Current Report Filing (8-k)

November 16 2021 - 8:01AM

Edgar (US Regulatory)

0000837852

false

0000837852

2021-11-15

2021-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 15, 2021

IDEANOMICS, INC.

(Exact name of registrant as specified

in its charter)

|

Nevada

|

20-1778374

|

|

(State or other jurisdiction

|

(IRS Employer

|

|

of incorporation)

|

Identification No.)

|

001-35561

(Commission File Number)

1441 Broadway, Suite 5116, New York, NY 10018

(Address of principal executive offices)

(Zip Code)

212-206-1216

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.001 par value per share

|

IDEX

|

The

Nasdaq Stock Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item

4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

(b)

On November 15, 2021, Ideanomics, Inc. (the “Company,” “our,” or “us”) has determined that a

restatement of our previously issued financial statements contained in our Quarterly Reports on Form 10-Q for the fiscal quarters

ended March 31, 2021 and June 30, 2021, respectively, would be required, to correct the revenue reported by our affiliate Timios

Holding Corp. (“Timios”), that provides title and agency services. The aggregate amount of the restatement is estimated

to be approximately $5.3 million for the aforesaid fiscal quarters. The restatement is expected to impact revenues in the title and

agency business. The impact of the restatement is estimated to lower gross revenues recorded in each of the fiscal quarters ended

March 31, 2021 and June 30, 2021 by approximately $2.9 million and $2.4 million, respectively, with an offsetting reduction in

cost of goods sold, without any change to our previously reported gross profit.

We

intend to file an amendment to our (i) Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2021, originally filed with

the Securities and Exchange Commission (the “SEC”) on May 17, 2021 and (ii) Quarterly Report on Form 10-Q for the fiscal

quarter ended June 30, 2021, originally filed with the SEC on August 16, 2021 to amend and restate financial statements and other financial

information. Accordingly, our previously issued financial statements contained in our Quarterly Report on Form 10-Q for the period ended

March 31, 2021 and Quarterly Report on Form 10-Q for the period ending June 30, 2021 should no longer be relied upon. Our management

discussed with BDO USA, LLP (“BDO”) the matters disclosed in this Item 4.02(b) on November 14, 2021.

The

restatements are expected to have an impact on the financial statements for the fiscal quarter ended March 31, 2021 and for the fiscal

quarter ended June 30, 2021, as previously filed, with changes reflected in the relevant financial statements, due to changes in accounting

treatment of revenues. No changes due to the restatement are expected to have any impact on our gross profit because revenues in the

title and agency business will be lower by approximately $5.3 million with an offsetting reduction in cost of goods sold.

Management

and our officers have consulted with the Company’s new auditor, BDO regarding the matters disclosed in this Current Report on Form

8-K (this “8-K”) in reaching the conclusion to restate the financial statements for the above noted periods.

(c)

We provided BDO with a copy of the statements set forth in Item

4.02(b) of this 8-K prior to the filing of this 8-K with the SEC. We requested that BDO furnish us with a letter addressed

to the SEC stating whether BDO agrees with the above statements as required by SEC rules. BDO has furnished the requested letter,

and it is attached hereto as Exhibit 7.01.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

Ideanomics, Inc.

|

|

|

|

|

|

Date: November 15, 2021

|

By:

|

/s/ Alfred P.

Poor

|

|

|

|

Alfred P. Poor

|

|

|

|

Chief Executive Officer

|

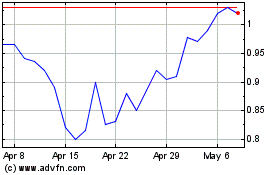

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

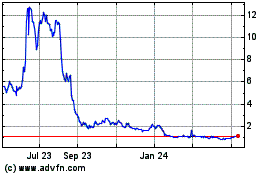

Ideanomics (NASDAQ:IDEX)

Historical Stock Chart

From Apr 2023 to Apr 2024