Kaival Brands Innovations Group, Inc. (NASDAQ:

KAVL) ("Kaival Brands," the "Company" or "we,” “our” or

similar terms), the exclusive U.S. distributor of all products

manufactured by Bidi Vapor, LLC ("Bidi Vapor"), including the BIDI®

Stick electronic nicotine delivery system, which are intended for

adults 21 and over, today announced its financial results for the

fiscal 2022 fourth quarter and full year ended October 31, 2022.

Eric Mosser, President & Chief Operating

Officer of Kaival Brands, stated, “Fiscal 2022 was an exceptionally

challenging year for us, primarily due to regulatory action by the

FDA that was ultimately overturned in August. For a portion of

fiscal 2022, we were prohibited from selling our flavored BIDI

Sticks, and our 2022 revenues reflect the significant extended

impact of this. The good news is that this impediment is behind us.

Moreover, despite the challenges, we accomplished several important

milestones during the year which we believe has laid the foundation

for renewed growth and progress in 2023, including expanding

existing sales channel relationships and initiating significant new

ones. We expect and hope that the FDA will continue to pull bad

actors from the marketplace, paving the way for companies like ours

to provide our products to adult smokers deserving of premium

e-cigarette product and experience.”

Fourth Quarter and Full-Year 2022

Highlights

- On or about May 13, 2022, the U.S.

Food and Drug Administration (“FDA”) placed the tobacco-flavored

Classic BIDI® Stick into the final Phase III scientific

review.

- In June, the Company’s wholly owned

subsidiary, Kaival Brands International, LLC ("KBI"), entered into

an international licensing agreement with Philip Morris Products

S.A. (“PMPSA”), a wholly owned affiliate of Philip Morris

International Inc., for the development and distribution of

electronic nicotine delivery system ("ENDS") products in markets

outside the U.S., subject to market (or regulatory)

assessment.

- In July, the Company announced the

launch of PMPSA's custom-branded self-contained e-vapor product,

VEEBA, being sold in Canada, with royalties due to KBI pursuant to

the international licensing agreement.

- In August, the U.S. Court of

Appeals for the Eleventh (11th) Circuit ruled in favor of Bidi

Vapor in its appeal of the FDA’s Marketing Denial Order (“MDO”)

issued to the non-tobacco flavored BIDI® Sticks. The court set

aside or vacated the MDO and remanded the PMTAs back to FDA for

further review.

- In December, KMS, Kaival’s

marketing & sales vendor, hired Dean Simmons, a former Vice

President of Sales of Swisher International, in preparation for an

expected resurgence of revenue growth following a pivotal legal

victory for Bidi Vapor this past summer.

Summary of Fourth Quarter and Full Year

Fiscal Results

Revenues: Revenues for the

fourth fiscal quarter ended October 31, 2022 were approximately

$3.0 million, compared to approximately $0.1 million for the prior

fourth fiscal quarter. Revenues for the full fiscal year ended

October 31, 2022 were approximately $12.8 million, compared to

approximately $58.8 million for fiscal year 2021. Revenues

decreased in fiscal year 2022, primarily in the first two fiscal

quarters, due to Bidi Vapor’s receipt of the MDO, our resulting

inability to sell our products and also generally due to increased

competition, which we believe was the result of the lack of

enforcement by federal and state authorities against sub-par and

low-priced vaping products, including illegal synthetic nicotine

disposable ENDS, that continued to enter the market illegally

without FDA authorization.

Following the 11th Circuit Court decision

vacating the FDA’s MDO in August, we began to aggressively reignite

sales efforts and expect an upturn in sales of all BIDI® Sticks,

anticipated to begin to show results in the second quarter of

fiscal year 2023 (which sales remain subject to FDA’s enforcement

discretion). We also anticipate that if the FDA begins enforcement

against illegally marketed or synthetic-nicotine vaping products,

there may be an increased demand for compliant and legal vaping

products, such as the BIDI® Stick.

Cost of Revenue, Net, and Gross Profit

(Loss): Gross profit for the fourth fiscal quarter ended

October 31, 2022 was approximately $1.1 million, compared to

approximately $(1.0) million gross loss for the prior fourth fiscal

quarter. Gross profit for the full fiscal year ended October 31,

2022 was approximately $1.2 million, compared to approximately

$11.9 million for fiscal year 2021. Total cost of revenue for the

fourth fiscal quarter ended October 31, 2022 was approximately $1.9

million, compared to approximately $0.9 million for the prior

fourth fiscal quarter, and approximately $11.5 million for fiscal

year 2022, compared to approximately $46.8 million for fiscal year

2021. The decrease in gross profit volume is primarily driven by

the downturn in sales of our products, beginning in the third

quarter and continuing through the end of fiscal year 2022, which

was primarily the result of the negative impact the MDO and the

overall impact the regulatory landscape had on our business.

Additionally, the cost of the discounts, coupons and promotions

programs, that we implemented in the third quarter of fiscal year

2021 to assist in growing and retaining the customer base and store

shelf space, contributed a lower gross profit margin per unit of

products sales for that period of time, as these discounts, coupons

and promotions decreased our revenues.

Operating Expenses: Total

operating expenses for the fourth fiscal quarter ended October 31,

2022 were approximately $3.8 million, compared to approximately

$4.3 million for the prior fourth fiscal quarter, and were

approximately $15.6 million for fiscal year 2022, compared to

approximately $22.4 million for fiscal year 2021. For the fiscal

year 2022, operating expenses consisted primarily of advertising

and promotion fees of approximately $2.7 million, stock option

compensation expense of approximately $6.0 million, professional

fees of approximately $3.2 million, salaries and wages of $1.7

million, and all other general and administrative expenses of

approximately $2.0 million. In fiscal year 2021, operating expenses

consisted of advertising and promotional expenses of approximately

$3.2 million, which included commissions paid to our third-party

marketing consultant QuikfillRx, and general and administrative

expenses of approximately $10.2 million. We expect future operating

expenses to increase while we generate increased sales growth and

invest in our infrastructure to support the planned revenue and

business growth.

Net Loss: Net loss for the

fourth fiscal quarter ended October 31, 2022 was approximately

$(2.7) million, compared to approximately $(1.6) million for the

prior fourth fiscal quarter, and approximately $(14.4) million for

the full fiscal year 2022, or $(0.36) basic and diluted net loss

per share, compared to a net loss of approximately $(9.0) million,

or $(0.38) basic and diluted net loss per share, for fiscal year

2021. The increase in net loss for the fiscal year 2022, as

compared to net loss in fiscal year 2021, is attributable to the

revenue and expense factors noted above.

Cash Position: We consider all

highly liquid investments with an original maturity of three months

or less when purchased to be cash equivalents. There were no cash

equivalents on October 31, 2022, or October 31, 2021. Cash and

restricted cash on October 31, 2022, and October 31, 2021, were

$3.7 million and $7.8 million, respectively.

Restricted cash consists of cash held short-term

in escrow as required. As of October 31, 2022, and October 31,

2021, we had $0 and $65,007 in restricted cash, respectively, for

amounts held in escrow.

Additional information regarding the Company’s

results of operations for the fiscal year ended October 31, 2022

will be available in the Company’s Annual Report on Form 10-K for

such reporting period, which report will be filed with the

Securities and Exchange Commission. Readers are encouraged to

review such Annual Report in its entirety, including the risk

factors related to the Company’s business described therein.

ABOUT BIDI VAPOR

Based in Melbourne, Florida, Bidi Vapor

maintains a commitment to responsible, adult-focused marketing,

supporting age-verification standards and sustainability through

its BIDI® Cares recycling program. Bidi Vapor's premier device, the

BIDI® Stick, is a premium product made with high-quality

components, a UL-certified battery and technology designed to

deliver a consistent vaping experience for adult smokers 21 and

over. Bidi Vapor is also adamant about strict compliance with all

federal, state and local guidelines and regulations. At Bidi Vapor,

innovation is key to its mission, with the BIDI® Stick promoting

environmental sustainability, while providing a unique vaping

experience to adult smokers.

Nirajkumar Patel, the Company’s Chief Science

and Regulatory Officer and director, owns and controls Bidi Vapor.

As a result, Bidi Vapor is considered a related party of the

Company.

For more information, visit

www.bidivapor.com.

ABOUT KAIVAL BRANDS

Based in Grant, Florida, Kaival Brands is a

company focused on incubating innovative and profitable products

into mature and dominant brands, with a current focus on the

distribution of electronic nicotine delivery systems (ENDS) also

known as “e-cigarettes”. Our business plan is to seek to diversify

into distributing other nicotine and non-nicotine delivery system

products (including those related to hemp-derived cannabidiol

(known as CBD) products. Kaival Brands and Philip Morris Products

S.A. (via sublicense from Kaival Brands) are the exclusive global

distributors of all products manufactured by Bidi Vapor.

Learn more about Kaival Brands at

https://ir.kaivalbrands.com/overview/default.aspx.

Cautionary Note Regarding

Forward-Looking Statements

This press release and the statements of the

Company’s management and partners included herein and related to

the subject matter herein includes statements that constitute

“forward-looking statements” (as defined in Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended), which are statements

other than historical facts. You can identify forward-looking

statements by words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,”

“position,” “should,” “strategy,” “target,” “will,” and similar

words. All forward-looking statements speak only as of the date of

this press release. Although we believe that the plans, intentions,

and expectations reflected in or suggested by the forward-looking

statements are reasonable, there is no assurance that these plans,

intentions, or expectations will be achieved. Therefore, actual

outcomes and results (including, without limitation, the results of

the Company sales and marketing efforts and the impact of the

August 2022 11th Circuit Court of Appeals decision as described

herein) could materially and adversely differ from what is

expressed, implied, or forecasted in such statements. Our business

may be influenced by many factors that are difficult to predict,

involve uncertainties that may materially affect results, and are

often beyond our control. Factors that could cause or contribute to

such differences include, but are not limited to: (i) future

actions by the FDA in response to the 11th Circuit Court’s decision

that could impact our business and prospects, (ii) the outcome of

FDA’s scientific review of Bidi Vapor’s pending PMTAs, (iii) the

success of our agreement with Philip Morris International, (iv) how

quickly domestic and international markets adopt our products, (v)

the scope of future FDA enforcement of regulations in the ENDS

industry, (vi) the FDA’s approach to the regulation of synthetic

nicotine and its impact on our business, (vii) potential federal

and state flavor bans and other restrictions on ENDS products,

(viii) the duration and scope of the COVID-19 pandemic and impact

on the demand for the products we distribute, (ix) general economic

uncertainty in key global markets and a worsening of global

economic conditions or low levels of economic growth, (x) the

effects of steps that we could take to reduce operating costs, (xi)

our inability to generate and sustain profitable sales growth,

including sales growth in the international markets, (xii)

circumstances or developments that may make us unable to implement

or realize anticipated benefits, or that may increase the costs, of

our current and planned business initiatives, (xiii) significant

changes in our relationships with our distributors or

sub-distributors and (xiv) other factors detailed by us in our

public filings with the Securities and Exchange Commission,

including the disclosures under the heading “Risk Factors” in our

Annual Report on Form 10-K for the fiscal year ended October 31,

2022, filed with the Securities and Exchange Commission on January

27, 2023 and accessible at www.sec.gov. All forward-looking

statements included in this press release are expressly qualified

in their entirety by such cautionary statements. Except as required

under the federal securities laws and the Securities and Exchange

Commission’s rules and regulations, we do not have any intention or

obligation to update any forward-looking statements publicly,

whether as a result of new information, future events, or

otherwise.

Investor Relations:Stephen Sheriff, Director of

Communications and

AdministrationIr.kaivalbrands.cominvestors@kaivalbrands.com

-- Tables Follow –

Kaival Brands Innovations Group,

Inc.Consolidated Balance

Sheets

|

|

October 31,2022 |

|

October 31,2021 |

|

ASSETS |

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

|

Cash |

$ |

3,685,893 |

|

|

$ |

7,760,228 |

|

|

Restricted cash |

|

— |

|

|

|

65,007 |

|

|

Accounts receivable |

|

574,606 |

|

|

|

1,985,186 |

|

|

Other receivable – related parties – short term |

|

1,539,486 |

|

|

|

— |

|

|

Inventory deposit – related party |

|

— |

|

|

|

2,925,000 |

|

|

Inventories |

|

1,239,725 |

|

|

|

15,326,370 |

|

|

Prepaid expenses |

|

426,407 |

|

|

|

319,531 |

|

|

Income tax receivable |

|

1,607,302 |

|

|

|

1,753,594 |

|

| |

|

|

|

|

|

|

|

|

Total current assets |

|

9,073,419 |

|

|

|

30,134,916 |

|

| |

|

|

|

|

|

|

|

|

Other receivable – related party – net of current portion |

|

2,164,646 |

|

|

|

— |

|

|

Right of use asset- operating lease |

|

1,198,969 |

|

|

|

55,604 |

|

| |

|

|

|

|

|

|

|

| TOTAL ASSETS |

$ |

12,437,034 |

|

|

$ |

30,190,520 |

|

| |

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

40,023 |

|

|

$ |

242,829 |

|

|

Accounts payable- related party |

|

— |

|

|

|

12,667,769 |

|

|

Accrued expenses |

|

1,099,157 |

|

|

|

579,604 |

|

|

Customer deposits |

|

44,973 |

|

|

|

— |

|

|

Deferred revenue |

|

235,274 |

|

|

|

— |

|

|

Operating lease obligation, short term |

|

166,051 |

|

|

|

13,020 |

|

|

Customer refund due |

|

— |

|

|

|

316,800 |

|

|

Total current liabilities |

|

1,585,478 |

|

|

|

13,820,022 |

|

| |

|

|

|

|

|

|

|

|

LONG TERM LIABILITIES |

|

|

|

|

|

|

|

|

Operating lease obligation, net of current portion |

|

1,050,776 |

|

|

|

46,185 |

|

| |

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

$ |

2,636,254 |

|

|

$ |

13,866,207 |

|

| |

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Preferred stock 5,000,000 shares authorized; Series A Convertible

Preferred stock ($0.001 par value, 3,000,000 shares authorized, 0

and 3,000,000 shares issued and outstanding as of October 31, 2022,

and October 31, 2021, respectively) |

|

— |

|

|

|

3,000 |

|

| |

|

|

|

|

|

|

|

|

Common stock ($0.001 par value, 1,000,000,000 shares authorized,

56,169,090 and 30,195,312 issued and outstanding as of October 31,

2022, and October 31, 2021, respectively) |

|

56,169 |

|

|

|

30,195 |

|

| |

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

29,375,787 |

|

|

|

21,551,959 |

|

| |

|

|

|

|

|

|

|

|

Accumulated deficit |

|

(19,631,176 |

) |

|

|

(5,260,841 |

) |

|

Total Stockholders’ Equity |

|

9,800,780 |

|

|

|

16,324,313 |

|

| TOTAL LIABILITIES &

STOCKHOLDERS’ EQUITY |

$ |

12,437,034 |

|

|

$ |

30,190,520 |

|

The accompanying notes are an integral part

of these consolidated financial statements.

Kaival Brands Innovations Group,

Inc.Consolidated Statements of

Operations

|

|

For the YearsEnded October

31, |

|

|

2022 |

|

2021 |

|

Revenues |

|

|

|

|

|

|

|

|

Revenues, net |

$ |

12,701,539 |

|

|

$ |

59,378,208 |

|

|

Revenues – related parties |

|

68,139 |

|

|

|

154,560 |

|

|

Royalty revenue |

|

117,292 |

|

|

|

— |

|

|

Excise tax on products |

|

(125,513 |

) |

|

|

(756,338 |

) |

| Total revenues, net |

|

12,761,457 |

|

|

|

58,776,430 |

|

| |

|

|

|

|

|

|

|

| Cost of revenue |

|

|

|

|

|

|

|

|

Cost of revenue – related party |

|

11,345,912 |

|

|

|

46,528,501 |

|

|

Cost of revenue – other |

|

174,520 |

|

|

|

314,049 |

|

| Total cost of revenue |

|

11,520,432 |

|

|

|

46,842,550 |

|

| |

|

|

|

|

|

|

|

| Gross profit |

|

1,241,025 |

|

|

|

11,933,880 |

|

| |

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

Advertising and promotions |

|

2,679,308 |

|

|

|

3,195,883 |

|

|

General and administrative expenses |

|

12,950,373 |

|

|

|

19,207,028 |

|

| Total operating expenses |

|

15,629,681 |

|

|

|

22,402,911 |

|

| |

|

|

|

|

|

|

|

| Other income |

|

|

|

|

|

|

|

| Interest income |

|

4 |

|

|

|

395 |

|

| Total other income |

|

4 |

|

|

|

395 |

|

| |

|

|

|

|

|

|

|

| Loss before income taxes |

|

(14,388,652 |

) |

|

|

(10,468,636 |

) |

| |

|

|

|

|

|

|

|

| Provision (benefit) for income

taxes |

|

(18,317 |

) |

|

|

(1,435,198 |

) |

| |

|

|

|

|

|

|

|

| Net loss |

$ |

(14,370,335 |

) |

|

$ |

(9,033,438 |

) |

| |

|

|

|

|

|

|

|

| Net loss per common share –

basic and diluted |

$ |

(0.36 |

) |

|

$ |

(0.38 |

) |

| |

|

|

|

|

|

|

|

| Weighted average number of

common shares outstanding – basic and diluted |

|

39,710,389 |

|

|

|

24,000,246 |

|

The accompanying notes are an integral part of

these consolidated financial statements.

|

Kaival Brands Innovations Group, Inc. |

|

Consolidated Statements of Changes in Stockholders’

Equity |

|

For the years ended October 31, 2022 and 2021 |

|

|

Convertible Preferred Shares |

|

Par Value Convertible Preferred Shares |

|

Common Shares |

|

Par Value Common Shares |

|

Additional Paid-in Capital |

|

Accumulated Deficit |

|

Total |

|

|

(Series A) |

|

(Series A) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balances, October 31,

2020 |

3,000,000 |

|

|

$ |

3,000 |

|

|

23,106,886 |

|

|

$ |

23,107 |

|

|

$ |

618,904 |

|

|

$ |

3,772,597 |

|

|

$ |

4,417,608 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock issued for services –

RSUs |

— |

|

|

|

— |

|

|

221,666 |

|

|

|

221 |

|

|

|

505,100 |

|

|

|

— |

|

|

|

505,321 |

|

| Common stock settled and

canceled |

— |

|

|

|

— |

|

|

(92,871 |

) |

|

|

(93 |

) |

|

|

(254,017 |

) |

|

|

— |

|

|

|

(254,110 |

) |

| Common stock issued for

compensation |

— |

|

|

|

— |

|

|

674,803 |

|

|

|

675 |

|

|

|

8,943,425 |

|

|

|

— |

|

|

|

8,944,100 |

|

| Stock option expense |

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

1,773,947 |

|

|

|

— |

|

|

|

1,773,947 |

|

| Common stock issued for cash,

net of financing cost |

— |

|

|

|

— |

|

|

5,405,000 |

|

|

|

5,405 |

|

|

|

8,300,367 |

|

|

|

— |

|

|

|

8,305,772 |

|

| Common stock issued for

warrant exercise |

— |

|

|

|

— |

|

|

879,828 |

|

|

|

880 |

|

|

|

1,664,233 |

|

|

|

— |

|

|

|

1,665,113 |

|

| Net loss |

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(9,033,438 |

) |

|

|

(9,033,438 |

) |

| Balances, October 31,

2021 |

3,000,000 |

|

|

$ |

3,000 |

|

|

30,195,312 |

|

|

$ |

30,195 |

|

|

$ |

21,551,959 |

|

|

$ |

(5,260,841 |

) |

|

$ |

16,324,313 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock issued for services –

RSUs |

— |

|

|

|

— |

|

|

123,256 |

|

|

|

123 |

|

|

|

172,256 |

|

|

|

— |

|

|

|

172,379 |

|

| Common shares settled and

cancelled |

— |

|

|

|

— |

|

|

(44,720 |

) |

|

|

(45 |

) |

|

|

(59,817 |

) |

|

|

— |

|

|

|

(59,862 |

) |

| Common stock issued for

compensation |

— |

|

|

|

— |

|

|

39,637 |

|

|

|

40 |

|

|

|

65,283 |

|

|

|

— |

|

|

|

65,323 |

|

| Exercise of common stock

warrants |

— |

|

|

|

— |

|

|

855,605 |

|

|

|

856 |

|

|

|

1,624,794 |

|

|

|

— |

|

|

|

1,625,650 |

|

| Converted Series A Convertible

Preferred Stock |

(3,000,000 |

) |

|

|

(3,000 |

) |

|

25,000,000 |

|

|

|

25,000 |

|

|

|

(22,000 |

) |

|

|

— |

|

|

|

— |

|

| Stock option expense |

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

6,043,312 |

|

|

|

— |

|

|

|

6,043,312 |

|

| Net loss |

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(14,370,335 |

) |

|

|

(14,370,335 |

) |

| Balances, October 31,

2022 |

— |

|

|

$ |

— |

|

|

56,169,090 |

|

|

$ |

56,169 |

|

|

$ |

29,375,787 |

|

|

$ |

(19,631,176 |

) |

|

$ |

9,800,780 |

|

The accompanying notes are an integral part of

these consolidated financial statements.

Kaival Brands Innovations Group,

Inc.Consolidated Statements of Cash

Flows

|

|

For the Year Ended |

|

For the Year Ended |

|

|

October 31, 2022 |

|

October 31, 2021 |

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

Net loss |

$ |

(14,370,335 |

) |

|

$ |

(9,033,438 |

) |

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

Stock based compensation |

|

237,702 |

|

|

|

9,449,421 |

|

|

Stock options expense |

|

6,043,312 |

|

|

|

1,773,947 |

|

|

ROU operating lease expense |

|

132,890 |

|

|

|

14,529 |

|

|

Write off of inventory |

|

259,563 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

Changes in current assets and liabilities: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Accounts receivable |

|

1,410,580 |

|

|

|

(583,624 |

) |

|

Other receivable – related party |

|

(3,704,132 |

) |

|

|

15,360 |

|

|

Prepaid expenses |

|

(106,876 |

) |

|

|

(319,531 |

) |

|

Inventory |

|

13,827,082 |

|

|

|

(15,319,987 |

) |

|

Inventory deposit – related party |

|

2,925,000 |

|

|

|

(2,925,000 |

) |

|

Income tax receivable |

|

146,292 |

|

|

|

(1,753,594 |

) |

|

Accounts payable |

|

(202,806 |

) |

|

|

242,829 |

|

|

Accounts payable – related party |

|

(12,667,769 |

) |

|

|

11,258,208 |

|

|

Accrued expenses |

|

519,553 |

|

|

|

(482,501 |

) |

|

Deferred revenue |

|

235,274 |

|

|

|

(623,096 |

) |

|

Income tax accrual |

|

— |

|

|

|

(1,331,856 |

) |

|

Customer deposits |

|

44,973 |

|

|

|

— |

|

|

Customer refund due |

|

(316,800 |

) |

|

|

316,800 |

|

|

Payments on operating lease liability |

|

(118,633 |

) |

|

|

(11,708 |

) |

| Net cash used in operating

activities |

|

(5,705,130 |

) |

|

|

(9,313,241 |

) |

| |

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

| Common stock issued for cash,

net of financing cost |

|

— |

|

|

|

8,305,772 |

|

| Proceeds from the exercise of

warrants |

|

1,625,650 |

|

|

|

1,665,113 |

|

| Settled RSU shares with

cash |

|

(59,862 |

) |

|

|

(254,110 |

) |

| Net cash provided by financing

activities |

|

1,565,788 |

|

|

|

9,716,775 |

|

| |

|

|

|

|

|

|

|

| Net change in cash and

restricted cash |

$ |

(4,139,342 |

) |

|

$ |

403,534 |

|

| Beginning cash and restricted

cash balance |

|

7,825,235 |

|

|

|

7,421,701 |

|

| Ending cash and restricted

cash balance |

$ |

3,685,893 |

|

|

$ |

7,825,235 |

|

| |

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURES OF

CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

| Interest paid |

$ |

— |

|

|

$ |

— |

|

| Income taxes paid |

$ |

— |

|

|

$ |

1,637,102 |

|

| |

|

|

|

|

|

|

|

| NON-CASH INVESTING AND

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

| Conversion of Series A

Preferred Stock Shares to Common Stock Shares |

$ |

25,000 |

|

|

$ |

— |

|

| ROU asset and operating lease

obligation recognized under Topic 842 |

$ |

1,276,255 |

|

|

$ |

— |

|

The accompanying notes are an

integral part of these consolidated financial statements.

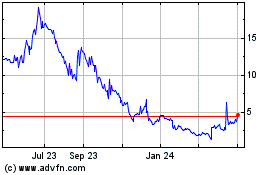

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Mar 2024 to Apr 2024

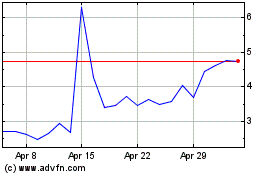

Kaival Brands Innovations (NASDAQ:KAVL)

Historical Stock Chart

From Apr 2023 to Apr 2024