Current Report Filing (8-k)

May 11 2022 - 5:05PM

Edgar (US Regulatory)

FALSE0000707549June 2600007075492022-05-112022-05-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) o f the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 11, 2022

LAM RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 0-12933 | | 94-2634797 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification Number) |

4650 Cushing Parkway

Fremont, California 94538

(Address of principal executive offices including zip code)

(510) 572-0200

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | | | | |

| | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, Par Value $0.001 Per Share | LRCX | The Nasdaq Stock Market

|

| | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Table of Contents

| | | | | | | | | | | |

Item 5.02

| | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers | |

| Item 5.03 | | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year | |

| Item 8.01 | | Other Events | |

| Item 9.01 | | Financial Statements and Exhibits | |

| SIGNATURES | |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On May 11, 2022, the Board of Directors (the “Board”) of Lam Research Corporation (the “Company”) approved the Lam Research Corporation Senior Executive Transition Policy (the “Transition Policy”). The following summary of the terms of the Transition Policy is qualified in its entirety by the text of such Transition Policy, which is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The purpose of the Transition Policy is to promote an orderly transition of senior executives and provide certain eligible executives with an opportunity to work a mutually agreed reduced schedule in anticipation of subsequent retirement. Executives eligible to participate in the Transition Policy include those serving as the Company’s Chief Executive Officer, President, Executive Vice President or Senior Vice President and who have attained a minimum age of 55, completed at least 5 years of service with the Company, and the sum of whose age and years of service is equal to or greater than 70.

Eligible executives who wish to commence a transition under the terms of the Transition Policy must provide at least 12 months’ prior non-binding notice of their intent to consider a transition and, prior to the start of their transition, must have entered into a transition agreement with the Company setting forth the material terms of the transition. The executive will continue employment during the transition period on either a full or part time schedule (which is not to be less than 10 hours per week). During the transition period, the executive will receive a base salary commensurate with the transition role and will continue to be eligible to participate in the Company’s annual incentive program and benefit programs (if permitted under their terms), and any equity awards the executive holds will continue to vest in accordance with their terms. During the transition, the executive must not compete with the Company or solicit any Company employees.

The Transition Policy will be administered by the Committee (or, as the Transition Policy pertains to the Chief Executive Officer, by the independent members of the Board of Directors) and may be modified or ended by the Company in its complete and absolute discretion prior to an executive’s execution of a transition agreement.

The foregoing description is qualified in its entirety by the Transition Policy, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On May 11, 2022, the Board amended and restated the Company’s Amended and Restated Bylaws (the “Bylaws”), effective immediately, to, among other things:

•update the procedural and information requirements in the advance notice bylaw in Section 2.2 of the Bylaws for stockholders to submit director nominations and stockholder proposals, including without limitation, provisions requiring parties wishing to nominate directors to state their intention to solicit 67% of the voting power of shares entitled to vote on the election of directors and file a definitive proxy statement with the U.S. Securities and Exchange Commission, providing for additional information to be provided in connection with director nominations and associated deadlines for providing such information, providing for updating of such information and requiring that all such information be accurate and complete, and empowering the Company to require that any person nominated for election to the Board submit to interviews with the Board;

•clarify that the number of nominees a stockholder may nominate for election at a meeting of stockholders (other than under the Company’s existing proxy access bylaw, for which the limits on number of nominees remains unchanged) shall not exceed the number of directors to be elected at such meeting; and

•add a new Section 2.2(h), which (1) clarifies that, for any nomination to be properly brought before a meeting by a record stockholder, the information provided by such stockholder, the beneficial owner, if any, on whose behalf any such nomination is made and the person so nominated shall not contain any false or misleading information or omit any material information that has been requested, and (2) specifies further powers of the corporation in the event of a failure to meet the procedural, information and other requirements of the advance notice bylaw in Section 2.2.

The foregoing description is qualified in its entirety by the amended and restated Bylaws, which are attached hereto as Exhibit 3.1 and incorporated herein by reference.

Item 8.01. Other Events

On May 11, 2022 the Company issued a press release announcing a $5 billion share repurchase authorization. A copy of the press release is attached as Exhibit 99.1 to this Form 8-K. The foregoing description of the share repurchase authorization is qualified in its entirety by reference to the full text of Exhibit 99.1 incorporated by reference in this Item 8.01.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

104 Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

*Indicates management contract or compensatory plan or arrangement in which executive officers of the Company are eligible to participate.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: | May 11, 2022 | LAM RESEARCH CORPORATION |

| | (Registrant) |

| | |

| By: | /s/ Ava M. Hahn |

| | Ava M. Hahn |

| | Senior Vice President, Chief Legal Officer |

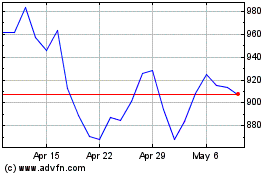

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

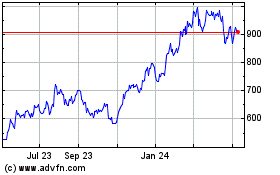

Lam Research (NASDAQ:LRCX)

Historical Stock Chart

From Apr 2023 to Apr 2024