HomeStreet Enters Into Share Purchase Agreement with Blue Lion Capital

July 11 2019 - 9:00AM

Business Wire

HomeStreet, Inc. (Nasdaq: HMST) (“the Company” or

(“HomeStreet”), the parent company of HomeStreet Bank, today

announced that it has entered into a share purchase agreement (the

“Share Purchase Agreement”) with Blue Lion Opportunity Master Fund,

L.P., Roaring Blue Lion Capital Management, L.P., Roaring Blue

Lion, LLC, BLOF II LP, Charles W. Griege, Jr. and Ronald K.

Tanemura (collectively, the “Blue Lion Group”), which together

beneficially owns approximately 6.48% of the Company’s common

stock.

Under the Share Purchase Agreement, the Blue Lion Group will

sell all of its 1,692,401 shares of HomeStreet’s common stock to

the Company for $31.16 per share, which price represents the

five-day volume weighted average price prior to the date of the

Company’s 2019 annual meeting, for an aggregate purchase price of

approximately $52.7 million.

The Share Purchase Agreement is in addition to the Company’s

previously announced share repurchase program authorizing the

repurchase of up to $75 million shares of the Company’s common

stock and separately approved by the Company’s Board of Directors.

Following the closing of the Share Purchase Agreement, combined

with recent open market repurchases, the Company will have spent

approximately $81.1 million on share repurchases to date and will

have repurchased approximately 9.82% of its shares outstanding. Due

to the size of the Share Purchase Agreement, the Company has

terminated its share repurchase program.

In addition, the Blue Lion Group has agreed to abide by certain

standstill provisions for three years from the date of the Share

Purchase Agreement. The Company and the Blue Lion Group have also

agreed to other customary provisions, including mutual

non-disparagement clauses, releases of claims, and covenants not to

sue during the term of the Share Purchase Agreement.

Mark K. Mason, HomeStreet’s Chairman of the Board, President,

and Chief Executive Officer, said, “We are pleased to have reached

this amicable resolution with Blue Lion Capital following our 2019

annual meeting. Our company has made a tremendous amount of

progress in the past year as we continue to transform HomeStreet

into a leading West Coast regional commercial bank, and moving

forward we are fully focused on executing this strategy and

realizing long-term value for our shareholders.”

Sidley Austin LLP is serving as legal advisor to HomeStreet and

Schulte Roth & Zabel LLP is serving as outside counsel to Blue

Lion Capital.

About HomeStreet, Inc.

HomeStreet, Inc. (Nasdaq: HMST) (the “Company”) is a diversified

financial services company headquartered in Seattle, Washington,

serving consumers and businesses in the Western United States and

Hawaii through its various operating subsidiaries. The Company’s

primary business is community banking, including: commercial real

estate lending, commercial lending, residential construction

lending, single family residential lending, retail banking, private

banking, investment, and insurance services. Its principal

subsidiaries are HomeStreet Bank and HomeStreet Capital

Corporation. Certain information about our business can be found on

our investor relations web site, located at

http://ir.homestreet.com.

Forward-Looking

Statements

This release, as well as other information provided from time to

time by the Company or its employees, may contain forward-looking

statements that involve risks and uncertainties that could cause

actual results to differ materially from those anticipated in the

forward-looking statements. Forward-looking statements give the

Company's current beliefs, expectations and intentions regarding

future events. You can identify forward-looking statements by the

fact that they do not relate strictly to historical or current

facts. These statements may include words such as “anticipate,”

“believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “should,” “will” and “would” and similar expressions

(including the negative of these terms). These forward-looking

statements involve risks, uncertainties (some of which are beyond

the Company's control) and assumptions. Although we believe that

expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity,

performance or achievements. The Company intends these

forward-looking statements to speak only at the time of this

release and the Company does not undertake to update or revise

these statements as more information becomes available, except as

required under federal securities laws and the rules and

regulations of the SEC. Please refer to the risk factors discussed

in the Company’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2018 and subsequent periodic and current reports

filed with the SEC (each of which can be found at the SEC’s website

www.sec.gov), as well as other factors described from time to time

in the Company’s filings with the SEC. Any forward-looking

statement made by the Company in this release speaks only as of the

date on which it is made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190711005254/en/

Investor Relations: Gerhard Erdelji, 206-515-4039

gerhard.erdelji@homestreet.com Media Relations:

Sloane & Company Dan Zacchei/Joe Germani, 212-486-9500

Dzacchei@sloanepr.com /

Jgermani@sloanepr.com

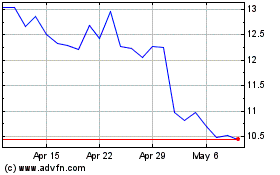

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Mar 2024 to Apr 2024

HomeStreet (NASDAQ:HMST)

Historical Stock Chart

From Apr 2023 to Apr 2024