Current Report Filing (8-k)

March 23 2023 - 4:03PM

Edgar (US Regulatory)

0000828146

false

0000828146

2023-03-17

2023-03-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event

Reported): March 17, 2023

INTERLINK ELECTRONICS, INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada |

001-37659 |

77-0056625 |

| (State or Other Jurisdiction |

(Commission |

(IRS Employer |

| of Incorporation) |

File Number) |

Identification No.) |

| |

1 Jenner, Suite 200 |

|

| |

Irvine, California |

92618 |

| |

(Address of Principal Executive Offices) |

(Zip Code) |

(805) 484-8855

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c)) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.001 par value |

|

LINK |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

Reference is made to the description of the Purchase Agreement (as

defined below) under Item 2.01 of this Current Report on Form 8-K (this “Report”), which description is incorporated

by reference into this Item 1.01.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

On March 17, 2023, Interlink Electronics, Inc., a Nevada

corporation (“Interlink” or the “Company”), acquired all of the outstanding shares in Calman Technology Limited,

a corporation organized under the laws of the United Kingdom (“Calman”), pursuant to a Share Purchase Agreement (the “Purchase

Agreement”) by and among the Company and the shareholders of Calman (the “Transaction”). Calman, based outside Glasgow,

Scotland, has over 25 years of experience in the design and manufacture of membrane keypads, graphic overlays and printed electronics.

The Purchase Agreement contains customary representations, warranties and covenants, including non-competition covenants on the part of

the sellers, who will continue to be employed by Calman.

Under the terms of the Purchase Agreement, the purchase price is GB£4,127,000

(approximately $4,998,000), of which GB£3,627,000 (approximately $4,392,000) was paid at closing and the balance is being held back

for up to nine months against claims for breaches of representations and warranties (subject to certain deductibles and caps). The purchase

price is subject to adjustment based on the extent if any to which Calman’s net working capital is more or less than GB£600,000 (approximately $727,000).

The foregoing description of the Purchase Agreement and the Transaction

does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, a copy of which is filed as Exhibit 2.1

hereto and is incorporated herein by reference. The representations, warranties, and covenants made by the parties in the Purchase Agreement:

(a) were made solely for the benefit of the parties to the Purchase Agreement; (b) are subject to limitations agreed upon by

the contracting parties, including being qualified by confidential disclosure schedules; (c) may have been made for the purposes

of allocating contractual risk between the parties to the Purchase Agreement instead of establishing matters as facts; and (d) are

subject to the standards of materiality applicable to the contracting parties that may differ from those applicable to investors. Investors

should not rely on any representations, warranties, or covenants contained in the Purchase Agreement, or any descriptions thereof, as

characterizations of the actual state of facts or conditions of Interlink, Calman, the sellers or any of their respective subsidiaries

or affiliates. Information concerning the subject-matter of any such representations, warranties, and covenants may change after the date

of the Purchase Agreement. Accordingly, investors should read the representations and warranties in the Purchase Agreement not in isolation,

but only in conjunction with the other information about the Company that it includes in reports, statements, and other filings it makes

with the Securities and Exchange Commission.

| Item 7.01 | Regulation F-D Disclosure. |

On March 20, 2023, the Company issued a press release announcing

entry into the Purchase Agreement and the Transaction described in Item 1.01 of this Form 8-K. A copy of the press release is furnished

as Exhibit 99.1 to this Form 8-K and is incorporated by reference herein. The information in such press release shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any registration statement

or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

| (a) | Financial statements of businesses or funds acquired. |

The financial statements required by Item 9.01(a) of

Form 8-K are not included in this Current Report on Form 8-K. The Company intends to file these financial statements by an amendment

within the timeframe permitted by Item 9.01(a).

| (b) | Pro forma financial information. |

The pro forma financial data required by Item 9.01(b) of

Form 8-K are not included in this Current Report on Form 8-K. The Company intends to file this pro forma financial information

by an amendment within the timeframe permitted by Item 9.01(b).

*Schedules and exhibits omitted pursuant to Item 601(b)(2) of

Regulation S-K. Interlink will furnish supplementally a copy of any omitted schedule or exhibit to the SEC upon request. Interlink may

request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedules or exhibits

so furnished.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: March 23, 2023 |

INTERLINK ELECTRONICS, INC. |

| |

|

| |

|

|

| |

By: |

/s/ Ryan J. Hoffman |

| |

|

Ryan J. Hoffman |

| |

|

Chief Financial Officer |

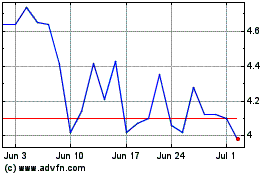

Interlink Electronics (NASDAQ:LINK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Interlink Electronics (NASDAQ:LINK)

Historical Stock Chart

From Apr 2023 to Apr 2024