION

Diversity and inclusion are integral to Northwest Pipe Company’s employee experience, and the Company is proud of its diverse workforce. Companies that are diverse in age, gender identity, race, sexual orientation, physical or mental ability, ethnicity, and perspective are shown to be more resilient. Northwest Pipe Company values differences as strengths and believes the Company’s success and achievements as a company culminate from each individual’s unique background, perspective, talents, and skillset. A diverse workforce and inclusive working environment are the foundation for building the most effective, high performing teams within the Company’s ACT culture.

| Notice and Proxy Statement | 2022

|

|

|

|

CREATING STAKEHOLDER VALUE |

The Company’s Affirmative Action Program (“AAP”) strives to hire, recruit, train, and promote employees without regard to race, age, religion, color, sex, national origin, physical or mental disability, marital or veteran status, sexual orientation, gender identity, or any other classification protected by law. Northwest Pipe Company only hires employees who meet the necessary education, training, skills and/or experience requirements to perform their job, and who can provide required documentation pertaining to legal eligibility and age requirements. To support these efforts, the AAP for the Company’s United States facilities is reviewed annually by a third-party consultant, establishing annual hiring goals for women, minorities, veterans, and individuals with disabilities.

|

| Notice and Proxy Statement | 2022

|

|

|

|

CREATING STAKEHOLDER VALUE |

INTENTIONS

As a company that values a diverse workforce, Northwest Pipe Company sets a high standard for its inclusive and equitable workplace, and it continually assesses its current standing and sets specific aspirations. The Company holds itself accountable for creating an environment where everyone can learn, grow, and thrive. Below is a summary of some of the Company’s activities that reflect these values.

ENVIRONMENTAL STEWARDSHIP

As a manufacturer of water related infrastructure products, Northwest Pipe Company has the privilege of bringing water to communities and improving livability. Water is an equalizer that drives a population’s health, individual growth, and prosperity. Water is a precious natural resource that requires careful handling to ensure a balance of community access and environmental sustainability.

With climate change disrupting weather patterns and causing long-term droughts in regions where water has previously been more available, responsible resource management and reliable water transmission solutions are becoming even more crucial. Northwest Pipe Company’s quality and long-lasting engineered steel pipe products support critical modernization projects that replace or rehabilitate crumbling, aging infrastructure, reducing water loss and saving trillions of gallons of water a year.

With the acquisition of ParkUSA, Northwest Pipe Company has advanced its ability to shape environmental stewardship. Many ParkUSA products are designed to pretreat water in municipal, industrial, and commercial applications. Pretreatment separators help remove suspended solids, including grease, oil, fats, and chemicals, from water before it enters a publicly controlled sanitary sewer or stormwater system. ParkUSA products tackle frequent water challenges with innovative yet practical applications of technology to collect, treat, and renew water to meet regulatory guidelines.

|

| Notice and Proxy Statement | 2022 |

|

|

|

CREATING STAKEHOLDER VALUE |

The Company manufactures products to support community developers, municipalities, utilities, commercial clients, and the military by developing resilient water systems to manage water quality, distribution, and conservation. Many solutions utilize automation to facilitate safe, efficient operations, and are designed to address emerging contaminants that may modify future regulations.

|

|

Northwest Pipe Company invests in improvements that not only make manufacturing more efficient, but also prove to be less harmful to the environment. The Company has made investments in three significant capital projects that enhance the coating and lining processing that improves particulate release and reduces emissions. In addition to building expansions and upgrades, the Company has also upgraded the lighting in many of its facilities to become brighter and more energy efficient, creating cost savings on utility expenses while increasing visibility for a safer working environment.

|

| A recent energy saving upgrade at the Portland facility not only reduces the Company’s energy output but also provides a safer work environment. Before and after photo provided by EC Electric. |

|

As a manufacturer, the Company strives to comply with environmental laws and regulations while minimizing waste. Looking forward, Northwest Pipe Company acknowledges the need to evaluate additional elements of its environmental footprint to inform a more holistic strategy to reduce its impact. |

The Company believes the key next steps include establishing baseline data for Scope 1 and Scope 2 greenhouse gas emissions and evaluating the opportunities that provide the most meaningful improvements. Northwest Pipe Company recognizes the importance of treating natural resources with the greatest respect, and recognizes that its obligation goes beyond providing the highest quality environmental infrastructure products.

WATER MANAGEMENT SOLUTIONS

The core of Northwest Pipe Company’s business is manufacturing and designing products that efficiently deliver water. Wise water management and conservation plays an integral role in strategic operations, quality management processes, and client deliverables. The Company’s tagline “A legacy grounded in water,” not only points to its core product lines in water infrastructure, but the Company’s commitment to protecting and securing one of the world’s most precious resources.

Water loss management remains critically important as the nation’s infrastructure continues to age, resulting in the loss of trillions of gallons of water each year. Northwest Pipe Company supports municipalities grappling with water or wastewater pipeline concerns or failures and offers cost-effective alternatives to full pipeline replacement.

Northwest Pipe Company manufactures steel pipe for two rehabilitation installation methods, sliplining and relining. Sliplining consists of inserting complete sections of steel cylinder into the host pipe, connecting the cylinder sections with an internal lap weld or gasket joints; whereas relining involves inserting collapsed steel cylinders into the host pipe and allowing the cylinder to expand to fit precisely inside the host line. Rehabilitation of water or wastewater pipelines offer an alternative solution to replacement of structurally deficient pipelines by traditional cut, remove, and replace methods.

|

| Notice and Proxy Statement | 2022 |

|

|

|

CREATING STAKEHOLDER VALUE |

The Company continues to develop new technology to combat water loss. The InfraShield® Seismic Resilient Joint System builds on the proven performance of C200 steel pipe and provides even greater resilience and sustainability during a seismic or geohazard event.

|

|

|

The design includes a small outward projection in the wall of the steel pipe near the spigot end of each segment that protects the joint by deflecting impact from the joint to the projection, which can stretch and fold during a seismic event, landslide, or from stress due to differential settlement or liquefaction hazards. The patent-pending technology is designed to continue delivering life-saving water to first responders and communities after an event. InfraShield® requires no additional contractor training, supervision, or specialized tools, which results in quick installation with no added installation costs or risks. |

Water Management and Efficiency

With the acquisition of ParkUSA, the Company has broadened its reach to manufacturing products that support water management, efficiency, treatment, and storage. ParkUSA products solve challenges in wastewater, stormwater, and potable water markets for both public and private clients.

The ParkUSA team designs its products to improve water sustainability in the natural and built environment. The products mainly focus on stormwater and wastewater solutions for civic and commercial buildings; utility and site work projects; and medical, military, and industrial facilities. The products often convey, pre-treat, and improve water quality before it enters back into the storm sewer and sanitary sewer systems. In stormwater applications, ParkUSA interceptors remove sediments, trash, and oil from stormwater runoff before it eventually drains into public waterways, rivers, aquifers, lakes, and oceans. Interceptors are often used in commercial applications to remove FOGS (Fats, Oils, and Grease) from commercial kitchens and food processing plants. They can also be used to remove oil from water in many industrial, automotive, medical, military or commercial facilities. These products remove excessive amounts of grease, oil, and sediment before the water returns into public water systems.

ParkUSA furnishes a suite of products designed to process and deliver water for storage and distribution, and provide reliable water metering. Water meters monitor and measure water usage, while backflow preventers protect the community and public water supply from cross-connections. A cross-connection can occur when there is a pressure drop in a water main, which causes a vacuum and can siphon water from end-users into the public water supply. ParkUSA also offers solutions for harvesting, detaining, and conveying rainwater.

ParkUSA products incorporate precast concrete, metal, plastic, and fiberglass components with integrated technology components that help clients meet the growing demands and regulatory requirements of the water, stormwater, and wastewater industries. The team continues to develop innovative yet practical applications of technology to collect, treat, and renew water to meet the demands of today and tomorrow.

Northwest Pipe Company values the importance of its role in supporting the delivery of clean, safe water while reducing public health risks and supporting water sustainability.

|

| Notice and Proxy Statement | 2022 |

|

CORPORATE GOVERNANCE

Northwest Pipe Company’s Board of Directors and management have committed themselves to establishing a strong corporate governance environment and to adopting best practices to meet the needs and goals of the Company. As part of that commitment, the Company has adopted Corporate Governance Principles, which cover such topics as qualifications and independence of Board members, the selection, orientation, and continuing education of Board members, as well as other topics designed to promote effective governance by the Board. The Company has also adopted a Code of Business Conduct and Ethics, which applies to all employees, officers, and directors of the Company. It sets forth guidance to help in recognizing and dealing with ethical issues, to provide mechanisms for reporting unethical conduct, and to promote a culture of honesty and accountability, and a Code of Ethics for Senior Financial Officers, which applies to senior financial officers and sets forth guidance to deter wrongdoing, promote honest and ethical conduct, and promote a culture of integrity and fairness. Copies of the Corporate Governance Principles, Code of Business Conduct and Ethics, and Code of Ethics for Senior Financial Officers are available on the Company’s website at www.nwpipe.com under “Investors” — “Corporate Governance,” or by writing to the Company’s Corporate Secretary, Northwest Pipe Company, 201 NE Park Plaza Drive, Suite 100, Vancouver, Washington 98684.

The Company has also adopted a Policy for Reporting Financial Irregularities (“Whistleblower Policy”), which is intended to create a workplace environment that encourages the highest standards of ethical, moral, and legal business conduct. The Whistleblower Policy establishes procedures for any person to confidentially and anonymously report violations by any of the Company’s personnel of the Code of Business Conduct and Ethics, or any laws, rules, or regulations without fear of retaliation. The Whistleblower Policy also contains procedures for submission of complaints involving the Company’s accounting practices and financial internal controls.

DIRECTOR ELECTIONS

While directors are elected by a plurality of votes cast, the Company’s Corporate Governance Principles include a director resignation policy, requiring a director who receives more votes “withheld” than in favor of election in an uncontested election to submit to the Board of Directors a letter of resignation for consideration by the Nominating and Governance Committee. The Nominating and Governance Committee shall recommend to the Board the action to be taken with respect to such offer of resignation, and the Board shall promptly determine whether to accept such resignation, and shall publicly disclose its decision and rationale within 90 days following certification of the shareholder vote. Since this policy was put into place in February 2013, no director has been required to submit their offer of resignation in accordance with this policy.

DIRECTOR INDEPENDENCE

The current Board of Directors consists of six directors, one of whom is currently employed by the Company (Mr. Montross). The Board has affirmatively determined that as of December 31, 2021, all of the other directors (Ms. Kulesa and Messrs. Franson, Larson, Paschal, Roman, and Yearsley) were “independent” in accordance with the standards of the Nasdaq Stock Market, including standards related to independence for service on the committees on which they serve, and as defined by the director independence guidelines included in the Company’s Corporate Governance Principles. As previously announced, Mr. Yearsley resigned from the Board of Directors in February 2022.

|

| Notice and Proxy Statement | 2022

|

|

Criteria for Director Independence

For a director to be considered independent, the director must not have any material relationships with Northwest Pipe Company, either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company, other than as a director or shareholder. Material relationships can include vendor, supplier, consulting, legal, banking, accounting, charitable, and family relationships, among others. The Board of Directors considered all relevant facts and circumstances in making its determination, including the following:

| |

✔

|

An independent director or nominee may not have been employed by Northwest Pipe Company or any of its subsidiaries or affiliates in the past three years.

|

| |

✔ |

An independent director or nominee may not receive in excess of $120,000 from Northwest Pipe Company during any period of twelve consecutive months within the past three years other than (i) compensation for board or board member service, (ii) compensation paid to a family member who is an employee (other than an executive officer) of the Company, or (iii) benefits under tax-qualified retirement plan or non-discretionary compensation.

|

| |

✔ |

An independent director or nominee may not have a family member who is, or at any time during the past three years was, employed by Northwest Pipe Company as an executive officer.

|

| |

✔ |

An independent director or nominee may not be, or have a family member who is, a partner in, or a controlling shareholder or an executive officer of, any organization to which Northwest Pipe Company made, or from which the Northwest Pipe Company received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, other than payments arising solely from the investments in the Company's securities or payments under non-discretionary charitable contribution matching programs.

|

| |

✔ |

An independent director or nominee may not be an executive officer of another entity where a Northwest Pipe Company executive officer serves, or has served during the past three years, on the compensation committee of such entity.

|

| |

✔ |

An independent director or nominee may not be, or have a family member who is, a current partner of Northwest Pipe Company's outside auditor, or was a partner or employee of the outside auditor who worked on the Company's audit at any time during the past three years.

|

BOARD LEADERSHIP STRUCTURE AND RISK OVERSIGHT

The Company’s Corporate Governance Principles provide that the independent members of the Board of Directors will select a lead director from among the independent directors if the positions of Chairperson of the Board and CEO are held by the same person or if the Chairperson of the Board is not an independent director. The responsibilities of the Chairperson of the Board include the following: set Board meeting agendas in collaboration with the CEO; preside at Board meetings and the annual shareholders’ meeting; assign tasks to the appropriate committees in accordance with their respective charters; serve as an ex-officio member of each Board committee; and ensure that information flows openly between management and the Board. The responsibilities of the lead director include the following: coordinate the activities of the independent directors; make recommendations to the CEO in setting Board meeting agendas on matters concerning the independent directors; prepare the agenda for executive sessions of the independent directors, chair those sessions, and be primarily responsible for communications between the independent directors and the CEO; evaluate, along with the members of the Compensation Committee, the performance of the CEO; assist the Nominating and Governance Committee in the annual self-evaluation of the Board; recommend to the Chairperson of the Board the retention of consultants, as necessary or appropriate, who report directly to the Board; advise the Chairperson of the Board as to the quality, quantity, and timeliness of information sent to the Board; consult with other members of the Board as to recommendations for Board and committee membership and chairpersons of the Board committees, and interview Board candidates; and perform such other duties as the Board may from time to time designate.

|

| Notice and Proxy Statement | 2022 |

|

Mr. Roman, who has served as the Chairperson of the Board since January 2013, was not “independent” within the meaning of the applicable rules of the Nasdaq Stock Market until October 1, 2021 because of his previous employment with the Company. Mr. Franson was appointed as the Board’s Lead Director in August 2016 while Mr. Roman was not considered "independent" within the meaning of the applicable rules of the Nasdaq Stock Market. Despite Mr. Roman now meeting the definition of "independent," the Board has determined to retain Mr. Franson's Lead Director designation, as a reflection of the Board's commitment to principles of independence.

Board’s Role in Risk Oversight

The Board of Directors oversees management’s Company-wide risk management activities which include assessing and taking actions necessary to manage risks incurred in connection with the long-term strategic direction of the Company and the operation of its business. The Board uses its committees to assist in its risk oversight function.

While senior management has primary responsibility for managing risk, the Board of Directors has responsibility for risk oversight with specific risk areas delegated to relevant Board Committees who report on their deliberations to the Board. The specific risk areas of focus for the Board and each of its Committees are summarized below. The Board relies on senior management to keep it informed with respect to the nature of risks facing the Company and how the Company is managing those risks.

|

Board/Committee

|

|

Primary Areas of Risk Oversight

|

|

Full Board

|

✔

|

Safety and employee welfare

|

| |

✔

|

Risk governance framework, including an enterprise-wide culture that supports appropriate risk awareness and the identification, escalation, and appropriate management of risk

|

| |

✔ |

Integrity, ethics, and compliance with its Code of Business Conduct |

| |

✔ |

General strategic, commercial, operational, and economic risks |

| |

✔ |

Financial projections including liquidity management |

| |

✔ |

Strategic acquisition transactions, including execution and integration, and the competitive landscape for such acquisitions |

| |

|

Legal risks such as those arising from litigation, environmental, and intellectual property matters |

| |

✔ |

Review of any other material transactions such as agreements involving corporate indebtedness, legal settlements or structure, commitments, or partnerships |

|

Audit Committee

|

✔

|

Risk management practices, including data protection and cybersecurity

|

| |

✔ |

Compliance with regulatory requirements |

| |

✔ |

Ensure the mitigation of certain financial risks |

| |

✔ |

Review the external auditor's qualifications and independence |

| |

✔ |

Treatment of any complaints regarding accounting, internal control, or auditing matters through the anonymous submission process, when applicable |

| |

✔ |

Accounting compliance oversite including the Company's integrity over financial internal controls systems and disclosures |

| |

✔ |

Review of material findings of any examinations conducted by federal, state, or other agencies |

| |

✔ |

Review of transactions with related persons |

|

Compensation

Committee |

✔

|

Human capital management matters

|

| ✔ |

Compensation plans, programs, and arrangements and other employment practices and policies |

| |

✔ |

Recruitment and retention of key talent |

| |

✔ |

Labor compliance |

| |

✔ |

Inclusion and diversity |

| |

✔ |

Executive compensation |

| |

✔ |

Maintaining remuneration framework |

|

| Notice and Proxy Statement | 2022

|

|

| Board/Committee |

|

Primary Areas of Risk Oversight |

|

Nominating and

Governance

Committee

|

✔

|

Identification of qualified candidates for membership on the Board of Directors |

| ✔ |

Review of corporate governance developments for the purpose of recommending to the Board of Directors corporate governance practices, including revisions to the Company's Corporate Governance Principles |

| ✔ |

Board training and onboarding |

| |

✔ |

Recommending committee membership to the Company's Board of Directors |

| |

✔ |

Succession planning |

| |

✔ |

Executive share ownership requirements and insider training compliance |

The Board of Directors acknowledges the increased risk of cyberattacks. The Audit Committee is responsible for oversight of the Company's cybersecurity program and discusses the topic regularly during meetings. The Audit Committee is involved with the review of management's policies and procedures to prevent, detect, and to the extent it could become applicable in the future, mitigate the effects of a discovered breach. The Audit Committee believes that the Company's efforts require continuous review due to the speed in which these types of criminal behaviors evolve, and due to the inherent risk with cybersecurity, that maintaining an insurance policy is necessary to help protect the operational and financial risks involved.

BOARD OF DIRECTORS MEETINGS

Regular attendance at the Company’s Board of Directors meetings and the Annual Meeting is expected of each director. The Board held five meetings during 2021, in addition to adopting unanimous written consents in lieu of a meeting. Each of the directors attended more than 75% of the total number of Board and applicable Committee meetings during their tenure in 2021. In addition, all of the directors serving at that time attended the Company’s 2021 Annual Meeting of Shareholders, with the exception of Ms. Kulesa.

BOARD OF DIRECTORS COMMITTEES

The Board of Directors has an Audit Committee, a Compensation Committee, and a Nominating and Governance Committee. Each of the Committees consists of independent directors and each of the Committees has adopted a written charter which is available on the Company’s website at www.nwpipe.com under “Investors” — “Corporate Governance.”

The table below lists the current membership of each Committee.

|

Board Member

|

Audit Committee |

Compensation Committee |

Environmental and Social Governance Committee (1) |

Nominating and Governance Committee |

|

Michael Franson

|

✔

|

✔+

|

|

|

|

Amanda Kulesa

|

|

|

✔+ |

✔

|

|

Keith Larson

|

✔+

|

✔

|

✔ |

|

|

John Paschal

|

|

✔

|

✔ |

✔+

|

| Richard Roman |

✔ (2) |

|

|

|

| |

+

|

Committee chair |

| |

(1) |

The Environmental and Social Governance Committee was established in April 2022. |

| |

(2) |

Richard Roman was appointed to the Audit Committee in April 2022. |

|

| Notice and Proxy Statement | 2022 |

|

Audit Committee

The Audit Committee of the Board of Directors is responsible for the oversight and monitoring of: the integrity of the Company’s financial reporting process, financial internal control systems, accounting and legal compliance, and the integrity of the financial reporting; the qualifications, independence, and performance of the independent auditors; the Company’s compliance with applicable legal and regulatory requirements; oversight of risk management practices, including data protection and cybersecurity; and the maintenance of open and private, if necessary, communication among the independent auditors, management, legal counsel, and the Board. The Audit Committee met eight times in 2021. Each member of the Audit Committee is “independent” as defined by applicable Securities and Exchange Commission (“SEC”) and Nasdaq Stock Market (“Nasdaq”) rules. The Board has determined that each member of the Audit Committee qualifies as an “audit committee financial expert” as defined by the rules of the SEC.

As a result of the resignation of Mr. Yearsley from the Company’s Board of Directors and its Audit Committee in February 2022, the Company was not in compliance with Nasdaq Listing Rule 5605, which requires that the Company’s Audit Committee be comprised of at least three directors, all of whom are independent pursuant to the rules of Nasdaq and applicable law. Pursuant to Nasdaq Listing Rule 5605(c)(4), the Company is entitled to a cure period to regain compliance with Nasdaq Listing Rule 5605, which will expire on August 10, 2022. On April 7, 2022, the Board appointed Mr. Roman, a current independent member of the Board, to the Audit Committee. With the appointment, the Company is now in compliance with Nasdaq Listing Rule 5605.

Compensation Committee

The Compensation Committee of the Board of Directors is responsible for the oversight and determination of executive compensation by reviewing, recommending, and approving salaries and other compensation of the Company’s executive officers, and administering the Company’s equity incentive and compensation plans, including reviewing, recommending, and approving equity incentive and compensation awards to executive officers. In addition, the Compensation Committee is responsible for recommending to the Board the level and form of compensation and benefits for all nonemployee directors; oversight of the Company’s human capital management matters; and reviewing, recommending, and taking action upon any other compensation practices or policies of the Company as the Board of Directors may request or the Committee may determine to be appropriate. The Committee has sole authority to retain and terminate a compensation consultant to assist in the evaluation of executive compensation. The Compensation Committee met four times in 2021. Each member of the Compensation Committee is “independent” as defined by applicable Nasdaq Stock Market rules.

Environmental and Social Governance ("ESG") Committee

In April 2022, the Board established the Environmental and Social Governance Committee of the Board of Directors, and appointed Ms. Kulesa as Chairperson and Messrs. Larson and Paschal as committee members. The members of the ESG Committee are currently developing the committee's charter for approval by the Board, which will identify the scope of its responsibilities. It is currently anticipated that the ESG Committee will be charged with responsibilities related to the Company's environmental and social responsibilities and other related public policy matters relevant to the Company. The first meeting of the ESG Committee will be held in June 2022. Each member of the ESG Committee is "independent" as defined by applicable Nasdaq Stock Market rules.

Nominating and Governance Committee

The Nominating and Governance Committee of the Board of Directors recommends to the Board corporate governance principles for the Company, identifies qualified candidates for membership on the Board of Directors, and proposes to the Board of Directors for its approval nominees for election as directors. The Nominating and Governance Committee met five times in 2021. Each member of the Nominating and Governance Committee is “independent” as defined by applicable Nasdaq Stock Market rules.

|

| Notice and Proxy Statement | 2022

|

|

COMMUNICATIONS WITH DIRECTORS

Any shareholder who wants to communicate with members of the Board of Directors, individually or as a group, may do so by writing to the intended member or members of the Board, c/o Chairperson of the Board, Northwest Pipe Company, 201 NE Park Plaza Drive, Suite 100, Vancouver, Washington 98684. Communications should be sent by overnight or certified mail, return receipt requested. All communications will be submitted to the intended member(s) of the Board in a timely manner.

Nominations by Shareholders

In identifying qualified candidates for the Board of Directors, the Nominating and Governance Committee will consider recommendations by shareholders. Shareholder recommendations as to candidates for election to the Board may be submitted to the Company’s Corporate Secretary, Northwest Pipe Company, 201 NE Park Plaza Drive, Suite 100, Vancouver, Washington 98684. The Nominating and Governance Committee will evaluate potential nominees, including candidates recommended by shareholders, by reviewing qualifications, considering references, and reviewing and considering such other information as the members of the Nominating and Governance Committee deem relevant.

The Company’s Bylaws permit shareholders to make nominations for the election of directors, if such nominations are made pursuant to timely notice in writing to the Company’s Secretary. To be timely, notice must be delivered to, or mailed to and received at, the principal executive offices of the Company not less than 60 days nor more than 90 days prior to the date of the meeting, provided that at least 60 days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders. If less than 60 days’ notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder must be received by the Company not later than the close of business on the tenth day following the date on which such notice of the date of the meeting was mailed or such public disclosure was made. A shareholder’s notice of nomination must also set forth certain information specified in the Company’s Bylaws concerning each person the shareholder proposes to nominate for election and the nominating shareholder. Under new rules recently adopted by the SEC, additional requirements must be met for such shareholder nominee to be included in the proxy card distributed to shareholders, including that such nomination be postmarked or transmitted electronically to the registrant at its principal executive office no later than 60 calendar days prior to the anniversary of the previous year's annual meeting date.

AUDIT COMMITTEE REPORT

The Audit Committee reports to and acts on behalf of the Board of Directors and is comprised solely of directors who satisfy the independence, financial literacy, and other requirements set forth in the listing rules of the Nasdaq Stock Market and applicable securities laws. In addition, each member of the Audit Committee qualifies as an “audit committee financial expert” as defined by the rules of the SEC.

The Audit Committee operates under a written charter, approved and adopted by the Board of Directors, which sets forth its duties and responsibilities. This charter, which is available in full on the Company’s website at www.nwpipe.com under “Investors” — “Corporate Governance”, is reviewed annually and updated, as appropriate, to address changes in regulatory requirements, authoritative guidance, evolving oversight practices, and investor feedback.

The Audit Committee’s primary duties and responsibilities are the oversight and monitoring of:

| |

●

|

the integrity of the Company’s financial reporting process, financial internal control systems, accounting and legal compliance, and the integrity of the financial reporting of the Company;

|

| |

●

|

the qualifications, independence, and performance of the Company’s independent auditors;

|

| |

●

|

the compliance by the Company with applicable legal and regulatory requirements;

|

| |

●

|

oversight of risk management practices, including the Company's data protection practices and cybersecurity program; and

|

| |

●

|

the maintenance of an open and private, if necessary, communication among the independent auditors, management, legal counsel, and the Board of Directors.

|

|

| Notice and Proxy Statement | 2022

|

|

Management is responsible for preparing the Company’s financial statements and maintaining effective internal control over financial reporting. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements in accordance with applicable auditing standards and issuing a report thereon, and for performing an independent audit of the effectiveness of the Company’s internal controls over financial reporting. In this context, the Audit Committee performed the following:

| |

●

|

met with Moss Adams, who has served as the Company’s independent registered public accountants since 2016, with and without management present, to review and discuss the Company’s audited financial statements and assessment of the Company’s internal control over financial reporting, as well as the critical audit matters addressed during the audit;

|

| |

●

|

asked management and Moss Adams questions relating to such matters and discussed with Moss Adams the matters required to be discussed by applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”), including Auditing Standard No. 1301, “Communications with Audit Committees”;

|

| |

●

|

reviewed the terms of the audit engagement, the overall audit strategy, timing of the audit, and significant risks identified; and

|

| |

●

|

reviewed the critical accounting policies and practices applied by the Company in preparation of its financial statements, and critical accounting estimates and significant unusual transactions affecting the Company’s financial statements.

|

Based on the reviews and discussions described in this report, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10‑K for the year ended December 31, 2021 for filing with the SEC.

The Audit Committee’s responsibilities also include monitoring the qualifications, independence, and performance of the Company’s independent auditors. In reviewing the auditor’s performance, the Audit Committee considers the quality and efficiency of the services provided by the audit team, and reviews and discusses the auditor’s most recent PCAOB inspection report and its system of quality control. The Committee also reviews and discusses proposed staffing levels and the selection of the lead engagement partner from the independent registered public accounting firm. Further, the Audit Committee recognizes the importance of maintaining the independence of the Company’s auditor, both in fact and in appearance. For 2021, the Audit Committee received and reviewed the written disclosures and letter provided by Moss Adams as required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the audit committee concerning independence, and the Audit Committee discussed with the independent accountants that firm’s independence. The Audit Committee concurs with Moss Adams’ conclusion that they are independent from the Company and its management.

Respectfully submitted by the Audit Committee of the Board of Directors.

AUDIT COMMITTEE

Keith Larson, Chairperson

Michael Franson

Richard Roman

|

| Notice and Proxy Statement | 2022 |

|

|

|

PROPOSAL #1: ELECTION OF DIRECTOR |

PROPOSAL #1: ELECTION OF DIRECTOR

|

|

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THIS PROPOSAL. |

At the Annual Meeting, one director will be elected, to serve for a three-year term. Unless otherwise specified on the proxy, it is the intention of the persons named in the proxy to vote the shares represented by each properly executed proxy for the election of the nominee named below. The Board of Directors believes that the nominee will stand for election and will serve if elected as a director. However, if the person nominated by the Board fails to stand for election or is unable to accept election, the proxies will be voted for the election of such other person as the Board may recommend.

The Company’s Articles of Incorporation and Bylaws provide that the Board of Directors shall be composed of not less than six and not more than nine directors. The size of the Board is currently fixed at six directors. Under the Company’s Articles of Incorporation and Bylaws, the Company’s directors are divided into three classes, with each class to be as nearly equal in number as possible. The term of office of only one class of directors expires each year, and their successors are generally elected for terms of three years, and until their successors are elected and qualified. The term of a director elected by the Board to fill a vacancy expires at the next annual shareholders’ meeting. There is no cumulative voting for election of directors.

Consistent with this vision, the Nominating and Governance Committee has responsibility for identifying director nominees who collectively have the complementary experience, qualifications, skills, and attributes to guide the Company and function effectively as a Board.

The Nominating and Governance Committee believes that the nominee presented in this proxy has key personal attributes that are important to an effective Board of Directors: integrity, candor, analytical skills, willingness to engage management and each other in a constructive and collaborative fashion, and ability and commitment to devote significant time and energy to serve on the Board and its committees. The Company considers the following specific experiences, qualifications, and skills to be critical in light of its strategic priorities, business objectives, operations, and structure.

DIRECTOR SKILLS AND QUALIFICATIONS

STRATEGIC SKILLS

Industries, End Markets, and Growth Areas. Experience in industries, end markets, and growth areas that the Company serves enables a better understanding of the issues facing these businesses.

Manufacturing Experience. Growing sales outside of the engineered steel pressure pipe water transmission market, particularly in precast infrastructure, is one of the Company’s long-term growth strategies. Hence, exposure to manufacturing economies is an important qualification for Company directors.

Regulated Industries/Government Experience. The Company’s customers and project stakeholders are subject to a broad array of government regulations, and demand for products and services can be impacted by changes in law or regulation in areas such as safety, environmental, and energy efficiency. It is important to have directors with experiences in government and regulated industries that provide insight and perspective in working constructively and proactively with governments and municipalities.

Innovation and Technology. The Company strives to lead the industry in water transmission and infrastructure innovation. Expertise in physical product development, testing, and introduction is critical to continuing new growth paths for the Company’s business.

Marketing. Driving growth in existing and new markets is critical for Company growth. The Company’s directors who have that expertise and a much-desired perspective in marketing will aide in delivery of the Company’s products and services.

|

| Notice and Proxy Statement | 2022 |

|

|

|

PROPOSAL #1: ELECTION OF DIRECTOR |

CORE COMPETENCIES

Senior Leadership Experience. Experience serving as CEO or a senior executive as well as hands-on leadership experience in core management areas – such as strategic and operational planning, financial reporting, compliance, risk management, and leadership development – provide a practical understanding of complex organizations.

Risk Management. In light of the Board of Directors’ role in risk, the Company seeks directors who can help identify, manage, and mitigate key risks, including cybersecurity, regulatory compliance, competition, brand integrity, human capital, climate change, and intellectual property.

Financial Expertise. The Company believes an understanding of finance and financial reporting processes is important for its directors to enable them to monitor and assess the Company’s operating and strategic performance and to ensure accurate financial reporting and robust controls. Northwest Pipe Company seeks directors with background and experience in capital markets, corporate finance, mergers and acquisitions, accounting, and financial reporting.

Public Company Board Experience. Service on the boards and board committees of other public companies provides an understanding of corporate governance practices and trends and insights into board management, relations between the board, the CEO, and senior management, agenda setting, and succession planning.

BOARD SKILLSET MATRIX

| |

Scott Montross

(CEO)

|

Michael Franson

(Lead Director)

|

Amanda Kulesa

|

Keith Larson

|

John Paschal

|

Richard Roman

(Chairperson)

|

|

Strategic Skills

|

|

|

|

|

|

|

|

Industries, End Markets, and Growth Areas

|

■

|

■ |

■ |

■

|

■

|

■

|

|

Manufacturing Experience

|

■

|

■

|

■

|

■

|

■

|

■

|

|

Regulated Industries/Government Experience

|

■

|

■

|

■

|

■

|

■

|

■

|

|

Innovation and Technology

|

■

|

■

|

■

|

■

|

■

|

■

|

|

Marketing

|

■

|

■

|

■

|

■

|

■

|

■

|

|

Core Competencies

|

|

|

|

|

|

|

|

Senior Leadership Experience

|

■

|

■

|

■

|

■

|

■

|

■

|

|

Risk Management

|

■

|

■

|

■

|

■

|

■

|

■

|

|

Financial Expertise

|

■

|

■

|

■

|

■

|

■

|

■

|

|

Public Company Board Experience (current | past)

|

■

|

■

|

■

|

■

|

■

|

■

|

|

■

|

Technical Expertise (direct hands-on experience or subject-matter expert during his/her career)

|

|

■

|

Managerial Expertise (expertise derived through direct managerial experience)

|

|

■

|

Working Knowledge (experience derived through serving as a member of a relevant board committee or serving as an executive officer or on the board of a public company in the relevant industry)

|

|

| Notice and Proxy Statement | 2022 |

|

|

|

PROPOSAL #1: ELECTION OF DIRECTOR |

NOMINEE AND CONTINUING DIRECTORS

The following table sets forth the names of and certain information about the Board of Directors’ nominee for election as a director and those directors who will continue to serve after the Annual Meeting.

|

Nominee

|

Age

|

Director

Since

|

Expiration of

Current Term

|

Expiration of

Nominated Term

|

|

Michael Franson

|

67

|

2016

|

2022

|

2025

|

|

Continuing Directors

|

|

|

|

|

|

Amanda Kulesa

|

46

|

2020

|

2024

|

|

|

Keith Larson

|

64

|

2007

|

2024

|

|

|

Scott Montross

|

57

|

2013

|

2023

|

|

|

John Paschal

|

63

|

2019

|

2023

|

|

|

Richard Roman

|

70

|

2003

|

2024

|

|

NOMINEE FOR DIRECTOR

MICHAEL FRANSON

|

Years of Service: 17

Age: 67

Committees:

• Audit Committee

• Compensation Committee - Chair

Independent: Yes

Other directorships: None

LEAD DIRECTOR

|

|

Specific Experience, Qualifications, Attributes, and Skills: |

| |

● |

Significant management and finance experience gained through senior leadership positions |

| |

● |

Extensive experience with merger and acquisition transactions |

| |

● |

Information technology and cyber expertise and a strong track record of dissemination company culture |

| |

● |

Deep understanding of corporate finance including investment banking, financial analysis, capital fundraising, and financial advisory services |

| Board of Director Tenure: |

| Michael Franson has been a director of the Company since August 2016. Mr. Franson previously served on the Board from 2001 until 2005, and again from 2007 until 2014. |

| Business Experience: |