Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

April 10 2020 - 9:13AM

Edgar (US Regulatory)

Prospectus

Supplement Filed Pursuant to Rule 424(b)(3)

Registration No. 333-234528

PROSPECTUS

SUPPLEMENT NO. 2 DATEd April 10, 2020

(To Prospectus Dated December 6, 2019)

NEPHROS,

INC.

This

prospectus supplement updates, amends, and supplements the information previously included in the prospectus dated December 6,

2019 relating to the sale or other disposition from time to time of up to 3,499,852 shares of our common stock by the selling

stockholders named in the prospectus. We are not selling any additional shares of common stock under the prospectus and will not

receive any of the proceeds from sales of shares of common stock by the selling stockholders.

The

sole purpose of this prospectus supplement is to modify certain information in the prospectus set forth under the caption “Selling

Stockholders” to provide updated information regarding the selling stockholders.

This

prospectus supplement is not complete without, and may not be delivered or used except in connection with, our prospectus, including

all amendments and supplements thereto.

This

prospectus supplement should be read in conjunction with the prospectus, which is required to be delivered with this prospectus

supplement. This prospectus supplement is qualified in its entirety by reference to the prospectus except to the extent that the

information herein modifies or supersedes the information contained in the prospectus. The prospectus is only modified as specifically

amended by this prospectus supplement.

All

references in the prospectus to “this prospectus” are amended to read “this prospectus (as supplemented and

amended).”

Investing

in our common stock involves substantial risks. See “Risk Factors” beginning on page 7 of the Prospectus to read about

important factors you should consider before purchasing our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus SUPPLEMENT. Any representation to the contrary is a criminal offense.

The

date of this prospectus supplement is April 10, 2020

The

“Selling Stockholders” section

of the prospectus is hereby replaced in its entirety with the following text:

SELLING

STOCKHOLDERS

This

prospectus covers the resale by the selling stockholders identified below of the Secondary Securities, which consist of 3,499,852

shares of our common stock, including 66,667 shares of our common stock issuance upon the exercise of outstanding warrants and

44,502 shares of our common stock issuable upon the exercise of outstanding options.

The

following table sets forth the number of shares of our common stock beneficially owned by the selling stockholders as of March

25, 2020, and after giving effect to this offering, except as otherwise referenced below.

|

|

|

Shares

beneficially

|

|

|

Number

of

outstanding

shares

|

|

|

Number

of

shares

offered by

selling

stockholder

|

|

|

Number

of

shares

offered by

selling

stockholder

|

|

|

Beneficial

ownership

after

offering(1)

|

|

|

Selling Stockholder

|

|

owned

before offering(1)

|

|

|

offered

by

selling stockholder

|

|

|

upon

exercise of warrants

|

|

|

upon

exercise of options

|

|

|

Number

of

shares

|

|

|

Percent

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wexford Partners 11, L.P.(2)

|

|

|

2,702,260

|

|

|

|

2,648,926

|

(4)

|

|

|

53,334

|

|

|

|

-

|

|

|

|

-

|

|

|

|

*

|

|

|

Wexford 11 Advisors LLC(2)

|

|

|

1,300

|

|

|

|

1,275

|

(4)

|

|

|

25

|

|

|

|

-

|

|

|

|

-

|

|

|

|

*

|

|

|

WPIC 2, LLC(2)

|

|

|

674,265

|

|

|

|

660,957

|

(4)

|

|

|

13,308

|

|

|

|

-

|

|

|

|

-

|

|

|

|

*

|

|

|

Wexford Capital LP(2)

|

|

|

128,969

|

(3)

|

|

|

77,525

|

|

|

|

-

|

|

|

|

44,502

|

(5)

|

|

|

10,608

|

|

|

|

*

|

|

|

TOTALS

|

|

|

|

|

|

|

3,388,683

|

|

|

|

66,667

|

|

|

|

44,502

|

|

|

|

|

|

|

|

|

|

*

Less than 1%.

|

(1)

|

Beneficial

ownership is determined in accordance with Rule 13d-3 under the Exchange Act, and includes any shares as to which the security

or stockholder has sole or shared voting power or investment power, and also any shares which the security or stockholder has

the right to acquire within 60 days of March 25, 2020, whether through the exercise or conversion of any stock option, convertible

security, warrant or other right. The indication herein that shares are beneficially owned is not an admission on the part of

the security or stockholder that he, she or it is a direct or indirect beneficial owner of those shares. Percentage of shares

beneficially owned after the resale of all the shares offered by this prospectus assumes there are outstanding 9,016,550 shares

of common stock.

|

|

|

|

|

(2)

|

The

shares previously beneficially owned by Lambda Investors LLC (“Lambda”) were distributed to Lambda’s direct

beneficial owners Wexford Partners 11, L.P., Wexford 11 Advisors LLC, and WPIC 2, LLC (collectively, the “Wexford Assignees”),

effective December 31, 2019. The shares beneficially owned by the Wexford Assignees may be deemed beneficially owned by (i) Wexford

Capital LP, which is the manager or investment manager of certain Wexford Assignees, (ii) Wexford GP LLC, which is the General

Partner of Wexford Capital LP, and/or (iii) Charles E. Davidson and Joseph M. Jacobs, each in his capacity as a managing member

of Wexford GP LLC and certain Wexford Assignees. The address of each of Wexford Capital LP, Wexford GP LLC, Mr. Davidson and Mr.

Jacobs is c/o Wexford Capital LP, 777 South Flagler Drive, Suite 602 East, West Palm Beach, FL 33401. The Wexford Assignees are

controlled by (i) Wexford Capital LP, (ii) Wexford GP LLC and/or (iii) Mr. Davidson and Mr. Jacobs. Dr. Mieyal and Mr. Amron,

two of our directors, are, respectively, a Vice President and a Partner and General Counsel of Wexford Capital LP.

|

|

(3)

|

Includes

6,896 shares of common stock issued as compensatory restricted stock grants in December 2019 to the Lambda representatives

serving on the Company’s Board of Directors and assigned to Wexford Capital LP and 3,712 shares of common stock issuable

upon on the exercise of options that are currently vested or will vest within 60 days of March 25, 2020. These shares are

not covered by the registration statement of which this prospectus forms a part.

|

|

|

|

|

(4)

|

Due

to the impact of historical reverse stock splits, the total amount of shares reflected on this table as held by the Wexford

Assignees is slightly higher than the sum of the per-transaction amounts reflected under “Acquisition of Securities

by Selling Shareholders” below.

|

|

(5)

|

Includes

40,836 shares issuable upon on the exercise of options that are currently vested or will vest within 60 days of March 25,

2020 and 3,442 shares issuable upon the exercise of options that will vest on December 19, 2020. The remaining 224 shares

were issuable upon the exercise of options that expired on January 8, 2020.

|

Acquisition

of Securities by Selling Stockholders

The

Wexford Assignees acquired their Secondary Securities from Lambda by an assignment effective December 31, 2019. Lambda acquired

the Secondary Securities assigned to the Wexford Assignees follows:

|

|

●

|

79,897

shares of common stock were acquired on November 14, 2007 upon conversion of a convertible promissory note (the “Series

A Note”) that was issued by the Company to Lambda on September 19, 2007 in a bona fide private placement;

|

|

|

|

|

|

|

●

|

1,304,677

shares of common stock were acquired on September 29, 2015 upon exercise of a warrant that was issued by the Company to Lambda

on November 14, 2007 upon conversion of the Series A Note;

|

|

|

|

|

|

|

●

|

334,412

shares of common stock were purchased in a registered rights offering that closed on March 10, 2011 (the “2011 Rights

Offering”);

|

|

|

|

|

|

|

●

|

309,175

shares of common stock were acquired on October 18, 2015 upon exercise of a warrant that was purchased by Lambda in the 2011

Rights Offering;

|

|

|

|

|

|

|

●

|

332,542

shares of common stock were purchased in a registered rights offering that closed on April 17, 2013;

|

|

|

|

|

|

|

●

|

583,362

shares of common stock were purchased in a registered rights offering that closed on March 14, 2014 (the “March 2014

Rights Offering”);

|

|

|

|

|

|

|

●

|

367,089

shares of common stock were purchased in a registered rights offering that closed on December 18, 2014 (the “December

2014 Rights Offering”); and

|

|

|

|

|

|

|

●

|

warrants

to purchase 66,667 shares of common stock were acquired by Lambda in a bona fide private placement that closed on June 3,

2016.

|

Wexford

Capital LP acquired its Secondary Securities as follows:

|

|

●

|

3,090

shares of common stock were purchased in the March 2014 Rights Offering;

|

|

|

|

|

|

|

●

|

1,650

shares of common stock were purchased in the December 2014 Rights Offering;

|

|

|

|

|

|

|

●

|

72,785

shares of common stock were issued as compensatory restricted stock grants between 2013 and 2018 to the Lambda representatives

serving on the Company’s Board of Directors and assigned to Wexford Capital LP; and

|

|

|

●

|

options

to purchase 44,502 shares of common stock were issued as compensatory grants between 2007 and 2018 to the Lambda representatives

serving on the Company’s Board of Directors and assigned to Wexford Capital LP.

|

Agreements

with Selling Stockholders

Registration

Rights Agreements

In

February 2013, November 2013 and August 2014, in connection with various loans received from Lambda, we entered into registration

rights agreements with Lambda. Pursuant to these agreements, we agreed to file, upon a demand by Lambda, a registration statement

covering the resale by Lambda of certain of the common stock held by Lambda. We also agreed to pay all of the expenses, including

reasonable legal fees, of Lambda in connection with the registration statement of which this prospectus forms a part and the resale

of shares by Lambda under the registration statement of which this prospectus forms a part. We are obligated to use our reasonable

best efforts to keep such registration statement continuously effective until such time as all the securities registered on such

registration statement on behalf of Lambda have been sold or are eligible for sale without restriction under the applicable securities

laws. The registration statement of which this prospectus forms a part has satisfied all of our registration obligations to Lambda

as of the date of this prospectus. Lambda’s rights under the registration rights agreements were assigned to the Wexford

Assignees pro rata in conjunction with the assignment of the Secondary Securities.

Investor

Rights Agreement

In

connection with our September 2007 financing, we entered into an investor rights agreement with the investors pursuant to which

we agreed to take such corporate actions as may be required, among other things, to entitle Lambda (i) to nominate two individuals

having reasonably appropriate experience and background to our Board of Directors (the “Board”) to serve as directors

until their respective successor(s) are elected and qualified, (ii) to nominate each successor to the Lambda nominees, provided

that any successor will have reasonably appropriate experience and background, and (iii) to direct the removal from the Board

of any director nominated under the foregoing clauses (i) or (ii). Under the investor rights agreement, we are required to convene

meetings of the Board at least once every three months. If we fail to do so, a Lambda director will be empowered to convene such

meeting. Arthur Amron and Paul Mieyal are the current Lambda directors. Lambda’s rights under the investor rights agreement

were assigned to the Wexford Assignees pro rata in conjunction with the assignment of the Secondary Securities.

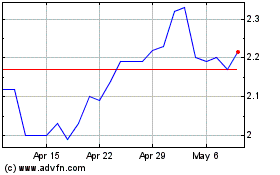

Nephros (NASDAQ:NEPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

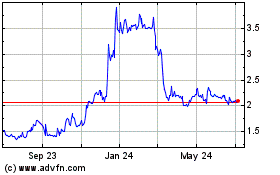

Nephros (NASDAQ:NEPH)

Historical Stock Chart

From Apr 2023 to Apr 2024