0001892480true

Hempacco Co., Inc. (the “Company”) is filing this amendment on Form 10-Q/A for the quarter ended September 30, 2022, to amend the Quarterly Report on Form 10-Q that was originally filed on November 15, 2022 (the "Original 10-Q") to provide the required interactive data files in connection with the Company’s financial statements and to make other minor changes to the Original 10-Q. 00001000000084780002337321300800000000000847800000000000196955320.7516803970200001293620000thirty months56592one year49445933330900018924802022-01-012022-09-300001892480hpco:HempaccoMember2022-02-090001892480hpco:StickItLabsLtdMember2022-01-012022-01-310001892480hpco:CheechAndChongsCannabisCompanyMember2022-01-012022-01-310001892480us-gaap:SubsequentEventMemberhpco:AlfalfaHoldingsLLCMember2022-10-012022-10-120001892480us-gaap:SubsequentEventMemberhpco:SonoraPaperCoIncMember2022-10-012022-10-120001892480us-gaap:SubsequentEventMemberhpco:HighSierraTechnologiesIncMember2022-10-012022-10-120001892480us-gaap:SubsequentEventMember2022-10-012022-10-040001892480us-gaap:SubsequentEventMember2022-10-012022-10-1200018924802022-01-060001892480hpco:GGIIAndRelatedEntitiesMember2022-09-300001892480hpco:NorthEquitiesCorpMember2022-09-012022-09-170001892480hpco:BousteadSecuritiesLLCMember2022-09-060001892480hpco:SeptemberOneTwoZeroTwentyTwoMemberhpco:BousteadSecuritiesLLCMember2022-09-300001892480hpco:SeptemberOneTwoZeroTwentyTwoMemberhpco:BousteadSecuritiesLLCMember2022-01-012022-09-300001892480hpco:SeptemberOneTwoZeroTwentyTwoMemberhpco:BousteadSecuritiesLLCMember2021-12-012021-12-1400018924802022-07-1500018924802022-07-012022-07-1500018924802021-04-070001892480hpco:FamilyTrustOfJerryHalamudaMember2021-12-012021-12-140001892480hpco:FamilyTrustOfJerryHalamudaMember2021-12-140001892480hpco:CFOAndDrStuartTitusMember2022-01-012022-09-300001892480hpco:CFOAndDrStuartTitusMember2021-12-060001892480hpco:CFOAndDrStuartTitusMember2021-12-012021-12-0600018924802021-08-012021-08-110001892480hpco:GGIIWarrantsMember2021-05-210001892480hpco:MexicoFranchiseOpportunitiesFundMember2021-05-012021-05-210001892480hpco:ConsultantMember2021-05-012021-05-2100018924802021-09-280001892480hpco:GGIICommonStockMemberhpco:ConsultantMember2021-05-012021-05-210001892480hpco:MexicoFranchiseOpportunitiesFundMember2021-05-200001892480hpco:MexicoFranchiseOpportunitiesFundMember2021-05-012021-05-200001892480hpco:HempaccoSeriesAPreferredSharesMember2021-05-012021-05-2000018924802021-04-012021-04-070001892480hpco:Cube17INCMember2020-12-310001892480hpco:USTMexicoIncMember2020-01-012020-12-310001892480hpco:USTMexicoIncMember2021-01-012021-12-310001892480hpco:GreenGlobeInternationalIncMember2022-01-012022-09-300001892480hpco:GreenGlobeInternationalIncMember2022-03-012022-09-300001892480hpco:LakeComoMember2021-12-310001892480hpco:LakeComoMember2022-09-300001892480hpco:USTMexicoIncMember2021-01-012021-09-300001892480hpco:USTMexicoIncMember2022-01-012022-09-300001892480hpco:StrategicGlobalPartnersIncMember2022-09-300001892480hpco:StrategicGlobalPartnersIncMember2021-12-310001892480hpco:StrategicGlobalPartnersIncMember2021-01-012021-09-300001892480hpco:StrategicGlobalPartnersIncMember2022-01-012022-09-300001892480hpco:StrategicGlobalPartnersIncMember2021-05-012021-05-210001892480hpco:StrategicGlobalPartnersIncMember2021-05-012021-05-310001892480hpco:PrimusLogisticsMember2021-05-210001892480hpco:PrimusLogisticsMember2021-05-012021-05-210001892480hpco:GreenGlobeInternationalIncMember2021-05-012021-05-210001892480hpco:Cube17INCMember2021-12-310001892480hpco:Cube17INCMember2022-03-310001892480hpco:Cube17INCMember2021-01-012021-03-310001892480hpco:Cube17INCMember2022-01-012022-03-310001892480hpco:Cube17INCMember2021-05-012021-05-210001892480hpco:Cube17INCMember2021-05-210001892480hpco:Cube17INCMember2021-05-012021-05-310001892480hpco:USTMexicoIncMember2020-12-310001892480hpco:PrimusLogisticsMember2020-12-310001892480hpco:GreenGlobeInternationalIncMember2022-09-300001892480hpco:PrimusLogisticsMember2021-12-310001892480hpco:PrimusLogisticsMember2022-09-300001892480hpco:USTMexicoIncMember2021-12-310001892480hpco:USTMexicoIncMember2022-09-300001892480hpco:ThirdPartyLoanAgreementMember2022-01-012022-09-300001892480hpco:ThirdPartyLoanAgreementMember2021-12-310001892480hpco:ThirdPartyLoanAgreementMember2022-09-300001892480hpco:ThirdPartyLoanAgreementMember2020-06-012020-06-150001892480hpco:ThirdPartyLoanAgreementMember2021-01-012021-01-150001892480hpco:BrockerRepresentationAgreementsMember2021-08-012021-08-110001892480hpco:GGIIWarrantsMember2021-08-012021-08-110001892480hpco:GGIIWarrantsMember2021-06-090001892480hpco:HempaccoWarrantsMember2021-03-012021-03-310001892480hpco:HempaccoWarrantsMember2021-02-280001892480hpco:BrockerRepresentationAgreementsMember2021-11-230001892480srt:MinimumMemberhpco:WarrantsMember2021-01-012021-12-310001892480srt:MaximumMemberhpco:WarrantsMember2021-12-310001892480srt:MinimumMemberhpco:WarrantsMember2022-01-012022-09-300001892480srt:MaximumMemberhpco:WarrantsMember2022-01-012022-09-300001892480srt:MaximumMemberhpco:WarrantsMember2022-09-300001892480srt:MinimumMemberhpco:WarrantsMember2022-09-300001892480srt:MinimumMemberhpco:WarrantsMember2021-12-310001892480hpco:WarrantsMember2022-01-012022-09-300001892480hpco:WarrantsMember2021-01-012021-12-310001892480srt:MaximumMemberhpco:WarrantsMember2021-01-012021-12-310001892480hpco:ConvertiblePromissoryNotesMember2020-06-012020-06-300001892480hpco:ConvertiblePromissoryNotesMember2022-06-012022-06-180001892480hpco:ConvertiblePromissoryNotesMember2022-03-012022-03-180001892480hpco:ConvertiblePromissoryNotesMember2022-03-180001892480hpco:ConvertiblePromissoryNotesMember2020-07-230001892480hpco:ConvertiblePromissoryNotesMember2020-12-310001892480hpco:ConvertiblePromissoryNotesMember2021-02-160001892480hpco:RelatedPartyMember2020-12-310001892480hpco:RelatedPartyMember2020-06-300001892480hpco:RelatedPartyMember2022-06-070001892480hpco:RelatedPartyMember2020-02-012020-02-170001892480hpco:RelatedPartyMember2020-02-170001892480hpco:ConvertiblePromissoryNotesMember2022-06-070001892480hpco:ConvertiblePromissoryNotesMember2021-01-012021-12-310001892480hpco:ConvertiblePromissoryNotesMember2021-05-210001892480hpco:ConvertiblePromissoryNotesMember2021-12-310001892480hpco:ConvertiblePromissoryNotesMember2021-05-012021-06-210001892480hpco:ConvertiblePromissoryNotesMember2020-07-012020-07-230001892480hpco:ConvertiblePromissoryNotesMember2021-02-012021-02-160001892480us-gaap:ShortTermDebtMember2020-01-012020-12-310001892480us-gaap:ShortTermDebtMember2020-12-310001892480us-gaap:ShortTermDebtMember2021-12-310001892480us-gaap:ShortTermDebtMember2022-09-012022-09-060001892480us-gaap:ShortTermDebtMember2022-01-012022-01-060001892480us-gaap:ShortTermDebtMember2021-01-012021-12-310001892480us-gaap:ShortTermDebtMember2022-09-300001892480us-gaap:ShortTermDebtMember2019-12-012019-12-110001892480us-gaap:ShortTermDebtMember2019-12-110001892480hpco:OperatingLeaseMember2020-01-012020-12-310001892480hpco:OperatingLeaseMember2021-01-012021-09-300001892480hpco:OperatingLeaseMember2022-09-300001892480hpco:OperatingLeaseMember2021-01-012021-12-310001892480hpco:OperatingLeaseMember2021-12-310001892480hpco:OperatingLeaseMember2020-12-310001892480hpco:OperatingLeaseMember2022-01-012022-09-300001892480hpco:KiosksPlusImprovementsMember2022-09-300001892480us-gaap:LeaseholdImprovementsMember2022-09-300001892480hpco:ProductionEquipmentMember2022-09-300001892480hpco:KiosksPlusImprovementsMember2020-12-310001892480us-gaap:LeaseholdImprovementsMember2020-12-310001892480hpco:KiosksPlusImprovementsMember2021-12-310001892480us-gaap:LeaseholdImprovementsMember2021-12-310001892480hpco:ProductionEquipmentMember2021-12-310001892480hpco:ProductionEquipmentMember2020-12-310001892480hpco:CustomerMember2021-12-310001892480hpco:Customer3Member2022-09-300001892480hpco:Customer3Member2021-12-310001892480hpco:Customer3Member2022-01-012022-09-300001892480hpco:Customer2Member2021-12-310001892480hpco:Customer2Member2022-09-300001892480hpco:CustomerMember2022-09-300001892480hpco:CustomerMember2022-01-012022-09-300001892480hpco:ProductionEquipmentMember2021-01-012021-12-310001892480us-gaap:LeaseholdImprovementsMember2021-01-012021-12-310001892480hpco:KiosksMember2021-01-012021-12-310001892480us-gaap:ConvertibleNotesPayableMember2020-01-012020-12-310001892480us-gaap:ConvertibleNotesPayableMember2021-01-012021-12-310001892480us-gaap:ConvertibleNotesPayableMember2021-01-012021-09-300001892480us-gaap:ConvertibleNotesPayableMember2022-01-012022-09-300001892480hpco:StickItUSSecondMember2022-09-120001892480hpco:StickItUSMember2022-09-012022-09-120001892480hpco:StickItUSFirstMember2022-09-120001892480hpco:StickItUSMember2022-09-120001892480hpco:StickItUSSecondMember2022-01-012022-09-300001892480hpco:StickItUSFirstMember2022-01-012022-09-300001892480hpco:SecondJVagreementMember2022-01-012022-09-300001892480hpco:FirstJVAgreementMember2022-01-012022-09-300001892480hpco:GreenGlobeInternationMember2022-01-012022-09-300001892480hpco:GreenGlobeInternationMember2022-09-3000018924802022-09-012022-09-1200018924802022-01-052022-01-1900018924802022-01-012022-01-2000018924802022-08-2900018924802022-01-032022-01-040001892480hpco:JointVentureAgreementMember2022-09-3000018924802022-08-012022-08-290001892480hpco:OneSeptemberTwoThousandTwentyTwoMember2022-01-012022-09-300001892480us-gaap:NoncontrollingInterestMember2022-07-012022-09-300001892480us-gaap:RetainedEarningsMember2022-07-012022-09-300001892480us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001892480us-gaap:PreferredStockMember2022-07-012022-09-300001892480us-gaap:CommonStockMember2022-07-012022-09-3000018924802022-06-300001892480us-gaap:NoncontrollingInterestMember2022-06-300001892480us-gaap:RetainedEarningsMember2022-06-300001892480us-gaap:AdditionalPaidInCapitalMember2022-06-300001892480us-gaap:CommonStockMember2022-06-300001892480us-gaap:PreferredStockMember2022-06-300001892480us-gaap:NoncontrollingInterestMember2022-09-300001892480us-gaap:RetainedEarningsMember2022-09-300001892480us-gaap:AdditionalPaidInCapitalMember2022-09-300001892480us-gaap:CommonStockMember2022-09-300001892480us-gaap:PreferredStockMember2022-09-300001892480us-gaap:NoncontrollingInterestMember2022-01-012022-09-300001892480us-gaap:RetainedEarningsMember2022-01-012022-09-300001892480us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001892480us-gaap:CommonStockMember2022-01-012022-09-300001892480us-gaap:PreferredStockMember2022-01-012022-09-300001892480us-gaap:NoncontrollingInterestMember2021-07-012021-09-300001892480us-gaap:RetainedEarningsMember2021-07-012021-09-300001892480us-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300001892480us-gaap:CommonStockMember2021-07-012021-09-300001892480us-gaap:PreferredStockMember2021-07-012021-09-3000018924802021-06-300001892480us-gaap:NoncontrollingInterestMember2021-06-300001892480us-gaap:RetainedEarningsMember2021-06-300001892480us-gaap:AdditionalPaidInCapitalMember2021-06-300001892480us-gaap:CommonStockMember2021-06-300001892480us-gaap:PreferredStockMember2021-06-3000018924802021-09-300001892480us-gaap:NoncontrollingInterestMember2021-09-300001892480us-gaap:RetainedEarningsMember2021-09-300001892480us-gaap:AdditionalPaidInCapitalMember2021-09-300001892480us-gaap:CommonStockMember2021-09-300001892480us-gaap:PreferredStockMember2021-09-300001892480us-gaap:NoncontrollingInterestMember2021-01-012021-09-300001892480us-gaap:RetainedEarningsMember2021-01-012021-09-300001892480us-gaap:AdditionalPaidInCapitalMember2021-01-012021-09-300001892480us-gaap:CommonStockMember2021-01-012021-09-300001892480us-gaap:PreferredStockMember2021-01-012021-09-300001892480us-gaap:NoncontrollingInterestMember2021-12-310001892480us-gaap:RetainedEarningsMember2021-12-310001892480us-gaap:AdditionalPaidInCapitalMember2021-12-310001892480us-gaap:CommonStockMember2021-12-310001892480us-gaap:PreferredStockMember2021-12-310001892480us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001892480us-gaap:RetainedEarningsMember2021-01-012021-12-310001892480us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001892480us-gaap:CommonStockMember2021-01-012021-12-310001892480us-gaap:PreferredStockMember2021-01-012021-12-310001892480us-gaap:NoncontrollingInterestMember2020-12-310001892480us-gaap:RetainedEarningsMember2020-12-310001892480us-gaap:AdditionalPaidInCapitalMember2020-12-310001892480us-gaap:CommonStockMember2020-12-310001892480us-gaap:PreferredStockMember2020-12-310001892480us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001892480us-gaap:RetainedEarningsMember2020-01-012020-12-310001892480us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001892480us-gaap:CommonStockMember2020-01-012020-12-310001892480us-gaap:PreferredStockMember2020-01-012020-12-3100018924802019-12-310001892480us-gaap:NoncontrollingInterestMember2019-12-310001892480us-gaap:RetainedEarningsMember2019-12-310001892480us-gaap:AdditionalPaidInCapitalMember2019-12-310001892480us-gaap:CommonStockMember2019-12-310001892480us-gaap:PreferredStockMember2019-12-3100018924802021-01-012021-09-3000018924802021-01-012021-12-3100018924802020-01-012020-12-3100018924802021-07-012021-09-3000018924802022-07-012022-09-300001892480us-gaap:SeriesAPreferredStockMember2021-12-310001892480us-gaap:SeriesAPreferredStockMember2020-12-310001892480us-gaap:SeriesAPreferredStockMember2022-09-3000018924802020-12-3100018924802021-12-3100018924802022-09-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:sqftutr:acrehpco:integer

As filed with the Securities and Exchange Commission on February 3, 2023

Registration No. 333-_____

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Hempacco Co., Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 2111 | | 83-4231457 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

9925 Airway Road,

San Diego, CA, 92154

(619) 779-0715

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Sandro Piancone

Chief Executive Officer

9925 Airway Road,

San Diego, CA, 92154

(619) 779-0715

(Names, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Lance Brunson, Esq. Callie Tempest Jones, Esq. Brunson Chandler & Jones, PLLC Walker Center 175 S. Main Street, Suite 1410 Salt Lake City, UT 84111 (801) 303-5737 | Louis A. Bevilacqua, Esq. Bevilacqua PLLC 1050 Connecticut Avenue, NW, Suite 500 Washington, DC 20036 (202) 869-0888 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for comply with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 3, 2023

PRELIMINARY PROSPECTUS

Hempacco Co., Inc.

4,729,729 Shares of Common Stock

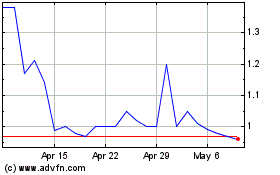

We are offering up to 4,729,729 shares of our common stock in a firm commitment public offering. We currently estimate that the public offering price will be $1.11 per share.

Our common stock is listed on the Nasdaq Capital Market under the symbol "HPCO." On February 2, 2023, the last reported sale price of our common stock on the Nasdaq Capital Market was $1.11 per share.

After completion of this offering, investors in the offering will own approximately 16.8% of our outstanding shares of common stock, other investors will own approximately 20.8% of our outstanding shares of common stock, and approximately 62.4% of our outstanding common stock will be owned by Green Globe International, Inc., a Delaware corporation. Accordingly, we are a “controlled company” under Nasdaq corporate governance rules and are eligible for certain exemptions from these rules, though we do not intend to rely on any such exemptions. See “Risk Factors – We will be a ‘controlled company’ within the meaning of the listing rules of Nasdaq and, as a result, can rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies” on page 24 for more information.

Investing in our common stock involves a high degree of risk. See the section of this prospectus entitled "Risk Factors" beginning on page 11 for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the United States Securities and Exchange Commission (the "SEC") nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | PER SHARE | | | TOTAL (4) | |

Public offering price(1) | | $ | 1.11 | | | $ | 5,249,999 | |

Underwriting discounts and commissions(2) | | $ | 0.08 | | | $ | 367,500 | |

Proceeds, before expenses, to us(3) | | $ | 1.03 | | | $ | 4,882,449 | |

(1) | The public offering price per share is estimated to be $1.11 per share. |

(2) | We have agreed to pay the underwriter a discount equal to (i) 7% of the gross proceeds of the offering. We have agreed to sell to the Representatives, on the applicable closing date of this offering, warrants in an amount equal to 7% of the aggregate number of shares of common stock sold by us in this offering (the "Representatives’ Warrants") (not including over-allotment shares). For a description of other terms of the Representatives’ Warrants and a description of the other compensation to be received by the Underwriter, see "Underwriting" beginning on page 61. |

(3) | Excludes fees and expenses payable to the Underwriter. The total amount of Underwriter's expenses related to this offering is set forth in the section entitled "Underwriting." |

(4) | Assumes that the Underwriter does not exercise any portion of their over-allotment option. |

We expect our total cash expenses for this offering (including cash expenses payable to our Underwriter for its out-of-pocket expenses) to be approximately $188,712, exclusive of the above discounts. In addition, we will pay additional items of value in connection with this offering that are viewed by the Financial Industry Regulatory Authority, or FINRA, as underwriting compensation. These payments will further reduce proceeds available to us before expenses. See "Underwriting" beginning on page 61.

This offering is being conducted on a firm commitment basis. The underwriter, Boustead Securities, LLC (the "Underwriter"), is obligated to take and pay for all of the shares of common stock if any such shares of common stock are taken. We have granted the Underwriter an option for a period of 45 days after the closing of this offering to purchase up to 15% of the total number of our shares of common stock to be offered by us pursuant to this offering (excluding shares of common stock subject to this option), solely for the purpose of covering over-allotments, at the public offering price less the underwriting discounts and commissions. If the underwriters exercise their option in full, the total underwriting discounts and commissions payable will be $422,625 based on the estimated offering price of $1.11 per share, and the total gross proceeds to us, before underwriting discounts and commissions and expenses, will be $6,037,499. If we complete this offering, net proceeds will be delivered to us on the applicable closing date.

The Underwriter expects to deliver the shares of common stock against payment as set forth under "Underwriting", on or about _____________, 2023.

BOUSTEAD SECURITIES, LLC | | EF HUTTON |

| | Division of Benchmark Investments, LLC |

Prospectus dated February 3, 2023.

TABLE OF CONTENTS

Please read this prospectus carefully. It describes our business, financial condition, results of operations and prospects, among other things. We are responsible for the information contained in this prospectus and in any free-writing prospectus we have authorized. Neither we nor the underwriters have authorized anyone to provide you with different information, and neither we nor the underwriters take responsibility for any other information others may give you. Neither we nor the underwriters are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We use various trademarks, trade names and service marks in our business, including "Disrupting Tobacco," "HempBox," "Hempbar," "The Real Stuff," "Solito," and "Cali Vibes D8." For convenience, we may not include the SM, ® or ™ symbols, but such omission is not meant to indicate that we would not protect our intellectual property rights to the fullest extent allowed by law. Any other trademarks, trade names or service marks referred to in this prospectus are the property of their respective owners.

INDUSTRY AND MARKET DATA

This prospectus includes industry data and forecasts that we obtained from industry publications and surveys including but not limited to certain publications of Hemp Industry Daily - Sector Snapshot - Smokable Hemp, as well as public filings and internal company sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. Statements as to our ranking, market position and market estimates are based on third-party forecasts, management's estimates and assumptions about our markets and our internal research. We have not independently verified such third-party information, nor have we ascertained the underlying economic assumptions relied upon in those sources, and we cannot assure you of the accuracy or completeness of such information contained in this prospectus. Such data involve risks and uncertainties and is subject to change based on various factors, including those discussed under "Risk Factors" and "Cautionary Statement Regarding Forward-Looking Statements."

PROSPECTUS SUMMARY This summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our securities. You should carefully read the entire prospectus, including the risks associated with an investment in our company discussed in the "Risk Factors" section of this prospectus, before making an investment decision. Some of the statements in this prospectus are forward-looking statements. See the section titled "Cautionary Statement Regarding Forward-Looking Statements." In this prospectus, "we," "us," "our," "our company" and similar references refer to Hempacco Co., Inc., a Nevada corporation formerly known as The Hempacco Co., Inc. OUR COMPANY Overview We are focused on Disrupting Tobacco™ by manufacturing and selling nicotine-free and tobacco-free alternatives to traditional cigarettes. We utilize a proprietary, patented spraying technology for terpene infusion and patent-pending flavored filter infusion technology to manufacture hemp and herb-based smokable alternatives. We have conducted research and development in the smokables space and are engaged in the manufacturing and sale of smokable hemp and herb products, including The Real Stuff™ Hemp Smokables. Our operational segments include private label manufacturing and sales, intellectual property licensing, and the development and sales of inhouse brands using patented counter displays. Our inhouse brands are currently sold in over 200 retail locations located in the San Diego, California, area, our private label customers include well-known and established companies in the cannabis and tobacco-alternatives industries, and we currently own approximately 600 kiosk vending machines which we plan to refurbish and use to distribute our products in a wider fashion under our HempBox Vending brand. Our hemp cigarette production facility, located in San Diego, California, has the capacity to produce up to 30 million cigarettes monthly. From our facility, we can ship small-to-large quantities of product—from single displays of product to targeted retail locations to truckloads of product to private label customers—with in-house processing, packing, and shipping capabilities. We believe that our manufacturing technologies will be a critical component of our success. We plan to continue to invest in research and development, and we currently have one approved patent and one patent pending with respect to our critical manufacturing processes. Our approved patent is an exclusivity patent to spray hemp with terpenes for flavoring or to add cannabidiol, which we refer to as CBD, or cannabigerol, which we refer to as CBG, and our pending patent relates to our flavored filter infusion technology. We also have several ready-to-file patent applications with respect to hemp manufacturing, hemp processing, design patents for hemp machines and merchandisers, and customized manufacturing equipment. We believe that we are positioned to rapidly grow our customer and product footprint through increasing marketing efforts, reaching agreements with master distributors who will sell to a broad network of retail establishments, and aggressively targeting additional distributors throughout the United States. We plan to drive and increase customer traffic with internet marketing to or with the clients that carry our products. We have experienced operating losses to date and negative cash flows from operating activities. We expect to continue to incur significant expenses related to our expanding operations and to generate operating losses in the near future. The size of our losses will depend, in part, on the rate of future expenditures and our ability to generate revenues. We incurred a net loss of $1,049,473 and $2,024,039 for the three and nine months ended September 30, 2022, respectively, a net loss of $1,870,675 for the year ended December 31, 2021, our accumulated deficit increased to $5,490,216 as of September 30, 2022, we had a working capital surplus of $3,558,716 as of September 30, 2022, and we had cash and cash equivalents of $2,973,686 as of September 30, 2022. Although our audited financial statements for the years ended December 31, 2021 and 2020, were prepared under the assumption that we would continue our operations as a going concern, the report of our independent registered public accounting firm that accompanies our financial statements for the years ended December 31, 2021 and 2020, contains a going concern qualification in which such firm expressed substantial doubt about our ability to continue as a going concern, based on our financial statements and results at that time, including our net loss of $1,870,675 during the year ended December 31, 2021, our accumulated deficit of $3,459,214 as of December 31, 2021, and our working capital deficit of $2,050,626 as of December 31, 2021. Our Products We have launched the production and sale of our own in-house brand of hemp-based cigarettes, The Real Stuff Smokables, in three presentations: the twenty pack, the ten pack, and the Solito™ single pack, all of which are sold in our patented counter displays in convenience stores through master distributors. We have also entered into several joint ventures to launch multiple smokables brands: Cali Vibes D8, a joint venture focused on Delta 8 smokable products; Hemp Hop Smokables, a joint venture with rapper Rick Ross and Rap Snack's CEO James Lindsay; a joint venture with StickIt Ltd., an Israeli corporation, to manufacture cannabinoid sticks for insertion into other cigarettes; a joint venture to launch Cheech & Chong-branded hemp smokables; Hempacco Paper Co., Inc., a joint venture with Sonora Paper Co., Inc. focused on rolling papers; Organipure, Inc., a joint venture with High Sierra Technologies, Inc. focused on hemp smokables; and HPDG, LLC, a joint venture to launch smokables products with Alfalfa Holdings, LLC. We have launched a brand of flavored hemp rolling papers, and we also manufacture private label hemp rolling papers for third parties. We are currently manufacturing hemp rolling papers for HBI International, one of the leading smoking paper producers in the world, and in the fall of 2021, we received our largest purchase order to date for approximately $9.2 million from HBI International's Skunk and Juicy brand to manufacture hemp rolling papers for it. |

Our products include the following:

Competitive Strengths We believe our manufacturing technologies, manufacturing facility manufacturing capacity, and management with extensive industry experience are strengths that set us apart from our competitors. Our manufacturing facility can quickly scale up production volumes, our management team has extensive experience in the cigarette and food and beverage industries, and because of our manufacturing technologies, which allow us to spray hemp with terpenes for flavoring or to add CBD or CBG, and add flavoring via our filter infusion technology, we believe our smokables products offer consistent and unique flavor and odor profiles to consumers, which we believe sets our products apart from competing products, which may lack flavor and odor consistency or smell like marijuana when smoked. Growth Strategy We seek to become the leader in sales and distribution of alternative smokable products. We aim to offer our products and affiliate products in over 100,000 convenience and liquor stores in the United States, and we also intend to build international sales and distribution channels for our products and affiliate products. Our goal is to build a portfolio of non-tobacco smokables brands, become the United States market leader in the space, and subsequently build exclusive master distribution relationships in other countries. We plan to do this in four ways: |

| | |

| ● | We intend to focus on growing our fast-moving consumer goods brands, such as our "The Real Stuff" smokables and "Hempbar," our line of "liquor flavored" infused hemp smokables for sale in liquor stores and bars. |

| ● | We plan to build a portfolio of patents and technologies, which should allow us to protect and grow our competitive position in the industry. |

| ● | We intend to expand our manufacturing capabilities. |

| ● | We plan to increase sales by focusing on master distributor relationships, e-commerce sales, and distribution of our brands, and joint venture brands. |

| | |

Our Corporate History and Structure We were incorporated in the State of Nevada on April 1, 2019, as "The Hempacco Co., Inc.," and on April 23, 2021, changed our name to "Hempacco Co., Inc." On May 21, 2021, we were acquired by Green Globe International, Inc., a Delaware corporation (“Green Globe”), and became a wholly owned subsidiary of it, and as of immediately prior to this offering, we are a majority-owned subsidiary of Green Globe International, Inc., with Green Globe International, Inc. owning approximately 78.7% of our capital stock. Additional information regarding our corporate history and transactions in connection with our prior acquisition by Green Globe are discussed more fully in the "Our Corporate History and Structure" section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 31. |

Impact of the COVID-19 Pandemic In December 2019, a novel coronavirus disease ("COVID-19") was reported to have surfaced in Wuhan, China, and on March 11, 2020, the World Health Organization characterized COVID-19 as a pandemic. The pandemic, which has continued to spread, and the related adverse public health developments, including orders to shelter-in-place, travel restrictions, and mandated business closures, have adversely affected workforces, organizations, customers, economies, and financial markets globally, leading to an economic downturn and increased market volatility. It has also disrupted the normal operations of many businesses, including ours. Our operations have been impacted by a range of external factors related to the pandemic that are not within our control. For example, many cities, counties, states, and even countries have imposed or may impose a wide range of restrictions on the physical movement of our employees, partners and customers to limit the spread of the pandemic, including physical distancing, travel bans and restrictions, closure of non-essential business, quarantines, work-from-home directives, shelter-in-place orders, and limitations on public gatherings. These measures have caused, and are continuing to cause, business slowdowns or shutdowns in affected areas, both regionally and worldwide. In 2020, we temporarily scaled down sales efforts at trade shows and with customers and potential customers in in-person meetings, and we were forced to source ingredients for some of the components of our products from alternative suppliers. These changes disrupted our business, and similar changes in the future may disrupt the way we operate our business. In addition, our management team has, and will likely continue, to spend significant time, attention and resources monitoring the pandemic and seeking to minimize the risk of the virus and manage its effects on our business. The duration and extent of the impact from the pandemic depends on future developments that cannot be accurately predicted at this time, such as the severity and transmission rate of the virus, the extent and effectiveness of containment actions and the disruption caused by such actions, the effectiveness of vaccines and other treatments for COVID-19, and the impact of these and other factors on our employees, customers, partners and vendors. If we are not able to respond to and manage the impact of such events effectively, our business will be harmed. To the extent the pandemic adversely affects our business and financial results, it may also have the effect of heightening many of the other risks described in the "Risk Factors" section. Corporate Information We are currently incorporated and in good standing in the State of Nevada. Our principal executive offices are located at 9925 Airway Road, San Diego, California, 92154, and our telephone number is (619) 779-0715. We maintain a website at https://hempaccoinc.com/. Information available on our website is not incorporated by reference in and is not deemed a part of this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock. |

THE OFFERING |

| | |

Shares being offered: | | Up to 4,729,729 shares of common stock (or 5,439,188 shares if the underwriter exercises the over-allotment option in full). |

| | |

Offering price: | | We currently estimate that the public offering price will be $1.11 per share. |

| | |

Shares outstanding immediately before the offering: | | 23,477,999 shares of common stock. |

| | |

Shares outstanding after the offering: | | 28,207,728 shares of common stock (or 28,917,187 shares if the underwriters exercise the over-allotment option in full). |

| | |

Over-allotment option: | | We have granted to the underwriters a 45-day option to purchase from us up to an additional 15% of the shares sold in the offering (709,459 additional shares) at the public offering price, less the underwriting discounts and commissions. |

| | |

Representatives’ warrants: | | We have agreed to issue to the representatives of the underwriter (the "Representatives") warrants to purchase a number of shares of common stock equal in the aggregate to 7% of the total number of shares issued in this offering. The Representatives’ warrants will be exercisable at a per share exercise price equal to 100% of the public offering price per share of common stock sold in this offering. The Representatives’ warrants will be exercised at any time, and from time to time, in whole or in part, commencing from the closing of the offering and expiring five (5) years from the effectiveness of the offering. The registration statement of which this prospectus forms a part also registers the issuance of the shares of common stock issuable upon exercise of the Representatives’ warrants. See the "Underwriting" section for more information. |

| | |

Use of proceeds: | | We expect to receive net proceeds of approximately $4,641,287 from this offering (or approximately $5,365,787 if the underwriters exercise their over-allotment option in full), based on the estimated public offering price of $1.11 per share and no exercise of the underwriters' over-allotment option, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We plan to use the net proceeds of this offering for sales, marketing and advertising initiatives; acquisitions of companies and technologies aligned and synergistic with our manufacturing technologies and growth objectives; expansion and upgrades to our existing manufacturing facility; research and development; hiring sales and other employees; expenses associated with being a public company; and general corporate and working capital purposes. See "Use of Proceeds" section for more information on the use of proceeds. |

| | |

Risk factors: | | Investing in our common stock involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the "Risk Factors" section beginning on page 11 before deciding to invest in our common stock. |

| | |

Lock-up: | | Our executive officers, directors and our majority shareholder have agreed not to offer, sell, agree to sell, directly or indirectly, or otherwise dispose of any shares of our common stock for a lock-up period through August 30, 2023, and we have agreed not to offer or sell any shares of stock until September 1, 2023. See "Underwriting" for more information. |

| | |

Trading market and symbol: | | Our common stock is listed on the Nasdaq Capital Market under the symbol "HPCO." |

| | |

The number of shares of common stock outstanding immediately following this offering is based on 23,477,999 shares outstanding as of February 3, 2023. |

SUMMARY FINANCIAL INFORMATION The following tables summarize certain financial data regarding our business and should be read in conjunction with our financial statements and related notes contained elsewhere in this prospectus and the information under "Management's Discussion and Analysis of Financial Condition and Results of Operations." Our summary financial data as of December 31, 2021 and 2020, are derived from our audited financial statements included elsewhere in this prospectus. Our summary financial data as of September 30, 2022 and 2021, are derived from our unaudited financial statements included elsewhere in this prospectus. All financial statements included in this prospectus are prepared and presented in accordance with generally accepted accounting principles in the United States ("GAAP"). The summary financial information is only a summary and should be read in conjunction with the historical financial statements and related notes contained elsewhere herein. The financial statements contained elsewhere fully represent our financial condition and operations; however, they are not indicative of our future performance. Although our audited financial statements for the years ended December 31, 2021 and 2020, were prepared under the assumption that we would continue our operations as a going concern, the report of our independent registered public accounting firm that accompanies our financial statements for the years ended December 31, 2021 and 2020, contains a going concern qualification in which such firm expressed substantial doubt about our ability to continue as a going concern, based on our financial statements and results at that time, including our net loss of $1,870,675 during the year ended December 31, 2021, our accumulated deficit of $3,459,214 as of December 31, 2021, and our working capital deficit of $2,050,626 as of December 31, 2021. |

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | | | Years Ended December 31, | |

| | 2022 | | | 2021 | | | 2022 | | | 2021 | | | 2021 | | | 2020 | |

| | (unaudited) | | | (unaudited) | | | (unaudited) | | | (unaudited) | | | | | | | |

Statements of Operations Data | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 592,235 | | | $ | 425,171 | | | $ | 3,438,458 | | | $ | 911,008 | | | $ | 1,187,273 | | | $ | 345,989 | |

Cost of Sales | | | 598,627 | | | | 315,281 | | | | 2,795,661 | | | | 613,784 | | | | 850,901 | | | | 899,699 | |

Gross Profit (Loss) from Operations | | | (6,392 | ) | | | 109,890 | | | | 642,797 | | | | 297,224 | | | | 336,372 | | | | (553,710 | ) |

Operating Expenses | | | 1,037,538 | | | | 423,679 | | | | 2,638,647 | | | | 1,237,423 | | | | 1,995,705 | | | | 751,279 | |

Operating Loss | | | (1,043,930 | ) | | | (313,789 | ) | | | (1,995,850 | ) | | | (940,199 | ) | | | (1,659,333 | ) | | | (1,304,989 | ) |

Other Income / (Expense) | | | (5,543 | ) | | | (53,514 | ) | | | (28,189 | ) | | | (256,504 | ) | | | (211,342 | ) | | | (160,455 | ) |

Net Loss | | | (1,049,473 | ) | | | (367,303 | ) | | | (2,024,039 | ) | | | (1,196,703 | ) | | | (1,870,675 | ) | | | (1,465,444 | ) |

Net Loss Attributable to Non-Controlling Interests | | | 617 | | | | - | | | | 2,200 | | | | - | | | | 14,250 | | | | - | |

Net Loss Attributable to Hempacco Co., Inc. | | | (1,048,856 | ) | | | (367,303 | ) | | | (2,021,839 | ) | | | (1,196,703 | ) | | | (1,856,425 | ) | | | (1,465,444 | ) |

Dividend Issued to Preferred Stockholders | | | - | | | | - | | | | - | | | | - | | | | (757,479 | ) | | | - | |

Net Loss Attributable to Common Stockholders | | | (1,048,856 | ) | | | (367,303 | ) | | | (2,021,839 | ) | | | (1,196,703 | ) | | | (2,613,904 | ) | | | (1,465,444 | ) |

| | As of September 30, | | | As of December 31 | |

| | 2022 | | | 2021 | | | 2020 | |

| | (unaudited) | | | | | | | |

Balance Sheet Data | | | | | | | | | |

Cash and Cash Equivalents | | $ | 2,973,686 | | | $ | 933,469 | | | $ | 500 | |

Total Current Assets | | | 5,197,591 | | | | 2,117,638 | | | | 101,462 | |

Total Assets | | | 14,664,060 | | | | 7,570,523 | | | | 5,657,894 | |

Total Current Liabilities | | | 1,638,875 | | | | 4,168,264 | | | | 2,931,761 | |

Total Liabilities | | | 2,083,505 | | | | 4,702,863 | | | | 3,435,326 | |

Accumulated Deficit | | | (5,490,216 | ) | | | (3,459,214 | ) | | | (1,602,789 | ) |

Total Stockholder's Equity | | | 12,587,842 | | | | 2,881,910 | | | | 2,222,568 | |

Non-Controlling Interests | | | (7,287 | ) | | | (14,250 | ) | | | - | |

Total Equity for Hempacco Co., Inc. | | | 12,580,555 | | | | 2,867,660 | | | | 2,222,568 | |

Total Liabilities and Stockholder's Equity | | | 14,664,060 | | | | 7,570,523 | | | | 5,657,894 | |

SUMMARY OF RISK FACTORS An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. These risks are discussed more fully in the "Risk Factors" section immediately following this Prospectus Summary. These risks include, but are not limited to, the following: |

| | |

| · | Since inception, we have experienced operating losses and negative cash flows from operating activities and anticipate that we will continue to incur operating losses in the near future. |

| | |

| · | If we are not able to successfully execute on our future operating plans, our financial condition and results of operation may be materially adversely affected, and we may not be able to continue as a going concern. |

| | |

| · | We may be unable to effectively manage future growth. We will need additional financing in the future, which may not be available when needed or may be costly and dilutive. |

| | |

| · | If we are unable to continue as a going concern, our securities will have little or no value. |

| | |

| · | We have a limited operating history, and we may not be able to successfully operate our business or execute our business plan. |

| | |

| · | We may incur significant debt to finance our operations. |

| | |

| · | We compete in an industry that is brand-conscious, so brand name recognition and acceptance of our products are critical to our success. |

| | |

| · | Our brand and image are keys to our business and any inability to maintain a positive brand image could have a material adverse effect on our results of operations. |

| | |

| · | Competition from traditional and large, well-financed tobacco or nicotine cigarette manufacturers or distributors may adversely affect our distribution relationships and may hinder development of our existing markets, as well as prevent us from expanding our markets. |

| | |

| · | We compete in an industry characterized by rapid changes in consumer preferences and public perception, so our ability to continue developing new products to satisfy our consumers' changing preferences will determine our long-term success. |

| | |

| · | We may be unable to respond effectively to technological changes in our industry, which could reduce the demand for our products. |

| | |

| · | We may experience a reduced demand for some of our products due to health concerns and legislative initiatives against smokables products. |

| | |

| · | Legislative or regulatory changes that affect our products, including new taxes, could reduce demand for products or increase our costs. |

| | |

| · | Our ability to develop, commercialize and distribute hemp smokables products and comply with laws and regulations governing cannabis, hemp or related products will affect our operational results. |

| | |

| · | International expansion efforts would likely significantly increase our operational expenses. |

| | |

| · | Our reliance on distributors, retailers and brokers could affect our ability to efficiently and profitably distribute and market our products, maintain our existing markets and expand our business into other geographic markets. |

| | |

| · | We incur significant time and expense in attracting and maintaining key distributors, and loss of distributors or retails accounts would harm our business. |

| | |

| · | We rely on suppliers, manufacturers and contractors, and events adversely affecting them would adversely affect us. |

| | |

| · | We have a single customer that accounts for a substantial portion of our revenues, and our business would be harmed were we to lose this customer. |

| | |

| · | Wholesale price volatility may adversely affect operations. |

| · | The Company may sustain losses that cannot be recovered through insurance or other preventative measures. |

| | |

| · | The Company may be subject to product liability claims and other claims of our customers and partners. |

| | |

| · | If we encounter product recalls or other product quality issues, our business may suffer. |

| | |

| · | It is difficult to predict the timing and amount of our sales, and as a result our sales forecasts are uncertain. |

| | |

| · | If we do not adequately manage our inventory levels, our operating results could be adversely affected. |

| | |

| · | Increases in costs or shortages of raw materials could harm our business and financial results. |

| | |

| · | Increases in costs of energy and increased regulations may have an adverse impact on our gross margin. |

| | |

| · | Disruption within our supply chain, contract manufacturing or distribution channels could have an adverse effect on our business, financial condition and results of operations. |

| | |

| · | If we are unable to attract and retain key personnel, our efficiency and operations would be adversely affected; in addition, staff turnover causes uncertainties and could harm our business. |

| | |

| · | If we lose the services of our Chief Executive Officer, our future operations could be impaired until such time as a qualified replacement can be found. |

| | |

| · | If we fail to protect our trademarks and trade secrets, we may be unable to successfully market our products and compete effectively. |

| | |

| · | Disruptions to our information technology systems due to cyber-attacks or our failure to upgrade and adjust our information technology systems, may materially impair our operations, hinder our growth and materially and adversely affect our business and results of operations. |

| | |

| · | Our business is subject to many regulations and noncompliance is costly. |

| | |

| · | Significant additional labeling or warning requirements may inhibit sales of affected products. |

| | |

| · | Our industry may become subject to expanded regulation and increased enforcement by the Food and Drug Administration (FDA) and the Federal Trade Commission (FTC) |

| | |

| · | Our business and operations would be adversely impacted in the event of a failure or interruption of our information technology infrastructure or as a result of a cybersecurity attack. |

| | |

| · | Our results of operations may fluctuate from quarter to quarter for many reasons, including seasonality. |

| | |

| · | Global economic, political, social and other conditions, including the COVID-19 pandemic, may continue to adversely impact our business and results of operations. |

| | |

| · | We may not be able to satisfy the continued listing requirements of Nasdaq and maintain a listing of our common stock on Nasdaq. |

| | |

| · | We are majority-owned by Green Globe International, Inc. ("GGII"), a small group of Company officers and directors hold a majority of the control of GGII, those officers and directors are able to control the election of members of GGII’s Board of Directors as well as the election of members of our Board of Directors, and they are able to generally exercise control over our affairs. |

| | |

| · | Our executive officers and the majority of our directors are also officers and directors of GGII, and conflicts of interest may arise as a result. |

| | |

| · | We are a “controlled company” within the meaning of the listing rules of Nasdaq and, as a result, can rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies. |

| | |

| · | During the nine months ended September 30, 2022, GGII advanced $621,755 in funding to us, and we may need additional funding from GGII in the future, which may not be available when needed. |

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained in this prospectus, before purchasing our securities. We have listed below (not necessarily in order of importance or probability of occurrence) what we believe to be the most significant risk factors applicable to us, but they do not constitute all of the risks that may be applicable to us. Any of the following factors could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your investment. Some statements in this prospectus, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section titled "Cautionary Statement Regarding Forward-Looking Statements".

We may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Risks Related to our Financial Condition and Capital Requirements

Since inception, we have experienced operating losses and negative cash flows from operating activities and anticipate that we will continue to incur operating losses in the near future.

We have experienced operating losses to date and negative cash flows from operating activities. We expect to continue to incur significant expenses related to our expanding operations and to generate operating losses in the near future. The size of our losses will depend, in part, on the rate of future expenditures and our ability to generate revenues. We incurred a net loss of $1,049,473 and $2,024,039 for the three and nine months ended September 30, 2022, respectively, a net loss of $1,870,675 for the year ended December 31, 2021, and our accumulated deficit increased to $5,490,216 as of September 30, 2022.

We may encounter unforeseen expenses, difficulties, complications, delays, and other unknown factors that may adversely affect our financial condition. Our prior losses and expected future losses have had, and will continue to have, an adverse effect on our financial condition. If our products do not achieve sufficient market acceptance and our revenues do not increase significantly, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our failure to become and remain profitable would decrease the value of our company and could impair our ability to raise capital, expand our business, diversify our product offerings or continue our operations. A decline in the value of our company could cause you to lose all or part of your investment.

If we are not able to successfully execute on our future operating plans, our financial condition and results of operation may be materially adversely affected, and we may not be able to continue as a going concern.

It is critical that we meet our sales goals and increase sales going forward as our operating plan already reflects prior significant cost containment measures and may make it difficult to achieve top-line growth if further significant reductions become necessary. If we do not meet our sales goals, our available cash and working capital will decrease and our financial condition will be negatively impacted.

We may be unable to effectively manage future growth.

We may be subject to growth-related risks, including capacity constraints and pressure on our internal systems and controls. Our ability to manage growth effectively will require us to continue to implement and improve our operational and financial systems and to expand, train and manage our employee base. Rapid growth of our business may significantly strain our management, operations and technical resources. If we are successful in obtaining large orders for its products, we will be required to deliver large volumes of products to our customers on a timely basis and at a reasonable cost. We may not obtain large-scale orders for our products and if we do, we may not be able to satisfy large-scale production requirements on a timely and cost-effective basis. Our inability to deal with this growth may have a material adverse effect on our business, financial condition, results of operations and prospects.

We will need additional financing in the future, which may not be available when needed or may be costly and dilutive.

We will require additional financing to support our working capital needs in the future. The amount of additional capital we may require, the timing of our capital needs and the availability of financing to fund those needs will depend on a number of factors, including our strategic initiatives and operating plans, the performance of our business and the market conditions for debt or equity financing. Additionally, the amount of capital required will depend on our ability to meet our sales goals and otherwise successfully execute our operating plan. We believe it is imperative that we meet these sales objectives in order to lessen our reliance on external financing in the future. We intend to continually monitor and adjust our operating plan as necessary to respond to developments in our business, our markets and the broader economy. Although we believe various debt and equity financing alternatives will be available to us to support our working capital needs, financing arrangements on acceptable terms may not be available to us when needed. Additionally, these alternatives may require significant cash payments for interest and other costs or could be highly dilutive to our existing shareholders. Any such financing alternatives may not provide us with sufficient funds to meet our long-term capital requirements. If necessary, we may explore strategic transactions that we consider to be in the best interest of the Company and our shareholders, which may include, without limitation, public or private offerings of debt or equity securities, a rights offering, and other strategic alternatives; however, these options may not ultimately be available or feasible when needed.

If we are unable to continue as a going concern, our securities will have little or no value.

Although our financial statements have been prepared under the assumption that we would continue our operations as a going concern, there is substantial doubt about our ability to continue as a going concern, based on our financial statements and results of operations at that time. Specifically, as noted above, we have experienced losses from operations and negative cash flows from operating activities due primarily to relatively high general and administrative expenses associated with launching our business, as well as an inventory obsolescence allowance expense. An inventory obsolescence allowance was created as a precautionary measure with regard to a large quantity of hemp biomass that is currently being used in production of our products, which we expect will be consumed within 6 to 12 months. All or a portion the allowance is expected to be credited back as other income as the biomass is used, but there is no guarantee that the biomass will be used, and that the allowance will be credited back as other income.

Although our audited financial statements for the years ended December 31, 2021 and 2020, were prepared under the assumption that we would continue our operations as a going concern, the report of our independent registered public accounting firm that accompanies our financial statements for the years ended December 31, 2021 and 2020, contains a going concern qualification in which such firm expressed substantial doubt about our ability to continue as a going concern, based on our financial statements and results at that time, including our net loss of $1,870,675 during the year ended December 31, 2021, our accumulated deficit of $3,459,214 as of December 31, 2021, and our working capital deficit of $2,050,626 as of December 31, 2021.

We expect to continue to incur significant expenses and operating losses for the foreseeable future. These prior losses and expected future losses have had, and will continue to have, an adverse effect on our financial condition. In addition, as noted above, continued operations and our ability to continue as a going concern may be dependent on our ability to obtain additional financing in the near future and thereafter, and there are no assurances that such financing will be available to us at all or will be available in sufficient amounts or on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we are unable to generate additional funds in the future through sales of our products, financings or from other sources or transactions, we will exhaust our resources and will be unable to continue operations. If we cannot continue as a going concern, our shareholders would likely lose most or all of their investment in us.

We have a limited operating history, and we may not be able to successfully operate our business or execute our business plan.

The Company was formed on April 1, 2019, and it is still in its development stage. We are therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenues. Given our limited operating history, it is hard to evaluate our proposed business and prospects. Our proposed business operations will be subject to numerous risks, uncertainties, expenses and difficulties associated with early- stage enterprises. There is no assurance that we will be successful in achieving a return on shareholders' investment, and the likelihood of success must be considered in light of the early stage of our hemp smokables operations.

We may incur significant debt to finance our operations.

There is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay our indebtedness, or that we will not default on our debt, jeopardizing our business viability. Furthermore, we may not be able to borrow or raise additional capital in the future to meet the Company's needs or to otherwise provide the capital necessary to conduct our business.

Risk Factors Relating to Our Business and Industry

We compete in an industry that is brand-conscious, so brand name recognition and acceptance of our products are critical to our success.

Our business is substantially dependent upon awareness and market acceptance of our products and brands by our target market: trendy, young consumers looking for a distinctive product tonality and/or the perceived benefits of hemp, CBD and CBG in their smokables as compared to nicotine or tobacco-based smokables. In addition, our business depends on acceptance by our independent distributors and retailers of our brands that have the potential to provide incremental sales growth. If we are not successful in the growth of our brand and product offerings, we may not achieve and maintain satisfactory levels of acceptance by independent distributors and retail consumers. In addition, we may not be able to effectively execute our marketing strategies in light of the various closures and cancellations caused by the COVID-19 pandemic. Any failure of our brands to maintain or increase acceptance or market penetration would likely have a material adverse effect on our revenues and financial results.

Our brand and image are keys to our business and any inability to maintain a positive brand image could have a material adverse effect on our results of operations.

Our success depends on our ability to maintain brand image for our existing products and effectively build up brand image for new products and brand extensions. We cannot predict whether our advertising, marketing and promotional programs will have the desired impact on our products' branding and on consumer preferences. In addition, negative public relations and product quality issues, including negative perceptions regarding the hemp industry, whether real or imagined, could tarnish our reputation and image of the affected brands and could cause consumers to choose other products. Our brand image can also be adversely affected by unfavorable reports, studies and articles, litigation, or regulatory or other governmental action, whether involving our products or those of our competitors.

Competition from traditional and large, well-financed tobacco or nicotine cigarette manufacturers or distributors may adversely affect our distribution relationships and may hinder development of our existing markets, as well as prevent us from expanding our markets.

The smokables industry is highly competitive. We compete with other smokables companies, including with "Big Tobacco" manufacturers and distributors, not only for consumer acceptance but also for shelf space in retail outlets and for marketing focus by our distributors, many of whom also distribute other smokables brands. Our products compete with both tobacco-based and hemp-based smokables, many of which are marketed by companies with substantially greater financial resources than ours. Some of these competitors are placing severe pressure on independent distributors not to carry competitive hemp brands such as ours. We also compete with regional hemp smokables producers and "private label" smokables suppliers.

Our direct competitors in the smokables industry include large domestic and international traditional tobacco companies and distributors as well as regional or niche smokables companies. These national and international competitors have advantages such as lower production costs, larger marketing budgets, greater financial and other resources and more developed and extensive distribution networks than ours. We may not be able to grow our volumes or maintain our selling prices, whether in existing markets or as we enter new markets.

Increased competitor consolidations, market-place competition, particularly among branded hemp smokables products, and competitive product and pricing pressures could impact our earnings, market share and volume growth. If, due to such pressure or other competitive threats, we are unable to sufficiently maintain or develop our distribution channels, we may be unable to achieve our current revenue and financial targets. As a means of maintaining and expanding our distribution network, we intend to introduce additional brands. We may not be successful in doing this, or it may take us longer than anticipated to achieve market acceptance of these new products and brands, if at all. Other companies may be more successful in this regard over the long term. Competition, particularly from companies with greater financial and marketing resources than ours, could have a material adverse effect on our existing markets, as well as on our ability to expand the market for our products.

We compete in an industry characterized by rapid changes in consumer preferences and public perception, so our ability to continue developing new products to satisfy our consumers' changing preferences will determine our long-term success.

Failure to introduce new brands, products or product extensions into the marketplace as current ones mature and to meet our consumers' changing preferences could prevent us from gaining market share and achieving long-term profitability. Product lifecycles can vary, and consumers' preferences and loyalties change over time. We may not succeed at innovating new products to introduce to our consumers. Customer preferences also are affected by factors other than taste, such as health and nutrition considerations and obesity concerns, shifting consumer needs, changes in consumer lifestyles, increased consumer information and competitive product and pricing pressures. Sales of our products may be adversely affected by the negative publicity associated with these issues. In addition, there may be a decreased demand for our products as a result of the COVID-19 pandemic. If we do not adequately anticipate or adjust to respond to these and other changes in customer preferences, we may not be able to maintain and grow our brand image and our sales may be adversely affected.

We may be unable to respond effectively to technological changes in our industry, which could reduce the demand for our products.

Our future business success will depend upon our ability to maintain and enhance our product portfolio with respect to advances in technological improvements for certain products and market products that meet customer needs and market conditions in a cost-effective and timely manner. Maintaining and enhancing our product portfolio may require significant investments in licensing fees and royalties. We may not be successful in gaining access to new products that successfully compete or are able to anticipate customer needs and preferences, and our customers may not accept one or more of our products. If we fail to keep pace with evolving technological innovations or fail to modify our products and services in response to customers' needs or preferences, then our business, financial condition and results of operations could be adversely affected.

We may experience a reduced demand for some of our products due to health concerns and legislative initiatives against smokables products.

Consumers are concerned about health and wellness; public health officials and government officials are increasingly vocal about smoking, vaping, and their adverse consequences. There has been a trend among many public health advocates to pursue generalized reduction in consumption of smokables products, as well as increased public scrutiny, new taxes on smokables products, and additional governmental regulations concerning the marketing and labeling/packing of smokable products. Additional or revised regulatory requirements, whether labeling, tax or otherwise, could have a material adverse effect on our financial condition and results of operations. Further, increasing public concern with respect to smokables could reduce demand for our hemp smokables products.

Legislative or regulatory changes that affect our products, including new taxes, could reduce demand for products or increase our costs.

Taxes imposed on the sale of certain of our products by federal, state, and local governments in the United States, or other countries in which we operate could cause consumers to shift away from purchasing our hemp smokables products. These taxes could materially affect our business and financial results.

Our ability to develop, commercialize and distribute hemp smokables products and comply with laws and regulations governing cannabis, hemp or related products will affect our operational results.

As of December 31, 2021, more than 40 states had enacted legislation to establish hemp production programs pursuant to the 2018 farm bill (the Agricultural Improvement Act of 2018, the "2018 Farm Bill"), which legalized the regulated production of hemp.

The 2018 Farm Bill was signed into law on December 20, 2018. The 2018 Farm Bill removed hemp from the U.S. Controlled Substances Act (the "CSA") and established a federal regulatory framework for hemp production in the United States. Among other provisions, the 2018 Farm Bill: (a) explicitly amends the CSA to exclude all parts of the cannabis plant (including its cannabinoids, derivatives, and extracts) containing a delta-9 THC concentration of not more than 0.3% on a dry weight basis from the CSA's definition of "marihuana"; (b) permits the commercial production and sale of hemp; (c) precludes states, territories, and Indian tribes from prohibiting the interstate transport of lawfully-produced hemp through their borders; and (d) establishes the USDA as the primary federal agency regulating the cultivation of hemp in the United States, while allowing states, territories, and Indian tribes to obtain (or retain) primary regulatory authority over hemp activities within their borders after receiving approval of their proposed hemp production plan from the USDA. Any such plan submitted by a state, territory, or Indian tribe to the USDA must meet or exceed minimum federal standards and receive USDA approval. Any state, territory, or Indian tribe that does not submit a plan to the USDA, or whose plan is not approved by the USDA, will be regulated by the USDA; provided that, states retain the ability to prohibit hemp production within their borders.

Marijuana continues to be classified as a Schedule I substance under the CSA. As a result, any cannabinoids (including CBD) derived from marijuana, as opposed to hemp, or any products derived from hemp containing in excess of 0.3% THC on a dry-weight basis, remain Schedule I substances under U.S. federal law. Cannabinoids derived from hemp are indistinguishable from those derived from marijuana, and confusion surrounding the nature of our smokables products containing hemp or CBD, inconsistent interpretations of the definition of "hemp", inaccurate or incomplete testing, farming practices and law enforcement vigilance or lack of education could result in our products being intercepted by federal and state law enforcement as marijuana and could interrupt and/or have a material adverse impact on the Company's business. The Company could be required to undertake processes that could delay shipments, impede sales or result in seizures, proper or improper, that would be costly to rectify or remove and which could have a material adverse effect on the business, prospects, results of operations or financial condition of the Company. If the Company makes mistakes in processing or labeling, and THC in excess of 0.3% on a dry-weight basis is found in our products, the Company could be subject to enforcement and prosecution under local, state, and federal laws which would have a negative impact on the Company's business and operations.

Under the 2018 Farm Bill, states have authority to adopt their own regulatory regimes, and as such, regulations will likely continue to vary on a state-by-state basis. States take varying approaches to regulating the production and sale of hemp and hemp-derived products under state food and drug laws. The variance in state law and that state laws governing hemp production are rapidly changing may increase the chance of unfavorable law enforcement interpretation of the legality of Company's operations as they relate to the cultivation of hemp. Further, such variance in state laws that may frequently change increases the Company's compliance costs and risk of error.

While some states explicitly authorize and regulate the production and sale of hemp products or otherwise provide legal protection for authorized individuals to engage in commercial hemp activities, other states maintain outdated drug laws that do not distinguish between marijuana, hemp and/or hemp-derived CBD, resulting in hemp being classified as a controlled substance under state law. In these states, sale of CBD, notwithstanding origin, is either restricted to state medical or adult-use marijuana program licensees or remains otherwise unlawful under state criminal laws. Variance in hemp regulation across jurisdictions is likely to persist. This patchwork of state laws may, for the foreseeable future, materially impact the Company's business and financial condition, limit the accessibility of certain state markets, cause confusion amongst regulators, and increase legal and compliance costs.

There are no express protections in the United States under applicable federal or state law for possessing or processing hemp biomass derived from lawful hemp not exceeding 0.3% THC on a dry weight basis and intended for use in finished product, but that may temporarily exceed 0.3% THC during the interim processing stages. While it is a common occurrence for hemp biomass to have variance in THC content during interim processing stages after cultivation but prior to use in finished products, there is risk that state or federal regulators or law enforcement could take the position that such hemp biomass is a Schedule I controlled substance in violation of the CSA and similar state laws. Further, there is a risk that state regulators and/or law enforcement may interpret provisions of state law prohibiting unlawful marijuana activity to apply to in-process hemp at any facility where we manufacture our hemp smokables products so that such activity is considered unlawful under state law.